Starting an FX Brokerage Business – How to Get a Forex Broker License

In this article, we’ll explain the steps for Starting an FX Brokerage Business and obtaining a Forex broker license, a key requirement for legal operations and client trust.

Financial markets have tremendously evolved over the years, and today, there are several ways to make money and achieve financial freedom: trading, brokering, and providing liquidity or technical support to market participants.

Technology played a major role in the rise of many intermediaries and businesses in the financial world. Therefore, more control measures are being enforced to ensure market integrity and stability.

As an FX broker, you must adhere to a wide range of Forex regulations stated in your license. Therefore, obtaining a Forex broker license shall be your top priority.

However, regulations may differ between countries and jurisdictions. Some countries put too strict Forex brokers regulation, while others are more lenient. Let’s find out the difference between these regulations and determine which one suits you better.

Key Takeaways

- Forex license states the rights and obligations between the FX brokerage firm and customers.

- Obtaining a Forex license promotes reliability, transparency and market integrity.

- European jurisdictions, like CySEC and FCA, impose strict laws for financial transactions and businesses.

- Offshore jurisdictions in Mauritius, Vanuatu and Seychelles are more flexible to companies dealing with Forex and investments.

Forex Market Brokerage

Working as a Forex broker is an exciting journey if you are interested in trading currency pairs and have vast knowledge of the market and incredible chances of making money.

It is the largest financial market in the world, with more than $6 trillion in transactions taking place daily and more than 150 currency pairing options. Almost every investor trades or has tried currency pairs in the Forex market.

Forex brokers provide traders with technological and legal solutions to execute market orders in exchange for commission fees and other charges. Given the massive number of Forex market participants, the chances of making a decent profit by intermediating are high.

The competition is high in the industry, given the long history of Forex trading and the amount of existing FX brokers that have established their brands for years. Therefore, to succeed in the market, you must have the nuts and bolts of the market.

Several factors contribute to the success of a Forex brokerage company, including service fees, trading instruments, trading software and reliability. Being a regulated forex broker plays a major role in gaining user confidence and converting more potential customers.

Forex License

The emergence of so many brokerage firms and financial services was accompanied by lots of scam companies. Fraudulent schemes and illegal companies surfaced on the trading scene, who claim to be brokers while all they do is collect money from several users and vanish without actually investing the money anywhere.

Moreover, some companies were involved in money laundering and used trading to hide their illicit activities. Therefore, regulatory entities started putting stringent restrictions to regulate financial organisations.

Regulatory bodies in different countries require a Forex broker license before commencing any trading or financial transactions. Otherwise, they would enforce hefty fines and punishments.

Forex license entails the rights and obligations of the broker, ensuring that they perform in the user’s best interest and in good faith. Moreover, traders are more likely to trust a licensed Forex broker because their funds are relatively safer than with a random intermediary company.

Why Obtain a Forex Broker License?

Obtaining an FX brokerage license is not only about following legal requirements. Clients are more likely to sign up at your platform and deal with you when you are regulated. Also, a license protects your business from unforeseeable legal consequences.

- Promoting trust and confidence – partners and customers trust you more when your business is regulated and is subject to certain jurisdictional requirements.

- Transparency and fairness – obtaining a Forex license entails providing financial statements and disclosing information to the authorities, ensuring fair competition and conduct.

- Access to service providers – banks, liquidity providers, and other financial institutions are more likely to trust you and establish professional relations with your Forex company when you follow legal procedures.

- Risk management – regulated brokers are less likely to be involved in any suspicious activity, ensuring the integrity of the market and safeguarding investors’ money.

- Business growth – Forex licenses can have international recognition, allowing you to expand your business to other countries.

How to Start a Forex Brokerage Company?

Starting a brokerage business is challenging yet rewarding. There are several companies that have already been in the market for several years, garnering much awareness and popularity.

However, finding your place in the market is not impossible because there are plenty of opportunities and chances to find a niche and capitalise on it.

The first step is to understand the market needs, which helps you determine the type of brokerage service you will offer. You must also decide whether to work as a discount broker or provide a full-service package.

Find a reliable liquidity partner and financial service provider who helps you connect with clients and markets, and select the trading software you want to offer to your clients.

Familiarise yourself with the legal requirements of obtaining a Forex license and the rights and duties of each license in a given jurisdiction.

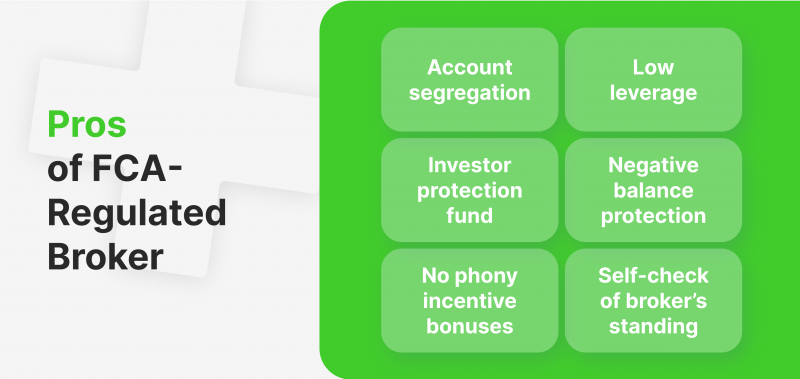

The UK’s financial service authority protects the trader’s funds up to £85,000 in case a regulated broker becomes insolvent.

General Forex Rules And Regulations

The legal requirements stated in the Forex license may differ between jurisdictions and the location of your business. European forex licenses are known for following a stricter framework than those offshore, but some companies prefer some flexibility to design better trading conditions and prices. These are general Forex license regulations:

- Before submitting for a business permit, you need to supply documentation, such as your identity, source of income, academic and professional qualifications and criminal record, to ensure the legality of your financial activities.

- Register your company as a legal entity according to the local laws and regulations.

- A statement about your capital, entailing how much money you have and how much is the working capital. The required amount differs between jurisdictions.

- Adhering and creating standard procedures for KYC (know your client) and AML (anti-money laundering). This may involve extensive documentation and reporting about the business owner’s income and registered traders and clients in your company.

- Obtain a Forex trading license according to the local laws and regulations and the working jurisdictions. For example, tier-1 and tier-2 are required for Forex trading in the US and Europe.

- Hire a legal compliance team to ensure you fully abide by the regulations and changes without indeliberately violating the law.

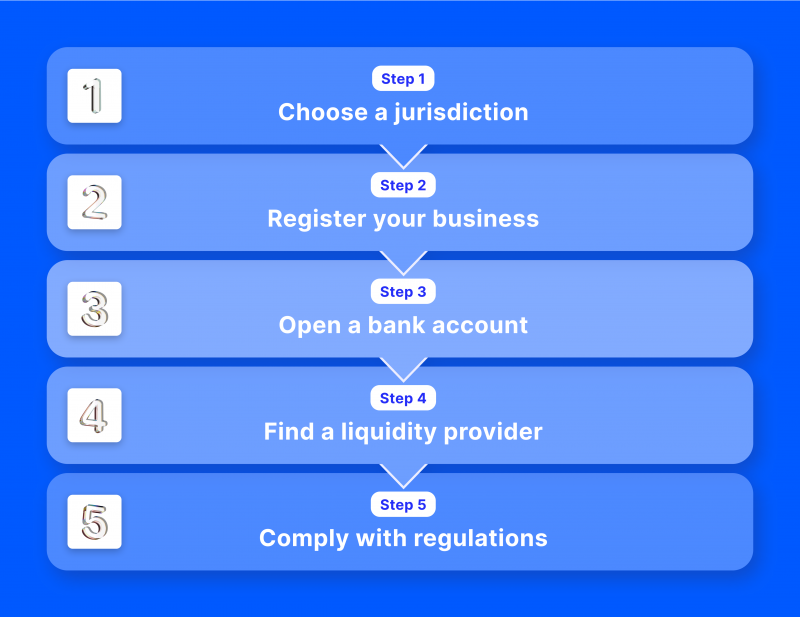

Launching a Forex Business: Step by Step

After creating your business plan and determining the target market you want to serve, it is time to start taking steps toward launching your Forex business.

Choose The license Jurisdiction

Selecting the source of licencing and the jurisdiction framework is critical because it will determine how you will conduct your business, the required documentation, financial disclosure and transparency measures.

Legislations differ according to your business’s location, and each has distinct conditions to launch your financial activities.

Register Your Business

Understanding the legal environment of the industry and the location where your company operates is crucial to registering your business. This step involves the preparation of documents, creating KYC and AML procedures, financial audit processes and obtaining Forex and other market-related trading licenses.

Once your company has a business status, you can conduct trading activities and offer brokerage services. Otherwise, working without a legal permit can expose your company to extensive fines.

Open a Bank Account

Having a corporate bank account is important because this is where you will be receiving money from your clients. Corporate bank account opening entails the regular submission of financial statements, like profit and loss or balance sheets, based on the monetary transactions in your bank account.

It is essential to carefully analyse the available options before selecting a bank based on capital requirements, interest rates, credit lines and loans.

Find a Reliable Liquidity Provider

A liquidity provider is a financial corporation that connects you with financial markets and order books, where a massive number of transactions take place and many Forex traders are available. Therefore, you can offer trading at highly liquid securities and lower commissions.

Comply With Laws and Regulations

Following the regulations is not only a prerequisite for opening a business but an ongoing process where the legal dynamics may change over time. Therefore, you must design and disclose your legal adherence plan and set standards of KYC and AML.

European Jurisdictions for Forex License

There are numerous legislations that regulate the financial trading environment worldwide, with each regulator working on a national or regional level.

FCA

The financial services authority in the UK is one of the highest-profile regulators that oversee brokerage companies and the overall trading environment in the UK.

The FCA was established in 2013 to ensure the trading market integrity and fairness towards individuals and companies, which contributes to the overall economic stability. The FCA puts strict regulations to protect consumers’ rights and promote healthy competition.

The UK’s FCA is an independent body that works under the national treasury, regulates the foreign exchange market, sets commission fees, introduces law changes, and enforces regulations. Therefore, any Forex brokerage firm must obtain an FCA license before offering trading services to UK citizens.

CySEC

The Cyprus Securities and Exchange Commission is a high-profile regulator overseeing Europe’s trading and financial services scene. CySEC is responsible for investment firms’ activities, trading markets, financial transactions and security transfers in Cyprus and Europe.

The commission follows a strict framework in evaluating Forex brokerage license applications and protecting investor rights to promote overall economic well-being.

CySEC can introduce or change financial regulations and carry out enforcement or disciplinary actions against violators.

Offshore Jurisdictions for Forex License

The Offshore Forex license provides a legal background for operating a Forex business with a lenient framework. Many companies used to offshore their service to avoid legal repercussions in the EU and the US and carried out illegal activities from the Carrebian islands or Oceania.

Therefore, the following authorities were established to regulate the financial business activities in those countries.

Seychelles Forex License

The Seychelles emerged as a famous offshore FCA that organises and regulates investing and financial activities. Obtaining a Forex trader license in the Seychelles is relatively inexpensive, ranging between $35,000 and $45,000, with a minimum capital of $50,000.

Brokerage companies in the Seychelles enjoy a flexible legal environment that allows them to offer legitimate services at affordable prices.

Vanuatu Forex License

Vanuatu is a collection of islands in Oceania that emerged as a Forex offshore jurisdiction with quick starting procedures and favourable tax requirements. This regulatory authority requires $50,000 starting capital, while the Vanuatu Forex license cost starts from $2,000.

This jurisdiction regulates the business conduct of investment firms, security exchanges and trading activities.

Mauritius Forex License

Mauritius is a popular jurisdiction and source for obtaining an FX license at low costs. Offshore brokers can start with a minimum investment of $18,000 and license fees starting from $20,000.

Mauritius has been a favourable destination for brokerage firms in the Forex industry due to local stability, simple licensing process, and transparency measures associated with its license.

St. Vincent and The Grenadines (SVG) Forex License

SVG provides the easiest and loose environment to set up a Forex company because there are no requirements for obtaining a license, and operating firms are not subject to any FCA frameworks.

However, SVG provides a model for identifying risky businesses and cooperating with regulatory authorities to prevent illegal business conduct.

Many brokers offshore their Forex activities to St. Vincent and The Grenadines because there are no income or corporate taxes, and company registration is the fastest.

Which Jurisdiction is The Right For You?

Selecting the right Forex license jurisdiction depends on many factors, including business model, capital, expected returns, target market, and your current geolocation and capability to offshore.

If you are aiming to serve European markets, the legal frameworks are relatively strict, and other trading tools may be limited. For example, CySEC allows a maximum of 1:30 leverage on major currencies, which can be as low as 1:2 in some securities.

On the other hand, offshore jurisdictions tend to be more flexible, leaving room for FX brokers to enjoy some freedom and offer a wider range of services, including higher leverage, lower minimum deposits and faster payment methods.

Conclusion

Working as a Forex broker entails several steps to set up the business and following legal requirements, starting from getting a Forex license.

Forex broker license states the terms and conditions of your business and the rights and obligations of you and your clients. Customers are more likely to trust a licensed broker than a Forex broker offshore because many remotely-based companies emerged, undertaking illegal activities and scamming client funds over the years.

Different licensing jurisdictions have distinct terms and conditions that you must comply with to obtain a Forex license. These regulatory bodies oversee the trading and investing scene and promote transparency and fairness for individuals, companies, and the economy.

FAQ

Do Forex traders need a license?

Yes, FX traders and brokers must get a license to follow the local laws and regulations. The trader’s license differs according to the trader’s location. For example, tier-1 and tier-2 license types are required in Europe and the US.

What license do you need to trade FX?

The license type depends on the jurisdiction and location of the business. For example, CySEC and FCA are European regulators that enforce strict rules for financial operations, while famous offshore FX broker licenses include the Seychelles FCA, Mauritius, and Vanuatu.

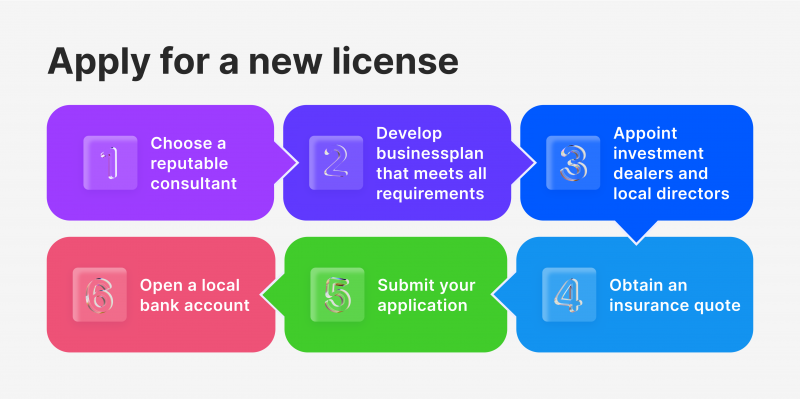

How do you get a broker's license?

Jurisdictions have different frameworks and procedures. Generally, a brokerage firm must register their company as a business, submit financial and identity documents and offer security trading according to the permits stated in each financial regulator.

Do you need a license to trade Forex in the UK?

Yes. The UK is one of the most prestigious markets to trade Forex and other securities that are subject to the FCA’s supervision. FX companies must get a license and adhere to regulations, like KYC & AML procedures, limits on leverage, acceptable payment methods and fee structures.

Recommended articles

By clicking “Subscribe”, you agree to the Privacy Policy. The information you provide will not be disclosed or shared with others.

Our team will present the solution, demonstrate demo-cases, and provide a commercial offer