外汇 流动性的主要特点

B2Broker 提供直接進入主要一級外匯流動性場所的機會, 以無法比擬的技術水平, 最深的流動性池, 執行速度和專業支援, 提升您的業務; 並且在極具競爭力的交易成本下, 具有完全的透明度和交易匿名性.

我們的流動性解決方案能為金融機構提供高度發展的流動性權限, 設施和連接選擇, 以應對最複雜的高頻交易系統. 利用我們的專長和技術, 為客戶量身定制流動性解決方案, 確切地執行他們的需要.

什麼是 頂級中優質?

頂級中優質 (PoP) 是指在領先全球的 PB 主經紀卷商業務 (Prime Broker) 擁有賬戶, 為外匯經紀商, 流動性供應商 (LP), 電子交易網絡 (ECN) 等其他市場參與者提供其服務的公司. PoP 縮小了機構與外匯零售市場 (散戶市場) 之間的差距, 並通過各種機制, 讓經紀商能在必要支持下為其交易作融資, 以支持大規模成交量.

自 2014 年起, 我們一直為經紀商, 對沖基金和加密貨幣基金, 投資經理, 專業交易員及其他金融機構提供 PoP 服務. 我們使用尖端技術, 加上專家團隊的優秀客戶服務, 帶來我們享負盛名的 PoP 解決方案.

尖端基础设施

执行交易的基础设施对于实现最快的交易 执行至关重要。从全球所有 Equinix 中心内的全球最大金融生态系统访问我们的全球网络覆盖。

与主要技术、桥梁和平台提供商的连接

我们的操作设置确保了 API 的快速实施。我们通过 FIX API 和多家技术提供商提供 FX Prime of Prime 经纪和流动性服务。 T-1 托管在 LD4。

反 DDOS

对于大型经纪商,建议部署防DDOS高防服务器,有效针对有针对性的DDOS攻击。

安全

所有服务器都使用严格的安全策略来防止恶意攻击、入侵和网络攻击。

热备份

适用于多用户系统的备份解决方案,无需停机即可执行备份。

搭配

数据中心设施为服务器提供托管服务以支持我们的客户。

故障转移系统

备用模式已准备好从故障系统或预定停机时间接管负载。

頂級中優質流程

我們的團隊定期與主要銀行和非銀行流動性供應商聯繫, 討論指向我們平台的所有流程 要素, 確保我們收到最好的聚合價格, 以為客戶的業務特別量身定制.

外汇流动性提供者池

一级银行

外汇 PBs

ECNs

MTF

做市商

非银行 LPs

暗池

Crypto Prime 流动资金池

做市商

加密经纪人

场外经纪商

加密货币交易所

B2Broker 即期流动性

暗池

股权流动性提供者池

DMA 供应商

票据交换所

流动性提供者

暗池

B2Broker Prime Of Prime 流动性

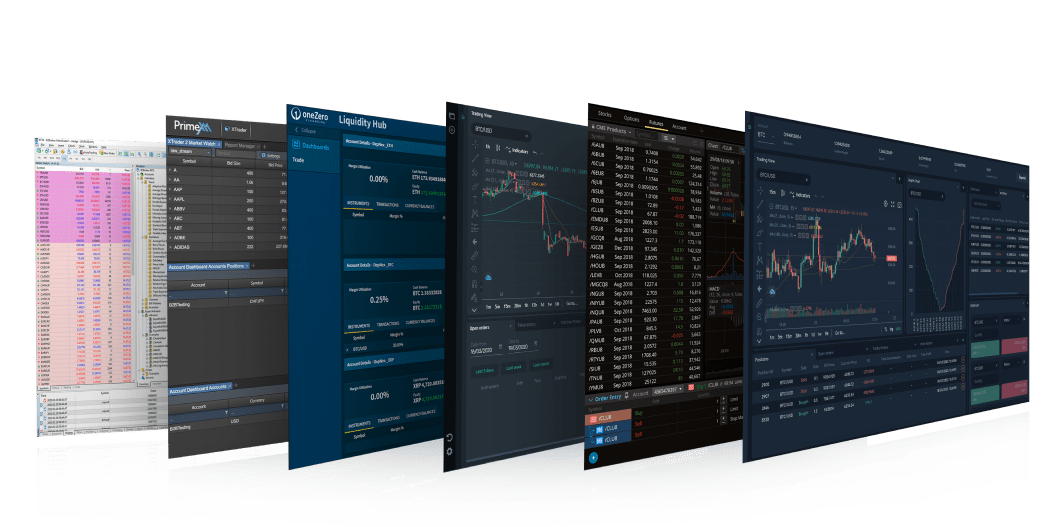

由 B2Broker 开发的交易所匹配引擎平台,为世界上最知名的交易所提供动力。

多资产类别执行、连接、聚合、分发和集线器的技术提供商。

一家拥有尖端聚合软件、超低延迟连接和机构级托管解决方案的金融技术提供商。

MetaQuotes Software 开发的在线零售外汇行业广泛使用的电子交易平台。

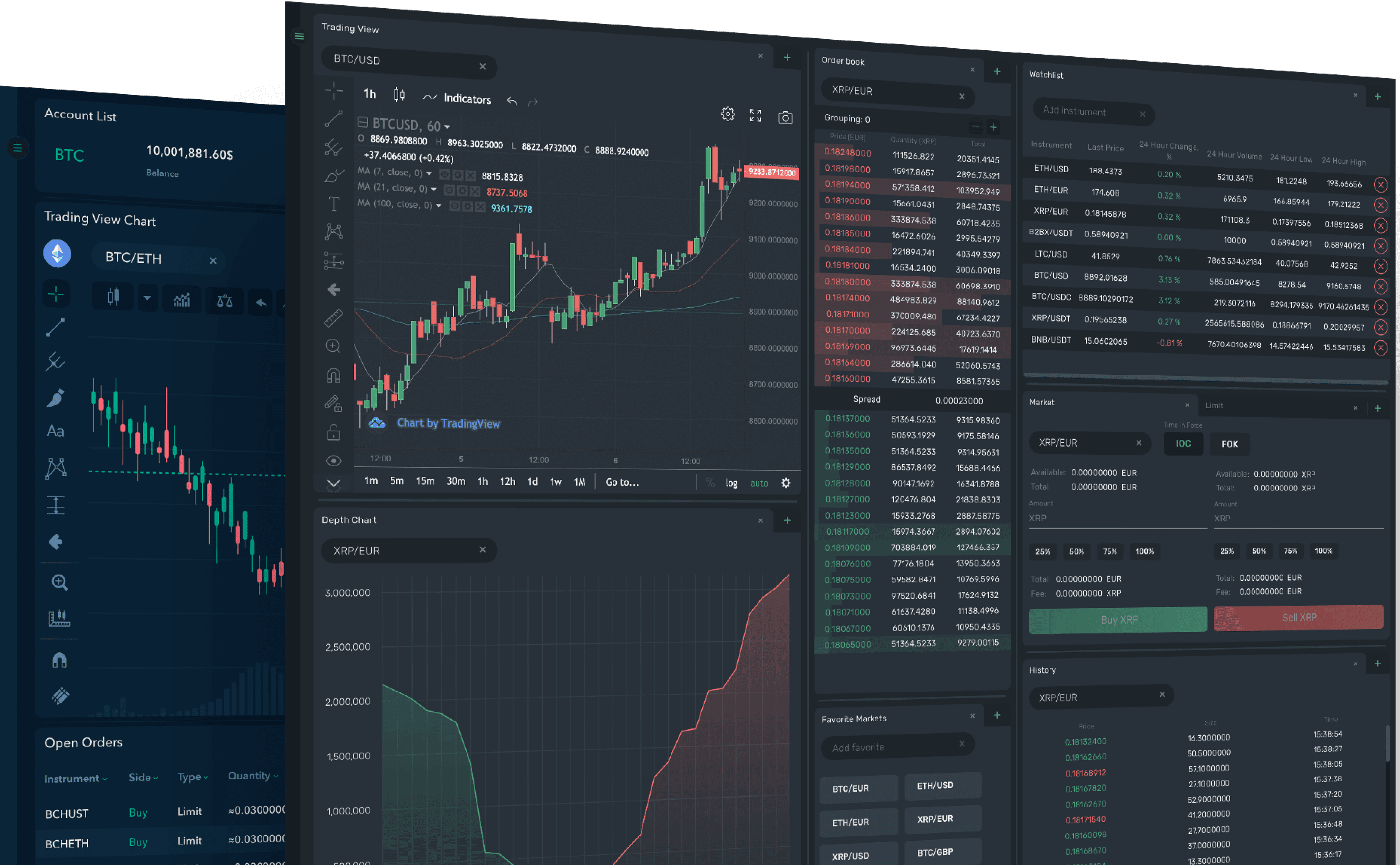

由 DevExperts 开发的多资产交易平台,支持交易股票、ETF、期货、期权、外汇、商品、差价合约和加密货币。

流动性制造商

抵押层

聚合和路由。

单一保证金账户

流动性

或使用其他类型的交付

FIX API

通过行业标准 API 接收量身定制的多资产流动性。允许您将任何专有交易平台集成到我们的流动性中。

白标

如果您没有自己的交易平台,您可以采用我们的交钥匙 WL 解决方案,包括 MT4/5、B2Margin,并使用我们基于尖端基础设施的流动性解决方案。

比較 頂級中優質流動性

我們有着與一級流動性供應商合作的實際經驗, 而且我們的有效性經得起時間考驗, 數十億美元 的成交額就可以證明這一點.

特色

單一 LP

頂級中優質

多個 LP

單一保證金賬戶模型

簡單風險管理系統

多種流動性

聚合流動性於一身

完整淨對沖持倉頭寸系統

單一保證金要求

單一佣金結構付款

競爭性價差及成交量

可靠的流動性流及多個後備

防止交易條件變化

交易對手風險

高 低 中

聚合与分发

从聚合流动性和多个分销场所获得最佳技术,以满足您的交易者需求。 B2Broker 继续扩大其流动性分配,通过多个分销系统聚合流动性。经纪商 和白标合作伙伴可以在短短 5 分钟内通过 FIX API 连接到我们的流动性池,并访问最深的机构行业流动性池,超低点差等等。

沉降

美元、欧元、英镑的电汇可通过 SWIFT、SEPA 和 Faster Payments 以及主要加密货币和稳定币的结算。

可用定居点

(存款/取款/转账)

法币

与流动性提供者的操作从未如此简单。通过以下方式以美元、欧元和英镑结算:

SWIFT USD, EUR, GBP

更快的付款英镑

SEPA 欧元

降低您的风险

根据您的需要以任何基于加密或法定货币的货币为保证金账户计价

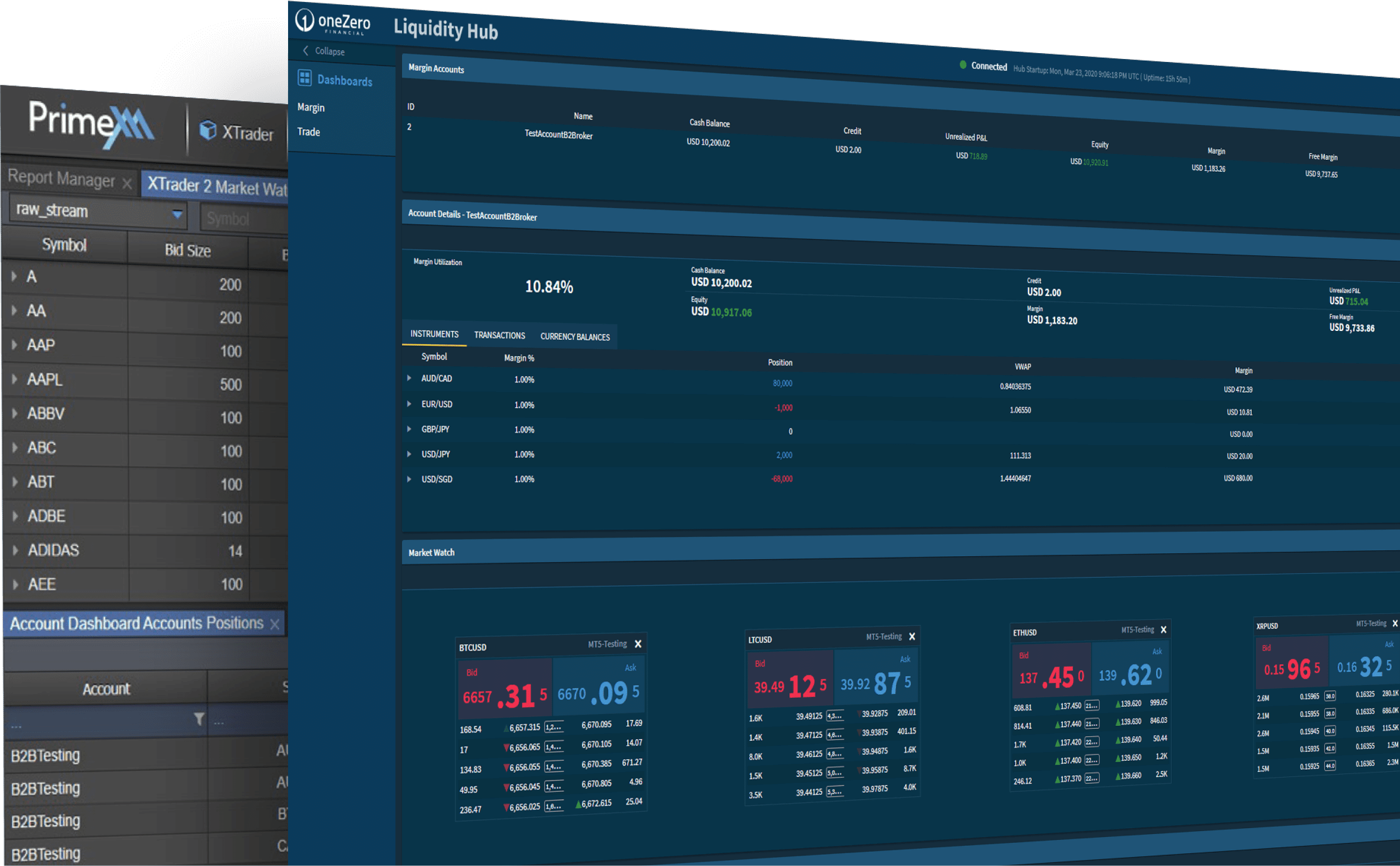

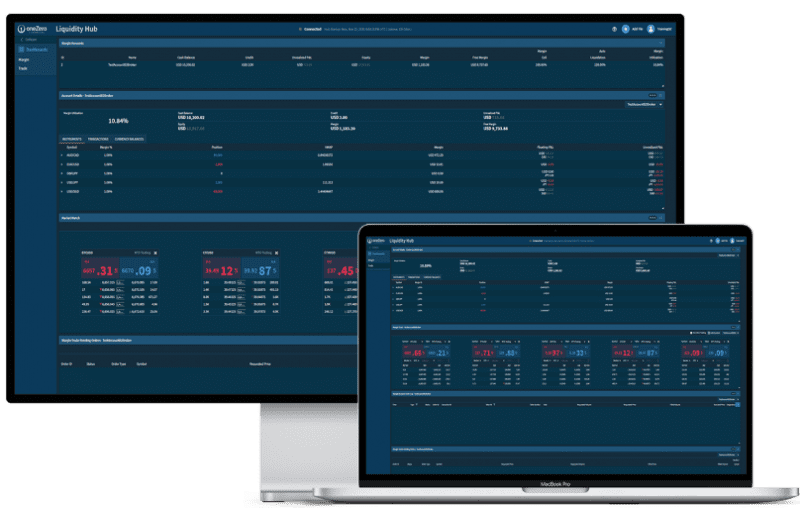

B2Broker 流动性 (B2Connect Hub)

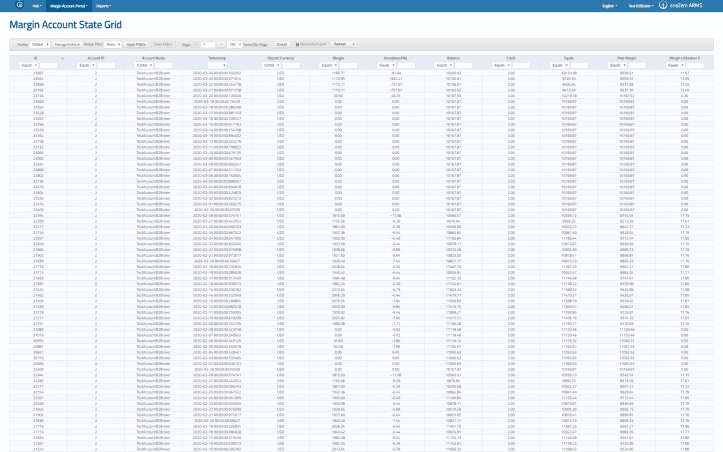

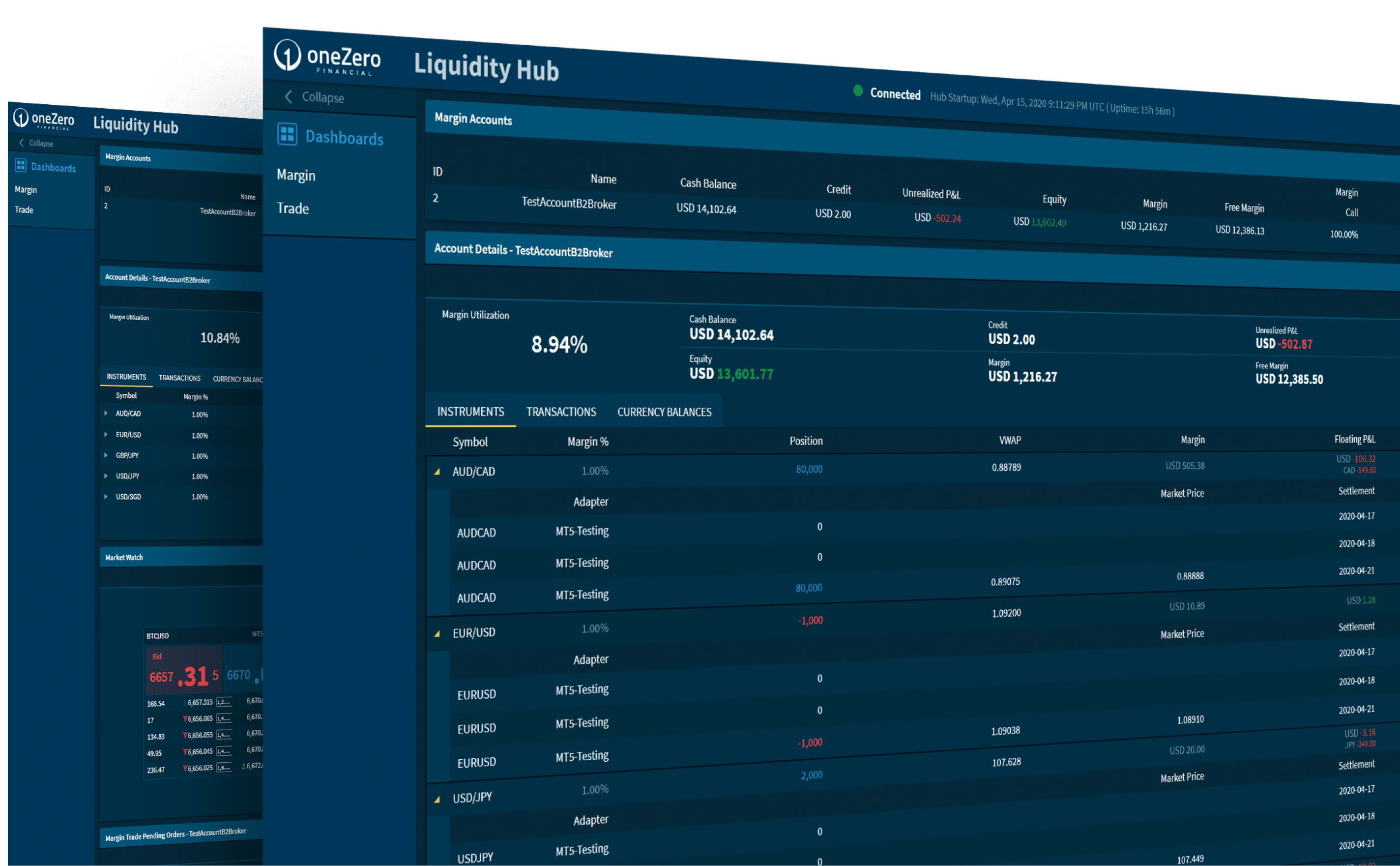

保证金账户管理系统

B2Margin

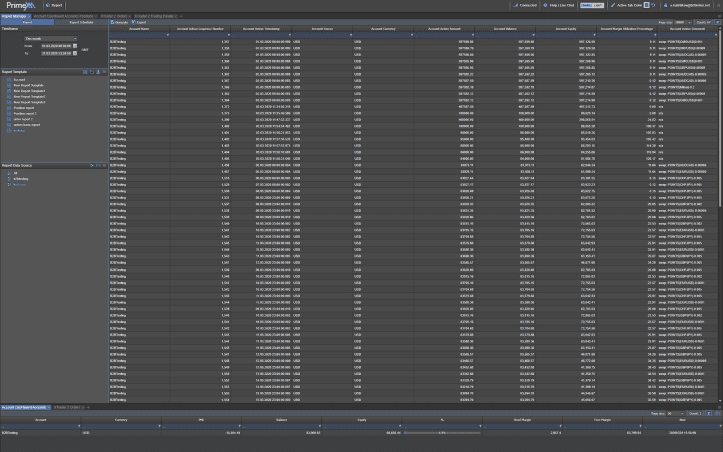

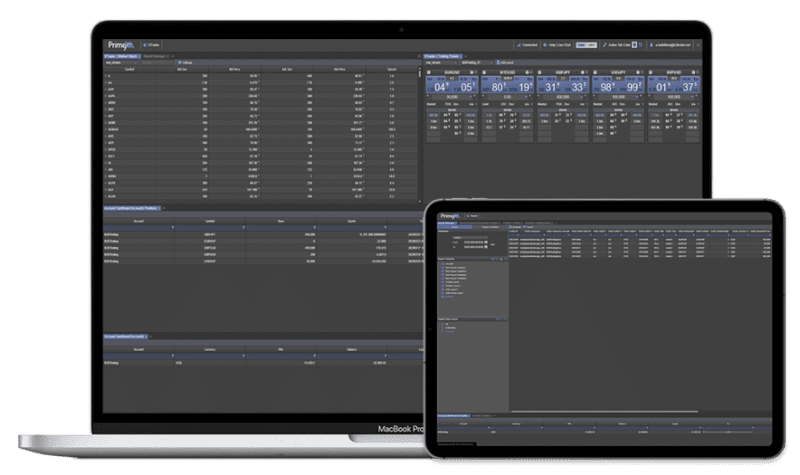

Prime XM

Xcore

One Zero Hub

交易平台

基于美元

基于USDT

基于日元的

基于欧元的

基于以太坊的

基于瑞波币的

基于比特币的

基于币安币的

多币种保证金账户

基于多币种的保证金账户允许经纪商将客户权益与经纪商权益之间的波动风险降至最低。保证金账户可以使用 B2Broker 流动性中的任何货币计价,包括加密货币。相互关联的不同货币的客户账户可以连接到一个保证金账户。例如,基于 BNB 和 BTC 的账户可以轻松地与基于 BTC 的保证金账户一起使用,并将两种货币之间波动性差异的风险降至最低。

不冒风险

上面的例子包含了客户群的基础货币的完全多样化,根据基于相同基础货币的保证金账户。在这种情况下,经纪人将使用与其客户相同数量的资本,而不会冒每种货币的波动风险。

扩展风险管理

在多币种指定保证金账户模型中,经纪人需要控制其所有保证金账户的权益,以便为其所有客户提供执行。这意味着经纪人必须在其保证金账户中保留更多资金——接近客户资金的 100%,以避免由于资金不足而拒绝客户订单。

B2Broker 流动性 (B2Connect Hub)

保证金账户管理系统

B2Margin

Prime XM

XCore

One Zero Hub

保证金账户

USD

交易平台

基于美元的

基于日元的

基于欧元的

基于USDT的

基于ETH的

基于瑞波币的

基于比特币的

基于币安币的

单一保证金账户

使用单一保证金账户的传统经纪方案,基于最受欢迎的客户的基础货币。该方案适用于基本法定货币的小波动风险,但对加密货币和外来货币具有巨大的波动风险。

全面的净额风险管理

上面的例子包含一个以美元为基础的保证金账户,以及许多以不同货币为基础的客户群。在这种情况下,经纪商将仅使用美元运作,但他们的客户拥有多样化的投资组合,这促使经纪商承担客户基础货币波动的风险。

波动风险

如果一位客户存入 10 BTC,则经纪商将在经纪商的保证金账户中以每 BTC 5000 美元 = 50000 美元的当前汇率覆盖客户的权益。如果客户赚取等于 1 BTC 的利润,则经纪商将按每 BTC 7000 美元 = 7000 美元的当前汇率获得利润。这样一来,客户的权益= 11 BTC,按每BTC 7000 美元的比率计算,等于77000 美元,经纪人有57000 美元的权益来覆盖客户。以每比特币 10000 美元及以上的比率计算,这种差异将显着增加。

7 種資產類別700 種交易產品

超過 700 種金融工具種 7 種資產類別, 包括指數, 股票, 貴金屬, 能源和加密數字貨幣. B2Broke 擁有良好 的聲譽, 紮實的金融市場專業知識及最佳的解決方案, 是業內熱門流動性供應商之一.

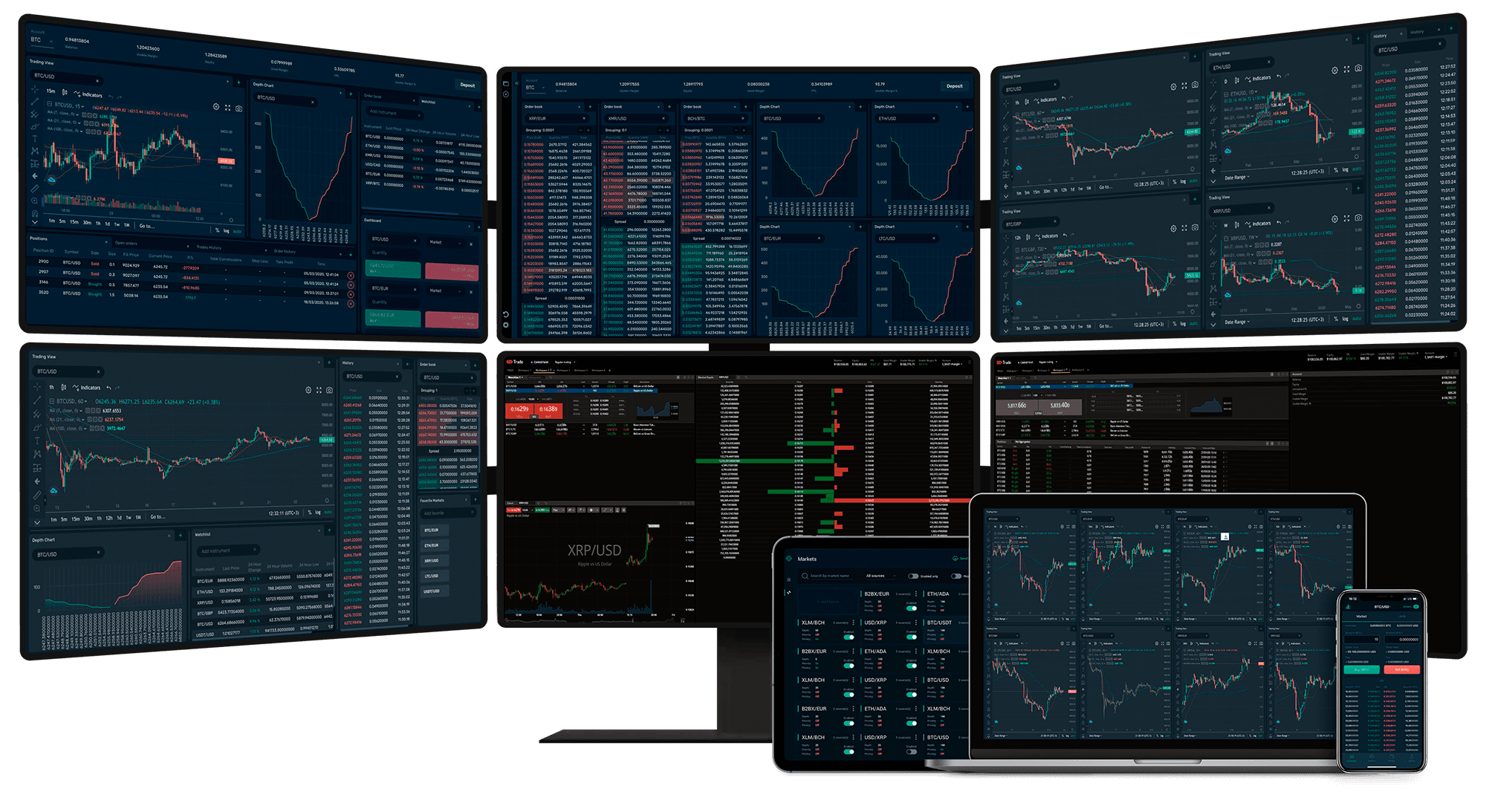

广泛的连接性

我们提供与 7 个不同交易平台的多连接交叉连接,并且可以通过 Fix API 连接到任何系统。流动性可以交付给任何交易系统和任何交易者,包括现金流动性、现金交易和场外交易。

使用其他交易平台?

用于交易和集成的 FIX API

通过行业标准 API 接收量身定制的多资产流动性。 它允许您将任何专有交易平台集成到我们的流动性中。

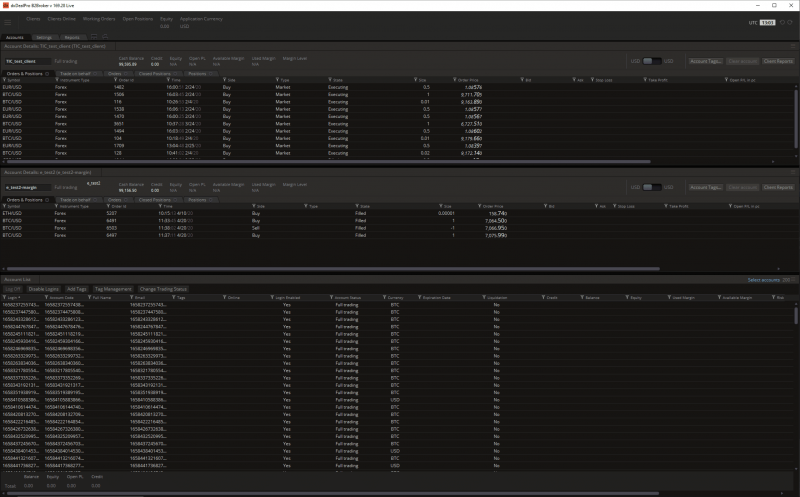

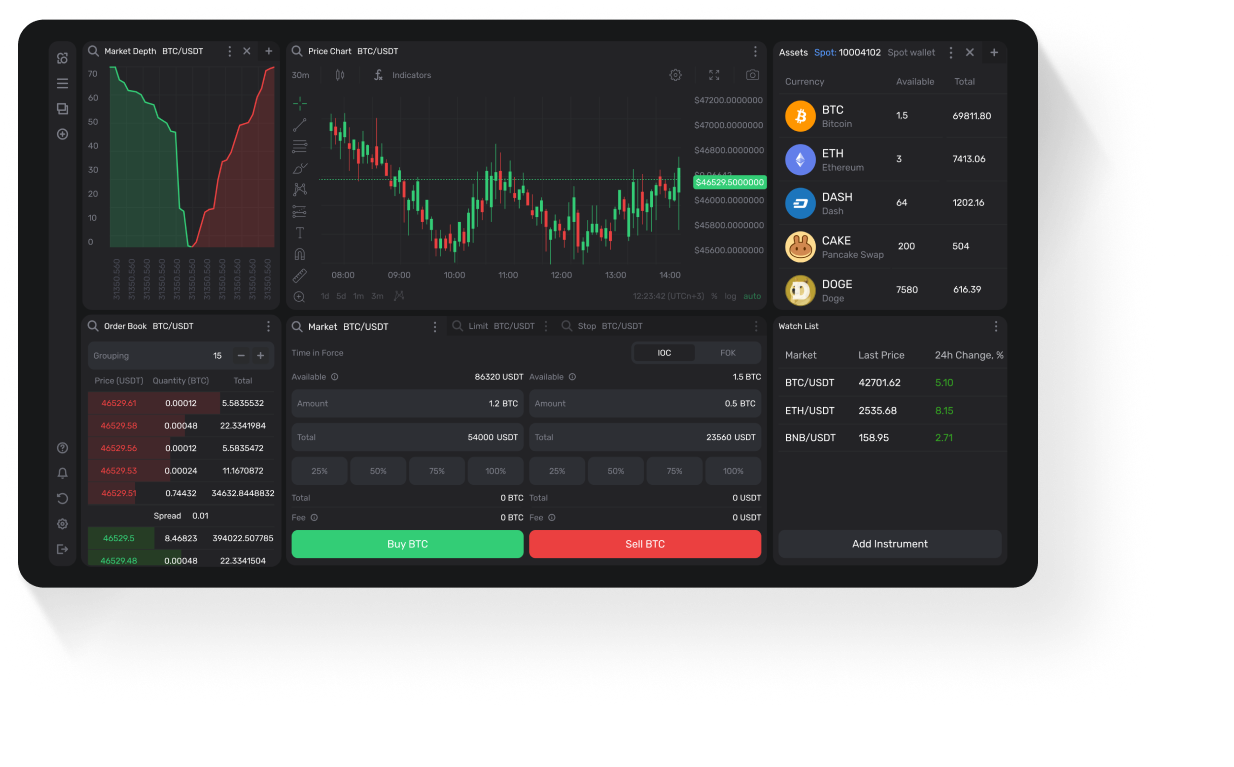

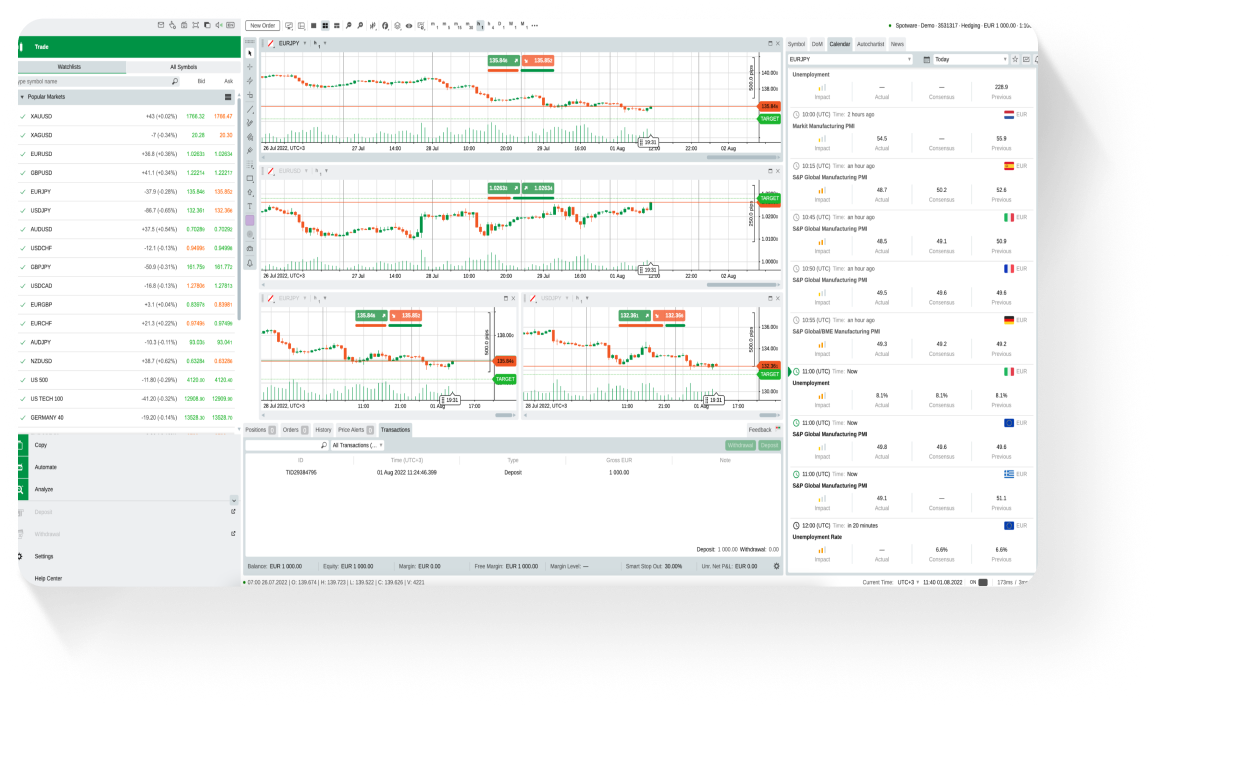

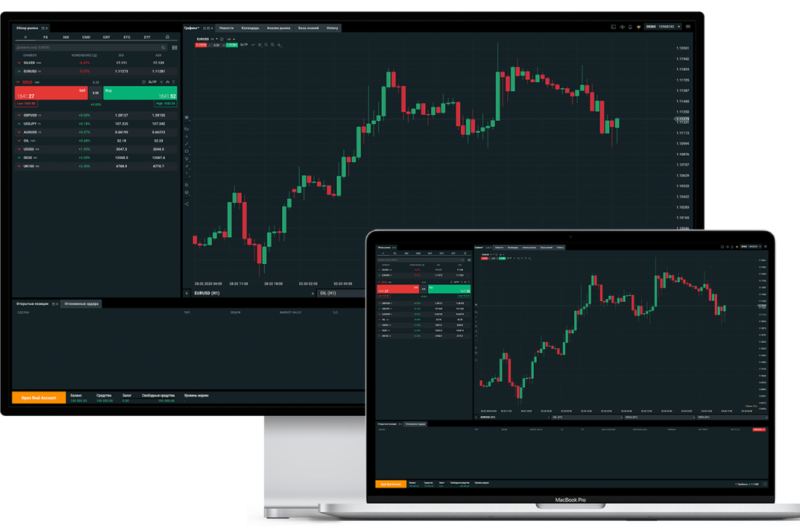

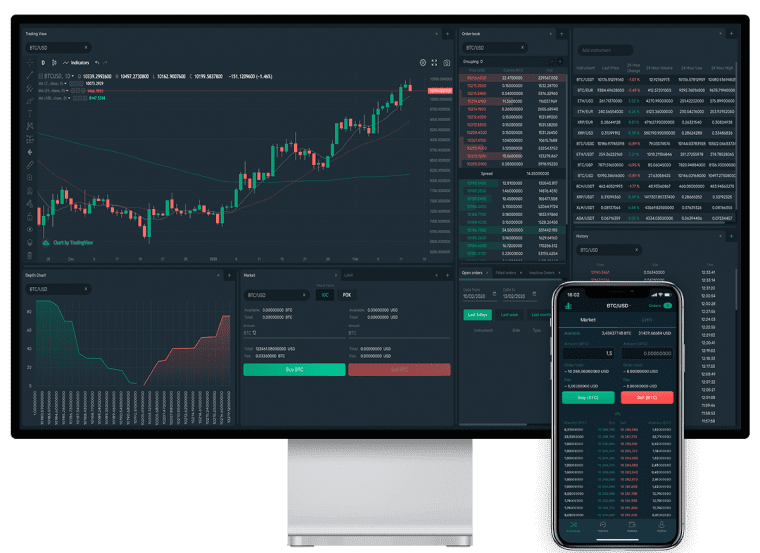

先进的交易平台和 API

我们获得流动性使我们能够确保快速有效地执行交易。通过我们的交易平台和 API 连接市场进行网络、手机和平板电脑交易

允许客户、交易者、投资基金或经纪人与我们的平台之间进行通信的标准协议。 FIX API 被众多银行、主要经纪商和对冲基金用于实时操作。

REST API

交易者、投资者和经纪人可以创建自定义交易应用程序,集成到我们的平台并构建算法交易系统。可以根据请求以支持标准 HTTP REST API 的任何语言进行调用。

WebSocket API

包括实时交易操作的实时流媒体和历史价格。它具有可扩展性、轻量级和健壮性,并且与任何符合 Java 的操作系统兼容。

MT4/5 的免费桥梁

我们提供最具竞争力的聚合流动性,并在连接流动性池方面提供充分的灵活性。我们完全免费使用我们的 MT4/MT5 桥接器,保证与多个流动性提供商的无缝连接。无设置费。无体积费。

自定义流

我们与其客户密切合作,提供现成或定制的流动性流以促进交易。这使经纪商能够受益于最佳执行和有竞争力的点差,以及原始、小、中和大的加价并获得回扣。

轻松执行

B2Broker 通过单一流动性合同协议和单一保证金账户提供无与伦比的技术水平和执行速度。无需与交易所、银行、主要经纪人或流动性提供者签订单独的协议。

单一保证金账户

只需与 B2Brоkеr 签署一份协议,他们将通过充当您的流动性和技术提供者来满足您的所有需求。

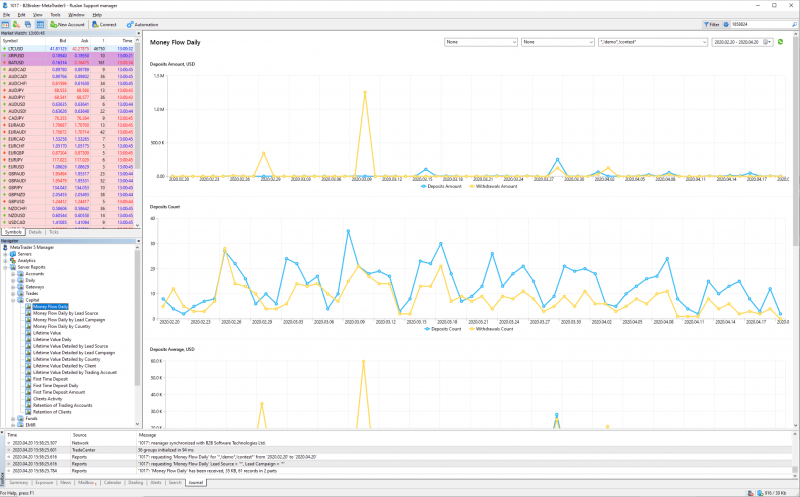

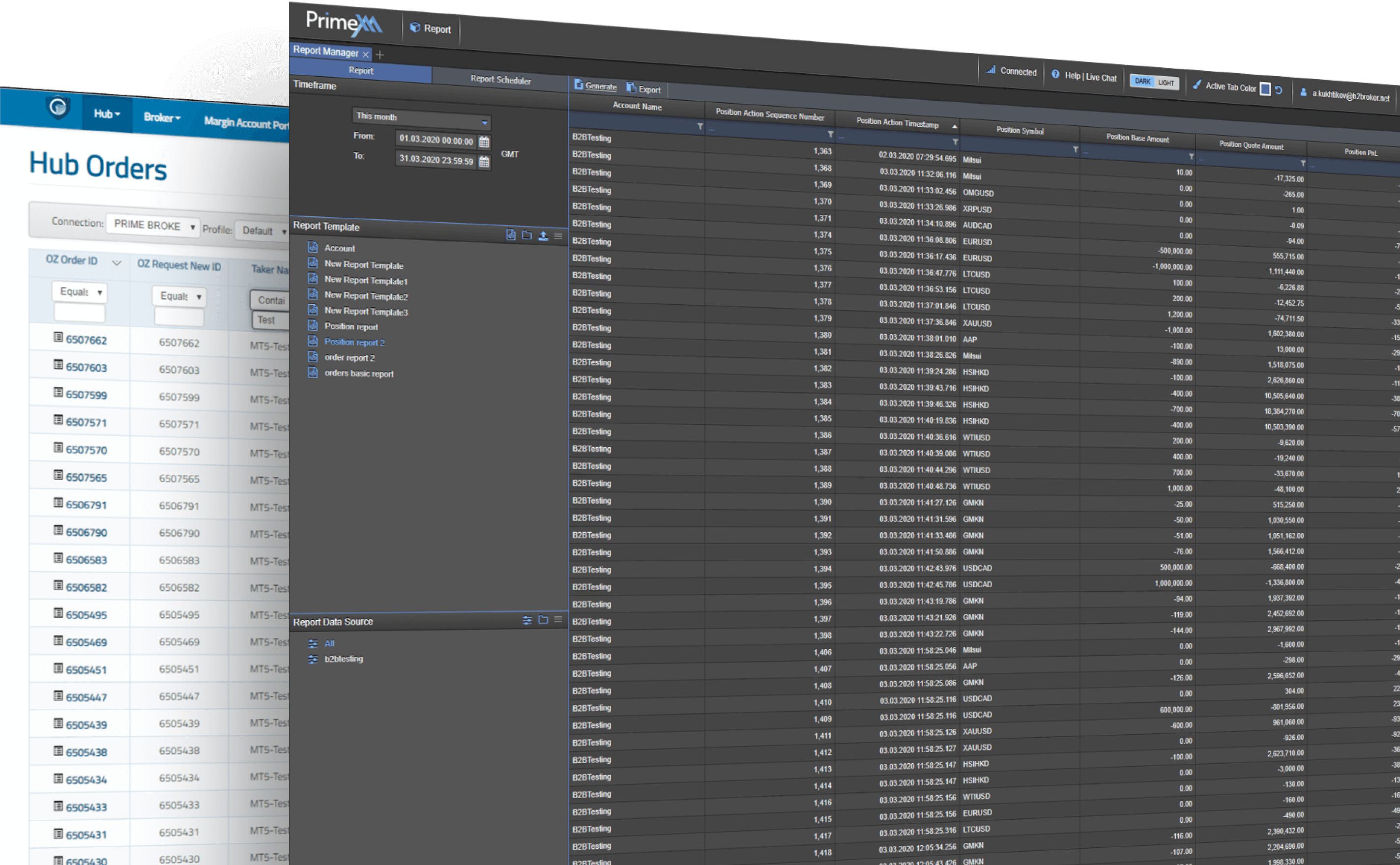

高级报告

使用我们先进的报告功能控制您的业务。通过电子邮件创建大量综合报告,例如详细的帐户报表和计划报告,并根据您自己的个人规范配置参数。利用实时和历史数据提前计划并最大限度地发挥您的业务潜力。

净空缺职位

净额结算是一种通过合并或汇总多项金融义务以得出净义务金额来降低金融合同风险的方法。

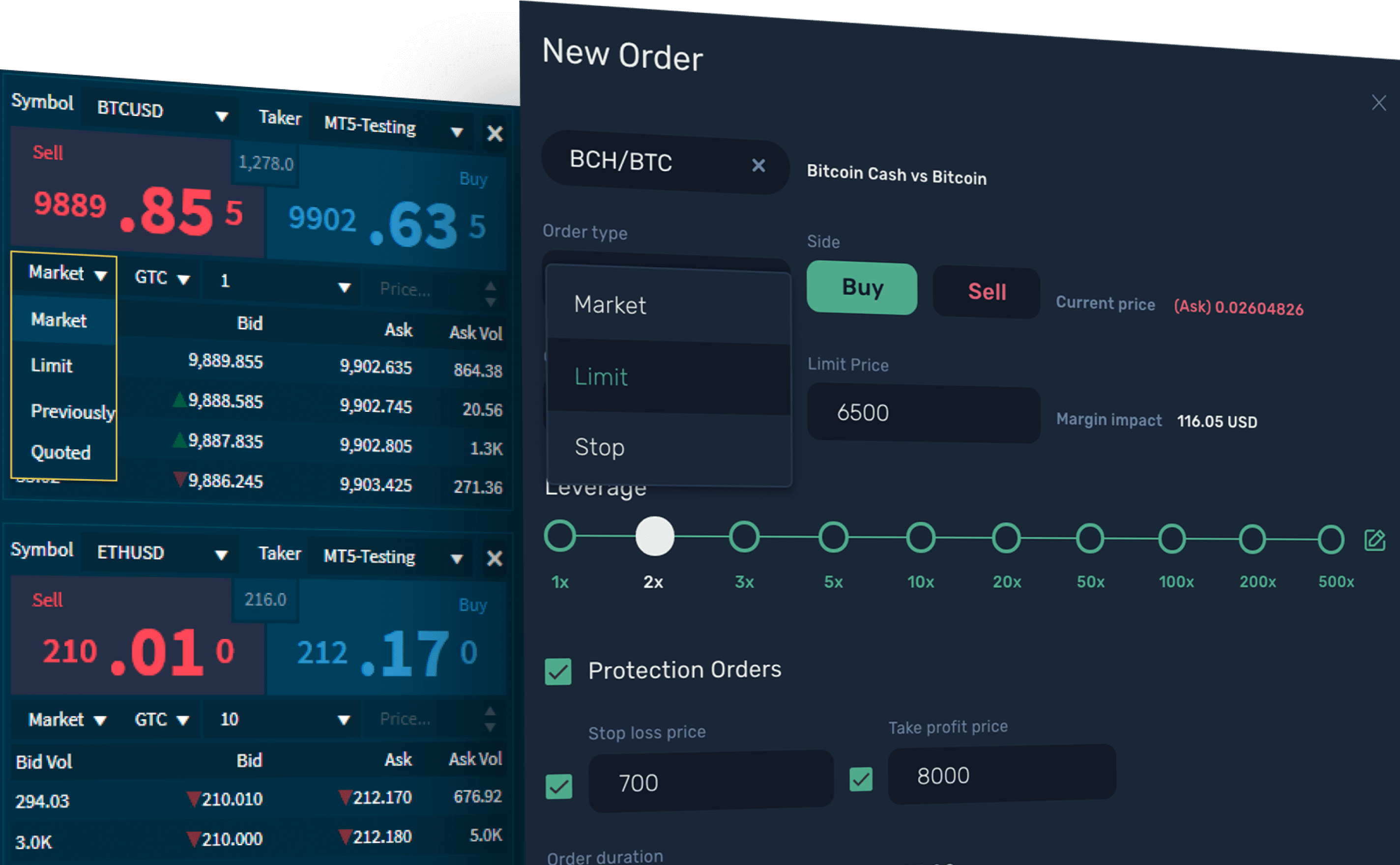

类型顺序范围

市场、买入止损、卖出止损、买入限价、卖出限价、止盈、止损、买入止损和卖出止损均可用。

5 分钟内连接

只需几分钟即可访问业内最深的机构流动性池!我们已经与多个交易平台和桥梁提供商集成。

最受欢迎的外汇交易平台

拥有尖端聚合软件、超低延迟连接、机构级托管解决方案的金融技术提供商。

一个多功能交易平台,适用于交易者、对冲基金经理和社会交易者,提供外汇、指数、商品、债券、股票和交易所交易基金。

多资产类别执行、连接、聚合、分发和集线器的技术提供商。

由 DevExperts 开发的多资产交易平台,支持交易股票、ETF、期货、外汇、商品、差价合约和加密货币。

由B2Broker开发的交易所匹配引擎平台,为全球知名交易所提供动力

一个完整的交易平台解决方案,具有全方位的功能,可满足每一种可以想象的投资偏好。

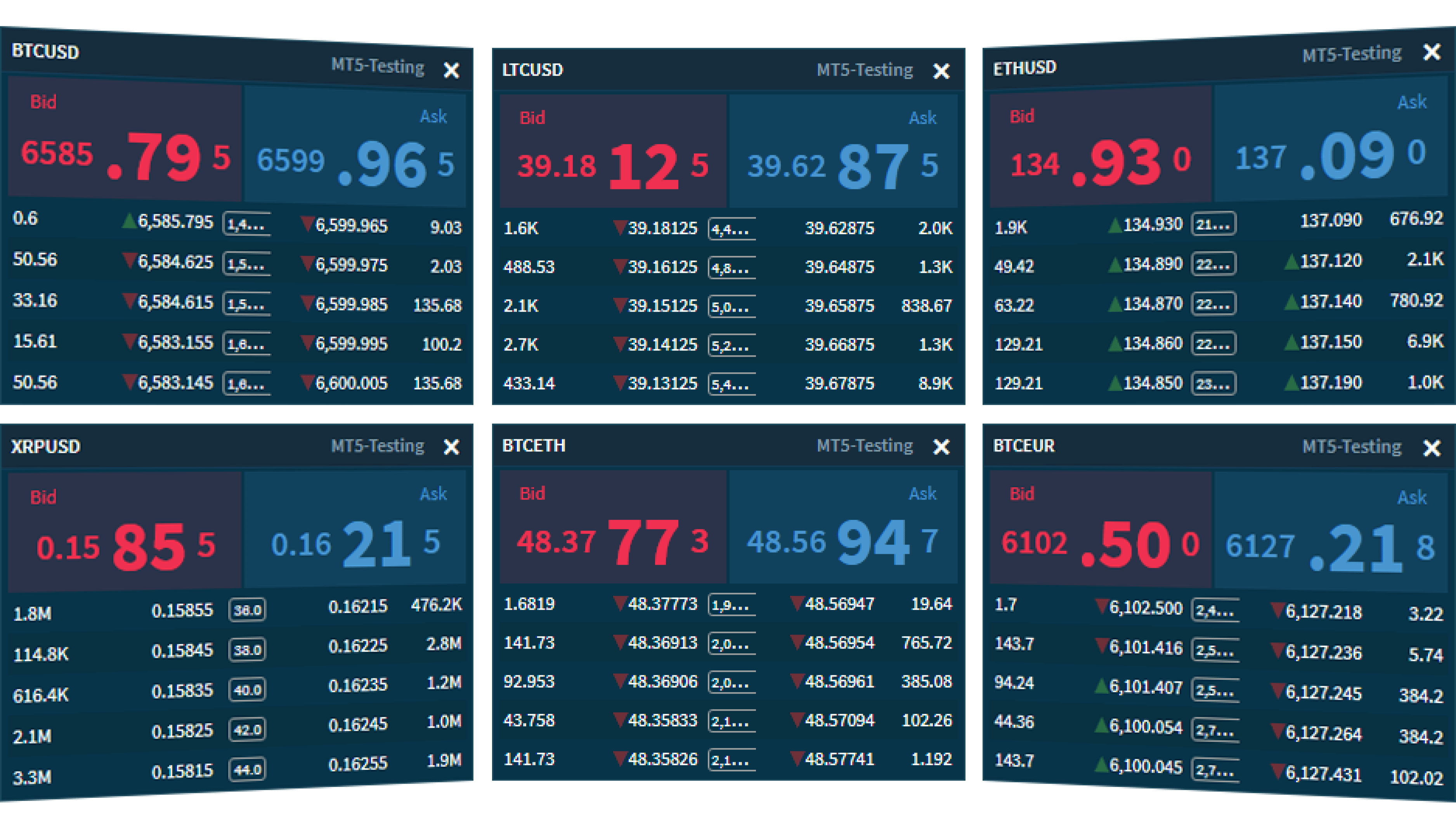

市场深度和流动性池

市场流动性影响从买卖价差到交易执行的方方面面,并且很重要,因为它会影响您开仓和平仓的速度。作为经纪商,您需要访问最深的流动资金池,以满足您交易者的所有需求。

为所有商业模式量身定制的流动性

我们的流动性解决方案为您提供访问和连接到根据您的确切需求定制的最深的流动性池。无论您的业务模式如何,B2Broker 都提供高度发达的流动性访问,以满足您所有客户的需求,包括那些使用高频交易、自动化、算法和 API 交易系统的客户。

经纪业务

经纪商为交易者提供平台访问权限,使他们能够交易不同的资产类别。我们支持众多经纪人,他们向我们寻求我们的技术和流动性专业知识,以便他们能够以最专业的方式为客户服务

来自多个全球流动性场所的最优惠价格

在线交易的世界领先者

通过 FIX API 快速获取数据和执行

指数、商品、外汇和 股票差价合约

金融机构

中小型银行需要获得深厚的流动性池和高效的全球市场准入。需要一种单独的方法来提供一个高度专业化的解决方案,以满足他们许多不同客户的需求。

客制化方式

B2Core后台解决方案

匿名且完全透明的流动性

24/7/365 专业 客户支持

做市商

做市商通常是在场外交易市场以公开报价连续买卖资产类别的实体。通过这样做,做市商充当了交易者进行的大部分交易的交易对手。值得注意的是,做市商总是与大众作对。

允许您的交易者随时执行交易

在几秒钟内完成订单并执行交易

与全球领先的 Prime of Prime Broker 合作

强大的平台范围和市场深度

对冲基金

对冲基金使用从投资者那里收集的集合资金投资于各种金融市场,并应用各种交易策略来提高其投资者的业绩和回报。

使用集合资金投资于各种金融市场

从 7 种资产类别和 800 多种交易工具中进行选择

适合高净值个人及专业投资者

个人客户经理的个性化服务

高频交易和量子团队

量子计算是电子交易的未来,通过使用算法实现高频交易 (HFT)。

由我们的专家开发的以专家技术为主导的解决方案

使用自动交易指令执行订单的算法交易

高速、高周转率和高订单交易比

分析多个市场并根据市场情况执行订单

无论您从事何种类型的金融业务,我们都会为您提供帮助。

愿景变成现实的地方

4:40

VIDEO

满足各种需求的行业领先流动性解决方案

在本视频中,交易部主管 John Murillo 讨论了公司在全球范围内被金融实体使用的机构流动性解决方案。

您的好处

24/7 技术支持

我们专业且乐于助人的技术支持团队 24/7 全天候随时待命,随时处理客户查询。

教程和材料

B2Broker 致力于与客户一起工作,以确保最终的用户满意度。广泛的教程和材料可用于协助所有技术方面。

支持的主要语言

我们知识渊博且友好的客户服务团队可以用 8 种语言为您提供帮助,包括英语、俄语、中文、波斯语、印地语、西班牙语、阿拉伯语和乌尔都语。

存款和取款

提供多种存款和取款方式,包括银行电汇、一系列流行的信用卡/借记卡、加密支付和 EMI。

教育

教育是我们服务的重要组成部分。我们提供各种培训材料,包括视频和演示,以帮助我们的客户了解业务。

多个司法管辖区

由 B2Broker 提供的 B2Prime 受多重監管. 作為一家全球流動性供應商, 我們正朝著在所有重要司法管轄區開設業務的方向邁進.

客户经理

我们所有的客户都被分配了一位个人客户经理,他随时可以回答问题并处理他们的所有要求。

技术支持

我们的技术支持对我们的技术解决方案有深入的了解,并随时为我们的客户提供任何具体的咨询。

取得您的優質流動性

我们随时为您提供根据您的具体要求量身定制的最佳流动性解决方案。现在联系我们。

高级报告

使用根据个人规格配置的参数创建大量全面、高度详细的报告。从详细的账户报表到交易量报告,完全控制您的运营并最大限度地发挥您的业务潜力。

客户支持

我们专业的客户服务团队全天候为您提供帮助。请随时与我们联系。

常见问题

有一个问题?有关我们产品和服务的有用信息的来源。

建议将已使用保证金维持在 65-75% 的水平,以避免止损离场。可采取的措施:

在 PrimeXM/OneZero 中止损离场时,头寸会发生什么?

在止损离场的情况下,在 PrimeXM/ OneZero 水平中会自动平仓,但在 MT 4/5 水平中会保留。止损水平为 120%。

我平仓了,但我的 PrimeXM/OneZero 余额没有受到影响,为什么?

PnL 仅在延期付款后记入保证金账户余额,日期是在 PrimeXm 的周六。对于OneZero,延期付款规则为:对于外汇工具[T+2(在2天内),或者对于美元/CCY2 和 CCY1/USD 对为 T+1,其中 CCYx 为[CAD、TRY、PHP、RUB、KZT、PKR]。T+0 适用于所有其他工具。

延期付款有几个定义:

1)这是一个流程,将头寸转移到下一个交易日。每天在固定的同一时刻自动执行延期付款。在延期付款期间,价差可能会扩大,因此在已使用保证金水平过高的情况下,一些头寸可能会通过止损离场来平仓。因此,建议将已使用保证金的水平保持在 65-75% 的水平上。延期付款是全球性的银行间事件,我们必须应对这样的事件。

2) 这是一个将 Pnl 转换为余额的时刻。它只涉及 PrimeXM 和 OneZero。

掉期每周可以更改几次:贷款和后续存款采用银行间利率处理,银行间利率每天都可能更改。我们从交易对家处收到掉期利率,不修改/不加成

在将掉期应用于交易平台之前,技术支持人员将通过电子邮件通知您即将发生的掉期变更。您可以在 B2Broker 规范中找到所有相关信息。

為什麼在平倉/ 持倉 MT 4/5 限價單後, 圖表顯示的價格還沒達到定義級水平?

MetaTrader 圖表是基於默認的客戶賣出價顯示. 您最初需要確定客戶買入價沒有達到價格水平. 這是必要的, 因為買入限價單/未平倉賣出倉位是由客戶買入價去執行. 您可以在 MetaTrader 終端設置中開啓客戶買入價顯示.

如何在 PrimeXM/OneZero 计算保证金水平(%)?

如果您知道开仓或维持仓位需要多少保证金,以及您当前的资产净值,就可以计算保证金水平(%)。以外汇工具为例: 1 手 EURUSD。100,000 欧元(以美元计)*基于美元货币汇率(1.13/1)(欧元兑美元汇率)*按规范计算的保证金费用(1%)= 1130 美元。保证金百分比公式 = (已用保证金(美元))/资产净值(美元)*100%。例如:您打算开 1 手 EURUSD,您的当前资产净值为 100,000 美元。在这种情况下,开仓 1 手 EURUSD 将需要 1130 美元(根据之前的计算),最终公式 = 保证金/资产净值*100% = 1130/100,000 * 100% = 1.13%。

差价合约的计算公式:手数 * 点价 * 增量(点)。例如:您有一个未结头寸 1 Buy AMZN。1 手 AMZN 100 点 = (手数*合约规模*点规模) = 1 00 美元 – 这是您在 AMZN 100 点价格波动中获得的利润。

如何在 PrimeXM/OneZero 中计算掉期?

您可以从 B2Broker 规范中获取掉期数据。

在此处。 如何根据您的头寸计算掉期:2)掉期计算公式:假设美元兑瑞士法郎的掉期多头为(-5)。那么,保持 50,000 手美元兑瑞士法郎未平仓合约的掉期费用 = 50,000(合约)*0,00001(点规模)*(-5)(掉期多头)*转换汇率(举例来说,假设美元兑瑞士法郎 = 0,95000,那么瑞士法郎兑美元 = 1,05263) = -2,63 美元。

B2Broker 油价 – 在下一个到期日期间,油价将逐渐走向期货价格,这是一种 SPOT 产品,而不是未来的差价合约。

您的请求需要等待财务部门的批准。财务部门的工作时间:工作日 7.00 GMT – 17.00 GMT。

还有其他问题吗?

我们随时准备回答您的所有问题。保持联系。

现在问我们

最好搭配

我们的流动性最好与领先的行业交易平台相结合,以提供极致的性能和用户满意度。

取得您的優質流動性

我们将根据您的具体需求,为您提供最好的流动性解决方案,帮助您扩大外汇业务。如果您仍有疑问,请随时联系我们。立即联系我们。

订阅并关注外汇、加密货币、大宗经纪和金融科技行业的最新创新。

12ms

12ms

X-Core

X-Core

Hub

Hub

Hub

Hub

WebSocket API

WebSocket API

观看更多

观看更多