Impact of Trump Inauguration – New Bitcoin Record and Higher Stocks

Donald Trump was announced as the president of the United States after a year of speculation about his upcoming decisions and impact.

The financial market is expecting big changes after the promised policies over the last year to improve the national industrial and technological status. Crypto businesses are anticipating what will Trump do, while the energy sector is believed to have dramatic changes.

Let’s review the financial outcomes of the Trump inauguration.

Trump Inauguration’s Impact on Financial Markets

On 20 January, Donald Trump was named the 47th president of the United States. The country’s financial and industrial situation is not at its best, putting several challenges ahead.

Trump promised to focus on cryptocurrencies as the catalyst for national growth, encouraging Bitcoin mining and leading blockchain developments. Other plans include strengthening the USD in the Forex market and improving the local energy sector through new projects.

Few markets reacted directly after the Donald Trump inauguration, while other sectors experienced speculative fluctuations.

Stocks

The inauguration sparked optimism in the stock market, particularly in sectors poised to benefit from his pro-business agenda.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

Billionaire investor and former hedge fund manager Stanley Druckenmiller said in an interview with CNBC that executives are excited about “going from the most anti-business administration to the opposite”.

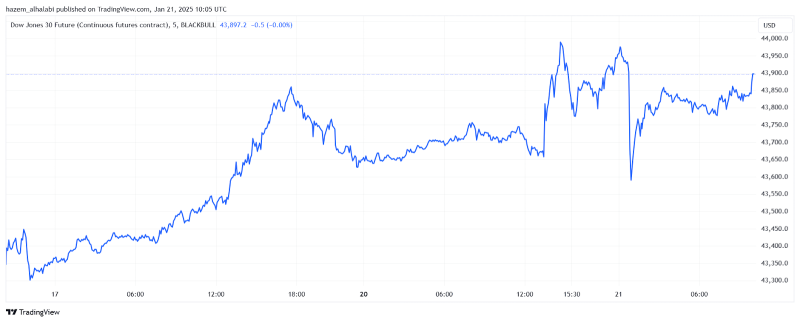

Trump’s inauguration impact on stock market companies included indices, energy, and financial equities. However, only futures prices were impacted because the market was closed.

- Dow Jones Futures experienced increased volatility, jumping by 0.6%, before dropping 0.75% of its value before the end of the day. NASDAQ-100 Futures and S&P Futures had similar movements due to the mixed sentiment between rising optimism and concerns over trade policy changes.

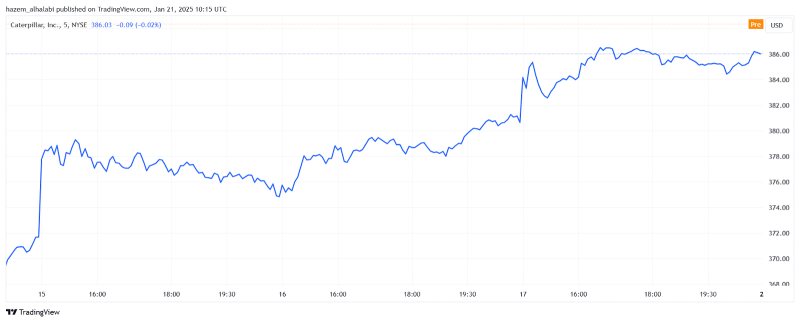

- Caterpillar and ExxonMobil experienced upward trends due to the anticipated increase in infrastructure investments. CAT stock prices rose by 2.5%, while XOM grew by around 2% just before the presidential ceremony.

Forex

Over the past year, the USD/EUR pair weakened by 3%, reflecting policy and inflation concerns. However, the US dollar showed mixed performance in the Forex market on 20 January.

- USD/GBP: Gained 0.7% on inauguration day as markets anticipated stronger fiscal policies.

- USD/EUR: The Euro dropped over 1% of its value against the Dollar, which was corrected later, reflecting eurozone indecision.

Much of this indecision is attributed to potential tariff discussions and monetary policy shifts. The financial impact of Trump’s presidency triggered a short-term dollar rally. However, its longer-term trajectory will depend on clearer signals from the fiscal and trade strategies.

Cryptocurrencies

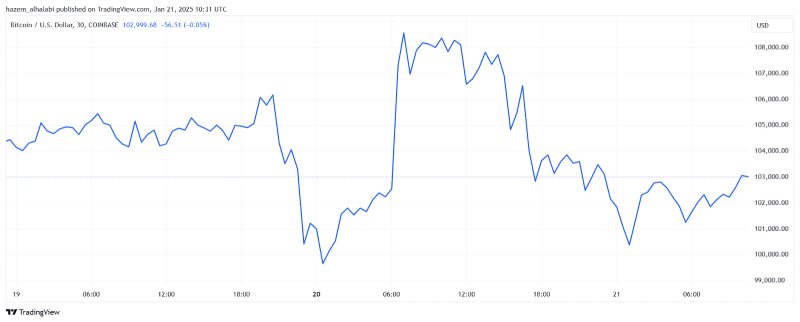

Trump on crypto signalled a shift in regulatory tone, expressing support for blockchain innovation. The speculations affected prices almost immediately, causing most cryptocurrencies to become more volatile.

- Ethereum: ETH rose 7% on the morning of 20 January, mirroring market enthusiasm across major coins.

- Bitcoin: BTC surged massively, reaching a new all-time high price of $109,000. The coin grew by +6% in a couple of hours, reflecting renewed investor confidence.

Besides the significant growth of major coins, $TRUMP and $MELANIA meme tokens also gained traction despite their speculative future.

Market participants expect favourable policies to drive adoption and innovation, positioning cryptocurrencies for potential mainstream integration and sustained growth during Trump’s term.

Energy Commodities

Trump highlighted his focus on energy independence, declaring a “national energy emergency” to boost domestic production and drilling rigs.

- Chevron: Stocks kept growing, recording over 6.5% gains over the previous week, benefiting from potential drilling expansions.

- Halliburton: Stocks kept increasing throughout the week, hitting over 10% growth in the past week with a continued uptrend this week amidst potential hikes in production services demand.

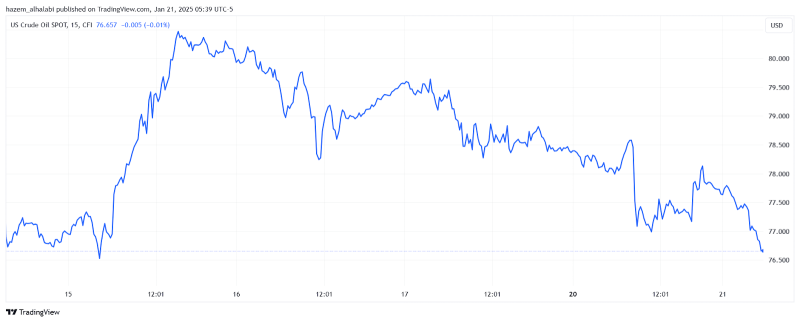

However, WTI crude oil dropped its barrel price significantly due to the expectations of higher output. The price per barrel decreased from $80 to $78 right before the inauguration day, falling to $76.5 on 21 January.

Conclusion

The Trump inauguration’s impact on the stock market, cryptocurrencies and the local currency were almost immediately evident. Financial and energy stocks climbed slightly amidst the anticipation of boosted energy production and improved economic policies.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Similarly, Trump’s stance on cryptocurrencies and blockchain triggered a significant bullish movement in the crypto market, which sent Bitcoin to a new record price.

However, some markets were highly volatile, fluctuating widely due to the possibility of higher tariffs on trade partners, changes in the international trade landscape and foreign policies.

Disclaimer: This article is for informational purposes only. It is not finance advice and should not be relied upon for investment decisions. Always do your own research and consult a financial advisor before investing.