Choosing the Best Forex White-Label Online Trading Platform: Detailed Guide

Articles

The forex trading field has conquered the centre stage of global investment practices. Today, most professional and retail traders are committing full-time to forex trading methodologies and earning impressive returns with cutting-edge forex trading solutions. The barriers to entering this market have never been lower, as any individual with moderate personal capital can take up this practice within hours.

However, earning substantial profits will take longer than that, as the forex field is more complex, fast-moving, and chaotic than ever. So, if you are considering entering this niche from the business side, your forex brokerage will have to provide numerous intricate services. These can include up-to-date analytics tools, advanced trading mechanisms, competitive pricing quotes, etc. This piece will discuss how white-label solutions can help forex brokers achieve this hefty goal and how to select the best white-label online trading platform without the hassle.

Key Takeaways

- White-label online trading platforms have become popular due to lower costs, optimal features and efficiency.

- White-label solutions offer numerous advantages, including pre-made software, complementary services, maintenance and frequent upgrades.

- There are many WL options available on the market, but interactive brokers, cTrader, and B2TRADER stand out from the competition.

Reasons to Adopt a White-Label Online Trading Platform

For the uninitiated, a white-label solution refers to a pre-made software or platform that can be readily used by businesses as their own product. The only adjustments white-label software requires are branding efforts, personalisation and some specific technical modifications depending on your business needs.

Acquiring white-label online trading platforms has become a dominant strategy for small and mid-sized forex businesses, allowing them to level the playing field with industry leaders at a fraction of the cost. Let’s discuss why.

Lower Costs and Optimal Operations

A white-label online trading platform should be compared to two main alternatives: in-house software development and outsourcing practices. Both of these platform solutions take massive capital investment from brokers. In the case of in-house software, brokers have to hire a team of developers who are proficient in forex technologies, order-matching systems, price aggregation algorithms, API connections, and numerous other complex modules.

Moreover, you will need to adopt your own servers, cybersecurity measures and many other digital or hardware tools to develop a fully-fledged brokerage platform. Even after these arduous tasks, the maintenance of the white-label online trading platform is arguably even more challenging, as it will need constant updates and improvements. So, you can’t shrink your development team once you’re done with building the software.

Outsourcing is equally or even more expensive, as third-party companies charge excessive fees for lending expert employees to build your infrastructure. Plus, all software and hardware costs are still your responsibility.

In the case of white-label software, all of the above-outlined expenses are replaced with a single monthly subscription fee and/or affordable commission charges. White-label providers serve numerous clients and can afford to provide a cutting-edge platform template without excessive costs on your business side.

Automatic System Upgrades and Improvements

As mentioned above, the forex brokerage landscape is evolving rapidly, presenting new tools like copy trading, automated solutions like trading robots and advanced trading instruments like CFDs or other derivative contracts.

Moreover, brokerages must constantly expand their currency offerings, maintain an optimal price aggregation algorithm, and track their system performance. You will also need to keep track of the new and popular trading options, such as algorithmic trading capabilities, to accommodate the trading strategies of your customer base.

White-label online trading platform providers handle all of these upgrades, supplying your platform with advanced tools and key features as they emerge on the FX market. As a result, your platform will include every tool and feature that is relevant in the current market trends without causing your monthly budgets to increase beyond feasible limits.

Supplementing the Lack of Experience

Finally, white-label online trading platform software is an excellent tool for newcomers who wish to avoid rookie mistakes in the forex brokerage field. In-house platform development, aside from being overly expensive, can also lead to incorrect decisions, poor business model construction, or other mistakes that result from inexperience.

White-label providers, who also often serve as liquidity providers, can help you stay on the right course and minimise the extent of your mistakes. The best white-label trading platform will deliver a system that has optimal pricing, convenient customer relationship channels, easy-to-navigate menus, and other crucial features that you can only learn from experience. As a result, WL solutions help you speed up the process of becoming a capable forex brokerage despite your lack of trading experience.

White-label online trading platforms can be used to develop partnerships as well, allowing brokers to outsource their services and increase revenue streams.

What to Consider when Looking at a Turnkey Forex Trading Platform

There are several essential variables you must research before making a final decision. First and foremost, your white-label trading platform software should be provided by a trustworthy supplier. Track record means everything in the online climate. If the WL solution provider is transparent and popular enough, you will have no problem researching its reputation and success rate.

Secondly, the features and capabilities of the WL software should be up-to-date and ready to perform without additional development. Popular features are also a must. The WL supplier should be capable of delivering a solution that helps you acquire a specific niche. For example, you might wish to construct a white-label copy trading platform, and your WL provider should supply you with appropriate systems to support this primary trading method.

Additionally, it is crucial to select a provider that doesn’t charge excessive fees on a monthly basis or through commissions. Being the lowest-cost forex broker is a strong competitive advantage in the FX field, and the less you have to pay for white-label services, the cheaper your services can be on the customer side.

Best White-Label Online Trading Platform Software

The current FX market has witnessed the emergence of numerous white-label providers that deliver premier forex platform templates at affordable prices. The brokers aiming to establish their platform through white labelling have a multitude of accessible and effective options. Naturally, some WL providers stand taller than the rest, providing more advanced features, optimal price aggregation and other neat benefits. Let’s explore some of the most popular choices in the current market.

Interactive Brokers

Interactive Brokers (IBKR) is one of the market leaders in the white-label niche, thanks to its deep liquidity channels and unmatched level of flexibility. IBKR provides white-label clients with ready-made liquidity options from forex financial markets, offering over 100+ currency options straight from the get-go.

Additionally, IBKR allows customers to completely modify their WL platform, construct a unique user experience and interface, adjust risk management practices, and develop their own business management workflow. As a result, businesses can take the IBKR white-label solution and make it their own to become a distinct forex brand.

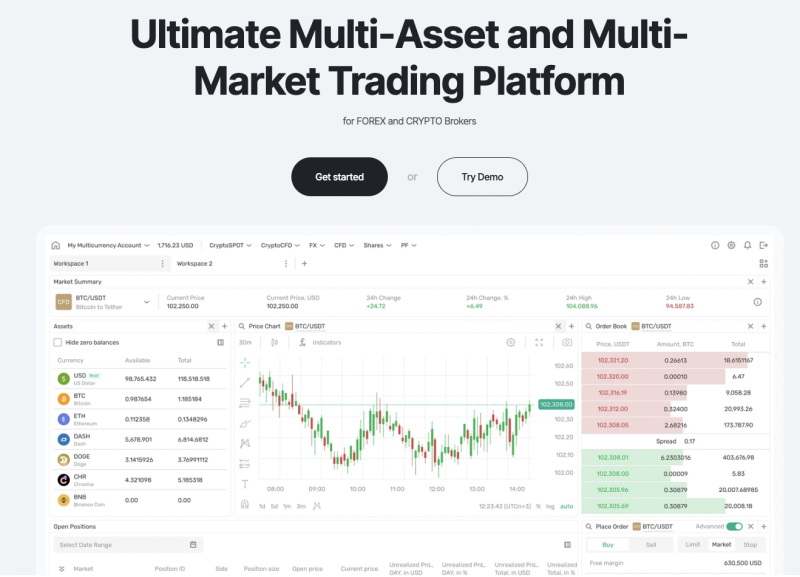

B2TRADER

B2TRADER is a brand-new platform produced by the B2BROKER group, the company delivering crypto and forex WL solutions. B2TRADER is not limited to forex markets, as it offers ultimate multi-asset and multi-market access for Forex, Crypto CPOT, and CFDs markets, offering brokers diverse income streams through one single platform.

B2TRADER was designed to provide lightning-fast execution speed and unmatched performance, providing 3000 trading instruments and processing over 3000 requests every second. The platform harnesses AWS to develop a global system of payments, using MongoDB and Amazon Redshift for data management purposes. Moreover, B2TRADER has integrated the renowned TradingView platform to elevate its data analytics capabilities.

B2TRADER includes numerous customisation options, letting business owners modify their platform and create a distinct workflow that accommodates their business model. Additionally, B2TRADER allows managers to seamlessly control commission rates across their different services to optimise their platform offerings.

The platform also has built-in monitoring and analytics features on the business side, providing automated reports on the most significant developments on the platform and letting businesses stay ahead of potential complications.

cTrader

cTrader is globally renowned for its ability to deliver a complete package, allowing broker businesses to enter the market in a matter of weeks. cTrader takes care of the licensing tasks, backup systems, server setups and other technical challenges on the way to constructing a fully-fledged brokerage platform.

cTrader also offers a variety of popular trading instruments, including margin trading capabilities. cTrader’s margin trading module is reinforced by b2broker’s liquidity solutions, allowing businesses to create an effective margin trading system that benefits all stakeholders.

Moreover, the cTrader white label solution is available in different operating systems, allowing businesses to create desktop and mobile applications to accommodate different customer niches. cTrader also offers legal assistance, optimised third-party integrations and numerous other complementary solutions for brokers to match trader needs. The cTrader white label cost is quite affordable compared to the rest of the market, which is great news for bootstrapped companies.

Final Remarks — Starting a Forex Brokerage with the White-Label Approach

White-label solutions have single-handedly lowered the barriers to entering the forex market. The cost of a white-label forex broker is exponentially lower compared to conventional development, which allows smaller companies to enter the industry confidently.

Thanks to the WL solutions, the question, “How much does it cost to open a forex broker?” has a completely different answer. However, adopting a white-label methodology is not just about saving money. A proper white label online trading platform will help you avoid rookie mistakes and guide your startup to a swift market entry in several weeks instead of months or years.