Cryptocurrency Exchange License: How and Why Should You Get It?

Articles

The crypto industry has shown impressive growth results in the last fiscal period, moving on from a massive market downturn into a gradual expansion with several sustained bull runs. Bitcoin is confidently returning to its all-time high, currently standing at $70K with several insignificant resistance points along the way. In recent months, Bitcoin’s resurgence has rallied the industry to expand and drive growth.

As a result, the crypto industry has never been more demanding of accessible, affordable, and efficient exchanges. Moreover, white-label solutions and readily available API integrations make it easy to start your cryptocurrency exchange in a matter of weeks.

One of the biggest roadblocks in this scenario is the cryptocurrency exchange license that you will be required to operate. This task is often why many business owners abandon their crypto business ambitions. However, obtaining a crypto exchange license can be much easier than you initially imagined if you follow the necessary steps. Let’s explore!

Key Takeaways

- Obtaining a cryptocurrency exchange license is a critical step in achieving regulatory compliance.

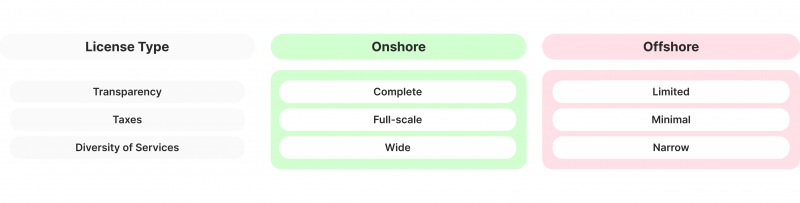

- Onshore and offshore licenses differ in requirements, flexibility, extent of potential partnerships and operational taxes, among other things.

- Acquiring a crypto exchange license varies dramatically depending on your chosen jurisdiction.

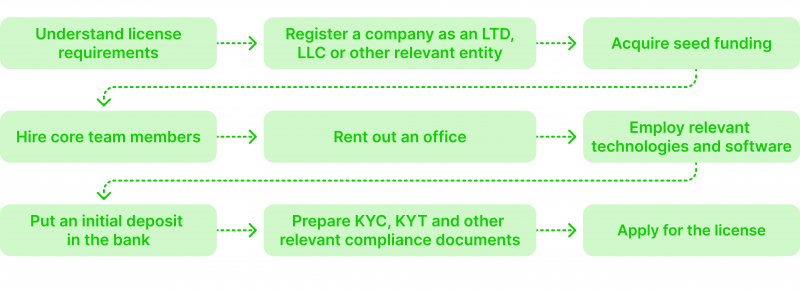

- Before applying for an exchange license, you should acquire seed capital, register your company, rent an office, hire core team members, and employ security measures.

Why is the Cryptocurrency Exchange License Important?

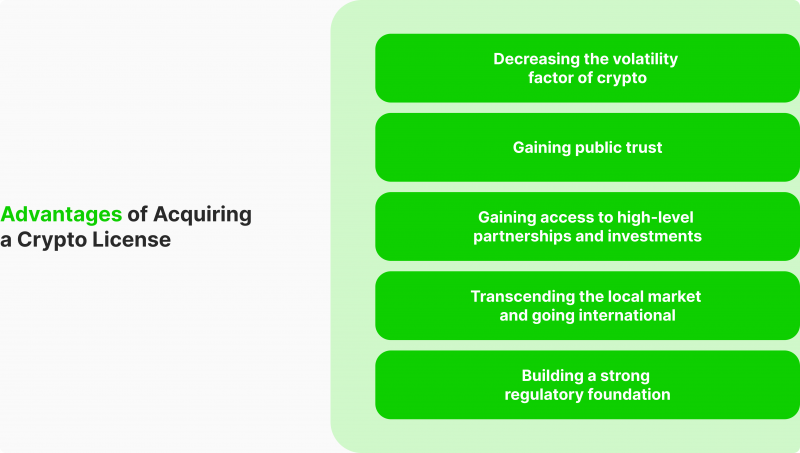

Aside from the fact that some jurisdictions outright demand a cryptocurrency exchange license, there are numerous advantages to acquiring this essential piece of paper. It is crucial to understand that the crypto industry is moving into the age of standardisation and compliance, raising transparency and reliability of the entire industry in the process.

Crypto licensing is one of the core pillars of this movement, allowing all sides of the market to develop a strong regulatory framework. Let’s discuss why.

Navigating the Volatile and Unstable Crypto Market

The core concept of blockchain’s decentralisation, anonymity and freedom of choice has inherent risks associated with scams, identity theft, fraud, money laundering and even virtual crime. Unfortunately, the foundations that make crypto an excellent financial asset also subject it to numerous digital threats. So, to keep the crypto industry free of malicious intent, regulatory authorities across the globe have developed new compliance frameworks.

As a result, the new rules and regulations strive to make the crypto field safer and more stable for all parties involved. It is no secret that crypto volatility is closely tied to the public’s distrust of crypto companies. With stories like FTX, numerous NFT scams, and other scandals, the crypto industry has been filled with uncertainty and danger in previous years.

However, the latest regulatory requirements have ensured that crypto companies will no longer be able to repeat the same malicious acts that have plagued the market so far.

Official Partnerships and Deals

On the business side, obtaining a cryptocurrency exchange license is important because it can open numerous closed doors for up-and-coming businesses. These opportunities include partnerships with large liquidity providers, commercial banks, global exchange systems, and order books. Additionally, acquiring seed capital as a registered and licensed crypto exchange provider will be easier.

Access to convenient funding sources is crucial in the early stages of your exchange business, as even a small contribution might prevent you from going under if market conditions tighten. Finally, licensing helps you acquire white-label and affiliate partners that can significantly increase your revenue streams through marketing channels and branding services.

International Exposure

Cryptocurrency exchanges should always strive to go global since local markets cannot satisfy your growing demands. Unless you are in the US, UK or another massive financial market within a single jurisdiction, you should strive to become an international exchange agency serving cross-border clients. So, looking beyond local regulations and seeking a US or EU crypto regulation license is desirable.

As a result, your international aspirations will be much easier to achieve, and your potential relationships with global partners will be significantly easier to attain.

Offshore is an infamous word in finance. However, offshore jurisdictions allow companies to operate freely and without tax burdens. They are often viewed as riskier prospects due to the lack of regulatory oversight.

Regular vs. Offshore Crypto Licenses

Before filing for a crypto exchange license, you should understand what differentiates regular and offshore crypto jurisdictions. While there are many differences from country to country, dividing the entire globe by onshore and offshore options is a good starting point when choosing a license jurisdiction. However, each document benefits particular business setups, and you should understand the differences thoroughly.

Most Popular Conventional Licenses

The US, UK, Germany and Dubai are the most popular onshore license providers worldwide. Onshore licenses are typically more challenging to acquire since they have strict regulatory requirements imposed by the country’s respective regulatory bodies.

In the USA, the SEC, FinRA, and CFTC have introduced most of the laws and regulations related to the crypto industry. Each country has its regulatory bodies that supply their version of compliance requirements.

However, the US, UK, and Germany have by far the strictest crypto laws, aiming to stabilise the industry and make it more transparent for regular users. Applying for onshore licenses takes more effort since you need a flawless understanding of local and international crypto-related laws.

Generally, it is necessary to hire legal support to understand every requirement and have all the paperwork ready thoroughly. Despite such steep requirements, onshore licenses are favoured globally and more tightly associated with transparency and high compliance.

Top Offshore Licenses

Offshore licenses are more flexible but less reliable alternatives to onshore license types. The most popular choices in this segment are the Cayman Islands, Mauritius, Malta, Seychelles Islands, and Labuan. While each of these countries has unique approaches to crypto regulations, they offer a tax haven for crypto companies worldwide.

As a result, if you acquire a cryptocurrency exchange license to operate from these offshore locations, your services will be inherently cheaper, allowing you to create a crypto exchange with affordable rates. The initial requirements for offshore licenses are also far more relaxed, requiring less initial capital, fewer documents, and compliance measures.

Offshore crypto exchanges can also keep client information undisclosed, giving clients the sense of security and anonymity lacking in onshore jurisdictions. The flexibility of offshore licenses also encompasses the extent of services provided, as offshore exchanges have fewer limitations on operating their company.

However, offshore exchanges do not enjoy the barrier of protection provided by regulatory bodies, making their services less safe for average users. The lack of regulations can also increase volatility, which is already dramatically high in the crypto field.

Finally, offshore companies generally have fewer partnership options to deepen their liquidity pools and expand their range of services. As a result, most off-shore exchanges are highly specialised service providers that might not meet the diverse demands of the crypto audience.

The MiCA Regulation

Regardless of your cryptocurrency exchange license, you should be mindful of the recently introduced Markets in Crypto Assets (MiCA) regulation. The MiCA regulation is not just a new law that adds another footnote to classifying crypto activities. Instead, the MiCA crypto rules will serve as a regulatory framework going forward, defining the entire compliance process for crypto companies.

As a result, the entire European region will have unified laws that determine how crypto assets should be stored, exchanged, owned, and sold across the entire jurisdiction. So, regardless of your license choice, you must be mindful of upcoming regulatory changes like MiCA, which will allow you to build a stronger legal foundation for your exchange business.

How to Get a Cryptocurrency Exchange License: Essential Steps

If you wish to jumpstart a cryptocurrency business, you can expect licensing tasks to be one of the most time-consuming challenges in your roadmap. However, as discussed above, taking the time and energy to sort out your licensing matters will yield significant benefits in the long run.

Moreover, contrary to popular belief, obtaining a license has become much easier for cryptocurrency businesses. The six primary steps below will help you simplify the workflow of obtaining a cryptocurrency exchange license without unnecessary delays and extra costs.

1. Prepare for the Basic Requirements

Firstly, it is crucial to understand the basic requirements imposed by the crypto jurisdiction of your choice. As discussed above, the first step is to choose between the onshore and offshore license types. The decision, in this case, will depend on your business preferences.

An onshore license is your best bet if you wish to serve more risk-averse clients and demand regulatory security. On the other hand, clients who wish to have more anonymity in their dealings and lower transaction fees will prefer offshore exchange companies.

It is up to you to decide which option suits your business aspirations in the long run. After choosing the desired jurisdiction, it is crucial to understand basic requirements. Some authorities require predetermined KYC and KYT procedures to ensure that anti-money laundering and anti-fraud measures are taken thoroughly.

Some authorities also demand readily available software, a full-scale workforce, and a physical presence within the region, most frequently in an office. In the following sections, we will explore each of these requirements.

2. Create and Register a Company

The task of company registration can vary in complexity and duration depending on the jurisdiction. Some countries let you register as a crypto organisation without many prerequisites. Still, most jurisdictions require proof of initial capital, KYC and KYT procedures, and relevant technologies supporting an operational exchange platform. If you face such requirements, you must postpone the company registration and take the next two steps in this guide first.

After achieving the technical prerequisites, the registration process will take several days, usually up to two weeks. During this period, authorities will check your track record, ensuring that your organisation is free of any faults and issues with the general law.

The vetting process regarding crypto assets and payment services, including exchange organisations, is even stricter. Most jurisdictions understand that cryptocurrency transactions have higher inherent risk compared to other financials, so the vetting process generally lasts longer.

3. Acquire Initial Capital

This is by far the most technically demanding step in our guide, including the hiring process of your core workforce, accumulating initial investment capital and purchasing all relevant technologies, both hardware and software.

The trickiest part is finding sufficient investors who are ready to finance your entire business in the beginning. Most crypto exchange business costs range anywhere from $100k to $350k. The high variance in development costs includes salary, rent, and technology price differences from country to country. So, it is crucial to create a business budget, forecast your potential costs, and present them to your prospective investors.

4. Hire Your Core Workforce and Employ Technology Solutions

If you acquire the crucial seed capital, it is time to build a core team of account managers, business analysts, developers, finance experts, and support specialists. It is not mandatory to hire everyone at once just to acquire a license, so you can take your time rounding out the complete staff roster later.

The final task, which will most likely coincide with your hiring procedures, is to acquire relevant technologies. This includes purchasing white-label software, API extensions, payment processing solutions, liquidity channels, servers and physical equipment for your company. This process will drastically vary depending on which business model you decide to adopt.

The white-label exchange model is the most cost-effective and takes the least time. However, in-house development might be a superior option for exchange startups with massive initial investments and the need to construct a custom exchange software from scratch.

5. Prepare All Relevant Documents

Once you finish the last step, your roadmap toward acquiring a license will be mostly done. Constructing the core company stack is the most resource-intensive process, and retrieving relevant documentation is trivial.

As mentioned above, documents needed for a cryptocurrency exchange license include signed proof of KYC, KYT, AML and CTF measures. Moreover, you must present documentation of your bank account containing the minimal capital requirement. Financial statements are also required. You don’t need to present a fully-fledged financial statement before entering the business. Instead, a simple budgetary template and balance sheet for cryptocurrency companies will suffice.

6. Establish a Physical Presence in the Region

To start crypto exchange operations, you technically do not require a dedicated office since most work can be done online, especially on white-label exchange platforms. However, most jurisdictions require a physical presence in the region where you acquire the license.

Regarding onshore documentation, your crypto exchange secures a license only if you have a full office in the area. Opening an office might be costly in some regions, but it will ultimately help you to get ahead of the competition in terms of credibility and transparency.

7. Apply and Wait

After sorting each of the previous five steps, the only thing left is to file for your preferred exchange license and wait. Some jurisdictions have steep one-off fees for acquiring a license. However, the cost of a cryptocurrency exchange license will most likely be affordable if you have acquired seed investment from venture capitalists or other similar sources.

Once you have paid the respective amount, the license approval will be finalised in six weeks to three months. While this period might seem extensive, regulatory bodies must conduct exhaustive checks on your background, operational capabilities, and other details before ensuring that your exchange is appropriately prepared to serve customers.

Final Thoughts – Is the Licensing Process Worth it?

As outlined above, the licensing process should be parallel with your crypto exchange development. So, if you plan everything out in advance, most of the license requirements are tasks you should do anyway.

However, acquiring all relevant documentation and carefully following each procedure is still a time-consuming process. Ultimately, obtaining a license pays off dramatically since the crypto landscape is shifting toward a more regulated future to protect its users.

The recent MiCA crypto regulation is a testament to this new trend, signifying the tectonic changes in the regulatory framework of the cryptocurrency field. So, to catch up with the changing times, having a strong legal footing in the industry is necessary; acquiring a license will be your first step toward achieving this goal.

FAQ

Do you need a cryptocurrency exchange license?

In most jurisdictions, commercial exchange platforms require a license. While developing a completely decentralised exchange without official licensing is possible, you will experience regulatory roadblocks in virtually every direction.

How long does it take to acquire a cryptocurrency exchange license?

It takes anywhere from six weeks to three months. Since this process is extensive, filing for a crypto exchange license as soon as possible is advisable.

Why do I need KYC and KYT compliance measures?

KYC and KYT protocols are invaluable in crypto, providing much-needed customer and stakeholder protection. Crypto is inherently dangerous due to its anonymity and digital nature. So, vetting potential customers and employees is critical to ensure their integrity.