What is PAMM/MAM/Copy Trading and How Does It Work?

Today, we will talk about three different solutions that the modern trading industry offers for long-time professional traders and those looking to trade for the first time. Are you curious and fascinated by trading in financial markets and looking for additional passive income? Is your schedule too busy to allow you to devote your full attention to full-time Forex trading? Then you came to the right. In this article you’ll learn about the benefits and advantages of copy trading, PAMM and MAM accounts, which may be the best choice for you.

Since the number of interested people in the financial market is growing every day, Forex and stock market have become places where both novices and professional traders have the opportunity to earn additional passive income or even find a new full-time job. This is possible because of the new trading approaches that have emerged in recent years.

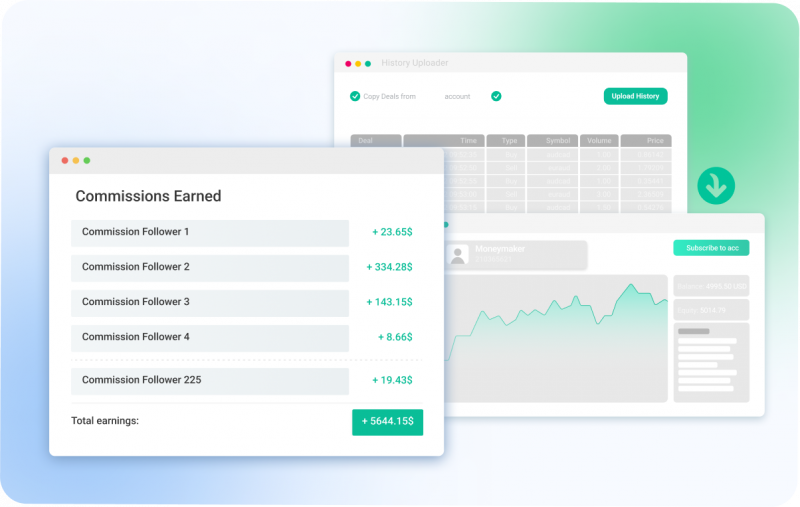

One of the most popular and progressive approaches is the PAMM account. PAMM stands for Percent Allocation Management Module, which will be explained in the first part of the article. What follows is MAM, or Multi-Account Manager. This solution is designed mainly for fund and money managers. It allows them to manage trades of multiple clients for a certain percentage of their successfully executed trades. This particular solution makes it easy for traders or money managers to execute several transactions for a group of several clients simultaneously. Therefore, it is way easier to manage risk from one account.

Generally, copy trading allows individual traders and investors involved in the financial markets to automatically and repeatedly copy trading positions opened and managed by other licensed professionals.

Copy trading connects a piece of the copying trader’s capital to the account of the copied trader. That being said, any trading decision made by the copied trading manager will show up in the member’s account. These actions include opening a position, designating Stop Loss and Take Profit orders, and closing a position. These activities are executed within the replicating trader’s account, concurring between the replicated investor’s account and the replicating trader’s distributed trading funds.

Before we dive into details, let’s find out what Percent Allocation Management Module is about and its benefits and advantages.

PAMM trading solution

So how does the PAMM account operate? PAMM is the name of the specific option that allows trading managers to trade money pooled from various sources, labeled as sub-accounts. A particular money manager with loads of trading experience and appropriate background promotes their services on certain websites. His resume always includes his performance history, background, possibly a qualification, conditions of a particular account, and more. It also specifies the commission that will be charged in winning trade. The money manager is responsible for the funds of investors, who trust him and risk their money, which means there is an additional stimulus for the manager to trade responsibly and bring the best possible result.

Please note that every investor who decides to invest in a specific account is signing up for the so-called ‘Limited Power of Attorney.’ This is an agreement where the client must consider and accept that he takes specific trading risks until the end of a certain period. After this period, investors can either withdraw their capital, continue to invest with the same money manager, or move their funds to a different provider.

Keep in mind that it is important to choose a reliable and well-regulated PAMM solution provider who is able to provide transparent operations and security for investors’ funds.

However, one of the inherent aspects of the trading industry is that none of these measures provided by any firm will guarantee protection against any losses that might occur from the account manager’s trading choice. Before proceeding, carefully read all the advice given by a particular broker.

Benefits Of PAMM Accounts

In this part, we will discuss what advantages of selecting a broker with a PAMM account:

First of all, as you already know, the best PAMM accounts enable its investors, regardless of their trading experience, to gain profits from trading without monitoring markets, carrying out analysis, and spending their time and energy.

The trade can be executed efficiently on one system without complicated accounting when using funds from different sources.

The money manager is often experienced in trading, which increases the likelihood of generating a profitable return.

The account manager has to invest their own funds into the account and only receives a commission when the trade is profitable, providing an incentive to trade to the best of their ability.

Investors can select from a wide range of money managers and spread funds across multiple money managers to diversify their portfolios.

A broker acts as a guarantor, preventing the money manager from withdrawing the funds and providing statistics and performance history of different PAMM accounts.

With the PAMM strategy, profits are mainly reinvested, resulting in interest generated on the initial deposit. This kind of profit is difficult to get using standard approaches.

The investor can start investing in a PAMM account with a particular amount of capital. Whereas the trading leader takes care of the investor’s account, clients are welcome to study and analyze various aspects of trading in financial markets to develop in trading and on a personal level.

The greater the assistance, the more the chance of losing one’s capital decreases. Professionals will do everything they can to reduce losses to a minimum and will do everything to realize winning trades.

The last but crucial factor is the platform’s safety. Every single person is doing everything to protect their capital. With a top-level and reliable provider, the trading manager is not allowed to manipulate the client’s funds.

On top of that, all PAMM platform providers are obliged to cooperate with authorized regulators, who screen every action to ensure everyone is protected from potential issues.

Potential risks of PAMM Accounts

There are two sides to everything, and that means that investing and enjoying the benefits of the PAMM platform, even with the most skilled traders, comes with a certain risk. It is simply impossible to avoid losses in trading, no matter what the financial market managers trade on. Therefore, please be aware that opening a PAMM account also has some disadvantages as it is quite a risky business.

The second possible disadvantage is that there is often not enough information available to check a money manager’s trading strategy in detail. Some find this inconvenient as they want to see what is going on with their capital; others just let the masters in the industry do their job.

To sum it up, in the PAMM accounts system, clients give permission to money managers to carry out trading on financial markets on their behalf. This solution has several advantages, such as the ability for investors to enjoy passive income without observing markets on a daily basis. However, consider that PAMM accounts are continuously exposed to the same risks as when trading individually. Thus, risk management is still essential and always remains relevant.

Now, when it is clear what PAMM means and what it offers, let’s proceed to another type of solution.

What is a MAM Trading System?

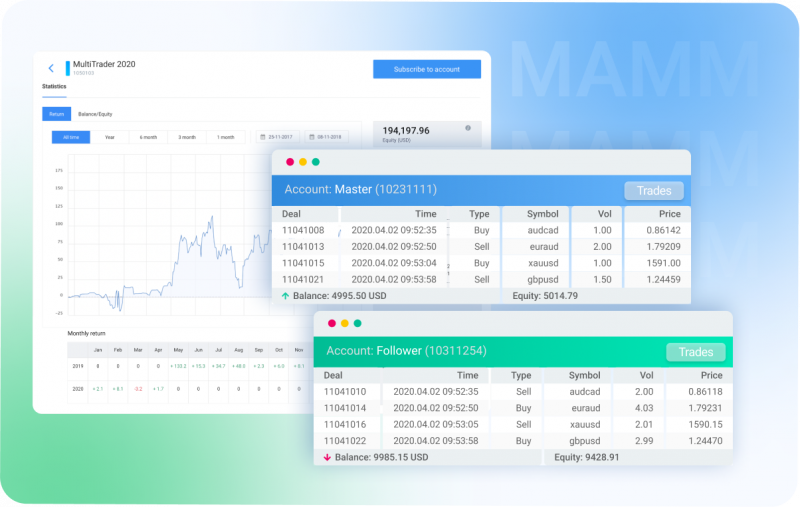

A Multi-Account Manager (henceforth MAM) trading system allows experienced investors to handle and manage a particular number of trading accounts held by various individuals. Every trade executed by the leading manager is replicated across the so-called “pool of funds,” with specifics such as trade size altered depending on the preferences or risk level set by a trading manager.

Part of this system is a MAM account, which is another unique way to invest in the financial markets, such as Forex, stocks, cryptocurrency, commodities, and more. These accounts essentially let customers place their capital with professional investors who will trade on their behalf. Since this is a part of a manager’s job, investors automatically pay a special commission for a return. Multiple online leading brokers offer MAM systems, and each of them provides unique rules and specifics.

Let’s examine how trading with a MAM solution actually works, its pros and cons, and what key factors to consider when choosing a MAM platform.

Pros of MAM Trading

The first aspect that makes this trading attractive is the transparency of this kind of investment. Every customer sees everything in detail on their trading platform, where a client can customize their profile based on their needs and desires.

Several platforms offer multiple ranges of account types. Typically, providers offer different options, depending on the client’s trading experience, expectations, and level of capital they want to invest.

Moreover, there are no restrictions on the number of trading accounts and deposit quantities.

These solutions are perfect for those who prefer not to spend too much of their free time at the computer, tracking events that affect the financial markets. There are assigned professional traders for these activities. Clients can rest assured that their capital is in good hands.

Client portions have a choice to start at a minimum of 0.01 lots per trade. It means that this solution is accessible for novice investors with less capital to begin investing.

Cons Of MAM Trading

Even though it all might sound excellent and ideal, we shall inform you that there are some downsides too, like in every business.

Be wise and do your research when choosing a MAM system provider. First of all, sometimes, it can be challenging to interpret the records of a MAM master, where there are no modern high-level tools. However, this can be avoided by choosing top-level platforms, of which there are more than enough.

Sometimes it can be challenging for a MAM framework to calculate the correct number of lots to be apportioned, mainly when there’s a massive distinction within the balance or value estimate of client contributions, occasionally leading to unbalanced trade shares for more significant accounts.

The last significant downside is when dishonorable customers misuse or plagiarize the strategy of MAM traders, mainly by copying these trades in for their separate account or even sharing it with a different person.

In conclusion, the MAM trading solution offers both beginners and professional traders attractive benefits. Because experts manage customers’ trades, it is highly possible to earn solid and passive profits without having to actively participate in trading. Therefore, the MAM trading solution attracts people due to its low level of active management.

MAM trading is an overall great solution with a real chance to earn extra cash almost effortlessly. Yet, there are still risks involved, and every new customer must consider them before investing in such solutions.

Copy trading

To finish this article, we will sum up the overall benefits of copy trading.

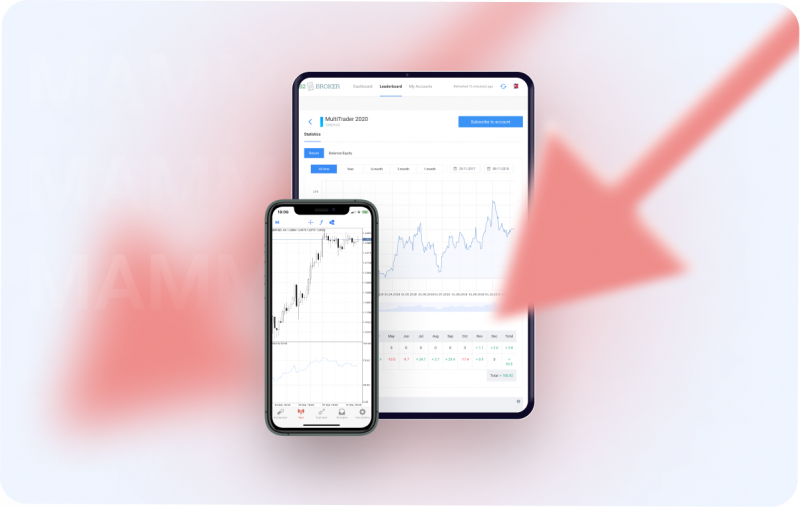

With copy trading, traders and investors increase their chances of making a profit. These solutions give new opportunities and a modern, easy-to-use way to invest in the financial market of any kind.

This type of trading solution is meant for people who have zero experience in trading or want to have passive income from investing.

Copy trading might also fit those who are busy enough to focus on trading independently. Copy trading is the best choice for customers who wish to follow up and analyze other successful traders who execute trades based on their skills, knowledge, and experience. It can be a great way to improve one’s trading strategy.

Each copy trading platform has its own specifics. Traders can choose which signals they want to duplicate, how much capital to invest, what type of trading pairs they want to trade, what kind of market to choose, and more.

Before you get into investing, it is also essential to have realistic expectations. Nobody will become a millionaire overnight. This is a long-term activity with ups and downs, where a certain risk of losing capital remains.

Thus, always remember to do your own research on financial literacy and trading psychology, and don’t forget about money management and setting your own financial goals.

By clicking “Subscribe”, you agree to the Privacy Policy. The information you provide will not be disclosed or shared with others.

Our team will present the solution, demonstrate demo-cases, and provide a commercial offer