California Fire Hits Insurance, Utility Stocks, and More

The California Fire is taking its toll, claiming lives, houses, and businesses. Three days after the uncontrollable spread of the blaze, companies’ stocks are suffering massively, especially in sectors closely associated with the damage, such as property REITs, utility, and insurance companies.

With unpredictable fire control and multiple hot zones, corporations are counting their losses, which we will highlight below.

California Fire – How it Started

The Los Angeles wildfire started on 7 January. While the ignition reason is still being investigated, many factors contributed to the quick spread of Lidia, Hurst, Kenneth, Eaton, and Palisades fire locations.

Due to the severe drought conditions Southern California has experienced, some regions recorded the driest start to the rainy season. This has left wildlife extremely dry and susceptible to ignition.

The powerful Santa Ana winds, with gusts reaching up to 160 km/h, also contributed to the spread of the California Palisades fire, exacerbating the situation and complicating containment efforts.

Stocks Affected by California Fire

With many evacuating their houses and escaping the raging inferno, companies have suffered from their direct exposure to financial risks and upcoming liabilities.

After announcing 9 January as a mourning day for Jimmy Carter’s funeral, after-hours movers could not save their investments due to the stock market’s closure, which affected investors and issuers.

The fire news highly impacted insurance, utility, and real estate companies, with leading firms losing massive amounts of their shares.

Utility

Utilities, like gas stations and hydro-plant facilities, are particularly vulnerable to wildfire impacts due to liability concerns from equipment-related fires, infrastructure damage, and operational disruptions caused by preventive measures like power shutoffs.

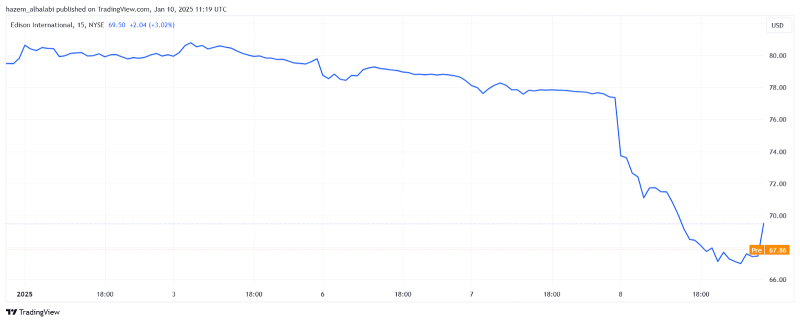

Edison International (EIX)

EIX is a public utility company that generates and distributes electricity and provides energy services.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

The company’s stock dropped by $10 between 7 and 8 January, from $77 to as low as $66 in one day. This dip marked its largest one-day percentage decrease since March 2020.

This decline is attributed to concerns over potential liabilities and the company’s proactive power shutoffs, which affected nearly 70,000 customers to mitigate fire risks.

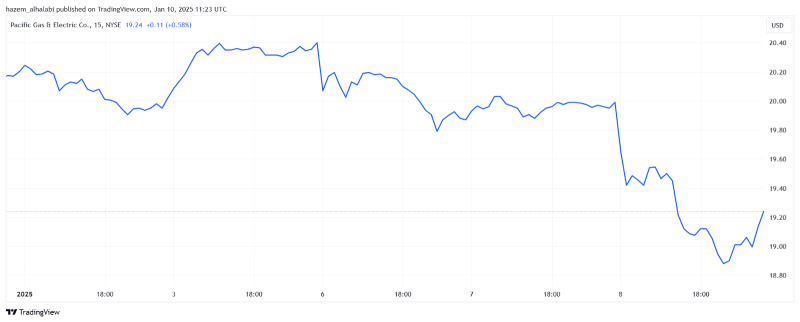

PG&E Corporation (PCG)

Pacific Gas and Electric Company is a utility that provides natural gas and electricity to customers in California. It uses nuclear, hydroelectric, fossil fuel, fuel cell, and photovoltaic sources.

Due to wildfire-related liabilities, the company faced investor apprehensions. On 8 January, PG&E’s stock lost around 6% of its value, dropping from $20 to $18.80 in one day before rebounding to $19.25 as of 10 January.

Insurance

Wildfires heavily impact the insurance sector due to the significant payouts required for property damage claims. These events often result in billions of dollars in insured losses, challenging insurers’ profitability and operational stability.

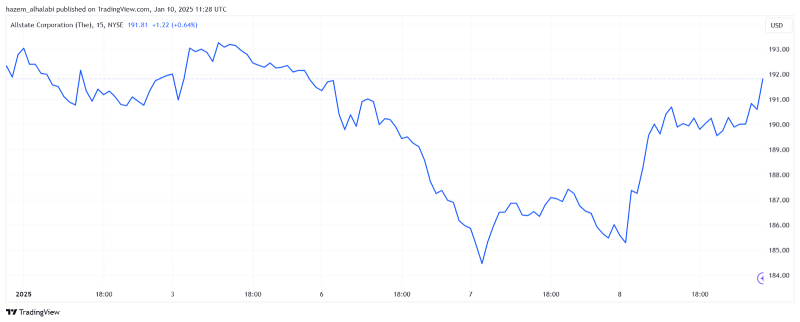

Allstate Corporation (ALL)

Allstate is an American insurance company that covers household assets like cars, homes, rentals, motorcycles, and more. It is among the insurers expected to incur significant losses due to the wildfires.

Analysts estimate that insured losses could exceed $20 billion, potentially making this the costliest wildfire event in US history. Despite this, as of 10 January, Allstate’s stock is trading at $192 after losing around 3.6% of its value in the previous days, indicating investor confidence in the company’s ability to manage these claims.

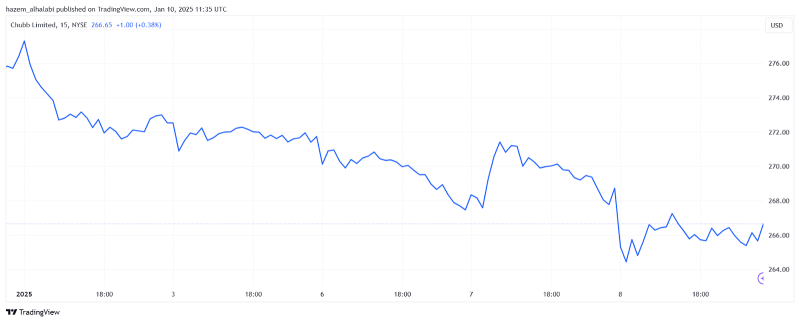

Chubb Limited (CB)

Chubb is a global insurance company that offers a variety of insurance products and services, including commercial and personal property, casualty insurance, personal accident and supplemental health insurance, and life insurance packages.

The firm is expected to face substantial claims, and its dwindling stock performance slumped even sharper after 7 January. On 8 January, Chubb’s stock lost around 2.5% of its value, from $271 to $264, before slightly bouncing to $266 as of 10 January.

Real Estate

The real estate sector faces challenges during such events due to property damage, reduced rental demand in affected areas, and potential devaluation of assets. These factors can lead to financial strain for property owners and real estate investment trusts (REITs).

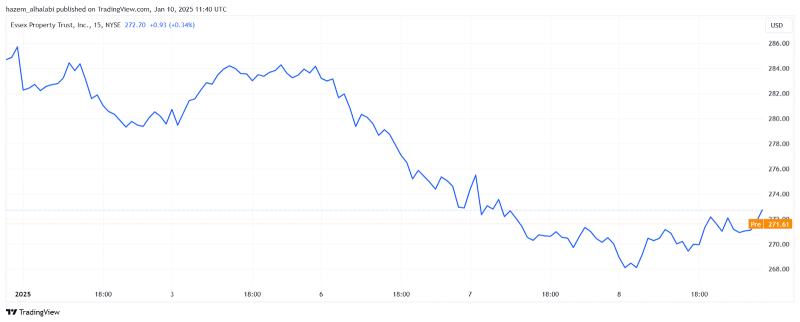

Essex Property Trust (ESS)

Essex Property is a real estate investment trust (REIT) with significant holdings in California, including commercial buildings, apartment units, and development projects. Property value declines in wildfire-prone areas could affect Essex Property Trust.

Its already-declining shares continued falling, with a significant drop of 2.5% on 8 January from the previous day and nearly 6% from the last week.

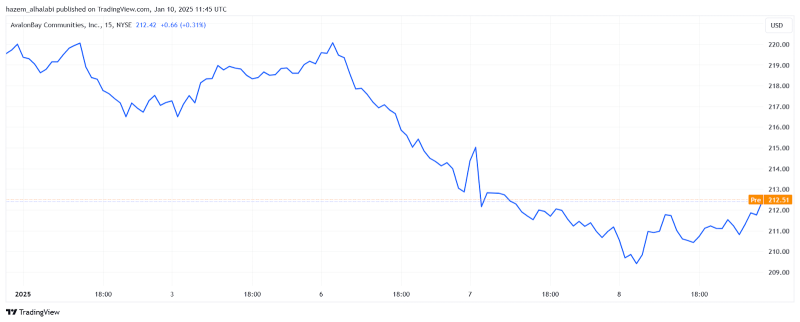

AvalonBay Communities (AVB)

AvalonBay is a REIT company that develops, owns, and finances apartment communities in the US, owning over 80,000 apartment houses in its portfolio.

AvalonBay Communities REIT might face similar challenges. Between 6 and 8 January, AVB’s weak stocks suffered a major hit, dropping from $220 to $209, or a 5% decline. The shares climbed slightly to $212 on 10 January, but they are still below their pre-fire performance.

How Can These Companies Recover From The Wildfire?

The recovery route depends on how long it takes to control the wildfire and implement policies for each associated firm.

For example, utility companies may recover by improving infrastructure, such as transitioning to underground power lines to prevent future liabilities, securing government support for wildfire mitigation costs, and adjusting rates to recoup financial losses.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Insurers can recover by repricing premiums to reflect wildfire risks, diversifying their geographic exposure to spread risks, and leveraging reinsurance to manage high claims payouts more effectively.

Finally, property companies and REITs may focus on long-term strategies when rebuilding damaged properties. This approach includes fire-resistant materials, prioritising investments in less fire-prone areas, and offering incentives to attract tenants or buyers back to affected regions.

Final Takeaways

The California fire has created substantial challenges for people and businesses. Multiple hot zones have emerged and spread across Los Angeles County.

Utilities, insurers, and real estate sectors are the most stocks affected by the California fire, due to their direct link and exposure to this unfortunate event, impacting their operations and financial stability.

However, strategic recovery efforts offer a pathway forward, including improved infrastructure, premium adjustments, and fire-resistant rebuilding.

Disclaimer: This article is for informational purposes only. It is not finance advice and should not be relied upon for investment decisions. Always do your own research and consult a financial advisor before investing.