B2CONNECT-Update: Interne Risikoübernahme, Integrität synthetischer Preise und ein smarteres Web-Erlebnis

Die Weiterentwicklung von B2CONNECT, unserem krypto-nativen Liquiditätshub, setzt sich mit dem September-Release fort — einem unserer bisher bedeutendsten Updates.

Nach der Einführung von Transparenz- und STP-Verbesserungen im August-Release konzentriert sich dieses Update auf Risikokontrolle, Liquiditätsoptimierung und eine intelligentere Administration.

Hier ein kurzer Überblick über die wichtigsten, jetzt live geschalteten Upgrades:

- B-Book & C-Book: Vollständige und teilweise Risikointernalisierung für eine intelligentere Ausführung.

- Synthetic Price Invalidation: Einheitlicher Schutz vor veralteten Kursen über alle Assets hinweg.

- Connector-Based Setup: Schlanker Workflow für die Liquiditätskonfiguration.

- Modern WebUI & SSO: Schnellere, sicherere und einfachere Administration.

- AMS CSV Tools: Schneller Import/Export für Margin- und Provisionsprofile.

- Asset Safeguards: Integrierte Prüfungen für Datenintegrität.

- Contract Size Fix: Präzise Parameterberechnungen für Derivate.

Sehen wir uns an, wie diese Upgrades Ihre Liquiditätsprozesse stärken.

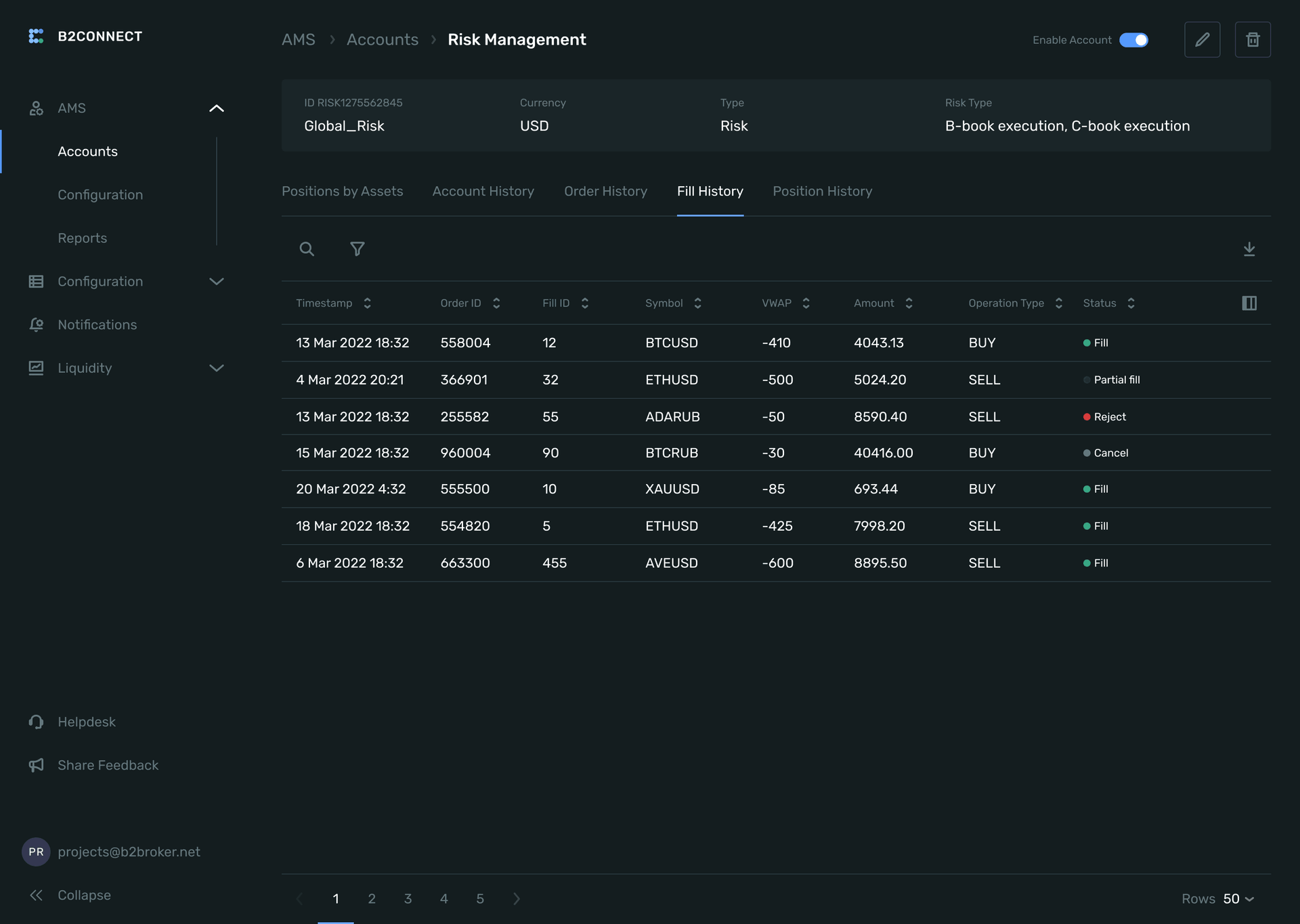

Vollständige Risikointernalisierung (B-Book): Mehr Wert aus jedem Trade schöpfen

Das September-Release bringt vollständige Risikointernalisierung (auch als B-Book-Ausführung bekannt) in B2CONNECT. Damit können Broker ausgewählte Symbole vollständig im Hub ausführen, ohne jeden Trade an einen externen Liquiditätsanbieter zu routen.

Die Einrichtung ist einfach und flexibel. Administratoren können die interne Ausführung pro Symbol aktivieren oder ganze Gruppen per CSV verwalten — ideal für große, schnelllebige Umgebungen. So können Teams genau dort interne Ausführung einsetzen, wo es wirtschaftlich sinnvoll ist, und die Profitabilität optimieren, ohne die Kontrolle aufzugeben.

Mit einer präzisen, symbolbasierten Ausführungssteuerung macht B2CONNECT die Internalisierung zu einem strategischen Vorteil. Das Ergebnis: stärkere Handelsmargen, weniger externe Abhängigkeiten und ein klareres Verständnis darüber, wo Ihr Risiko tatsächlich liegt.

Teilweise Risikointernalisierung (C-Book): Hedging und interne Kontrolle ausbalancieren

Als Ergänzung zur vollständigen Internalisierung führt B2CONNECT jetzt die teilweise Risikointernalisierung (C-Book) ein — ein flexibles Hybridmodell, das externes Hedging mit interner Ausführung verbindet.

Über die neue Hedge Ratio können Broker exakt festlegen, wie viel Exposure extern gehedgt wird — von 0% (volles B-Book) bis 100% (volles A-Book). Innerhalb dieses Spektrums spiegelt das System externe Fills automatisch für den internen Anteil wider und gewährleistet identische Preise und Mengen auf beiden Seiten.

Die Vorteile sind unmittelbar: geringere Kommissionskosten, weniger Slippage und volle Transparenz bei der Risikoallokation. Sowohl Market- als auch Limit-Orders werden unterstützt, sodass über alle Flows hinweg eine konsistente Ausführung sichergestellt ist.

In der Praxis gibt C-Book Brokern die Freiheit, ihre Risikostrategie in Echtzeit anzupassen — einen Teil des Flows zu internalisieren, wenn die Spreads breit sind, oder bei veränderten Liquiditätsbedingungen mehr Exposure nach außen zu verlagern.

Das ist ein intelligenterer, agilerer Weg, Risiko und Profitabilität in volatilen Märkten auszubalancieren.

Synthetic Price Invalidation: Zuverlässigere Marktdaten über alle Symboltypen hinweg

Präzise Preisbildung ist das Rückgrat jeder verlässlichen Handelsumgebung. Mit diesem Release erweitert B2CONNECT seine Invalidation-Logik auf synthetische Symbole, sodass reale und synthetische Märkte denselben Integritätsregeln folgen.

Wenn ein Bein eines synthetischen Paares keine Quotes mehr von einem Liquiditätsanbieter erhält, setzt das System jetzt automatisch das Orderbuch für dieses Paar zurück und sendet ein Price-Invalidation-Signal an alle angeschlossenen Plattformen und Empfänger.

So wird gewährleistet, dass veraltete oder unvollständige Daten sofort aus Ihrem Feed entfernt werden und synthetische Paare ebenso präzise und vertrauenswürdig bleiben wie ihre organischen Gegenstücke.

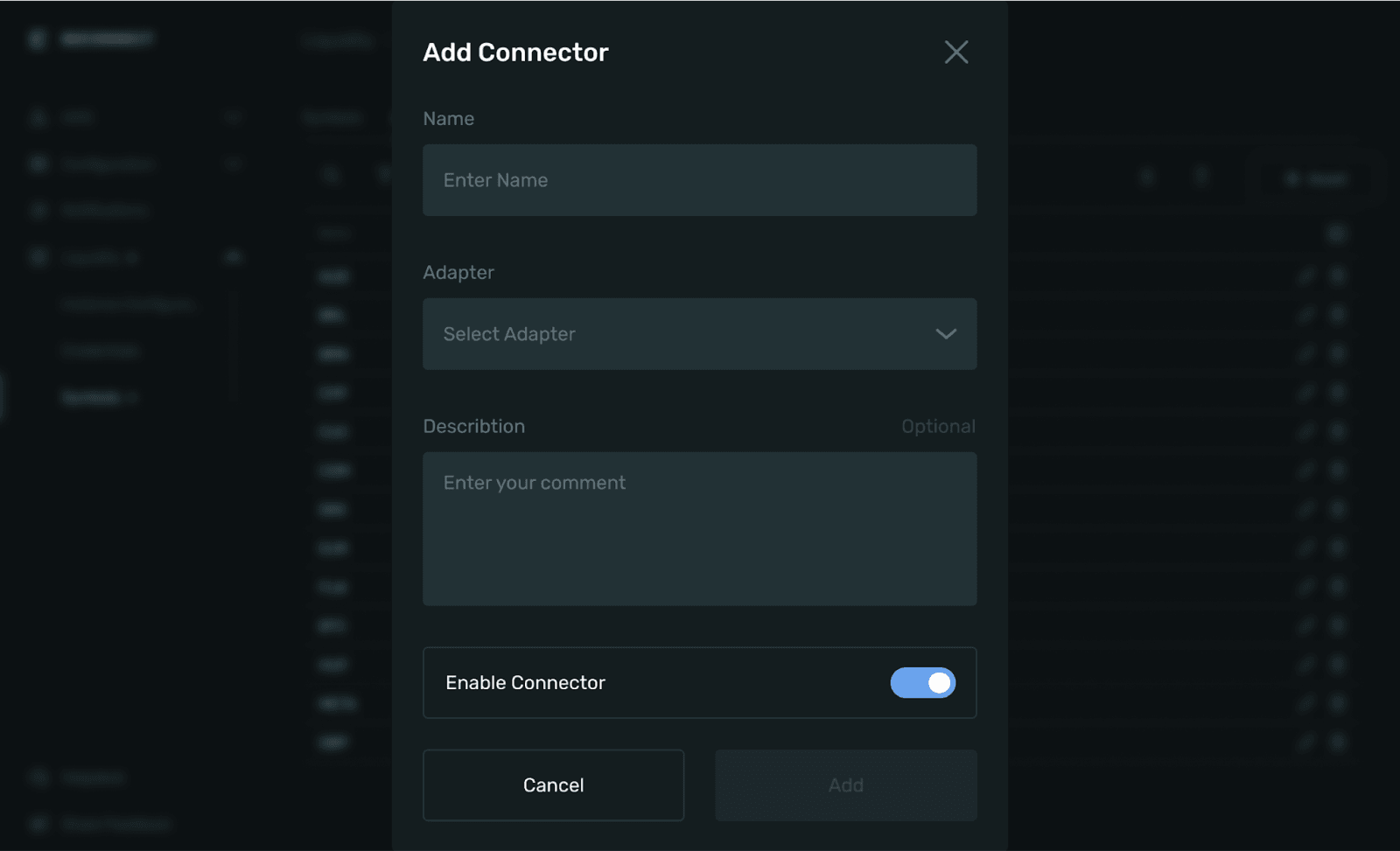

Connector-Based Liquidity Configuration: Klarer, schneller und leichter zu verwalten

Das Einrichten der Liquidität in B2CONNECT ist deutlich intuitiver geworden. Statt einer einzigen globalen CSV-Datei nutzen wir jetzt einen connector-basierten Konfigurationsflow, der jeder eingehenden Verbindung ein eigenes, strukturiertes und transparentes Setup gibt.

Administratoren können jetzt:

- Assets in großen Mengen hochladen und automatisch ihren Liquiditätsanbietern zuordnen.

- Symbol-Listings zwischen Market Makern und dem Hub mit einem Klick abgleichen.

- Quoting-Parameter pro Connector direkt per CSV anpassen.

Dieser Ansatz beschleunigt nicht nur das Onboarding erheblich, sondern reduziert auch Konfigurationsfehler und liefert einen klaren Überblick über jeden Liquiditätsstrom — ideal für komplexe Umgebungen mit mehreren Anbietern.

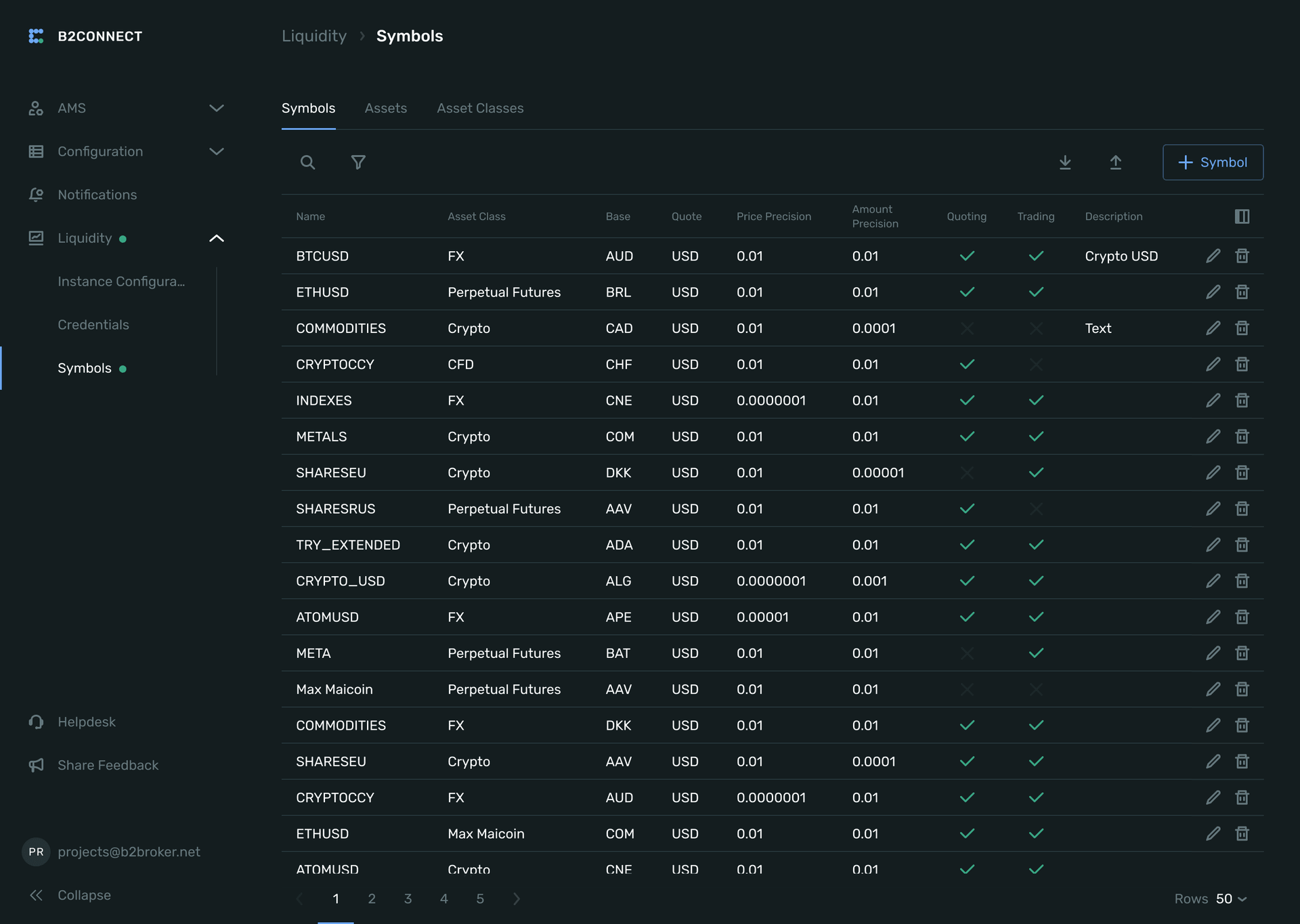

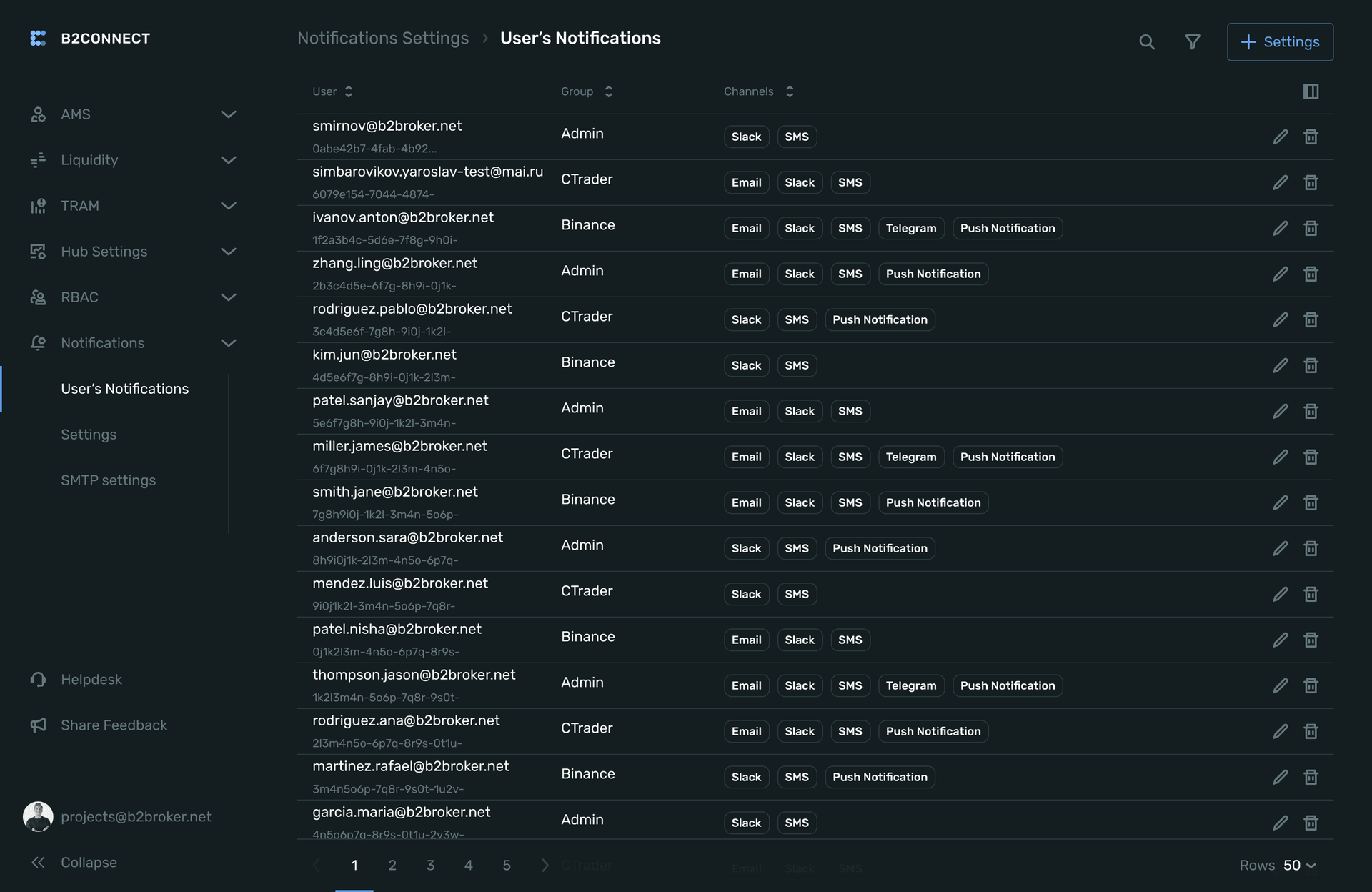

Modern WebUI und SSO: Eine einheitliche, intelligentere Admin-Erfahrung

Dieses Update bringt eine frische, modernisierte WebUI mit Fokus auf Benutzerfreundlichkeit und Sicherheit. Das neu gestaltete Admin-Panel strafft die Navigation, verbessert die Datensichtbarkeit und führt standardbasiertes Single Sign-On (SSO) ein, um die Authentifizierung über alle Umgebungen hinweg zu vereinheitlichen.

Wesentliche Verbesserungen umfassen:

- Vereinfachte Navigation: Ein klareres Layout erleichtert das Auffinden zentraler Bereiche wie Liquidity, Symbols, Accounts und Settings.

- Benachrichtigungen und Einstellungen: Benachrichtigungen und globale Parameter befinden sich jetzt unter Hub Settings.

- Breitere Datentabellen: Erweiterte Tabellen zeigen mehr Informationen auf einen Blick und reduzieren Klicks.

- Überarbeitete Seitenleiste: Neu aufgebautes Navigationskonzept mit klarerer Informationsarchitektur.

- Sicheres SSO: Ein Identity Provider für alle Nutzer, für sicheren, konsistenten Zugang, ohne zu ändern, wie Endnutzer sich anmelden.

In Summe sorgen diese Updates für eine schnellere, intuitivere Administration, sodass Teams Konfigurationsänderungen sofort vornehmen können, ohne auf Entwicklerunterstützung zu warten.

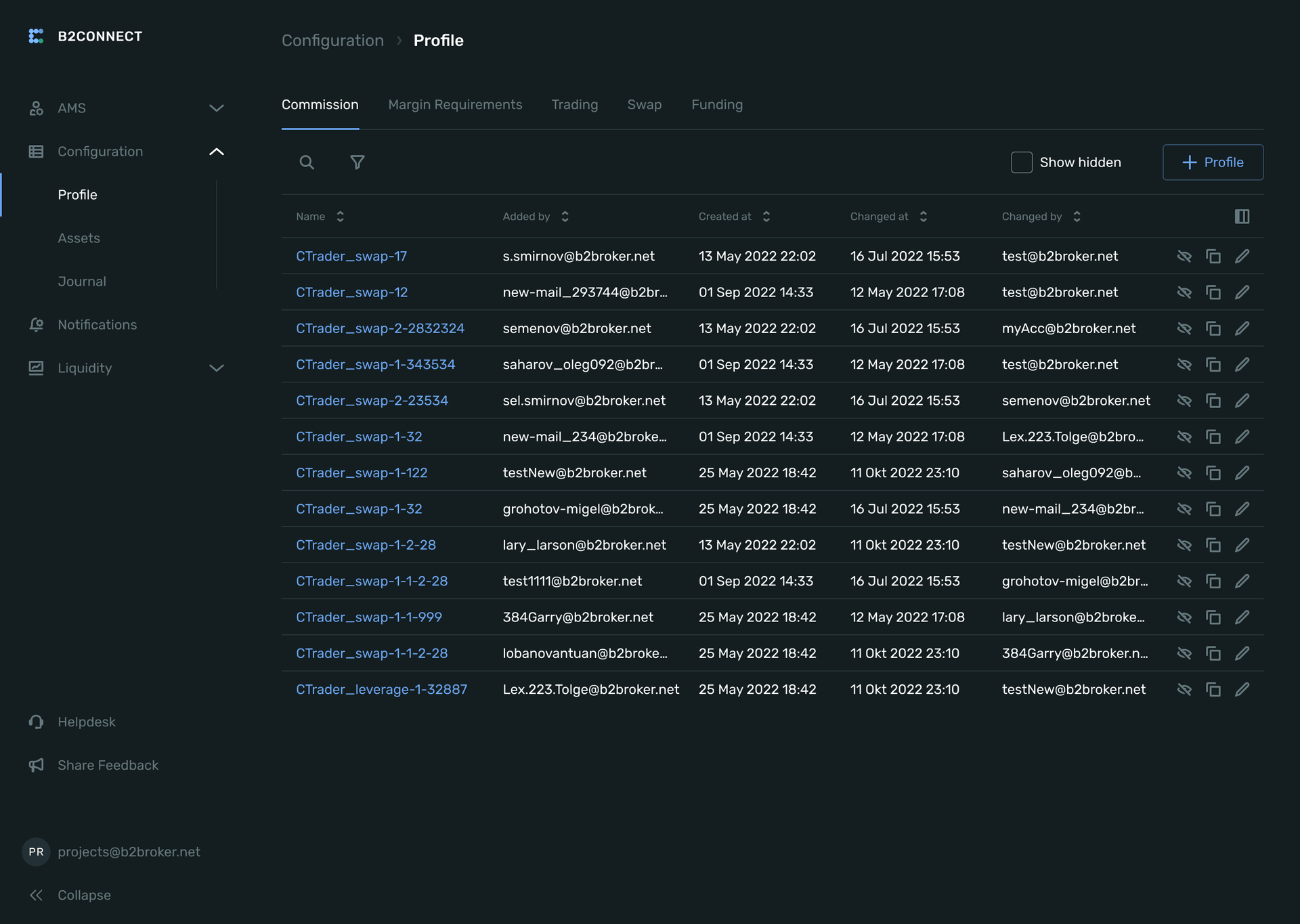

AMS (Account Management System) Profile: In Minuten konfigurieren mit CSV-Import/Export

Die Verwaltung von Hunderten oder gar Tausenden Einträgen in Margin- und Provisionsprofilen muss nicht mehr manuell erfolgen. Der CSV-Import/Export-Assistent ermöglicht es Administratoren jetzt, alle AMS-Profile zu exportieren, in großen Mengen zu bearbeiten und mit einem Klick wieder hochzuladen.

Der Assistent validiert Ihre Daten automatisch und markiert Fehler, bevor Änderungen angewendet werden, sodass Genauigkeit und Konsistenz über alle Profile hinweg gewährleistet sind. Für Broker mit großen, multi-assetbasierten Setups bedeutet das: weniger Zeit für Konfiguration, mehr Zeit für den Handel.

Asset-Management-Schutzmaßnahmen: Integrierter Schutz für die Systemintegrität

B2CONNECT enthält jetzt integrierte Sicherheitsprüfungen, die das Löschen von Assets verhindern, die an anderer Stelle im System referenziert werden. Diese neuen Schutzmechanismen sichern die Datenintegrität und verhindern versehentliche Fehlkonfigurationen, die den Betrieb stören könnten.

Fix: Korrekturen des Kontraktgrößen-Multiplikators für Derivate

Wir haben außerdem einen wichtigen Fix für Instrumente mit Kontraktgrößen-Multiplikatoren umgesetzt. Alle Handelsparameter (einschließlich Mindestordergröße, Preisschritte und Nominalwerte) spiegeln die Kontrakt-Multiplikatoren nun korrekt in der FIX SecurityList wider.

Das gewährleistet höchste Präzision im Derivatehandel, bei dem Kontrakteinheit und zugrunde liegendes Asset voneinander abweichen können. Ihre Trader und angeschlossenen Plattformen können sich nun auf korrekte Parameter und ein saubereres Reporting über alle Derivateprodukte hinweg verlassen.

Einen intelligenteren Liquiditätshub aufbauen

Das September-Release stärkt B2CONNECT auf allen Ebenen — von Risikomanagement und interner Ausführung bis hin zu Datenintegrität und operativer Effizienz.

Unsere Teams arbeiten bereits an den nächsten Leistungs- und Reporting-Verbesserungen, die darauf abzielen, die Ausführungslogik weiter zu straffen und die Multi-Asset-Abdeckung auszubauen.

Bleiben Sie dran für das nächste Kapitel in der Evolution von B2CONNECT!