What Criteria Do Traders Use to Choose a Brokerage Firm?

Articles

Operating a forex brokerage business is not easy in the modern landscape. The invention of digital solutions has expanded the forex industry beyond simple exchange operations.

Now, when traders set up their investment account, they expect a suite of analytics tools, live data feeds, advanced trading mechanisms and a deep selection of trading pairs with optimal price quotes.

The digital revolution has also increased competition in the brokerage field. Today, online brokers must provide affordable transaction fees and excellent services to keep up with the competition.

However, managing a growth-oriented brokerage business requires a lot more effort than affordability and high-quality services. This piece will go over the most vital aspects of how traders choose a brokerage firm and how you can master each of these variables.

Key Takeaways

- The forex brokerage business model will become a dominant business idea in 2024.

- To construct a strong brokerage brand, you must understand the needs and preferences of customers.

- Customers value credibility, speed, diversity and security. They also prefer brokerages that provide learning materials and analytics.

- Licensing is also crucial, as it will determine the extent of your operations beyond the local market.

- The most important aspect is to create a business that makes sense as a single unit, maximising the efficiency of all systems.

Understanding the Trader’s Point of View in Forex

The forex landscape is much more demanding than it used to be a decade ago. When traders access their brokerage accounts, they expect to see all the best tools and features available in a single space, which is a far cry from the simplistic exchange system leading the market in the early 2000s.

As the traders become more educated in complex trading concepts and strategies, their needs change exponentially, requiring access to state-of-the-art systems and up-to-date market analysis tools. However, financial planning and strategising are only part of the client’s experience.

Most brokers fail to comprehend that their platform represents a potential digital home for retail traders. When individuals consider choosing a broker for their needs, they choose a trading platform they feel comfortable with, which doesn’t just include affordable trading costs and currency pairings. Every aspect of trading platforms should work well together to create a coherent ecosystem, allowing traders to analyse, track and execute deals with minimal outside help.

On average, traders can spend up to five hours on a single platform, almost a full day looking at dashboards, charts and pairing lists. So, it is no wonder that traders will switch to different brokerage firms if they experience even the slightest inconvenience with their brokerage accounts.

So, building a streamlined platform that incorporates user experience on every level is essential. But what factors exactly should you consider when constructing a foolproof brokerage business model? Let’s discuss.

Building a Perfect Forex Brokerage Platform

The daily volumes of forex markets have exceeded $7 trillion, creating a colossal market for forex brokerages. Despite such a high demand from traders, the industry has already been saturated with numerous types of brokers, with discount brokers leading the charge as the most common variation.

To become a forex broker in this harsh environment, it’s crucial to understand your customers and build a service that works fluidly. Here’s what you need to know.

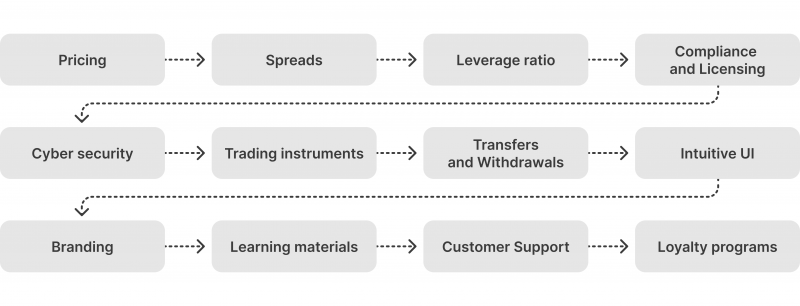

Pricing, Spreads and Margin Account Minimums

Pricing is by far the biggest consideration by clients when selecting a broker.

Problem

Most retail traders using brokerage platforms are representatives of the middle class, having access to a moderate amount of financial resources.

So, their price considerations are sensitive, and most traders tend to choose brokers with the most accessible prices. This includes any fees you might charge your customers, from monthly subscriptions and trade commissions to additional payments for analytics tools or premium packages.

Another huge monetary concern is the spreads offered on your platform. FX trading entails large-volume transactions for profitability; even a tiny difference in spreads could massively decrease the trader’s profitability.

In the case of margin accounts and leverage options, clients are always concerned about what leverage ratios the broker offers. The leverage in margin trading represents the ratio of acquired capital to the trader’s capital. It can range anywhere from 2:1 to 50:1, depending on currency types and other factors. Margin trading has become wildly popular due to its upside, and users demand high leverage to execute trades with massive profit margins.

As a forex broker, your pricing package should be transparent, easily understandable, and without hidden charges. Customers are sensitive to hidden or increasing fees and will probably abandon your platform if their monthly expenses increase. Having the lowest commission fees or subscription rates is not mandatory as long as you position your brand strongly and highlight your strong core offerings.

Solution

On the other hand, spread margins should be as tight as possible. Spreads directly impact users’ profitability, and providing customers with the most optimal bid/ask prices is imperative. Even the state-of-the-art services and technologies will not convince your customers to stay if your spread margins are not competitive enough.

Finally, the margin trading options should be accessible, considering the customer-related risks and your profitability goals. Giving clients a high leverage ratio is risky if you don’t incorporate market risks and create customer profiles to understand their positions better.

So, you must choose an optimal leverage that will not constrain your customers but won’t put you in a tricky financial position. Regardless of the margin, account maintenance fees should be affordable.

Trading Software and Features

While customers don’t see behind the curtains of platform development, they are very much interested in the end-result and getting the smoothest trading software they can afford. So, it is crucial to develop or acquire a brokerage platform that is up-to-date, performs well even with massive traffic and delivers all the relevant features for professional traders.

Problem

There are three distinct ways to obtain brokerage software as a business. First is in-house development, second is outsourcing, and the third option is white-label software. Clients don’t care which one you choose as long as they receive the optimal services for their payments. However, choosing the right option is critical from the business side.

Firstly, in-house solutions are very expensive and take massive resources to complete. In most cases, in-house development is conducted only by companies that already possess substantial capital and can afford significant budgetary expenditures every month.

You need to hire a full team of developers who are fluent in the brokerage market systems and give them all the required infrastructure to build a complete platform. For smaller companies, the cost of building a platform in-house might be bigger than their entire operating budget.

Somehow, outsourcing services might be even more expensive than that since outsourcing firms charge excessive fees for providing expert staff. The costs are confounded by the fact that you still have to purchase all relevant software licenses and hardware tools. So, both options are quite pricey for average broker startups.

Solution

The third option, white-label software, is the most appropriate answer for smaller and mid-level brokerages in acquiring a competitive broker platform. WL solutions are affordable since WL providers sell the same platform template to numerous clients. As a result, you can pay a fraction of the cost for the same quality features, performance, and trading mechanisms that you would receive through in-house development or outsourcing. If you select a reliable and experienced WL provider, you will avoid many newcomer mistakes while setting up a competitive brokerage hub for your clients.

Expert WL providers have been in the market for years or even decades, harnessing their experience to construct a platform that maximises client satisfaction while allowing you to operate an efficient business.

While WL platforms are not as customisable as in-house solutions, they are more than enough for your needs at a smaller or mid-level. Moreover, there is always an option to add third-party tools and extensions to make your WL software even more attractive for your customers.

Compliance, Security and Reputability

Any sector dealing with client funds has a stricter road toward credibility than others. After all, customers are highly sensitive about investing their hard-earned money into questionable platforms. So, developing security measures and compliance practices is crucial. Here’s why.

Problem

Clients often compare brokerage firms with compliance and licensing information. Clients also care about firms’ credibility, frequently searching for online reviews and client feedback. Even the slightest hint of dishonesty or dissatisfied ex-clients can impact your potential customers, motivating them to search for someone with a flawless track record.

Finally, cybersecurity is crucial if you wish to build the best forex broker online. The general public has become wary of the endless cyber threats online, frequently threatening to displace their mutual funds or hack their brokerage accounts.

Solution

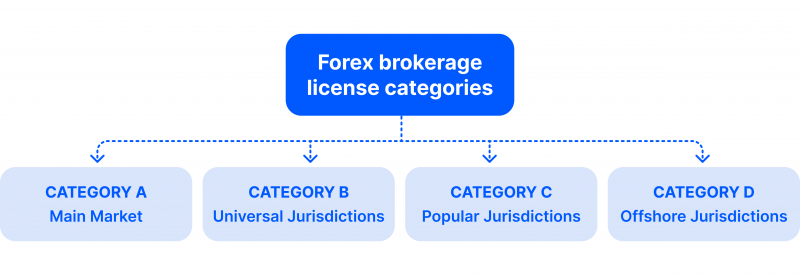

Generally, it is a great sign when brokers have US or European licenses of A or B categories, allowing them to access the highest quality order books and deliver optimal prices. In the case of the US, brokers can pursue federal licenses from authorities like the Securities Investor Protection Corporation (SIPC) and private licenses from organisations like the Financial Industry Regulatory Authority (FINRA).

However, in specific cases, offshore licenses are also useful for clients who wish to operate without restrictions and outside the European region.

Regardless of your licensing choice, your compliance measures must be airtight, adhering to all relevant laws and regulations within your jurisdiction and internationally. Compliance measures will help you implement good KYC and KYT mechanisms and protect your clients from scams, fraud or other malicious practices.

Lastly, the cybersecurity tools should be robust and up-to-date, protecting your platform from phishing attacks, dot.net attacks, trojan horse viruses and other potential cyber threats. Don’t save money on lacklustre cybersecurity measures, as they could lead to a disaster in the long run.

Platform Speed, Transfers and Withdrawals

Forex trading is a lightning-fast industry where winners are separated from losers by minutes or even seconds of execution speed. When selecting the right brokerage firm, clients always consider the platform’s overall speed, including processing capabilities, transfers and withdrawals.

Problem

Most forex trading strategies depend on swift execution, as currency exchange rates fluctuate rapidly and require instant action for profitability. Failure to provide appropriate processing times can lead to slippage, which happens when the trade is requested at a specific price, but the execution occurs on a later quote instead.

Naturally, clients are very sensitive to slippage, which could turn profitable deals into redundant strategies or massive losses.

Aside from the processing speed, most forex traders value the convenience and accessibility of transfers and withdrawals. It is crucial to understand that many of your clients deal in forex as a full-time job, which requires them to make frequent transactions and take out their earned profits in due time and without complications.

Solution

First, you should implement a cutting-edge payment processing engine and a gateway, minimising the risk of slippage and execution delays. While the premier gateways and trade matching engines are not the cheapest products out there, their near-instant execution is more than worth the price of admission.

You should also develop solid relationships with partners that provide order book access to improve the price aggregation efficiency and always deliver optimal prices to clients.

As for transfers and withdrawals, creating a convenient system that allows users to execute everything through a couple of clicks is crucial.

No excessive checks, clunky menus or other extra steps toward simply withdrawing the funds from the platform. Despite its apparent nature, some brokers fail to understand how important it is to conduct transfers and withdrawals efficiently and merely, as customers can conduct these two actions several times per day.

Trading Instruments and Tools VS Investment Goals

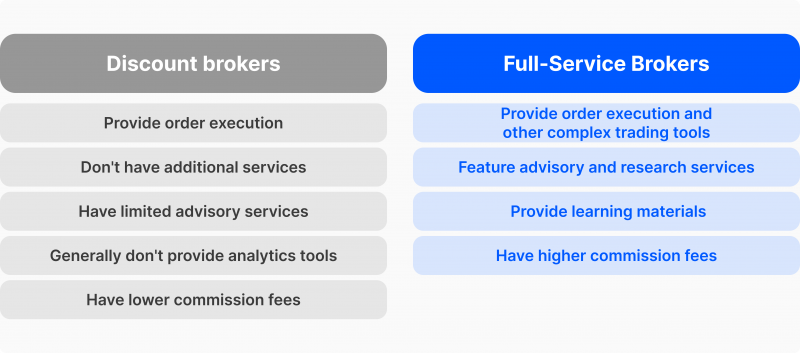

Regarding trading tools, the forex industry has come a long way, developing various complex mechanisms for high-level trading. So. it is essential to understand which direction you want to take, from being a discount broker to a full-service broker.

Problem

Discount brokers were extremely popular in the last decade, taking up the majority of smaller brokerages around the world. Once the barrier for complex trading, liquidity, and technology has been lowered, many discount brokers have become broker-dealers or full-service providers.

However, this transition is difficult, as full-service brokers provide many more tools, features and complementary mechanisms than discount brokers’ simple processing capabilities. While it is certainly an upgrade to become a full-service broker, it might not always be necessary.

Solution

Your forex business could sometimes benefit more if you provide niche discount brokerage services. This primarily works with markets with many newcomers or part-time traders who only wish to utilise affordable deal processing services. So, there’s nothing inherently wrong with choosing a discount broker model.

However, you will most likely lose out on any full-time and experienced brokers who wish to take up margin trading, derivatives, exchange-traded funds or any other complex trading strategies. So, the best approach here is to understand your target audience well and make an informed decision.

If you wish to go international and serve the highest tier of traders, being a full-service broker is not just recommended but mandatory. Conversely, local brokerages could do better if they take up a more limited discount broker role in their initial years of operation.

General Accessibility and Customer Support

Technology is prone to breakdowns, errors and occasional confusion. Even the most adept traders can experience odd technical challenges that need to be addressed as soon as possible.

Problem

We have already discussed the importance of speed in forex operations, and technical fluency is inseparable from it. Any delays caused by system malfunctioning or other technical issues can lead to dissatisfied customers who switch to a different provider.

Forex traders, like any other digital users, are very impatient toward system issues and will not tolerate a buggy system without appropriate support. While software issues and other confusion might be inevitable, you must construct a rock-solid customer support portal. Otherwise, your customers will take their funds elsewhere.

Solution

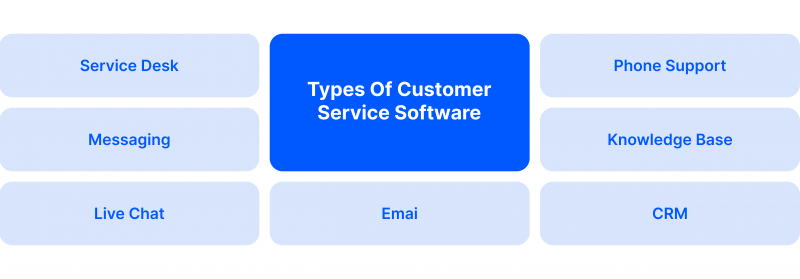

Building the right customer assistance system is difficult, as it requires considerable human resources to support clients 24/7. However, modern solutions have made it exponentially easier to deliver high-quality support without excessive costs. AI-powered chatbots, FAQ pages, automated ticketing systems, CRM back office tools and other tools can help you minimise the need for many support specialists within your organisation.

The complex technical issues will still require the presence of human specialists, but trivial problems can be handled by automated bots and chatbots that instantly deliver answers to clients.

Pleasant Surprises And Branding

Finally, all the solutions, tools, compliance practices and other aspects must be strengthened by a distinct branding. Regardless of the industry, clients enjoy personalisation and memorable branding from companies. Things are no different in forex, with significant players creating a solid brand around their offerings through different strategies.

Problem

Considering that forex brokers charge a fee for almost every action on the platform, customers are looking for a confident digital platform with a distinguished online presence, superb credibility, and numerous complimentary services for free.

Clients will not engage with Forex platforms that look like pre-made templates, only accommodating basic features and lacking any personality or branding.

Solution

There are many ways to distinguish yourself as a brand. First and foremost, building strong marketing channels is mandatory, allowing you to increase your brand exposure considerably. The platform itself should be in line with your brand vision.

If you want to create a simple-to-use platform, everything should be accessible and easy to execute. On the contrary, if your branding is sophisticated and aimed at high-level traders, you should build up your credibility with premier licenses and cutting-edge trading mechanisms.

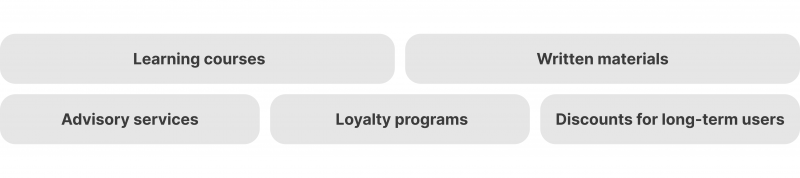

Aside from choosing a brand niche, building customer loyalty programs is essential, allowing your clients to benefit from sticking with you in the long term. Moreover, providing educational resources like videos, webinars, and reading materials is a great way to turn newcomer traders into loyal full-time customers.

Additional Qualities of a Good Forex Broker

Aside from all aspects analysed above, a prudent business can always build unique solutions to elevate its presence in the market. Good forex brokers often provide financial advisors to their long-term clients. While this service is costly, it pays dividends in the long term.

After all, as a full-service broker, it is in your best interest to help your clients succeed by developing a robust investment strategy.

Additionally, you can build a demo brokerage account for newcomer traders to play around with. Demo accounts are a great way to test trading skills and strategies without incurring any losses.

Individuals who take up forex trading practice through online broker courses will significantly appreciate this gesture, as they are keen to learn first and risk their hard-earned money later. Finally, affiliate programs like introducing brokers are a great venue to explore, as they can raise your profile in the digital landscape.

Final Takeaways – How to Start a Forex Broker The Right Way

The financial markets are more saturated than ever, thanks to the lowered entry barriers. However, there’s always a place for a forward-thinking brokerage agency that commits to quality, transparency and dependability. While the steps outlined above will take a lot of effort and determination to achieve, they will lead you to construct a competitive player in the forex field.

With enough effort put into acquiring licenses, building a secure and intuitive platform and taking care of your clients, your target audience will no longer wonder how to choose a brokerage firm. They will see your platform as a no-brainer choice!

FAQ

Is building a forex brokerage platform in 2024 worth it?

Despite increased competition and an overwhelming number of forex-oriented startups, the overall quality in the market is not at the elite level. So, investing in a premier forex brokerage platform will give you an advantage over most smaller and mid-sized forex agencies.

What do clients consider when choosing an FX brokerage?

The most important criteria clients consider are reputability, the extent of features, processing speed, convenience and security. Additionally, customers value additional tools like advanced analytics and educational resources.

Which forex brokerage model is best in 2024?

Deciding between discount and full-service brokerage depends on your specific goals. In general, the discount model is better for beginners, as it only offers exchange processing. It is a simple model that can be executed well with limited resources. However, at a certain point, it makes sense to become a full-service broker to continue business growth.