EU Crypto Regulations – How is Bitcoin Adoption Improving in Europe

2025 is promised to be the best year for cryptocurrencies, as most coins started the year on a strong note. Bitcoin spot ETFs were approved by the SEC almost a year ago, more traditional investors are considering decentralised assets, and jurisdictions are lenient toward digital assets.

However, the EU crypto regulations are not following up at the same pace. The MiCA framework has three years of full implementation, while the European Central Bank is still discussing the Digital Euro, which could launch in 2028-2029.

Therefore, European countries are taking tentative steps to integrate crypto assets and attract as many investors as possible.

EU Crypto Regulations Overview

Starting this year, some European cryptocurrency regulations will become effective, such as the Markets in Crypto Assets (MiCA), establishing a framework for unified licensing, transparency, and investor protection.

Crypto exchanges, wallet providers, and brokers must comply with Anti-Money Laundering (AML) and Know-Your-Customer (KYC) rules, as well as properly disclose risks and segregate client funds.

While this marks progress, it comes years after the US introduced stricter oversight through entities like the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

Europe permits legal ownership and self-custody of digital assets. However, large transfers are subject to reporting, and capital gains taxation varies by country.

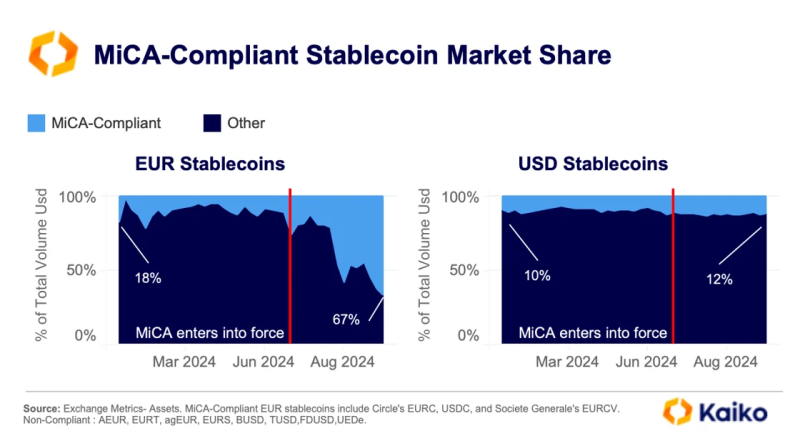

Stablecoins in Europe are under increased scrutiny, with requirements for reserve transparency and stricter compliance frameworks—areas that other markets, such as Singapore, addressed earlier.

The EU’s Directive on Administrative Cooperation (DAC8) introduces reporting obligations for crypto platforms. In contrast, decentralised finance (DeFi) and decentralised platforms remain largely unregulated, leaving gaps compared to the US and Asia’s proactive stances.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

Italy’s Intesa Sanpaolo Buying $1m Bitcoin

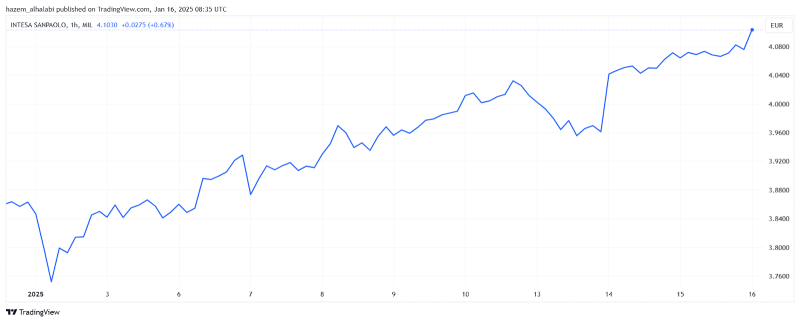

In an outstanding move, Italy’s largest financial institution, Intesa Sanpaolo Bank, has purchased $1 million worth of Bitcoin, the largest crypto asset.

The Intesa Sanpaolo Bitcoin purchase comes timely as the coin drops just under the $100,000 mark, with investors “buying the dip, positioning the country as a key player in Europe’s digital finance ecosystem.

On 13 January, Intesa Sanpaolo’s CEO announced the acquisition of 11 BTC, which he described as a “test”, stating that they will not transition into a “crypto bank”. However, this transaction caters to rising investors’ demands and helps them cope with the crypto market growth.

Intesa Sanpaolo’s stock price increased by 3.55% following the announcement, reflecting a higher investor interest.

This puts crypto Italy on par with the Swiss investment bank UBS, which offers crypto ETFs, providing exposure to main cryptocurrencies, such as Bitcoin and Ethereum.

French MP Urging Bitcoin Strategic Reserve in Europe

After Trump announced the US Bitcoin Reserve Plan, voices are increasing in Europe for a similar approach.

In late 2024, a French member of Parliament, Sarah Knafo, called for the EU to adopt a Strategic Bitcoin Reserve rather than the current outdated financial frameworks.

The MP discussed that a digital Euro could make the financial system even more centralised and strengthen the overreach of institutions.

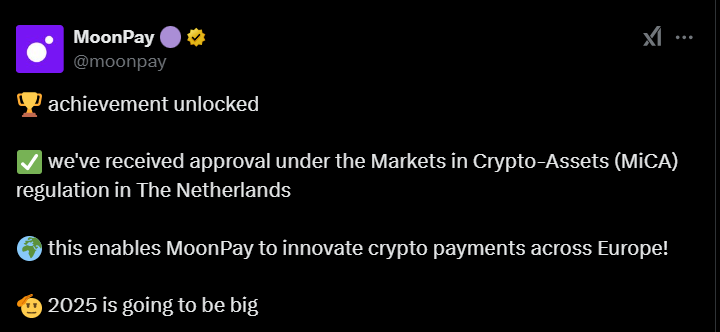

Netherlands Issues MiCA Licenses for The Time

The Netherlands became the first EU country to issue licenses under the MiCA regulation, granting MoonPay, BitStaete, ZBD, and Hidden Road the authority to operate in all 27 member states.

The Dutch Authority for the Financial Markets (AFM) issued the licenses, showcasing a proactive approach to providing legal clarity, enhancing investor protection, and preventing manipulation in the digital asset industry.

Spain’s CaixaBank to Sell BTC in 2025

CaixaBank has announced plans to offer Bitcoin services in 2025, joining other Spanish banks like Santander and BBVA. CaixaBank’s move reflects a growing institutional adoption of cryptocurrencies.

The bank intends to provide access to Bitcoin and other cryptocurrencies while adhering to investor protection and compliance standards. This step responds to the increasing demand for digital asset services among European customers and positions CaixaBank as a key player in the evolving crypto ecosystem.

Germany’s DWS to Launch its Stablecoin

DWS, a subsidiary of Deutsche Bank, plans to launch the first euro-pegged stablecoin in 2025. It will be regulated by Germany’s Federal Financial Supervisory Authority (BaFin).

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

The stablecoin will provide businesses and investors with a secure, decentralised alternative to fiat money, reflecting the country’s stance on integrating blockchain technology into its financial system.

The stablecoin will be under a new joint venture with Flow Traders and Galaxy, called AllUnity, which is powered by robust reserves and focuses on stability and transparency.

Conclusion

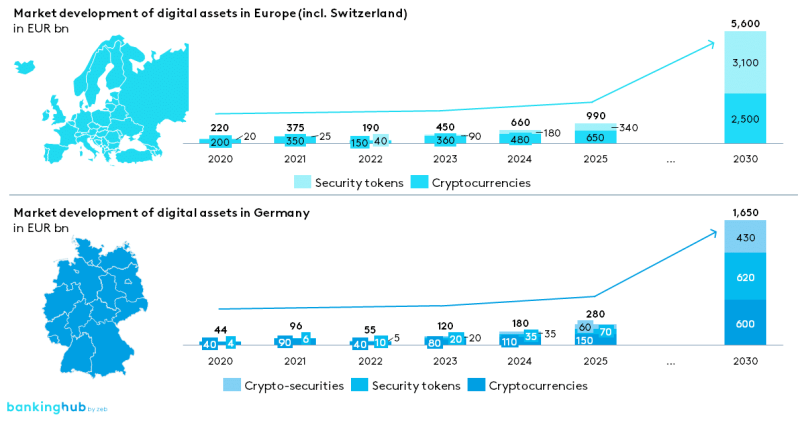

As the world heads towards more adaptive blockchain regulations, European countries are taking faster steps to integrate decentralised and digital assets into their offerings, attracting more investors and focusing on better regulations.

This year, more EU crypto regulations are coming into force. Italy, Spain, Germany, and the Netherlands are making crucial decisions to proactively define the national DeFi infrastructure and lead regional developments.

Disclaimer: This article is for informational purposes only. It is not finance advice and should not be relied upon for investment decisions. Always do your own research and consult a financial advisor before investing.