Cómo un Software de Prop Trading Impulsará su Negocio

El mundo de las inversiones y el trading no deja de evolucionar, especialmente con los enormes avances tecnológicos que han reducido las barreras de entrada y dotado a las nuevas empresas de intermediación de todo lo necesario para competir con éxito en el mercado.

Las cuentas PAMM, los copiadores de estrategias y el trading automatizado son algunos ejemplos de la injerencia de la tecnología en el trading actual. El Prop Trading es un modelo de negocio innovador que está dando mucho que hablar en el sector de la intermediación financiera.

El software de Prop Trading permite a las empresas atraer a los operadores más destacados y hacer que inviertan en nombre de la empresa de intermediación, lo que en la mayoría de los casos da lugar a situaciones en las que todos salen ganando. Veamos en detalle qué es el Prop Trading y cómo se puede crear una empresa de Prop Trading.

Datos clave

- El trading propietario se refiere a empresas que operan para sí mismas además de ofrecer servicios de intermediación a sus clientes.

- Los Prop Traders deben superar varios retos antes de convertirse en operadores internos de un bróker.

- Integrar un software de Prop Trading amplía las fuentes de ingresos de su empresa al permitirle obtener ganancias de sus actividades y de las ganancias de los Prop Traders.

¿Qué es el Prop Trading?

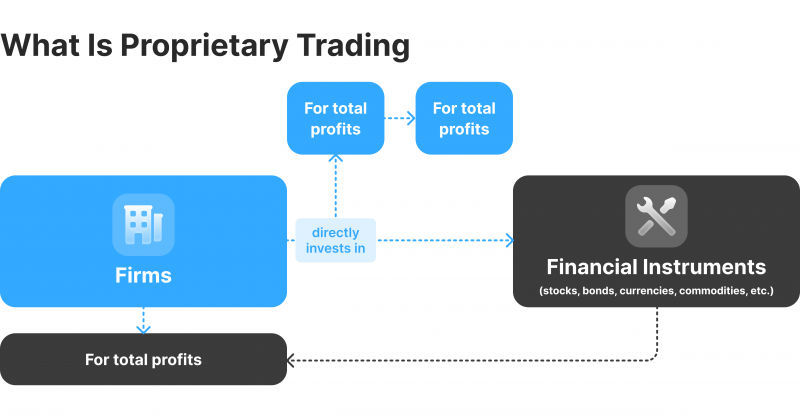

El Prop Trading o trading propietario es un modelo de intermediación en el que la empresa financiera utiliza sus recursos para operar por cuenta propia además de servir a sus clientes.

De este modo, los brókers utilizan su capital y sus capacidades para obtener beneficios financieros y aprovechar sus avanzados sistemas de trading, gestión del riesgo y estrategias de trading de éxito.

Las empresas de Prop Trading utilizan diferentes métodos para atraer a los operadores más exitosos a su equipo interno y convertirlos en traders propietarios. Los brókers utilizan el software de Prop Trading como una rama de sus diversos servicios financieros, alineándose con la creciente demanda y las avanzadas tecnologías.

Incorporar una plataforma de Prop Trading permite a los brókers ampliar sus servicios, atraer a más usuarios y aumentar sus beneficios.

¿Cómo funciona el Prop Trading?

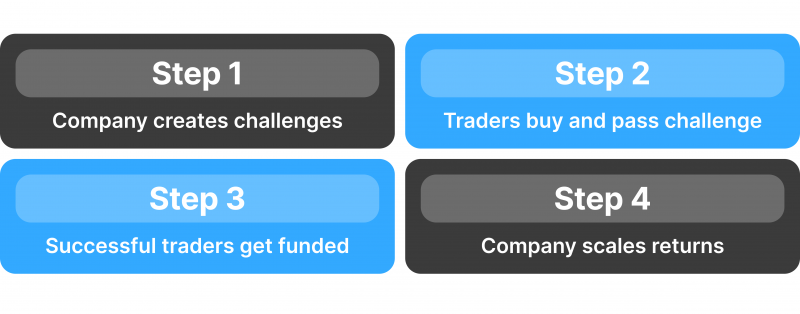

Las empresas de trading propietario fijan retos para que los inversores pongan a prueba sus habilidades de trading. Una vez superados los retos, son recompensados con una cuenta financiada con acceso a la tecnología, la cartera de riesgos y el capital de negociación de la empresa.

Estos desafíos instruyen a los candidatos a operar en mercados financieros o valores seleccionados y alcanzar objetivos específicos, como metas de ganancias, pérdidas mínimas o un determinado nivel de ingresos netos.

Las plataformas de Prop Trading se quedan con un porcentaje de las posibles ganancias o pérdidas que los traders obtengan durante los retos de Prop Trading. La empresa de Prop Trading gana de este flujo de ingresos, el cual puede variar una vez el operador tenga éxito en todas las tareas y se convierta en un Prop Trader de la empresa.

Además, las empresas de Prop Trading independientes operan sobre una base contractual, en la que un grupo de operadores presta servicios a otras empresas de Prop Trading sin estar vinculados a una plataforma de intermediación.

¿Tienes alguna pregunta sobre la configuración de tu bróker?

Nuestro equipo está aquí para ayudarte, ya sea que estés comenzando o creciendo.

Características del Prop Trading

Las empresas pueden añadir software de Prop Trading al lanzar sus negocios desde cero o como una línea de producto adicional a su negocio existente. Estas son algunas de las ventajas de utilizar una plataforma de Prop Trading.

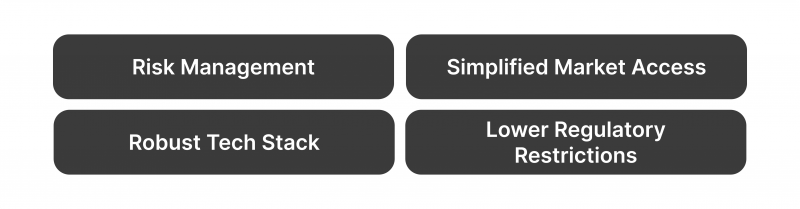

Gestión del riesgo

El software de Prop Trading moderno incluye herramientas de gestión del riesgo que tienen en cuenta la volatilidad cambiante del mercado y garantizan que los operadores tomen medidas calculadas. Las empresas de Prop Trading garantizan que inversores y profesionales de primera nivel operen por ellas tras superar todos los retos.

Por otra parte, los Prop Traders minimizan sus riesgos utilizando los recursos y tecnologías de la empresa para tomar decisiones informadas que no expongan el capital a peligros significativos.

Acceso sencillo al mercado

Las nuevas empresas de intermediación utilizan software de trading propietario para penetrar rápidamente en el mercado y competir con las empresas existentes. Este enfoque innovador permite a las empresas participar desde un nuevo ángulo que desafía y premia a los operadores profesionales antes de servir a una amplia categoría del mercado.

Esta estrategia es crucial ante la creciente competencia y la plétora de operadores cuyos servicios pueden ser idénticos.

Sólida pila tecnológica

Las empresas de trading propietario confían en la configuración tecnológica y las plataformas del bróker para tomar las decisiones de inversión correctas. Esto incluye plugins de trading, herramientas de análisis, trading algorítmico, cuentas gestionadas y gestión de back-office.

El software de las empresas de Prop conecta al operador con amplios pools y fuentes de liquidez, especialmente cuando los proporcionan instituciones financieras de liquidez de primer nivel que ofrecen una gran accesibilidad al mercado y un elevado volumen de negociación.

Menores restricciones normativas

El mercado de Prop Trading es relativamente nuevo. Por lo tanto, no está tan fuertemente regulado como el de los brókers de Forex, que está sujeto a múltiples jurisdicciones reguladoras y autoridades financieras.

Esto no elimina la necesidad de cumplir unos protocolos mínimos de seguridad, como la Ley contra el Blanqueo de Capitales (AML, por sus siglas en inglés) y las prácticas de Conocimiento a su Cliente (KYC, por sus siglas en inglés).

Los primeros procedimientos modernos de KYC fueron introducidos a finales de los 90 por el Banco de Inglaterra debido al creciente aumento del blanqueo de dinero y las actividades financieras ilegales.

Mayores fuentes de ingresos

Las empresas de Prop Trading pueden ampliar potencialmente sus fuentes de ingresos gracias a su operativa independiente, por las comisiones por servir a sus clientes y recibiendo un porcentaje de las actividades de los Prop Traders.

Además, las empresas de Prop de Forex exigen a los participantes que paguen ciertas primas por participar. Si no cumplen sus tareas, tendrán que volver a pagar para superar el reto de Prop Trading, lo que genera ingresos recurrentes para el bróker.

Cómo Lanzar una Empresa de Prop Trading

Aventurarse en el modelo de negocio del Prop Trading conlleva ciertos riesgos, como cualquier otra empresa. Sin embargo, los retos que ofrece el software de las empresas de Prop incrementan la posibilidad de contratar a los mejores operadores.

En primer lugar, debe familiarizarse con las leyes y normativas aplicables en materia de oferta de servicios financieros en su región o en el territorio de su mercado objetivo. Averigüe qué requisitos de licencia debe cumplir antes de obtener un permiso.

Luego, busque un proveedor de plataformas de Prop Trading que pueda dotarle de los medios tecnológicos y financieros necesarios para poner en marcha su negocio de Prop Trading.

Establezca retos y cuotas de entrada para atraer operadores que comiencen a negociar para usted. Organice un sistema de recompensas adecuado para garantizar que los operadores permanezcan en su plataforma y sigan proporcionándole flujos de ingresos.

Cómo integrar un software de Prop Trading

Encontrar el software de Prop Trading adecuado para su empresa es crucial, porque cambiar de proveedor cada cierto tiempo es costoso, lleva mucho tiempo y resulta molesto para sus operadores.

Por ello, estas son las 7 principales cualificaciones de un software de Prop Trading que debe considerar.

- Actividades financieras reguladas y reputación adecuada para ganarse la confianza de los operadores y comprometerse con las comunidades.

- Accesibilidad para facilitar la ejecución de posiciones de trading de alto valor y cuentas de margen para ampliar las ganancias potenciales.

- Cuotas de instalación y lanzamiento competitivas que tengan en cuenta sus limitaciones presupuestarias o sus requisitos de escalabilidad.

- Pila tecnológica avanzada para garantizar el correcto funcionamiento del software de trading y la perfecta integración con proveedores externos.

- Posibilidades de integración para potenciar su plataforma con métodos de pago rápidos, fuentes de liquidez, actualizaciones de precios y noticias.

- Mecanismo adecuado de capacitación e incorporación para garantizar un acceso sencillo a los nuevos operadores propietarios.

- Retos de Prop Trading adecuados con paneles de control que sigan y analicen de forma precisa y transparente las actividades de los operadores.

B2Prop: Innovador software de Prop Trading

B2Prop es un software de trading propietario recientemente lanzado con tecnologías y funcionalidades que satisfacen y superan las necesidades de los brókers.

Descubra las herramientas que impulsan a más de 500 corredurías

Explore nuestro ecosistema completo — desde la liquidez hasta el CRM y la infraestructura de trading.

Lanzado por el proveedor líder de soluciones financieras, B2BROKER, y respaldado por su avanzado ecosistema, el nuevo B2PROP garantiza la integración perfecta de una plataforma de Prop Trading para impulsar el potencial de su negocio.

B2PROP es respaldado por las amplias fuentes de liquidez y conexiones de B2BROKER, que proporcionan accesibilidad a la más amplia gama de instrumentos y mercados de trading. B2PROP también admite pagos criptográficos gracias a su compatibilidad con diversas blockchains y soporte de criptomonedas de B2BINPAY.

Lanzar su plataforma de Prop Trading con B2PROP es muy sencillo gracias a su sencillo registro, sus bajas comisiones y su enfoque personalizado, que le permite elegir las características y funcionalidades que su negocio necesita.

Conclusión

El término “Prop Trading” hace referencia a las empresas de intermediación que realizan operaciones financieras para obtener beneficios propios, además de ofrecer servicios de inversión a sus clientes.

Los brókers integran software de Prop Trading para ampliar su gama de servicios, atrayendo a los profesionales del trading más selectos para que se conviertan en Prop Traders internos tras superar retos específicos.

Entrar en el mundo del trading propietario puede ser muy lucrativo si se hace bien. Por ello, debe encontrar un proveedor de software de Prop Trading confiable que le proporcione apoyo tecnológico y financiero para ampliar sus fuentes de ingresos y hacer crecer su negocio.