How to Launch Your Own ETF?

This article will explain what ETFs are and what value they represent from an investment perspective. You will also learn about the main types of ETFs and their advantages. Ultimately, you will find a short guide on the basic steps to create your own ETF.

The investment industry today is experiencing dramatic changes with the advent of cryptocurrencies, which have become the foundation for the transformation of the entire economic system. Despite this, classic trading instruments do not lose their grip and remain in the trend, providing a no less profitable way to multiply capital. One such instrument is exchange traded investment funds.

Key Takeaways

- An exchange-traded investment fund is an index fund, the units (shares) of which are traded on the stock exchange. The structure of an ETF usually repeats the structure of the chosen underlying index.

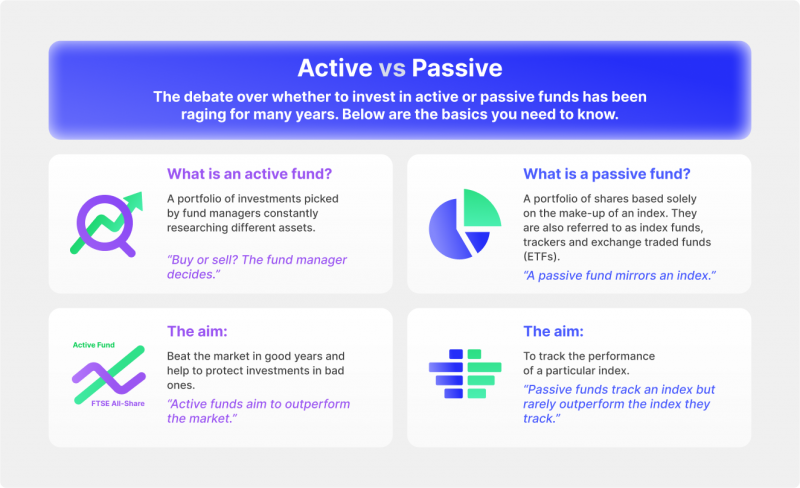

- ETFs can be active and passive, where in the first case there are managers to make up a basket of instruments for the fund, and in the second case, the fund is a copy of an index, whose price changes when the price of the index changes.

What is an ETF and Why is it Interesting from an Investment Perspective?

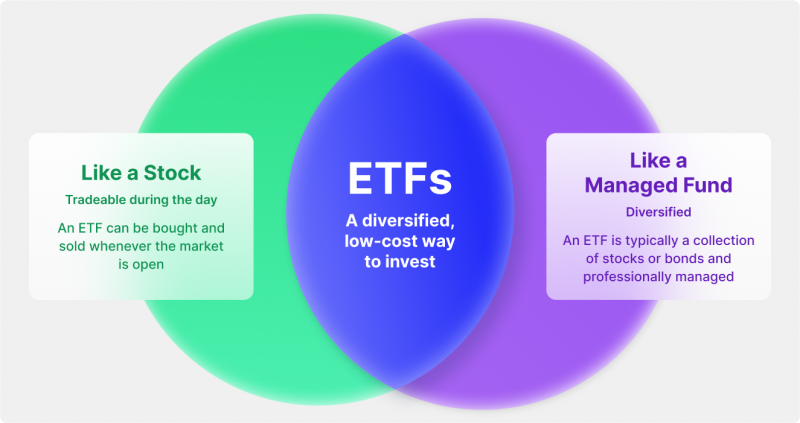

An ETF (Exchange Traded Fund) is an exchange-traded fund that invests in specific groups of assets. The mechanism of ETFs is quite simple. The company (the ETF issuer) has a certain asset (for example, shares of an index, gold, etc.) and issues securities on this asset, whose price dynamics depend on the price dynamics of the underlying asset.

ETFs first appeared in Canada. In the United States, they emerged in 1993 with the launch of the first ETF on the S&P500 index, which received the designation SPY. Since then, ETFs have grown in popularity worldwide, with trading volumes, shares in assets under management, and the total number of ETFs traded on the world’s stock exchanges steadily increasing.

An exchange traded fund is a portfolio of securities, sometimes called a “basket”, traded like ordinary stocks. That said, when an investor buys an ETF, he or she buys one part of an entire portfolio of securities, not the shares that make it up. An ETF fund may also consist of derivatives chosen to track a particular financial indicator or commodity asset.

Exchange traded funds are conventionally divided into actively and passively managed funds. The first group includes professionally managed ETFs, which aim to outperform other instruments in terms of returns. The second group is passively managed (index ETF), the performance of which is tied to the benchmark dynamics. In this case, the management company’s task comes down to following the index as closely as possible, so any potential profits from such funds are limited by the indicator’s profitability. For example, a change of 1.5% in the index value will cause the ETF price to change by approximately 1.5% before taxes and commissions are deducted.

Nevertheless, passive management funds have a significant advantage over actively managed ETFs: their overall expense level is significantly lower. Because of this factor, most passive management funds are traded on the exchange, while the share of actively managed funds does not exceed 1% of the total number of ETFs.

Some ETFs pay dividends and coupons. This information can be clarified when selecting an ETF.

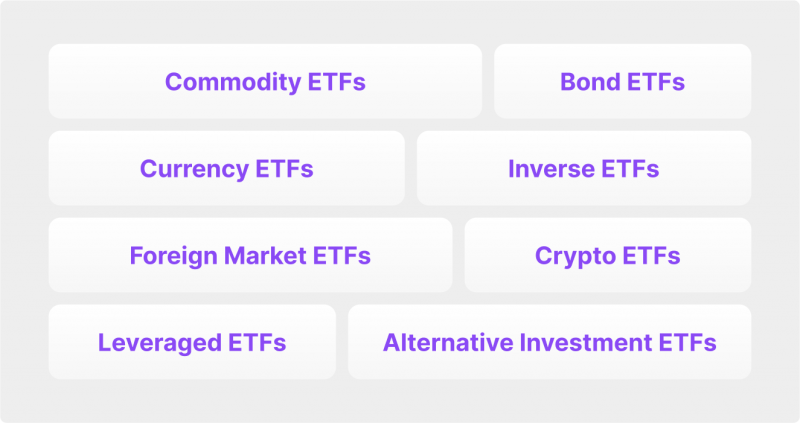

Basic Kinds of ETFs

Again, all exchange traded funds are divided into two main categories: active and passive. An actively managed exchange-traded fund (ETF) differs in that it invests in a variety of financial assets (such as stocks, bonds, currencies, or commodities) chosen by managers, rather than passively following an underlying index or rules-based ETF strategy. Passive (index) ETFs replicate the dynamics of the underlying asset, which is designed with a number of rules in mind. The fund managers, for the most part, duplicate the movements of the index.

Active ETFs

Let’s first look below at the main types of active ETFs.

Bond ETFs

Bond ETFs are comprehensive investment portfolios comprising government or corporate debt securities and are closely linked to a particular stock index. Transactions involving bond ETFs are virtually indistinguishable from other securities transactions on the exchange. All the same programs and algorithms are used, and one has to pay the same taxes on the income as in the case of stocks.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Commodity ETFs

ETF funds of this type invest money in physical commodities. Some of the most popular among them are agricultural commodities. Investments in natural resources like oil and ore, as well as precious metals like gold or silver, are also common. Commodity ETFs typically focus either on commodities held in physical stocks or investments in commodity futures contracts.

Currency ETFs

Currency ETFs are pooled investments that give investors access to foreign currencies. They allow investors to assess changes in exchange rates for one or more currency pairs. Like other exchange traded funds (ETFs), investors can buy currency ETFs on exchanges like corporate stocks. These investments are usually managed passively, with the underlying currencies held in one country or basket of currencies.

Inverse ETFs

Inverse ETFs are index-linked exchange-traded funds whose value changes against the underlying asset’s price or benchmark. For example, an inverse ETF on the S&P 500 shows a positive trend when the index falls and a negative trend when it rises.

Foreign Market ETFs

Investing in foreign ETFs allows investors to gain exposure to markets outside of the United States, such as Japan’s Nikkei Index or Hong Kong’s Hang Seng Index. In addition to gaining exposure to various countries and regions, these funds can also provide investors with international growth opportunities.

Crypto ETFs

Cryptocurrency ETFs theoretically work just like any other ETF. While most ETFs track an index or basket of assets, a cryptocurrency ETF tracks one or more digital tokens. Like any other ETF, cryptocurrency ETFs are traded on an exchange like regular stocks, and they are also subject to changes in price throughout the day as investors buy and sell them.

Alternative Investment ETFs

Investors can gain exposure to asset classes that are otherwise difficult or expensive to acquire, such as real estate and commodities, using alternative ETFs. As opposed to investing directly in the underlying asset, these funds offer a cost-effective and straightforward method for investing.

Leveraged ETFs

A leveraged ETF rises in value faster than the index it tracks, and a leveraged ETF can target returns two or even three times the daily return of its index. For example, a triple-leveraged ETF based on the S&P 500 should rise 3 percent the day the index rises 1 percent. A double-leveraged ETF would be targeting double returns. Because of the way leveraged ETFs are structured, they are best suited for traders looking for short-term returns on a target index within a few days, not for long-term investors.

Passive ETFs

Passive ETFs (also known as index funds) mimic indices and are only affected by changes in the indices. Classic examples are VOO (ETF by Vanguard on the S&P 500 index) or QQQ (ETF by Invesco on the Nasdaq 100 index).

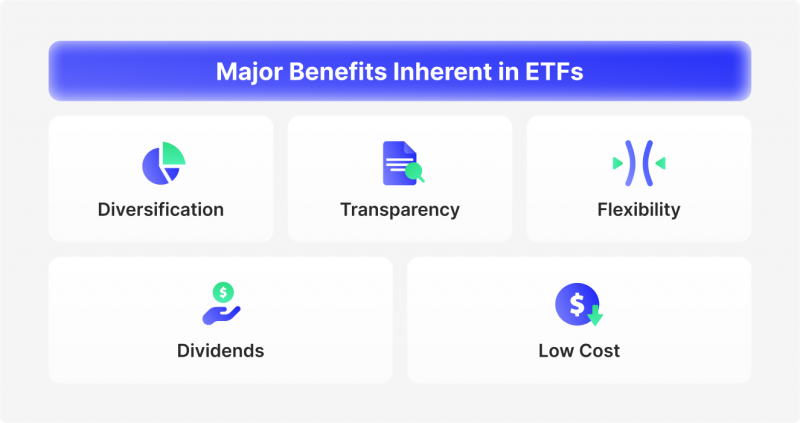

Major Benefits Inherent in ETFs

Funds, by their very nature, are ready-made sets of securities, so investors do not need to select assets for their portfolios and spend time on detailed study of the business of individual companies. As with mutual funds, investing in various ETFs carries certain advantages that create excellent opportunities for achieving investment goals. Let’s take a look at each of them.

Diversification

ETFs are one of the few trading instruments that give access to an incredibly broad list of assets available for the investment process. As described above, ETFs are a group of instruments where the underlying asset may be a cryptocurrency, precious metal, Forex or agricultural product. With such a wide selection of asset classes to trade, investors are able to implement the most daring strategies while diversifying their investment portfolio. Due to the presence of such opportunities, investment activity becomes more diverse and allows receiving income from different groups of financial instruments.

Transparency

The portfolio structure of ETF funds (especially index funds) is absolutely transparent. Being a close analogue of well-known market indices, ETFs allow investors to understand both their risks and expected returns, as well as change the characteristics of their portfolio. Because the price of an ETF is continually updated with changes in the prices of components of the underlying index, investors are always aware of the value of their ETF portfolio. TF net asset value (NAV) data is published daily.

Flexibility

ETFs have no expiration date and are actively traded throughout the entire trading session at the exchange. Investors invest in exchange-traded funds based on specific objectives: short-term, intraday trading or long-term investing. Due to the simplicity of ETF transactions, investors can achieve long-term investment planning effectiveness. Taking into account the fact that the minimum lot is equal to one unit (one ETF), an investor can open positions in several different indices even with a small amount of initial capital.

Dividends

When a fund receives dividends from its assets, it has two choices: pay dividends to investors or keep the money to buy new securities and increase the value of the ETF by the dividend. The choice depends on the fund’s policies and the laws of the country where it is registered.

Investing in such an ETF doesn’t entitle the investor to dividends, however the value of the stock of this ETF will increase as the fund earns money. And the ETF with dividend payments will transfer the received dividends to the investor’s account with a certain periodicity.

Low Cost

One of the most significant benefits of investing in ETFs is their low cost. ETFs typically have lower expense ratios than mutual funds, which means investors can save on fees. The low fees associated with ETFs can have a significant impact on long-term investment returns. It’s also worth knowing that regardless of the type of ETFs you prefer to trade, compared to investing in any mutual fund, their purchase price will be many times lower.

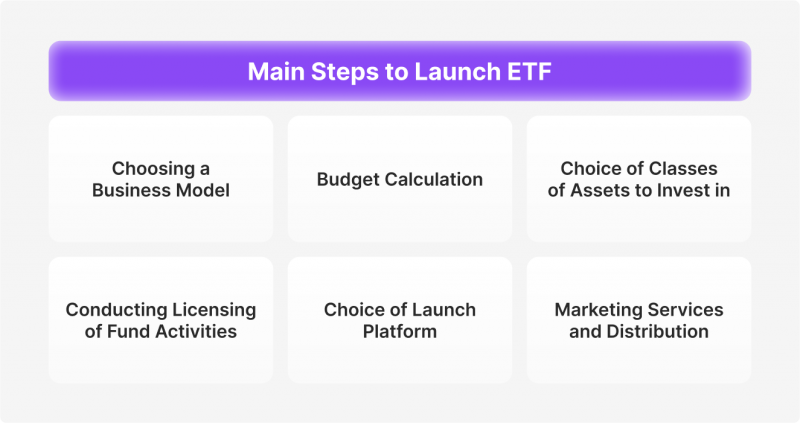

Main Steps to Launch ETF

Many beginning investors face two key questions when determining where to invest their money: how much disposable or investment assets are available and which investments to choose when building a portfolio. When it comes to deciding which investment destination to select, there are various options, from mutual funds to exchange-traded funds (ETFs), stock purchases, etc. etc. Many advanced investors, however, wonder: how do you create your own ETF? Here are a series of steps to help you do that.

Choosing a Business Model

Creating your own ETF requires consideration of several important points, the first of which is the choice of a business model for its launch. To date, there are two opposing alternatives for doing this. The first option involves creating the fund in-house from scratch, paying attention to all the details, including fund accounting, marketing, budgeting etc. The second method involves the use of white label solutions, which offer ready-made solutions for ETF projects. They are efficient and reliable, but can also be expensive.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Budget Calculation

Planning your budget is the foundation for everything else as launching an ETF can be costly. You can expect the cost to vary by fund type and include $100,000 to $500,000 in financial industry regulatory authority (f. e SEC) regulatory costs. The lower bound is for conventional funds that do not deviate from a basic strategy that mirrors a single large-cap index. About $2.5 million to set up an ETF with initial asset purchases. About $200,000 per year to manage and properly oversee the fund. A fraction of the cost of the fund is to list it on an exchange. These costs, of course, increase as the fund’s value grows.

Selecting Classes of Assets to Invest in

After calculating your budget, it’s worth thinking about which asset class your ETF will invest in. Today, there are numerous different asset classes that have their own advantages and disadvantages, as well as specific characteristics. Crypto assets, Forex currency pairs and derivative CFD instruments trading on various markets can yield good returns. Less profitable, but still lucrative, will be bonds, commodities and precious metals markets. In any case, diversification is a good thing, which helps hedge investment risks.

Conducting Licensing of Fund Activities

In order to be able to carry out investment activities on the capital markets, it is mandatory for all participants to hold a license — and ETFs are no exception. Licensing of ETFs is conducted by the US SEC. It is also important to note that the licensing procedure costs money, which is definitely something to consider at the budgeting stage.

Choosing a Launch Platform

Obviously, creating a successful ETF fund requires experience in fund management, marketing and compliance, as well as other specialties. If you choose to create an ETF with turnkey solutions, it is worth conducting a careful analysis of the many criteria that will help you make the right choice of a reliable WL ETF solutions provider. Among other things, it is worth paying attention to the experience, expertise, and availability of all the necessary permits for the company to conduct its activities.

Marketing Services and Distribution

Regardless of how strong your exchange traded concepts are, marketing is really key to the success of your fund, and you should plan and allocate appropriate funds and develop a full long-term business plan for launching and operating the fund. You need to have a clear picture of your potential target audience, taking into account various market conditions, investment trends and market challenges. Understanding your target client and their approach to investing is a critical step in developing your fund; this is an area that should not be overlooked.

Conclusion

Today every third investment company is interested in buying ETF instruments. So, creating your own ETF has the potential, just like launching a crypto exchange or Forex broker, to bring great returns, in particular due to the opportunity to invest in an incredibly wide range of different trading asset classes.

FAQ

What is an ETF, and why is it a good investment?

An ETF (Exchange Traded Fund) is a fund that invests in a basket of assets, such as stocks, bonds, or commodities, and trades on an exchange like a stock. ETFs are popular for their diversification, transparency, low cost, and flexibility, making them a strong option for both novice and experienced investors.

What are the main types of ETFs available?

ETFs can be broadly categorized into active and passive ETFs. Active ETFs are professionally managed and aim to outperform the market, while passive ETFs replicate an index, tracking its performance. Specific types include bond ETFs, commodity ETFs, currency ETFs, and crypto ETFs, each offering unique investment opportunities.

How to start an ETF fund?

To start an ETF fund, you need to choose a business model (in-house development or white-label solutions), plan your budget (considering regulatory costs, management, and initial asset purchases), select the asset classes for investment, secure the necessary licenses (e.g., from the SEC in the U.S.), and develop a strong marketing strategy to attract investors.

Recommended articles

Recent news