What is RegTech? What Makes It Necessary for Financial Institutions?

With the rise of artificial intelligence, blockchain, and machine learning, staying compliant has become more complex than ever. These challenges require businesses to balance innovation and legality, which is the core role of RegTech.

At the same time, regulations struggle to keep pace with these tech advancements, making it more challenging for businesses to adapt legal frameworks and rendering regulatory technology a vital tool.

But does adopting yet another technology justify the cost? Let’s explore RegTech, how it works, and whether it’s a worthwhile investment for your business.

Key Takeaways

- RegTech stands for regulatory technology, which entails providing technologically advanced solutions to ensure legal compliance.

- RegTech uses artificial intelligence, machine learning, blockchain, and cloud computing to automate compliance practices.

- Financial services, payment providers, and tech firms use these services to operate legally during dynamic regulatory changes.

- Some RegTech practices include monitoring risks, tracking behavioural patterns, and updating changes in legal frameworks.

What is RegTech?

RegTech refers to the use of technology to help financial institutions comply with regulatory requirements more effectively and efficiently. It uses advanced tools, such as artificial intelligence, blockchain, and cloud computing, to streamline compliance processes, reduce risks, and improve transparency.

RegTech solutions help businesses manage large volumes of regulatory data, update changes, automate reporting, and detect fraudulent activities to address current and potential issues. Such protocols gained popularity following worldwide financial crises and recessions, which led to the rise of more stringent laws.

As regulatory frameworks become more complex, businesses increasingly rely on regulatory technology to operate while ensuring full legal adherence.

Why is RegTech Important?

RegTech is crucial for different businesses but is prominent in the financial sector because it simplifies compliance, reduces operational costs, and enhances risk tracking and management. It allows companies to track and adopt evolving regulations as manual processes become futile. It is most used to automate compliance tasks, minimise human errors, and align institutions with regulatory requirements. Moreover, it helps early detection of financial crimes, ensuring businesses operate within legal frameworks and maintain customer trust.

History & Growth

This concept emerged following the 2008 financial crisis, when regulators imposed stricter compliance requirements on financial institutions. Initially, firms relied on traditional measures, which were costly and inefficient.

However, with advancements in AI, big data, and big-data processing, RegTech in banking gained traction as a more effective approach to meet financial regulations.

In the 2010s, RegTech startups emerged to provide automation tools for legal reporting, fraud detection, and risk management. Governments and regulatory bodies recognised the potential of such solutions, driving more investments in the sector.

The global RegTech market grew significantly, driven by increasing regulatory complexity and the demand for cost-effective solutions.

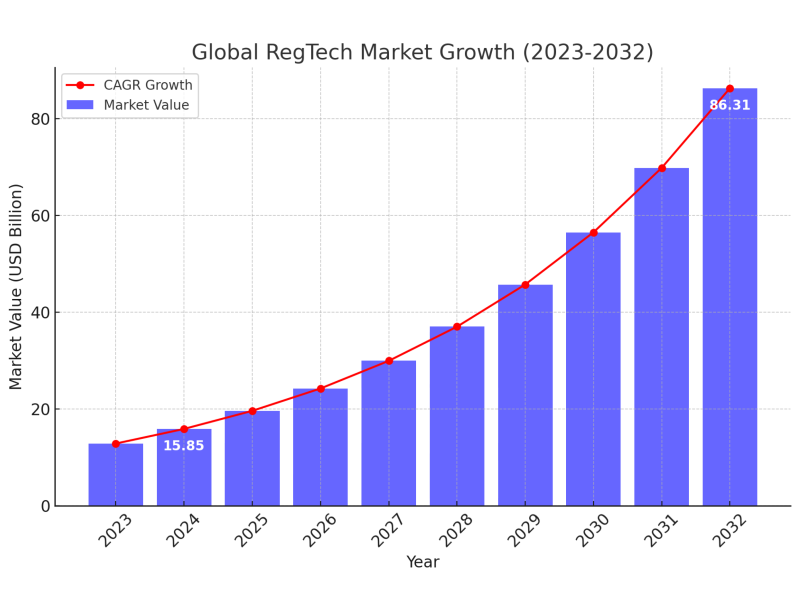

In 2023, the market was valued at $12 billion and is estimated to have reached over $15 billion in 2024. This trend is expected to continue growing at a CAGR of 23.6%, reaching almost $86 billion by 2032.

Much of these trends come from North American markets, generating over 33% of the total market capitalisation. Moreover, governmental initiatives contributed to the adoption of RegTech practices.

In 2023, the Australian Government granted $5 million to small and medium-sized enterprises for adopting RegTech under the BRII Act, while the Monetary Authority of Singapore announced a $35 million grant in 2021 to enhance RegTech and reporting accuracy.

Today, RegTech compliance keeps growing, integrating cutting-edge technologies like blockchain and machine learning to enhance security, transparency, and efficiency.

How RegTech Works—Key Technologies

Companies leverage advanced technology and tools that focus on automation to make tracking, analysing, and updating compliance processes more seamless. RegTech saw a major boost with the rise of decentralisation, high-volume processing capabilities, and other breakthroughs.

AI & Machine Learning

Artificial intelligence and machine learning play a crucial role in RegTech by analysing significant regulatory data and identifying patterns of non-compliance.

This helps automate reporting, detect fraud, and improve risk assessment. Machine learning algorithms continuously evolve, allowing financial institutions to adapt to new regulatory changes more effectively.

Blockchain

Blockchain technology enhances transparency and security in regulatory compliance. By providing an immutable ledger of transactions and tokenising assets and certificates, blockchain ensures that financial records are tamper-proof and easily auditable.

It is particularly useful in anti-money laundering (AML) processes and secure data sharing between companies and regulators.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Cloud Computing

Cloud computing enables financial institutions to securely store, process, and share large volumes of data. It also allows real-time compliance monitoring, reduces infrastructure costs, and improves scalability.

Cloud-based RegTech provides seamless integration with existing financial systems, enhancing operational efficiency and making it more viable for businesses to integrate such tools.

Types of RechTech Solutions

Companies use regulatory technology solutions to address various activities that fall under the compliance umbrella, such as the following.

Risk Monitoring

RegTech helps organisations monitor risks in real time by analysing transaction data and activities to identify potential legal breaches.

It uses or creates a benchmark and points out any system anomalies that are further audited for possible threats. Automated alerts allow institutions to take proactive measures to prevent financial crimes.

Client Identification

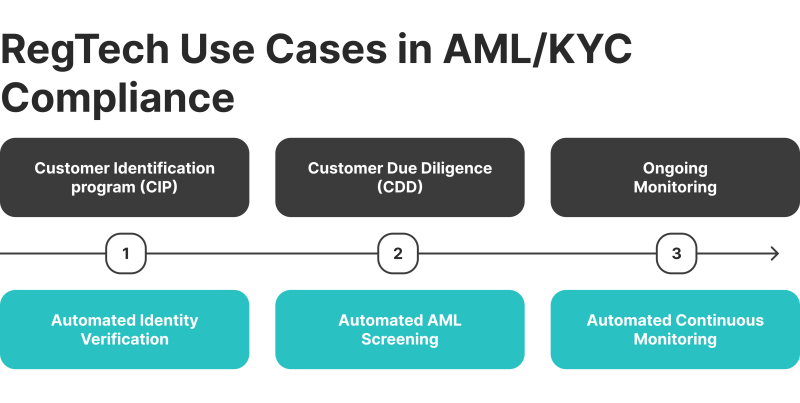

RegTech can also be implemented in Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols when onboarding new clients or processing transactions. It uses AI and biometric verification to authenticate customer identities and monitor activities, reducing fraud risks and ensuring compliance with regulatory requirements.

Fraud Detection

AI-driven fraud detection systems analyse transactional patterns to identify suspicious activities, such as unusual amounts or new destinations. As such, they detect and isolate fraudulent transactions before they occur, enhancing system security and user trust.

Data Analytics

RegTech uses advanced data analytics to process large datasets, identify trends, and generate compliance reports that meet local or global standards. This gives companies and auditors clearer insights about internal processes, prompting fact-based decision-making and improving regulatory oversight.

Data Protection

RegTech uses advanced encryption techniques, like those used in crypto transactions, to ensure data privacy and security. This helps financial institutions comply with data protection regulations such as the General Data Protection Regulation (GDPR).

Legal Analysis

AI-powered legal tools can review regulatory documents, interpret obligations, and assist companies in staying up to date with legal frameworks. They use natural language processing (NLP) to scan, categorise, and highlight key regulatory changes, reducing the time and effort required for manual legal assessments and minimising human error.

Regulatory Compliance

Automated compliance management systems track regulatory obligations and adjust internal policies accordingly. These alignments can be done either fully automatically or by alerting admins to perform these changes. Both ways help businesses remain compliant with evolving regulations.

Training

RegTech offers compliance training platforms that provide interactive learning modules, real-time regulatory updates, and scenario-based training for employees. They utilise AI-driven simulations, quizzes, assessments, and personalised training to ensure employees understand evolving requirements and better track employee progress.

What Businesses Need RegTech?

While RegTech in banking and the financial industry is more prevalent, it is also applicable in sectors with dynamic regulatory environments, rapidly changing technologies, and high adherence duties.

Industries that face stringent regulatory scrutiny and monitoring usually need automated solutions to track, report, and mitigate compliance risks.

- FinTech Startups & Payment Processors: These businesses use RegTech to comply with AML and KYC regulations, ensuring seamless and compliant customer onboarding and safe activities.

- Cryptocurrency Exchanges: Given the high risks of fraud and money laundering associated with crypto money, RegTech solutions help monitor transactions and maintain legality.

- Healthcare & Telecommunications: These sectors leverage advanced tech for data management and protection, ensuring adherence to privacy laws such as GDPR and the Health Insurance Portability and Accountability Act (HIPAA).

RegTech Benefits for Companies

Regulatory technologies are not just trend-chasing practices or merely following the legal bare minimum. They offer various cost-effective and scalable answers to today’s challenging regulatory environment.

Cost Efficiency

RegTech significantly reduces compliance costs by automating manual processes, minimising reliance on large legal teams, and decreasing the risk of human errors that usually lead to hefty penalties.

Legal automation solutions help businesses streamline regulatory reporting, reducing the time and effort required for audits and documentation required by authorities.

Additionally, RegTech tools identify potential compliance breaches early, preventing fines and reputational damage. Ultimately, companies can allocate resources more efficiently, eliminate redundancies and optimise workflows without excessive spending.

Higher Accuracy

AI RegTech solutions enhance accuracy by automating compliance reporting and using less human intervention. They offer real-time big-data analytics faster than manual input, ensuring financial institutions remain compliant with the latest requirements and make informed decisions.

With more tech breakthroughs, RegTech uses advanced algorithms to detect anomalies, generate custom reports, and provide personalised insights, reducing the risk of misreporting or overlooked violations.

AI also assists in continuous learning, data validation, and regulatory interpretation, helping businesses understand complex legal frameworks and enabling staff members to enact regulatory changes.

Risk Mitigation & Management

RegTech plays a crucial role in mitigating and managing risks by continuously monitoring transactions, identifying suspicious activities, and analysing their impact.

AI-powered systems detect unusual behavioural patterns, such as transaction amounts, sender/receiver, and payment methods, enabling early intervention against fraud, money laundering, and other financial crimes.

Automated risk assessment tools strengthen compliance vulnerabilities and provide real-time alerts to prevent regulatory breaches. Additionally, they streamline risk reporting, helping businesses maintain transparency and adhere to evolving requirements with less input and cost.

Scalability

RegTech tools are flexible, suiting different business types and sizes. As such, companies and startups can adapt to evolving regulatory demands swiftly.

Additionally, businesses can expand compliance operations without significant infrastructure investments or extensive recruiting and training programs.

Cloud platforms offer real-time regulatory updates, seamless integration, and enhanced data security that align with different systems and databases.

Whether serving a few clients or hundreds of customers and wealthy investors, companies can scale legal efforts up or down based on changing regulatory landscapes, ensuring operational flexibility.

Advantages and Disadvantages

While RegTech can be highly beneficial for companies to streamline and automate their compliance activities, adopting such advanced tech can be challenging. The costs and complications associated with adopting such systems can negate the advantages.

Pros

- Enhances efficiency: RegTech automates compliance processes, reducing the time and effort required for regulatory reporting and audits, especially in strictly monitored industries.

- Reduces costs: Businesses save substantial operational expenses by minimising the need for large compliance teams and preventing regulatory fines.

- Improves risk management: AI-driven tools detect suspicious transactions and mitigate fraud and money laundering risks earlier to prevent possible breaches.

- Provides real-time monitoring: Cloud RegTech solutions offer continuous compliance tracking, ensuring companies stay updated and comprehend regulatory changes.

- Better data security: Advanced encryption and secure cloud storage protect sensitive financial data from breaches and aid in the early detection of vulnerabilities.

- Increases transparency: Blockchain solutions ensure immutable financial transactions and records, improving regulatory oversight and preventing data tampering

Cons

- High costs: Deploying and implementing RegTech systems requires significant investment in technology, infrastructure, and training.

- Dependence on technology: Overrelying on AI, machine learning, and cloud computing can lead to operational challenges if technical issues arise or biases emerge.

- Frequent updates required: Constantly evolving regulations need regular system updates, leading to additional costs and operational disruptions.

- Potential integration issues: Legacy systems may not easily integrate with modern RegTech solutions, requiring additional customisation efforts and time to ensure a smooth performance.

- Skilled professionals needed: Managing and optimising RegTech requires expertise, leading to increased demand for specialised talent that can increase overhead costs.

Top 3 RegTech Companies

Today, tens of RegTech providers offer services in various industries, such as healthcare, cloud computing, banks, and other financial services firms.

They target established businesses that want to automate their legal processes or FinTech startups that want affordable compliance solutions to operate legally.

ComplyAdvantage

ComplyAdvantage is a leading RegTech company founded in 2014 that specialises in AI-driven financial crime risk assessment. It offers real-time tracking tools that support AML compliance, transaction screening, and customer risk evaluation.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

It uses machine learning to help financial institutions, FinTech companies, and banks detect and mitigate fraud efficiently, automate regulatory adherence, and minimise manual compliance burden.

ComplyAdvantage has worked with renowned brands in diverse industries, including Allianz, Nissan, Santander Bank, Zendesk, and thousands of other businesses. They help companies fully comply with changing regulations by integrating with existing capabilities and offering a comprehensive risk management system.

Trulioo

Trulioo is a global identity verification company that was founded in 2011 and currently serves 195 countries around the world.

It specialises in Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols, enabling businesses across financial services, e-commerce, and cryptocurrency sectors to verify identities against government databases and international standards.

Trulioo focuses on the financial services industry, partnering with leaders like MasterCard, American Express, Experian, and Equifax. It provides automated compliance solutions to enhance fraud prevention and adhere to stringent regulations like the GDPR directives.

The company’s flagship platform, GlobalGateway, provides identity verification for individuals, financial firms, payment processors, and digital platforms, streamlining customer onboarding procedures while ensuring high security levels.

MetricStream

MetricStream is an old-school player in risk management solutions that has been operating since 1999. It caters to various industries like banking, healthcare, and manufacturing, with a special focus on tech firms.

The company offers advanced governance, risk management, and compliance solutions, helping organisations streamline their regulatory processes more effectively and efficiently.

MetricStream has partnered with major enterprises worldwide, including Amazon Web Services, Capco, EPAM, Deloitte, and KPMG. It provides these companies with elite compliance workflow automation, real-time risk assessment, and detailed audit report generation.

Conclusion

RegTech is the latest AI trend that serves companies with the best tools to ensure legal compliance in a more streamlined and seamless way. It minimises the need to hire large teams and manually track and update legal frameworks using automated monitoring technologies.

It also utilises advanced detection and mitigation protocols to track internal systems and flag any anomalies or possible threats, such as unusual transactions or patterns, that may lead to breaches.

This allows businesses, especially in highly regulated areas, to operate legally and ensure full compliance with evolving requirements.

FAQ

How does RegTech work?

RegTech (Regulatory Technology) uses AI, big data, and automation to help businesses efficiently comply with regulations. It streamlines compliance processes by monitoring transactions, detecting risks, and ensuring adherence to laws, reducing costs and regulatory penalties.

What companies use RegTech?

Banks, insurance companies, FinTech firms, and asset management firms use RegTech for compliance, fraud detection, risk management, and anti-money laundering. Major users include JPMorgan Chase, HSBC, BlackRock, PayPal, and other tech firms and manufacturers.

What is the difference between RegTech and FinTech?

FinTech focuses on improving financial services through technology, such as digital banking and payments, while RegTech specialises in managing regulatory compliance for businesses to meet legal requirements.

Is using RegTech necessary?

It is not mandatory. However, it is crucial for companies to ensure compliance, reduce risks, and avoid heavy fines due to breaches. With evolving regulations and increasing complexity, RegTech helps businesses stay ahead of legal requirements more efficiently and safely.