How to Start Your Own Forex Broker in 2025?

This article will tell you what a Forex brokerage company is and how to create such a company. You will also learn how to start your own Forex broker in 2025 from zero using a simple sequence of steps.

The Forex industry has demonstrated a remarkable capacity to bounce back and recuperate despite being impacted by global crises. This is partly due to the support of governments worldwide, which acknowledge the significance of the Forex space in today’s interconnected and globalised world economy and take the requisite actions to restore normalcy as and when required.

Online retail Forex trading has gained popularity in recent years and is expected to continue growing due to its convenience and accessibility. This has resulted in a surge in demand for online Forex brokerages.

Key Takeaways

- A Forex brokerage firm is an intermediary between users and the capital markets, giving direct access to trade a large list of trading instruments.

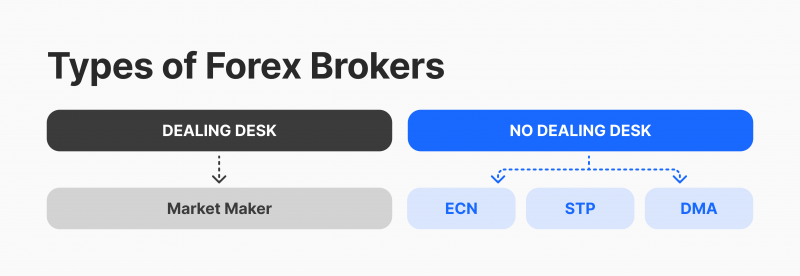

- Most FX brokerage houses operate on two models — Dealing Desk and Non-Dealing Desk, each of which has its own features, advantages, and disadvantages.

What is a Forex Broker Company?

A Forex broker is a special company that performs the intermediary function between a trader and the currency exchange. It is also called a dealing centre, which provides access to various financial instruments and analytics.

In addition, with the help of a team of specialists, it helps to properly execute all the documents necessary for the conclusion of transactions.

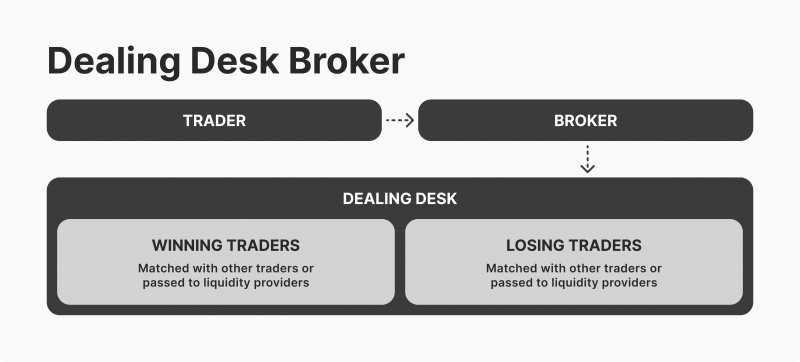

When it comes to Forex brokerage houses, there are two main types of models they work on — dealing desks (also known as market makers) and non-dealing desks. In the case of the dealing desk, the Forex broker creates a market by reflecting the interbank market quotation and offering these prices to its clients.

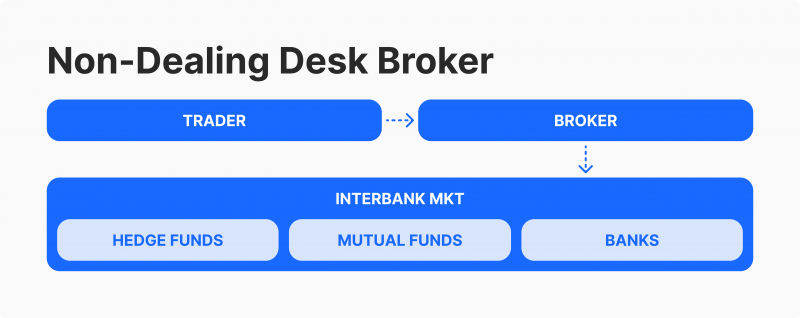

On the other hand, non-dealing desks route their clients’ orders to liquidity providers, and from the liquidity pool, the best quote is obtained and offered to their retail clients.

In Forex trading, brokers can be categorised based on their organisational structure. One such category is non-dealing house brokers, who typically offer traders access to ECN (Electronic Communication Network) or STP (Straight-Through Protocol) execution.

However, it’s important to note that there are different types of brokers out there, some of whom combine dealing with non-dealing conditions, making them a hybrid Forex broker. Traders must understand the differences between these broker types to choose the one that best suits their needs and trading style.

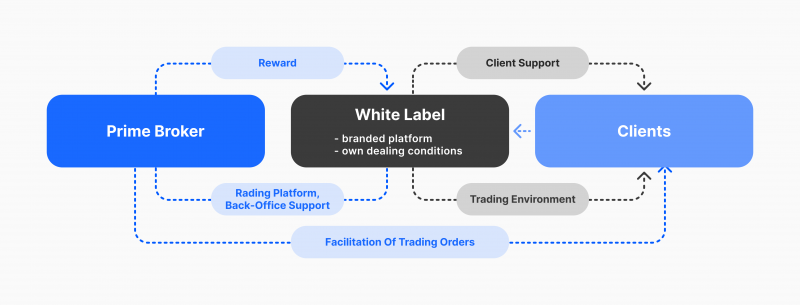

In addition to the White Label model, there is a form of cooperation within its framework called Grey Label, which implies a simplified model of using ready-made solutions of the company and at a lower cost.

Forex Broker Company Creation Models

Creating a Forex brokerage company, as well as creating any kind of business, is a challenging task. On the one hand, it requires professional skills in planning, analysis, and management and an intuitive comprehension of business processes. On the other hand, it involves the availability of significant resources, including time, capital, and labour.

Thanks to the development of the FX space, new models have emerged to help start a Forex brokerage firm much faster, more conveniently, and more reliably, taking into account the specifics of work, individual requirements, and characteristics of each client.

1. White Label Model

Forex broker business model working on the basis of a White Label system is one of the most popular and effective initiatives, time-tested and proven to be a powerful tool to start a Forex broker using all the advantages of modern solutions in the field of FX, taking into account an individual approach to each client.

The White Label model enables a startup of any format and size to quickly and safely enter the Forex market and start providing services related to trading currency pairs and other investment instruments due to the simple concept behind its operation.

Ready-made infrastructure, operational support and deep customisation capabilities allow the launching of a full-fledged Forex brokerage house in the shortest possible time and at a lower cost, taking into account the dynamics of changes in user demand and market conditions.

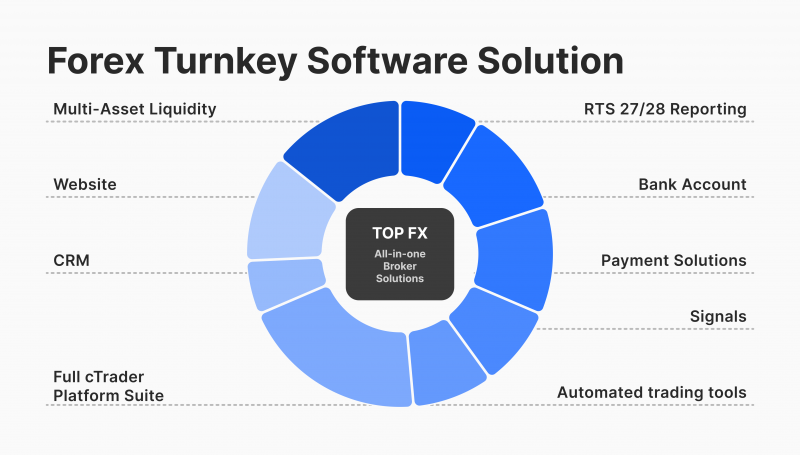

2. Turnkey Solution

Unlike the White Label model, creating a turnkey Forex brokerage company is a bit more complex and creative process, including many stages of development, programming, customisation, design, testing, etc.

This way of launching your Forex brokerage project involves cooperation with a specialised company engaged in developing and implementing such solutions, taking into account the individual features of each company’s business concept, its requirements and wishes.

The creation of a turnkey brokerage company starts with the preparation of the appropriate trading infrastructure and interface, website development, as well as the ecosystem, including the selection of liquidity sources, order entry systems, payment systems, API integration systems, and built-in security modules, including user verification and authentication.

3. Own Development

Independent development and launch of a Forex brokerage project is the most labour-intensive task in all senses, requiring full dedication and understanding of many aspects and nuances of different areas, including finance, programming, and design.

Nevertheless, this method, given the necessary amount of financial, labour and time resources, as well as the required equipment and technological stack, allows you to use all the potential and creativity of the company to create a product that meets all the requirements of the business concept embedded in it.

Basic Steps to Start a Forex Brokerage Firm from Zero

If you have a good budget, a lot of knowledge of the FX sector and a decent experience of working with products and solutions that give access to the capital markets, and in particular, the FX market, then the question of how to open a Forex brokerage company will be rhetorical, because in this case, we are talking about the independent launch of the project.

As mentioned above, the independent development and implementation of a Forex brokerage system is a task that requires careful planning of all aspects. This can be achieved by following the steps below:

1. Choosing a Business Mode

Defining the Forex brokerage house business model is the initial step which will directly influence his future work. It involves determining the type of brokerage you want to run, the markets to focus on, and the services to provide.

Forex brokerages typically operate under two main models: market maker and straight-through processing (STP). Market makers counteract their clients’ trades, while STP brokers transmit them directly to liquidity providers.

2. Licensing and Registration

To start a business in the Forex market, it is necessary to register a company and obtain the required licences. Licence is an essential factor that traders consider when choosing a Forex broker.

Licences are issued by different government regulators in various jurisdictions. However, the choice of a particular regulator depends on the size of the broker’s business, its budget and other factors. From a legal point of view, a broker’s licence indicates which regulator oversees its activities, which ultimately determines the company’s reputation.

3. Solving Legal Formalities

At this stage, the legal aspects of working in the country/region where the company plans to operate are studied and analysed. The importance of this step is to have a clear understanding of the legal regime and regulations, as well as aspects of providing financial services, as they may differ significantly from country to country.

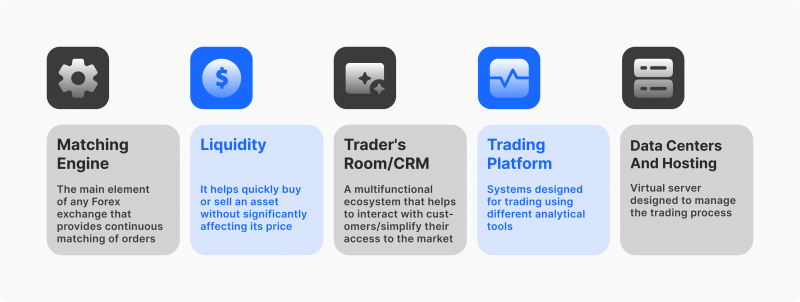

4. Development and Installation of Infrastructure

Starting a Forex brokerage from scratch is a laborious task that requires a significant investment of time, money, and effort. It requires substantial resources to establish all the necessary components to set up everything.

This includes running a Forex company infrastructure, setting up electronic payment services, developing a trading terminal, and establishing a matching engine for order matching and Forex broker CRM, among other preliminary activities.

One alternative option is utilising an existing brokerage exchange infrastructure with the White Label model, which can help save considerable time, money, and effort.

5. Connecting the Liquidity Source

As a Forex broker, your primary responsibility is to provide the customers with liquidity. This considers working with liquidity providers who can give access to the interbank market. Liquidity suppliers can be banks, financial institutions, or other brokerage houses.

However, it is crucial to choose a reputable and reliable Forex broker liquidity provider who can offer competitive pricing and fast execution.

Partnering with a trustworthy liquidity provider can ensure the clients receive the best possible trading experience, increasing profitability and customer satisfaction.

6. Marketing and Promotion

After establishing the necessary infrastructure and formulating comprehensive risk management policies, the next step towards launching a brokerage entails creating an appropriate brand identity, developing an effective marketing strategy, and reaching out to potential clients.

This can be achieved through various methods, including leveraging social media platforms, optimising search engine results, and utilising paid advertising techniques to promote brokerage.

Conclusion

Nowadays, the question of how to open a Forex brokerage company is always relevant because the popularisation of the Forex world becomes a catalyst for the development of new technologies and ways of earning money, giving incentives to companies to develop and implement new solutions related to the process of trading on the markets, attracting more investors and traders every day.

Therefore, launching your Forex brokerage initiative allows gaining valuable experience in this market and knowledge in many areas, including business planning, marketing, trading systems, and programming, forming a reliable and competitive FX company.

FAQ

What are the key steps to start your own Forex brokerage?

To start your own Forex brokerage, you need to choose a business model, obtain proper licensing, set up trading infrastructure, partner with liquidity providers, and develop a strong marketing strategy.

How much capital is needed to start your own Forex brokerage?

The capital required to start your own Forex brokerage depends on your chosen model (White Label, Turnkey, or in-house development), licensing fees, infrastructure costs, and marketing expenses.

Why is liquidity important when starting a Forex brokerage?

When you start your own Forex brokerage, partnering with reliable liquidity providers ensures smooth order execution, competitive spreads, and a better trading experience for your clients, increasing trust and profitability.

Recommended articles

By clicking “Subscribe”, you agree to the Privacy Policy. The information you provide will not be disclosed or shared with others.

Our team will present the solution, demonstrate demo-cases, and provide a commercial offer