Start a FOREX BROKER with our Turnkey Solution

For 10 years, we’ve helped over 500 clients launch FOREX Brokers. As the largest WL Provider, we offer cost-effective solutions to start a business in weeks

Mark Speare

Chief Client Officer

Benefits of our FX Turnkey Components

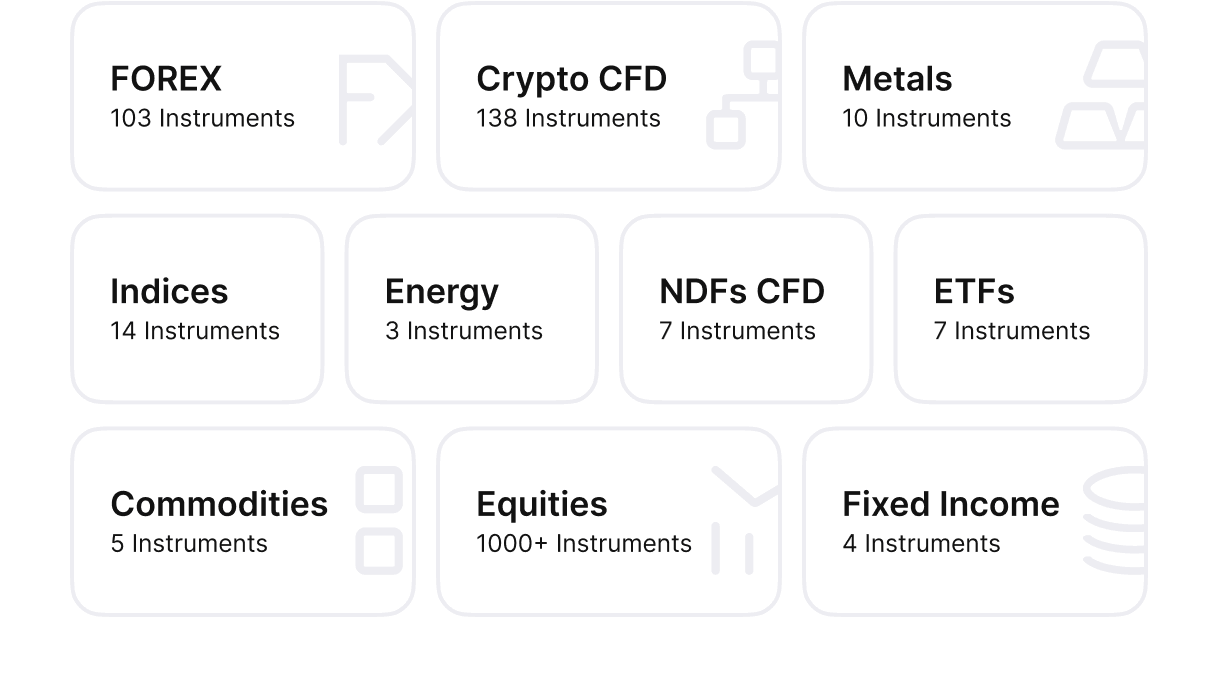

Prime of Prime Regulated Multi-Asset Liquidity

One margin account for 10 asset classes, enabling seamless trading across diverse markets with enhanced flexibility.

Ready to launch your FOREX business now?

Join businesses already started successfully with B2BROKER

Turnkey package advantages

Make your business launch as smooth as possible

Brokerage flow

More on our YouTube channel

Building a brokerage from scratch can be costly – We save you millions

Revenue streams for Brokers

Take trading to the next level with B2TRADER

- Power of SaaS. Launch and scale effortlessly with our secure, fully automated, and cloud-based brokerage solutions.

- Liquidity Agnostic. Connect seamlessly with your preferred liquidity providers or utilize our integrated network.

- Single Multi-Asset Account. Trade forex, stocks, crypto, and more—manage all your investments from one account.

- Dynamic Leverages. Adjust leverage on-the-fly to match market conditions and trading strategies.

- Different Accounts for Different Strategies. Tailor accounts to suit diverse trading goals, from hedging to scalping, all on one platform.

- Customizable Collateral. Set flexible collateral rules to maximize your trading potential and manage risks effectively.

Articles

FAQ

How to Start a Forex Broker?

If you’re looking to start a forex broker, one of the most efficient and cost-effective ways to go about it is to use a white label solution. With a white label, you’ll be able to outsource all of the technical aspects of setting up and running your brokerage, from hosting & servicing your trading platforms to maintaining regulatory compliance. This will allow you to focus on building your business and serving your clients while leaving the day-to-day operations to someone else. Of course, starting any business has its challenges and risks, but if you do your due diligence and choose a reputable white label provider, you can give yourself a head start.

Does your Crypto gateway accept Visa/MasterCard?

Could you tell me which Brokers are your clients?

Do you provide any assistance or support?

Do you provide Islamic (SWAP Free) Accounts?

Can I brand my Broker?

Do you provide futures and cash equities?

How do I accept payments from my clients?

I am a MetaTrader* White Label of another service provider. Can I connect B2BROKER liquidity?

Do I need to buy my own PrimeXM Core or OneZero Hub? How much does it cost?

I have my own MetaTrader* trading server. How can I connect B2BROKER Liquidity?

Do you charge any transactional fees or do I set my own ?

What are your swap rates?

Can I create a B-book broker with you?

Do you help with opening bank accounts?

Do you help with obtaining a FOREX license?

Which payment systems are integrated into B2CORE (Traders' room)?

Do you provide 1:1000 leverage?

Ready to launch your FOREX business now?

Join businesses already started successfully with B2BROKER