Особенности Кабинета Трейдера: Как Выбрать Лучший

Сегодня практически каждый трейдер, работающий на финансовых рынках, сталкивается с множеством задач, связанных с обеспечением оптимальных условий для стабильного процесса зарабатывания денег.

Этот процесс включает множество переменных, связанных с учетом и контролем, которые зависят от степени эффективности выбранной им торговой стратегии и, в конечном итоге, финансовых результатов его торговой деятельности.

Специально разработанное решение — кабинет трейдера — предназначено для контроля и регулирования всех аспектов торговой деятельности как начинающих, так и профессиональных трейдеров.

Эта статья представляет собой краткое изложение принципов работы кабинета трейдера, а также описание основных функций, которые помогают в работе как трейдерам, так и брокерским компаниям.

Ключевые Моменты

- Кабинет трейдера — это многомодульный высокопроизводительный инструмент, предоставляющий пространство для оптимизации контроля торговой деятельности.

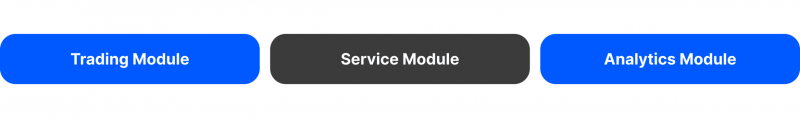

- Кабинет трейдера состоит из торговых, сервисных и аналитических модулей.

- Основной функцией, доступной в кабинете трейдера, является онлайн-кошелек.

Что Такое Решение “Кабинет Трейдера”?

Кабинет трейдера, часто называемый клиентским порталом или личным кабинетом, — это защищенная цифровая платформа, предлагаемая брокерскими компаниями и торговыми сервисами. Это основное пространство, где трейдеры могут следить за своими счетами, совершать транзакции и пользоваться различными услугами, относящимися к их торговой деятельности.

Дизайн кабинета трейдера ориентирован на улучшение пользовательского опыта, предоставляя широкий спектр инструментов и функций, что позволяет трейдерам легко и эффективно управлять всеми аспектами своей торговой деятельности.

Пользователи могут эффективно управлять своими инвестиционными портфелями в кабинете трейдера, осуществлять депозиты и выводы средств, а также отслеживать свои торговые результаты в режиме реального времени.

Такое решение часто включает функции, такие как детализированные сводки счетов, история транзакций и аналитика производительности, что позволяет трейдерам следить за своим прогрессом и принимать решения, основанные на данных.

Кроме того, благодаря своей природе кабинет трейдера упрощает процесс торговли. Он предоставляет трейдерам необходимые ресурсы для принятия обоснованных решений, такие как инструменты для анализа рынка, экономические календари и новостные ленты, которые часто интегрированы в его экосистему.

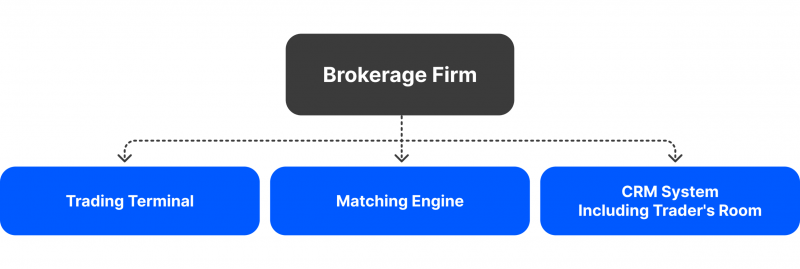

Кабинет трейдера является компонентом практически любого решения для бэк-офиса Форекс на сегодняшний день.

Какие Основные Модули Входят в Кабинет Трейдера?

Кабинет трейдера является ключевым компонентом для эффективного функционирования брокерской компании. Он способствует организации личных кабинетов клиентов на сайте брокера, а также позволяет развивать функциональные возможности бэк-офисного программного обеспечения Форекс, управлять платежными системами, а также обрабатывать запросы на документацию и верификацию клиентов.

Тем временем кабинет трейдера представляет собой сложный и многофункциональный инструмент, состоящий из различных модулей, отвечающих за эффективную и бесперебойную работу. Эти модули включают:

Торговый Модуль

Торговый раздел предоставляет обзор портфеля инвестора, детализируя количество активов и их текущую рыночную стоимость. Он также предлагает функции для покупки или продажи ценных бумаг, валют или контрактов, охватывая все действия, связанные с биржевой торговлей, такие как сделки купли-продажи.

Есть вопросы по настройке брокерского сервиса?

Наша команда готова помочь — будь вы в начале пути или на этапе расширения.

Продвинутые брокерские платформы, как правило, включают книгу ордеров в интерфейсе трейдера, показывающую торговую активность в режиме реального времени через список заявок на покупку и продажу.

Альтернативно, некоторые поставщики услуг могут предложить более упрощенный интерфейс, который фокусируется исключительно на лучших доступных предложениях, позволяя пользователям устанавливать лимитные ордера с точными ценовыми условиями, такими как «купить по максимуму» или «продать по минимуму».

Сервисный Модуль

Сервисный раздел кабинета трейдера разработан для вашего удобства и эффективности, облегчая управление аккаунтом. Он позволяет вам легко обрабатывать отчеты, личную информацию и различные документы.

В этой области вы можете вносить и выводить средства, переводить активы между разными биржами или рыночными сегментами, а также просматривать отчеты о недавних ордерах и транзакциях.

Кроме того, он предоставляет информацию о удержанных налогах и комиссиях, а также возможности обновления личных данных и деталей аккаунта.

Аналитический Модуль

Аналитический раздел — это мощный инструмент в настройке кабинета трейдера, охватывающий все аспекты продвижения финансовых продуктов, включая инвестиционные идеи, торговые стратегии, рекомендации по акциям, мнения аналитиков и новости рынка.

Он предоставляет вам информацию, необходимую для принятия обоснованных решений. Хотя этот раздел может не быть особенно полезным для опытных профессиональных трейдеров, важно отметить, что аналитика от известных брокеров может значительно влиять на рыночные цены; выпуск новых комментариев часто приводит к заметным колебаниям стоимости активов.

Ключевые Функции, Доступные в Кабинете Трейдера

Полная система кабинета трейдера предлагает ключевые функции и возможности, которые помогают ей достичь своего полного потенциала. Эти элементы создают оптимальные условия работы как для брокеров, так и для трейдеров.

Таким образом, почти все кабинеты трейдеров на рынке Форекс предлагают следующую функциональность:

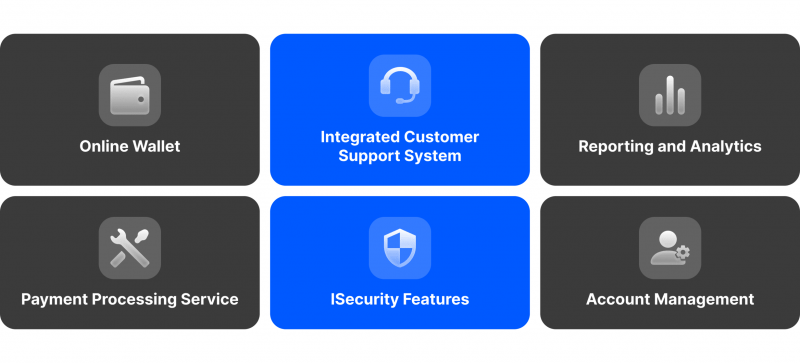

Онлайн-кошелек

Онлайн-кошелек — это главная функция, предоставляемая в большинстве кабинетов трейдеров для синхронизации торговой активности и средств. С помощью онлайн-кошелька торговые операции упрощаются, что позволяет осуществлять плавные переводы между кошельком и торговыми счетами. Это также упрощает управление комиссионными IB и внутренние транзакции, связанные с кошельком.

Интегрированная Система Поддержки Клиентов

Кабинет трейдера предоставляет интегрированную систему поддержки клиентов, предлагая помощь в режиме реального времени через живой чат. Кроме того, имеется система тикетов поддержки для отправки и отслеживания запросов, а также доступ к обширной базе знаний с FAQ и библиотекой ресурсов.

Отчеты и Аналитика

Кабинет трейдера предоставляет инструменты отчетности и аналитики, такие как отслеживание производительности, позволяя пользователям создавать детализированные отчеты о своих торговых результатах, включая отчеты о прибыли/убытках. Также предлагается возможность создания индивидуальных отчетов, которые могут быть настроены под конкретные нужды, а также инструменты для подготовки отчетности по налогам для упрощения создания отчетов для налоговых целей.

Сервис Обработки Платежей

Кабинет трейдера оснащен полноценным модулем обработки платежей, который играет ключевую роль в управлении финансовыми операциями на платформе. Этот модуль позволяет пользователям осуществлять различные финансовые транзакции напрямую в их аккаунтах, включая депозиты, вывод средств и внутренние переводы.

Интеграция обработки платежей в кабинет трейдера обеспечивает брокерам возможность создания упрощенного процесса, исключающего необходимость в использовании внешних сервисов для финансовых операций. Такая интеграция повышает эффективность транзакций и гарантирует, что все финансовые операции проводятся безопасно и быстро.

Кроме того, модуль обработки платежей часто поддерживает несколько способов оплаты, удовлетворяя разнообразные потребности пользователей по всему миру.

Будь то банковские переводы, кредитные/дебетовые карты или цифровые кошельки, трейдеры могут выбрать наиболее удобный вариант. Модуль также может предлагать автоматическую обработку комиссий IB и обеспечивать мгновенный доступ к средствам, что значительно упрощает весь процесс торговли.

Функции Безопасности

Кабинет трейдера включает в себя надежные меры безопасности, направленные на защиту учетных записей пользователей. Одной из ключевых функций является двухфакторная аутентификация (2FA), которая добавляет дополнительный уровень защиты, требуя второй формы проверки при входе в систему.

Нам доверяют доверяют более 500 брокеров по всему миру

Изучите нашу экосистему — от ликвидности и CRM до полноценной торговой инфраструктуры.

Кроме того, конфиденциальные данные защищены с помощью современных методов шифрования, что обеспечивает сохранность личной и финансовой информации от несанкционированного доступа.

Платформа ведет комплексные журналы активности, которые отслеживают все взаимодействия с аккаунтом для повышения безопасности и обеспечения прозрачности. Эта функция позволяет пользователям тщательно отслеживать активность своих учетных записей, предоставляя дополнительное чувство безопасности и контроля.

Управление Аккаунтом

Кабинет трейдера предоставляет интегрированные сервисы управления аккаунтом, позволяя пользователям управлять несколькими торговыми счетами из одной централизованной платформы. Эта функция повышает продуктивность, ускоряя процесс управления и облегчая трейдерам контроль над их различными инвестициями.

Пользователи могут воспользоваться мониторингом в реальном времени, который мгновенно обновляет балансы счетов, уровни капитала и маржи. Кроме того, платформа предоставляет доступ к истории транзакций, позволяя трейдерам просматривать детализированные записи о своих депозитах, выводах средств и торговой активности, что способствует принятию взвешенных решений.

Заключение

Кабинет трейдера — это важный инструмент для всех, кто занимается торговой деятельностью. Он включает в себя полный набор инструментов для работы на финансовых рынках, таких как мультивалютные кошельки, аналитические ресурсы, обновления рынка, торговые платформы, экономические календари, функции технического анализа и подробные отчеты о текущих транзакциях.

Это универсальное решение упрощает взаимодействие с различными торговыми инструментами, делая процесс более эффективным, простым и удобным для пользователя.

Тем не менее, чтобы полностью использовать возможности кабинета трейдера, важно глубоко понять его разнообразные функции и применять их в реальных сценариях. В конечном итоге, использование этой системы может значительно улучшить ваш торговый опыт, делая его более прибыльным и приятным.

FAQ

Что такое кабинет трейдера?

Кабинет трейдера — это защищенный онлайн-портал, предоставляемый брокерскими компаниями, который позволяет трейдерам управлять своими счетами, совершать сделки и получать доступ к различным финансовым услугам. Он служит центральным узлом для торговой деятельности, управления аккаунтами и финансовых операций.

Как модуль обработки платежей приносит пользу трейдерам?

Модуль обработки платежей упрощает финансовые транзакции, интегрируя функции внесения депозитов, вывода средств и переводов напрямую в кабинете трейдера. Эта функция поддерживает несколько способов оплаты и облегчает автоматическую обработку комиссий, делая управление финансами более удобным.

Могу ли я настроить свой кабинет трейдера под свои нужды?

Да, многие кабинеты трейдеров предлагают опции настройки, такие как регулирование настроек аккаунта, персонализированные панели управления и настройка торговых стратегий. Эти функции позволяют адаптировать платформу под ваши конкретные потребности и предпочтения в торговле.

Как определить, какой кабинет трейдера лучше всего подходит для моих нужд?

Оцените ваши требования и предпочтения в торговле, затем сравните разные кабинеты трейдеров на основе ключевых функций, описанных выше. Учитывайте такие факторы, как дизайн пользовательского интерфейса, возможности обработки платежей, меры безопасности и доступные торговые инструменты, чтобы выбрать платформу, которая лучше всего соответствует вашим потребностям.