Components of a Back-Office System for Forex Brokers

Articles

The Forex market has evolved significantly over the past few decades, emerging as a major hub for international currency trading. This has facilitated the rise of FX brokers, entities offering an online platform for retail and institutional investors to trade foreign currencies.

In 2025, the competitive landscape of Forex brokerage has intensified, which will strengthen more in the coming years, necessitating the adoption of sophisticated technology for streamlined operations. The back-office system is central to this technological infrastructure, a comprehensive setup that integrates various elements to deliver a seamless trading experience to clients and ensure efficient business management.

So, what exactly is an FX brokerage back-office system, and what are the crucial components that make it so essential for any FX brokerage?

Key Takeaways

- FX brokerage back-office systems are software applications that handle operational tasks in Forex brokerage, such as transaction processing and risk management.

- Back-office systems are crucial for operational efficiency, client management, regulatory compliance, and providing analytical business insights.

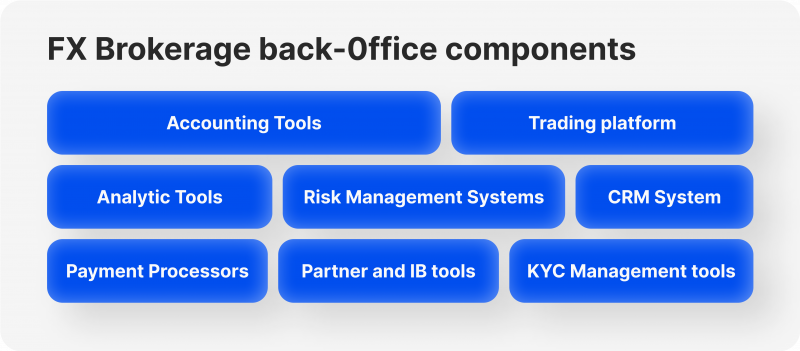

- Elements of these systems include CRM software, reporting tools, risk management, payment processor integration, partner management, KYC management, and more.

- Top FX brokerage back-office systems providers include B2CORE, FX Back Office, and UpTrader, each offering a unique range of services.

What Is a Forex Brokerage Back-Office System?

The FX brokerage back-office system is a comprehensive technological infrastructure that underpins a Forex brokerage’s operational efficiency, regulatory compliance, and customer service. It serves as the backbone of the business, addressing the multifaceted demands of the dynamic and highly competitive Forex industry.

A back-office system essentially functions as the control centre of a brokerage, managing and harmonising various integral processes. It includes a range of sophisticated tools and applications that aid in streamlining and automating routine tasks, facilitating the smooth functioning of the business.

This system integrates several key components, each contributing to a cohesive operational structure. So, let’s discuss this in detail.

1. Customer Relationship Management (CRM)

Forex brokerage is a client-centric business. The ability to attract new clients and retain existing ones largely determines a brokerage’s success.

A CRM system is a part of the back office system that specifically focuses on managing client interactions. Therefore, in the competitive Forex industry, a robust CRM system is not just an option but a necessity. Forex CRM software facilitates a streamlined communication process, handles customer queries efficiently, and aids in customer acquisition and retention. This tool also allows brokers to maintain comprehensive customer profiles, tracking their trading behaviour and preferences to offer personalised services.

2. Forex Brokerage Trading Platform

The brokerage platform is the nucleus of Forex trading operations. It offers an interface where traders can conduct trades and monitor the Forex market in real-time. The platform provides an array of functionalities, such as market analysis tools, charting capabilities, news feeds, and more. It connects the broker with liquidity providers, thus facilitating trade execution at competitive prices. The brokerage platform must offer a user-friendly interface, high-speed performance, and robust security measures to ensure seamless trading experiences for clients.

3. Reporting and Analytics Tools

Data-driven decision-making is a cornerstone of successful Forex brokerage operations. Reporting and analytics tools enable brokers to extract, analyse, and interpret vast volumes of trading data. These insights can monitor trading activities, understand market trends, optimise trade execution, and improve overall business strategies. A sophisticated reporting system also facilitates regulatory compliance by generating accurate and timely reports for auditing purposes.

4. Compliance and Risk Management Systems

The Forex industry is heavily regulated, and brokers must adapt to strict guidelines to maintain their licenses. A robust compliance system ensures adherence to these regulations by monitoring transactions, preventing fraudulent activities, and keeping detailed records for audit purposes. Complementing this, risk management systems help brokers identify and mitigate financial and operational risks. These systems offer risk analysis, real-time monitoring, and alerts to maintain the integrity of the broker’s operations.

5. Accounting and Finance Systems

Forex brokers deal with substantial financial transactions daily. Hence, an efficient accounting system is crucial for managing these transactions and tracking revenues, expenses, and profit margins. It also helps to accurately calculate Forex broker fees, enabling them to offer competitive rates to their clients. The finance system should offer features like automated invoicing, real-time financial reporting, and integration with other components of the back-office system for efficient financial management.

6. Payment Processors

Forex trading involves constant transactions, including deposits, withdrawals, and inter-account transfers. Therefore, seamless payment processor integration is a crucial component of a Forex back-office system. This feature ensures that the brokers can offer their clients various payment methods, from bank transfers and credit/debit cards to digital wallets and cryptocurrency payments. A sound payment processing system should be robust, secure, and capable of handling multi-currency transactions, providing traders with a smooth, secure, and flexible trading experience.

7. Partner and IB (Introducing Broker) Management Tools

Partners and Introducing Brokers (IBs) play a significant role in client acquisition in the Forex industry. Therefore, an efficient partner and IB management system is vital to a Forex broker’s back-office system. This system enables the broker to track and manage the performance of its partners and IBs, calculate and pay out commissions, and provide necessary support and resources for their operations. The partner and IB management system should have features like performance tracking, commission calculation, multi-tier partnership management, and a dedicated partner portal.

8. KYC Management Tools

In the context of increasing regulatory scrutiny, the importance of KYC management in Forex brokerage operations cannot be overstated. A dedicated KYC management system helps brokers collect, verify, and manage customer identity information as regulatory authorities require.

This system ensures compliance with anti-money laundering and counter-terrorist financing regulations. It helps protect the brokerage from potential fraud and other illegal activities. A comprehensive KYC management system should provide features like document collection and verification, risk assessment, customer screening, and audit trail generation.

Choosing The Best Forex Back-Office System

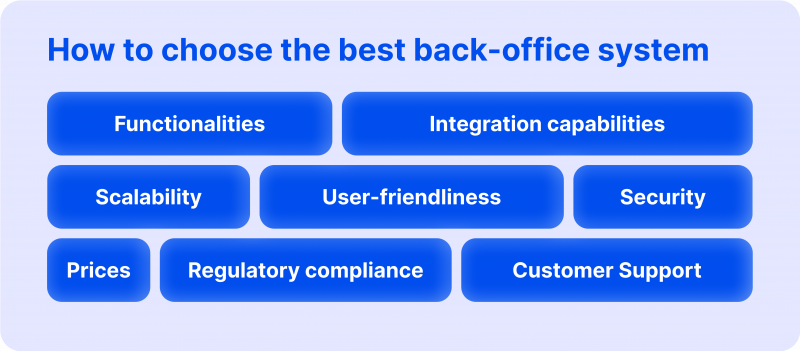

Choosing a Forex CRM solution for your business requires careful consideration. Here are some key factors to contemplate while making your selection.

Functional Requirements – Begin with understanding your business’s specific needs. The back-office system should meet your applicable requirements, such as client management, transaction processing, compliance and risk management, data reporting and analytics. A system that adjusts to your unique operational needs can enhance efficiency and productivity.

Integration Capability – The ability of the back-office system to integrate with other software applications like the trading platform, payment processors, and CRM software is vital. Seamless integration facilitates smooth data flow between different systems, promoting cross-functional efficiency.

Scalability – As your business grows, the back-office system should be capable of scaling up to accommodate the increasing volume of transactions, clients, and data. Choosing a system with flexible scalability options is advisable to avoid future constraints.

User-Friendliness – A system with an intuitive interface and easy-to-use features facilitates quicker adoption and reduces the learning curve for your team. It helps maximise the system’s utility and improves overall operational efficiency.

Security – Given the sensitive nature of the data handled by a back-office system, robust security features are non-negotiable. The system should adhere to the latest data security standards to protect your and your client’s data.

Regulatory Compliance – Compliance with Forex regulations is paramount in the trading industry. The back-office system should support compliance functions like KYC management and AML checks and generate necessary reports for auditing purposes.

Customer Support – Lastly, consider the level of customer support provided by the back-office system provider. Timely technical assistance and a responsive support team can be a lifesaver when you encounter system issues or require help with feature utilisation.

Cost of Forex back office software – The expense associated with these solutions can fluctuate substantially, depending on the provider. While researching, one might come across a vast range of offers. Yet, on average, such software, including the necessary functionalities, tools, and services for comprehensive monitoring of traders’ activities and personal data, might cost approximately $1000-1500 per month as part of a Forex CRM system.

Leading Back-Office Software Providers

Now, let’s talk about some of the industry’s best back-office systems for Forex brokers.

B2CORE

B2CORE ranks among the most advanced Forex CRM programs available in the market. This solution provides Forex brokers and exchanges with convenient access to detailed information about their clients, administrators, and business partners. B2CORE combines rich functionality with a user-friendly interface. It supports Android, iOS, Windows, and MacOS platforms, making it a truly multifunctional system.

B2CORE encompasses three major components:

- The trader’s room – a space packed with a robust set of tools for trading.

- The back office – a system offering customer management, validation checks, and a support ticket system with various valuable features.

- The CRM system – a solution designed for automating and controlling company interactions with customers while storing and organising information about their trading activity.

FX Back Office

Starting as a visionary idea among experienced industry professionals, FX Back Office has transformed how the FX brokerage business operates daily. With a team comprising members with industry experience dating back to 2007, this company positions itself as a seasoned Forex CRM provider.

It offers various solutions, such as a CRM system and a back office for financial businesses, which provide comprehensive control over user trading activity and generate detailed reports. Furthermore, it gives access to an IB and affiliate portal, a Percent Allocation Money Management (PAMM) system, and a B2B help desk.

UpTrader

UpTrader is also one of the best Forex CRM companies, focusing on helping clients maximise profit, customise conditions, and acquire and retain clients efficiently.

UpTrader offers custom software development and innovative SaaS products, including Forex CRM, FX back office, trader’s room, White Label social trading platform, Forex and crypto liquidity, as well as MT4 and MT5 PAMM and MAM modules, and social trading.

Final Remarks

Starting a currency exchange business is never easy, especially if you build everything from scratch. Gladly, Forex back-office systems exist, helping brokers to organise and manage everything from user account registration to actual trading on the market. The back-office system allows brokers to run their operations smoothly, stay in line with regulatory rules, and stand out in the highly competitive Forex market. Therefore, getting familiar with FX back-office systems is crucial to building a successful FX brokerage.

FAQ

What does the back office do in forex?

The back office in Forex manages operational tasks like transaction processing, account management, risk management, regulatory compliance, and reporting. It supports the smooth functioning of a Forex brokerage.

What type of CRM do forex companies need?

Forex companies need a CRM (Customer Relationship Management) system that effectively manages client data, tracks interactions, handles client queries and complaints, and facilitates personalised communication. The CRM should integrate well with other software applications in the back-office system.

What is an IB in Forex?

In Forex, an IB (Introducing Broker) is an individual or an organisation that introduces new clients to a Forex brokerage. In return, the IB receives a commission from the broker for each trade made by the referred clients.

What is a CRM in Forex?

A CRM in forex is a system that manages the relationship between the forex brokerage and its clients. It aids in collecting and analysing client data, managing client interactions, and personalising communication, thereby enhancing client management.