Top 10 Best Crypto-Friendly Countries for Your Business

This article will explore the most crypto-friendly countries so that you can choose to start a crypto business.

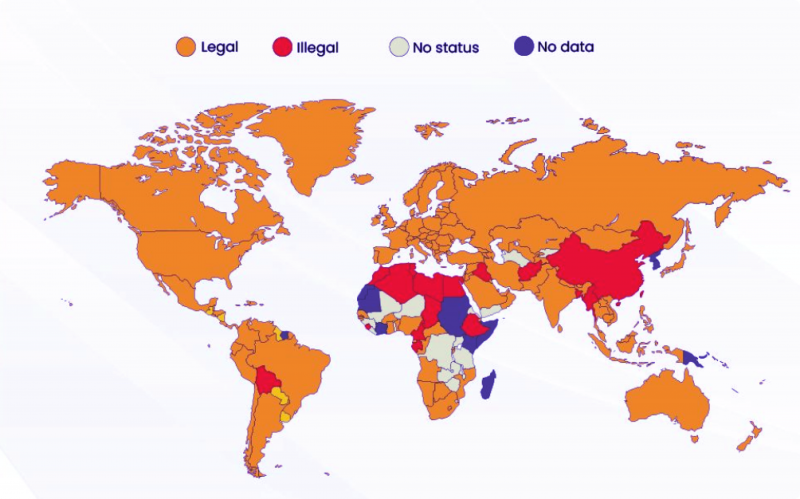

Cryptocurrency has revolutionised finance, offering new opportunities for investors and businesses. However, countries worldwide are grappling with regulating this emerging market. Some countries have embraced crypto payments, creating a favourable environment, while others have taken a cautious or restrictive approach.

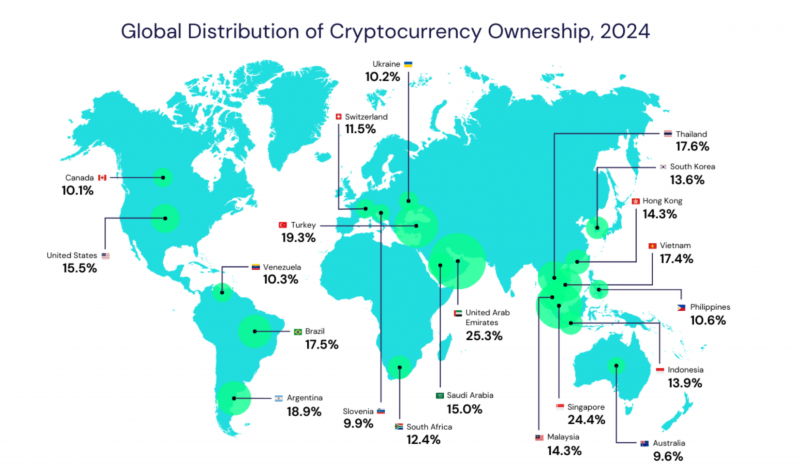

Today, numerous countries embrace cryptos, increasing virtual money usage in investment, trading, and payment.

Key Takeaways

- Crypto-friendly countries facilitate crypto operations by offering supportive regulations, low taxes, and developed infrastructure.

- Crypto taxes work similarly to taxes on other assets or property.

- China, Egypt, and Qatar are the least crypto-friendly countries.

- Portugal, Switzerland, El Salvador, and others are cryptocurrency-friendly countries.

Defining Crypto Friendliness

A crypto-friendly country fosters the growth of the crypto industry. These countries offer clear and supportive regulations, tax incentives, high adoption and acceptance of cryptocurrencies, well-developed infrastructure, and an innovative mindset. These countries provide certainty and stability for companies and individuals operating in the crypto space, offering low or no capital gains taxes, income taxes, or value-added taxes (VAT) on crypto activities.

These countries also have a well-developed infrastructure to support the crypto industry, including crypto exchanges, wallets, payment processors, and other related services. This ecosystem facilitates the seamless use and integration of cryptocurrencies. This mindset encourages the growth and development of the crypto industry within a country.

Crypto-friendly countries have evolved since the advent of crypto in 2009, with many countries softening their stance against the technology to capitalise on global trends. Some countries aim to be considered one of the world’s most crypto-friendly nations, while others focus on creating foreign investment opportunities and generating revenue through minimal crypto taxes.

This mutually beneficial relationship benefits both parties, as the country becomes a top choice for crypto holders, and investors save their hard-earned money. However, a country’s crypto-friendly status does not necessarily imply a large number of crypto users.

Explaining Crypto Taxation

A crypto-friendly country should have minimal crypto capital gains, income taxes, and exchange taxes. Cryptocurrency tax rules are constantly evolving, making it crucial to stay updated. The Internal Revenue Service (IRS) classifies cryptocurrency as a convertible virtual asset, including NFTs and stablecoins, which abides by the same principle as traditional property transactions. If an asset has digital asset characteristics, it will be treated as a digital asset for federal income tax purposes.

Crypto exchanges, transactions, and income from crypto are taxed by most governments. Taxable transactions include selling digital assets for cash, trading digital assets, using crypto as payment, mining or staking crypto, receiving airdropped tokens, getting paid in crypto, and receiving interest or yield in crypto.

However, not every crypto transaction is taxable, with activities such as buying digital assets with cash, transferring digital assets between wallets or accounts, gifting blockchain money, and donating cryptos being tax-deductible.

Cryptocurrency taxes are similar to other asset or property taxes, creating taxable events for owners when they are used and gains are realised. These events include the sale of digital assets for fiat, exchange of digital assets for property, goods, or services, exchange or trade of digital assets for another, receipt of digital assets as payment, receipt of new digital assets due to hard forks, mining or staking activities, airdrops, and any other disposition of a financial interest in a digital asset.

Why You Should Carefully Select a Country for Your Crypto Business?

In today’s world, the choice of a country for blockchain coins investments is crucial due to its regulatory environment, taxation policies, market access, legal protections, acceptance and adoption, geopolitical stability, and innovation.

Countries with favourable regulatory environments can determine the feasibility and security of crypto investments, while countries with stringent regulations or inconsistent policies can impact the legality and ease of conducting crypto-related activities. Access to crypto markets can also vary, with some countries having well-established exchanges and infrastructure while others may have limited access.

Legal protections for crypto users and investors also vary, with some countries offering comprehensive frameworks and others lacking such safeguards. Acceptance and adoption of cryptocurrencies also vary, with some countries fostering innovation and the development of blockchain projects through government support, investment incentives, and a vibrant startup ecosystem.

Choosing a country with a stable political and economic environment can reduce the risk associated with crypto investments. It is advisable to seek legal and financial advice when considering international crypto investments to ensure compliance and mitigate risks.

What Are the Least Crypto-Friendly Countries?

Despite the growing popularity of crypto in the world, some countries still refuse to adopt digital currency and even ban its use.

Thus, Qatar, Egypt, Bangladesh, Morocco, and China are among the least crypto-unfriendly countries.

In 2017, China banned certain crypto exchanges and introduced a comprehensive ban on crypto purchases and mining in 2021. This ban is still active, with violators facing prison terms.

Fragen zu Ihrer Broker-Einrichtung?

Unser Team steht Ihnen zur Seite – egal, ob Sie gerade starten oder Ihr Geschäft ausbauen.

Qatar has banned crypto operations and trading on its territory, with the Qatar Financial Centre adopting a 2020 act prohibiting banks and financial institutions from exchanging, receiving, sending, or creating accounts for cryptos. The ban was prompted by concerns about money laundering and terrorist financing. Qatar, a tech-oriented country, is exploring the possibility of issuing its own centralised digital currencies as an alternative.

Egypt has banned crypto mining and operations since 2018, citing Dar Al-Ifta’s declaration that blockchain operations are contrary to Sharia law, as they are similar to gambling or speculation. The fatwa, issued in January 2018, became legally binding.

Bangladesh declared cryptographic tokens illegal in 2014, and Morocco banned all crypto activities in 2017.

Top 10 Crypto-Friendly Countries

The choice of a country for crypto endeavours is a critical decision that can significantly impact the success and safety of your investments. Here is the list of the most crypto-friendly countries to start your business.

1. Malta

With its progressive regulations and advantageous tax structure, Malta, also known as Blockchain Island, is attracting large companies in the crypto coins industry. The country’s clear regulations for cryptocurrency businesses make it a prime location for blockchain companies globally.

Malta has implemented measures to safeguard the interests of crypto businesses and investors and promote a level playing field in the market. This aids in the expansion of the crypto industry while ensuring the safety of customers.

Malta recognises Bitcoin as a “unit of account, medium of exchange, or a store of value.” Crypto trades are treated similarly to day trading stocks or shares, with a Business Income Tax rate of 35%, but it can be reduced to 0% to 5% depending on earnings and residency. Malta offers regulatory advantages such as innovative development, investor protection schemes, international recognition, and a safe environment for crypto trading.

2. Singapore

Singapore is a leading Asian fintech hub and one of the best jurisdictions for cryptocurrencies and innovation, thanks to its strong regulatory framework and its lack of capital gains tax.

The city-state exempts digital tokens from taxes and simplifies the understanding and compliance of tax obligations for investors and companies. Singapore supports cryptocurrency by having well-defined regulations and initiatives to support innovation. Also, a trading platform in Singapore may need a license to operate. Unless engaged in trading, people in Singapore are not obligated to pay taxes on their crypto income.

Crypto transactions are considered barter trade, avoiding income tax. Singapore’s central bank supports crypto, stating that the blockchain ecosystem should be closely monitored to prevent illegal activity. However, innovation should be welcomed, making it an ideal place to establish a legal crypto or blockchain company supported by regulatory bodies.

3. Portugal

Portugal is a desirable location for cryptocurrency entrepreneurs and investors due to its favourable tax environment, crypto-friendly regime, support for blockchain innovation, and clear regulatory framework for crypto assets, exempting individuals from VAT and offering advantageous tax rates.

The Portuguese Tax Authority declared cryptocurrency trading and transactions tax-free for individuals, with profits exempt if they’re not the main income source and tokens have been held for over 365 days. However, in 2023, taxes were introduced on crypto transactions, subject to a 28% tax.

Portugal is a popular nomadic hub, offering an easy tax residency process and friendly digital currency taxation. Companies providing crypto services are taxed on capital gains. Moreover, Portugal hosts international crypto events like Nearcon23 and the Web Summit.

4. Switzerland

Switzerland is a leading nation in finance and innovation, making it a magnet for blockchain and crypto companies. The Crypto Valley houses major companies such as Ethereum and Cardano Foundations.

The country offers favourable crypto regulations, clear guidelines for ICOs, and low taxes on crypto profits for individuals and businesses. Professional crypto traders may face a slight wealth tax of 0.5% to 0.8%, applicable to all assets.

The country classifies cryptocurrency as assets rather than securities, and its advanced financial transaction infrastructure makes it a preferred destination for crypto companies. Cryptocurrencies are taxed under the Wealth Tax system, with private investors not paying capital gains taxes on personal wealth assets since buying and selling via professional traders is considered business income.

Mining is considered self-employment and subject to business income tax. Individual trading of cryptocurrency is exempt from capital gains tax, and remote workers should declare wages in crypto as salary income.

5. Estonia

Estonia, a Baltic nation known for its advanced e-government services, is also a crypto-friendly country due to its early embrace of cryptocurrencies, established licensing system for exchanges and wallet providers, and well-developed digital infrastructure. The country attracts blockchain startups and promotes cryptocurrency and digital enterprise through its e-Residency program, allowing remote access to digital services.

Estonia treats cryptocurrency as an asset for income tax, with normal taxes and capital gains for sale and purchase. However, buying and selling are not VAT-exempt. Estonia is one of the few EU member states regulating cryptos, developing its first regulatory framework over three years ago.

Obtaining a business license is quick and easy, with a small fee of 3,300 euros. Estonia’s competitive tax policy excludes income tax and VAT on Bitcoin and altcoins.

Estonia imposes a 20% corporate income tax on crypto companies’ profits, requiring them to pay taxes on dividends distributed to shareholders.

6. Germany

Germany acknowledges Bitcoin as a legitimate medium of exchange and has strict regulations to protect the crypto sector from fraud and money laundering. The country supports the secure and open crypto industry by addressing potential risks and enforcing compliance standards. Cryptocurrencies are considered private money in Germany, exempt from VAT and long-term capital gains tax, and earnings from holding them for over a year before selling.

However, businesses involved in crypto trading are subject to corporate income tax. This makes cryptocurrency a favourable tax treatment for working nomads and remote workers in Germany. The rules apply to Bitcoin sales within one year but not within a year.

Germany’s robust economy and regulatory framework are attracting a growing number of crypto startups, particularly in Berlin, which is a hub for European crypto innovation.

7. Slovenia

Slovenia is a crypto-friendly country with a progressive approach to cryptocurrencies, fostering innovation. The country has the highest market capitalisation of crypto and blockchain projects per capita, attracting crypto companies and investors from around the globe.

Entdecken Sie die Tools, die über 500 Broker unterstützen

Erkunden Sie unser komplettes Ökosystem – von Liquidität über CRM bis hin zur Handelsinfrastruktur.

Slovenia offers a favourable tax rate for businesses involved in digital transactions. Income generated from your cryptocurrency investments is subject to taxation. However, the profits from selling your coins may be tax-exempt based on your individual circumstances.

Slovenia has a strong interest in crypto coins and has made substantial financial investments in the market. Numerous blockchain companies in the area are thriving. Mining cryptocurrency in the country is tax-free, as the rules are not stringent. However, individuals engaged in cryptocurrency mining are required to pay a 25% tax on their earnings.

8. Canada

Canada, a global leader in blockchain and crypto technology, has a well-defined regulatory structure that balances investor interests and innovation. Cryptocurrencies are classified as commodities and subject to capital gains taxation, with clear standards and reporting requirements.

Canada has a strong Bitcoin community and has no legislation that restricts its use. Despite recent attempts to centralise the crypto market, the government still welcomes the technology. Crypto companies are classified as Money Service Businesses (MSBs) and must register with the Financial Transaction Analysis and Reporting Center of Canada (FINTRAC). Canada has one of the highest numbers of BTC ATMs in the world, and several Canadian banks allow crypto transactions, making life easier for investors and businesses.

9. Luxembourg

Luxembourg, a Western European country, has become a major financial centre by fully embracing cryptos and blockchain technology. In 2016, Luxembourg recognised BTC as a valid payment method.

The Financial Regulator granted a license to the first European cryptocurrency exchange, making Luxembourg an attractive hub for blockchain innovators looking to establish a presence in the European market.

The country prioritises financial innovation by developing crypto-related products and integrates blockchain technology into its financial system. The country had a global crypto adoption index score of 0.002 in 2023.

10. El Salvador

El Salvador is becoming one of the most crypto-friendly countries lately. The country was the first to recognise Bitcoin as a legal tender in 2021 and is now a tax haven for crypto investors and firms seeking a tax-friendly environment. The country’s regulations require businesses to embrace Bitcoin and also invest in a universal wallet for public use. El Salvador is predicted to receive increased funds and stimulate its economy through the use of Bitcoin. This could potentially establish the country as a hub for innovative concepts regarding digital currency. Furthermore, the nation offers tax incentives for cryptocurrency operations, allowing profits and assets from digital currency to remain untaxed.

Concluding Thoughts

Today many countries are recognising the benefits of blockchain coins and taking steps to ensure safe and easy use for their citizens. The increasing global use of cryptocurrencies is expected to give crypto-friendly countries a significant impact on the future of currency. These countries are backing initiatives that employ blockchain technology and foster fresh concepts, aiming for a financial system that is equitable and accessible to all.

FAQ

What are the best countries for crypto?

Countries like Singapore, Switzerland, Malta, Estonia, and Portugal are renowned for their favourable regulations and supportive government policies, making them the best crypto-friendly countries.

Are there countries without crypto tax?

Countries like Bermuda, Cayman Islands, El Salvador, Georgia, Germany, Hong Kong, Malaysia, Malta, Puerto Rico, Singapore, Slovenia, and Switzerland are countries with 0 crypto tax.

Can I pay taxes with crypto in a crypto-friendly country?

In some countries, it is not a standard practice to pay taxes using digital money.

What are the top 10 countries that use Bitcoin?

The top 10 countries embracing Bitcoin include Malta, Singapore, Portugal, Switzerland, Estonia, Germany, Slovenia, Canada, Luxembourg, and El Salvador. These nations have crypto-friendly regulations, low taxes, and advanced infrastructure, making them ideal for crypto businesses and investors.

Which country has the most crypto investors?

The United States leads the world in the number of crypto investors, followed by India and Nigeria. These countries have high adoption rates due to their large populations, growing interest in digital assets, and supportive infrastructure.

Why is El Salvador among the top countries that use Bitcoin?

El Salvador is the first country to adopt Bitcoin as legal tender. As of today, it still remains a leading Bitcoin-friendly nation due to its zero crypto tax policy, government-backed initiatives, and innovative efforts to integrate Bitcoin into daily transactions and the economy.