Time of CBDCs. What is Happening in 2023?

Articles

The emergence of CBDC technology has led to large-scale changes not only at the level of national financial systems, but also within the framework of global monetary regulation, which has opened up new opportunities for interaction between governments, financial institutions and banking structures. As a result, the question has arisen as to what the future holds for the practical application of this form of money and whether it can replace the usual cash in the near term.

This article will help you understand what CBDC technology is and how it works. In addition, you will find out which countries are already using this technology in practice, what benefits it brings to the financial system, and how it will affect the use of cash in 2023.

Key Takeaways

- It is expected that in the near future CBDCs will completely replace cash, offering greater security, payment processing speed and ease of use.

- Nigeria, Uruguay, Bahamas, and China have become pioneers in the practical application of CBDC technology within the national financial system.

- One of the most important benefits of CBDC is the control of corruption and anti-money laundering, which has become one of the biggest problems in today’s world of finance.

What is CBDC Technology, and How Does it Work?

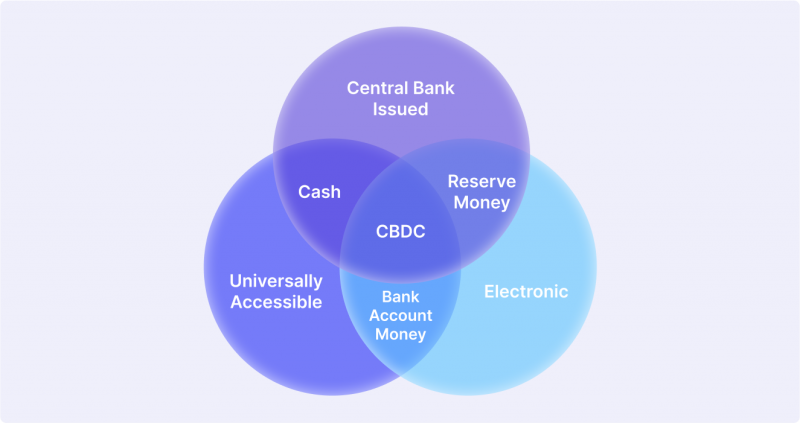

A central bank digital currency (CBDC) is a type of payment instrument based on a national currency issued by the central banks of a state, which guarantees the stability of that currency relative to its fiat (paper and non-cash) counterpart, regulates the circulation of that currency and all other transactional aspects. Such currencies are entirely within the realm of the traditional financial system.

Central bank digital currencies are a concept close to crypto technologically, but far from it in spirit. In the context of traditional finance, CBDC is a perfectly logical response to the cryptocurrency market, representing an attempt to bring cryptocurrency out of the shadows, not through total bans, but through a competitive approach. That is, governments are trying to offer participants in the financial system a somewhat cryptocurrency-like currency in the hope that in the future, it will win a significant share of the crypto market or supplant cryptocurrency altogether.

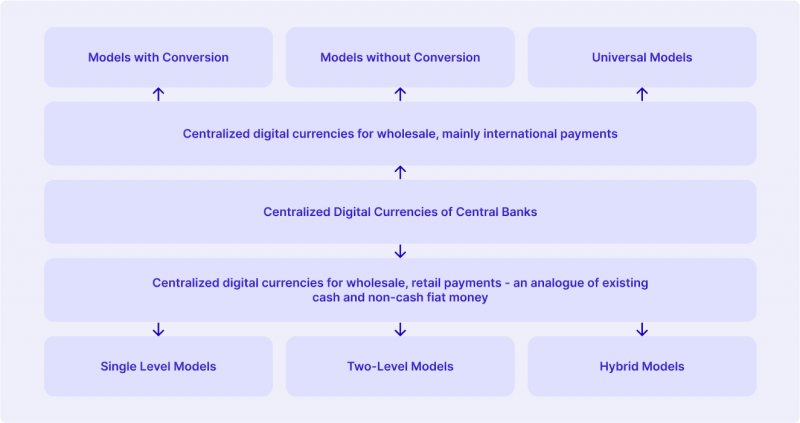

Today, CBDC is categorized into types, which include wholesale and retail CBDC. Retail CBDC is mainly used for payment transactions in the B2C segment, with all participants in the financial system gaining access to the central bank’s liabilities. This form of digital currency can increase the speed and accessibility of electronic payments for all users (both individuals and companies), reduce the cost of payment transactions, and improve the quality of monetary policy.

Wholesale CBDC, on the other hand, implies significant restrictions on access to central bank obligations. Only interbank market participants (commercial banks and settlement institutions) have access to these assets. The use of this form of digital currency improves the quality of interbank settlements, increases their speed, and reduces banks’ costs of payment transactions. At the same time, the risks associated with cross-border payment transactions for financial institutions are also reduced, demonstrating the effectiveness of CBDC.

Today, CBDC technology is the last stage in the development of crypto payment systems, after stablecoins and tokens.

Which Countries Already Have CBDCs?

There is considerable debate among experts in both the crypto industry and other fields of finance on whether CBDC is a valid concept at this point in time. Many believe that CBDC needs to be revised regarding its elaboration and implementation. Others argue that this technology will provide a lifeline for the global economy, particularly when economic conditions become difficult. One way or another, implementation has already begun, so let’s look at the number of countries that already have CBDCs.

According to the Atlantic Council website, an online tracker of statistics related to the development and use of CBDC technology, only few countries have successfully launched and are testing the new technology within the national monetary system.

Uruguay

Uruguay conducted a large-scale CBDC pilot program back in November 2017. The Central Bank of Uruguay called its digital currency e-Peso. The tokenized national currency was able to be exchanged even in the absence of telecommunications networks. Uruguay offered e-Peso payments without access to a smartphone, without a mobile app, using USSD (Unstructured Supplementary Service Data) to register and manage their wallets.

Despite a successful pilot project that ended in mid-2018, the Central Bank of Uruguay plans to further develop and improve e-Peso technology in order to be able to improve cross-border payments and strengthen financial stability of the national currency.

Jamaica

The Central Bank of Jamaica has received permission from the Senate to issue a virtual token called Jam-Dex. The currency is denominated at 1:1 to the national currency (the Jamaican dollar) and is freely convertible into paper notes and coins. Before its official introduction, the project was promoted by the National Commercial Bank (NCB) through its Lynk digital wallet. Now, other financial institutions are also expected to join en masse. The Bank of Jamaica’s official website has a special section with answers to the most popular questions about Jam-Dex.

The pilot was launched in August 2021 to showcase the country’s future digital economy. The recognized positives of the pilot include better security, convenience (no need to have a bank account), reduced transaction costs, increased competition between payment providers, and more digital services available.

China

The digital yuan has developed rapidly in recent years since the Chinese authorities announced the launch of the CBDC three years ago. Functional testing of the digital national currency began last year when it was actively introduced into the country’s financial systems. As a result, just a few months ago, the turnover of the state digital currency exceeded ¥100 billion ($14 billion). In addition, the number of transactions has reached 360 million, and over 5.6 million merchants already support the digital yuan as a means of payment.

Nigeria

Nigeria is the first African country to introduce CBDC. Its population is 217 million, and its national currency is the naira. In the past year, Nigeria’s Central Bank (CBN) has moved to the final stage of testing the CBDC currency, the eNaira. The Central Bank of Nigeria engaged renowned payment service providers such as Flutterwave, which added eNaira to its list of payment options for merchants, to make the project successful.

All state and commercial banks were initially included in the project, and conditions were created to encourage the public to use the new digital national currency. When using eNaira to pay for certain goods and services, there are discounts such as 5% for rickshaw rides, etc.

Bahamas

The Government of The Bahamas has severe plans for CBDC technology. It has already introduced the so-called Sand Dollar, a currency designed to strengthen the national monetary system and financial inclusion. The value of the Sand Dollar is pegged to the Bahamian dollar, which in turn is pegged to the US dollar.

Bahamians are the first island nation in the world to introduce digital currency at the state level. The central bank has mandated six financial institutions — Omni Financial and Kanoo, SunCash, and Cash N Go — to provide technical and developmental support for the new project.

Era of CBDCs: The Benefits of Implementing CBDC Technology

Like any other technology, CBDC has benefits and drawbacks, as well as several distinguishing characteristics that have helped it win favor with governments, which are currently working to develop digital versions of their respective national currencies. The following benefits of CBDC technology are intended to enhance the financial system:

Tax Control

CBDC can simplify taxation, be safer, and be more reliable for the government. Key features include real-time taxation, automatic auditing, and automated integration with public and private registries. Instead of placing the accounting burden on individuals and companies, the government can receive taxes automatically and in real-time.

Improved Cross Border Payments

Cross-border payments face four main problems: high cost, low speed, limited access, and the need for more transparency. Issues arise from the complex processing of compliance checks, limited uptime, outdated technology platforms, long transaction chains, high funding costs, and weak competition.

Cross-border CBDCs can reduce reliance on intermediaries and minimize transaction costs and time. For CBDCs to be an effective cross-border payments accelerator, international cooperation is needed to coordinate and incorporate cross-border functions early.

Financial Monitoring

CBDC enables financial control at all levels: incoming, outgoing payments, payments between key actors within the state, be they government officials, businessmen, the military, volunteers or simply citizens of the state. Digital currencies also allow greater control over monetary and fiscal policy. Changing the interest rate or distributing financial aid through fiscal digital payments is one of the most important tools for developing a country’s monetary system.

Fighting Corruption

CBDC technology can significantly improve transparency and anti-money laundering, and support anti-corruption campaigns by governments and the IMF. The eCurrency Information and Supervision component of the CBDC platform is beneficial, allowing central banks to monitor currency transactions and integrate with anti-money laundering systems.

The eISS eCurrency technology under development today provides both CBDC supervisory and information functions. Supervisory functions help to manage workflows related to the issuance and distribution of CDBCs and surveillance of distributed security equipment. The information functions assist in collecting real-time statistics on currency movements, speeds, wallets, transactions, etc. They allow access to macroeconomic statistics as well as individual transactions or wallets.

Investment Attractiveness

CBDC creates economic transparency and addresses many of the risks that outside investors assess when making investments in a country. As this currency is issued by the government and backed by fiat national currency, it can be a reliable investment instrument, which is nevertheless not without risks, as in the case of investing in other trading asset classes.

24/7 Access to Financial Payments

Commercial bank branches may be far away, and services may have limited opening hours, while retail CBDCs offer 24/7 payment anywhere, including mobile devices, smart cards, and software. Moreover, digital currency settlement (including international settlements) can be much faster than legacy payment systems. CBDC can process more than 50,000 transactions per second for stable fees within fractions of a cent. VISA averages around 5,000 transactions per second.

An open market model for transaction processing can unlock competition by encouraging lower prices and innovation. CBDC is cheaper than credit cards such as VISA or Mastercard while reducing the likelihood of errors, crimes, and reconciliations due to the secure recording of transactions. Operating with a single fixed and distributed ledger is more efficient than operating with multiple variable ledgers.

CBDCs vs. Cash: Will the Financial System Move to the Use of Electronic Money In 2023?

The CBDCs era is coming, and conversations are escalating in the information space on whether CBDCs will replace cash or not. CBDC will become a reality and a necessary and dominant form of digital currency in the future. The area is undergoing extensive study: 86% of all central banks last year said they were engaged with CBDC. That’s up from 65% three years earlier. The essence of CBDC is certainty, as global financial development requires innovation from central banks. The benefits for central banks are clear: tighter controls, outstanding tracking and monitoring capabilities, the ability to implement monetary policy measures quickly, and the ability to withstand the growing influence of fintech and financial institutions. However, there is a dark side to these new innovations.

CBDC innovations, particularly the shift from cash to digital money, depend on trust that central banks and other associated government agencies will not abuse their newfound power.

Regardless of the advantages and disadvantages, central banks have no choice but to engage in the digital battle; otherwise, decentralization threatens to destroy the traditional system and institutions, and they are prepared to spend every dollar they have to protect them. Of course, some benefits are worth reaping, but if no governance mechanism protects people from state-sponsored abuse, what is left to protect the people these institutions should care for?

Conclusion

CBDC technology is rapidly gaining popularity among different countries, overshadowing cryptocurrencies, bank deposits and traditional forms of payments. With its many benefits, this technology will transform the financial system by facilitating both local and cross-border payments, making it more resilient, especially in times of economic crisis.