Why is Bitcoin Exchange Balance Important?

When looking for a reliable exchange platform, seasoned traders understand the power of technical analysis and researching the ins and outs of the exchange software before investing in the offered assets.

Checking the supported blockchains, execution protocols, and supported integrations is essential for evaluating the platform’s performance. However, inspecting the liquidity levels is important to ensure stable performance. How do you check that? Using the crypto balance.

The Bitcoin exchange balance is a key metric that helps investors understand the platform’s reliability. Let’s examine this concept in more detail and explain how you can use it to your advantage.

Key Takeaways

- The Bitcoin exchange balance refers to the volume of available BTCs in a given crypto exchange platform.

- The crypto balance is associated with liquidity. High BTC exchange balances refer to highly liquid markets.

- The Bitcoin balance of an exchange changes according to crypto whales’ activities, market speculations and buying and selling pressures.

Understanding Bitcoin Exchange Balance

The BTC exchange balance is the liquidity level at a specific trading platform or across multiple exchanges. It represents the number of Bitcoins available, which contributes to the ease with which you can buy and sell BTC and the impact of executing large-volume orders.

Usually, crypto exchanges store Bitcoin holdings in cold and hot wallets for security reasons. Cold wallets are kept off the internet, while hot wallets are online storage connected to the exchange platform.

The Bitcoin balance on exchange measures the amount of underlying coins held in the hot storage. This liquidity plays an important role in executing market orders.

If the Bitcoin amount on the exchange is high, it means there is high liquidity and trade positions are processed much faster because there is a sufficient amount of matching orders.

Conversely, if the Bitcoin exchange balance is low, trading involves some risks because there is an insufficient number of counterpart traders and assets to find a matching order that suits the asking price. In this case, order processing involves significant bid-ask spread divergence and price slippage.

Bitcoin Exchange Balance Chart Explained

Let’s take a look at different Bitcoin balance charts. Below is the Binance Bitcoin balance for 2021-2022. Here, we see that starting in May 2020, when the previous halving event happened, the Bitcoin balance increased significantly in the following months.

This increased Bitcoin liquidity, accompanied by increased buying activities and rising BTC prices. However, a year later, the dynamic was restored, and we can see that when the balance decreases, the coin price increases, which is justified by the supply and demand forces.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Nevertheless, Binance kept a high Bitcoin balance without sharp declines, encouraging traders to continue trading on this exchange.

Having this insight is crucial to understanding the exchange liquidity flows and tendencies before investing. However, most exchanges include the balance chart in the premium subscription plan.

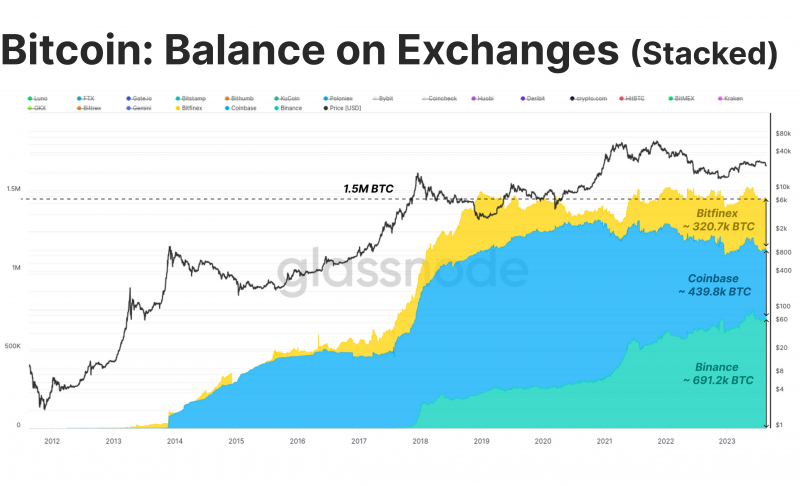

Now, if we take another example and look at the overall Bitcoin market balance chart below, there is a negative correlation between the BTC balance and price.

More significantly, in May 2022, liquidity levels were extremely low, suggesting a bullish movement and that most crypto traders are holding on to their coins amidst an upward price rally.

Despite having relatively lower liquidity in 2022 than in 2020, other market indicators show that it is caused by increasing prices and buying activities and not due to market stagnation.

Crypto Exchange Balance Flows

Liquidity flow is a crucial indicator that drives market prices and investment decisions. Exchanges connect their platforms with crypto liquidity sources to supply coins and digital assets. Professionals use this insight by tracking BTC exchange balances inflows and outflows.

Exchange Inflows

Bitcoin balance inflow refers to the volume of cryptocurrencies moving in the market. When there is an increase in Bitcoin inflow to exchange addresses, the exchange liquidity rises.

This happens for different reasons. However, it is crucial to understand that inflows mean that crypto holders are releasing digital assets from their storages and cold wallets to the exchange for a reason.

For example, they could be preparing for a large-volume order execution or want to sell their holdings and prefer to keep funds “liquid” to speed up the transaction process.

Increasing the supply indicates that traders are selling the underlying assets, and prices are more likely to decrease, triggering a bearish sentiment.

Exchange Outflows

On the other hand, exchange outflows refer to the liquidity leaving the exchange, which means that crypto owners are storing their holdings away from the market.

This move indicates that holders are not looking to sell or trade their assets any time soon, triggering a bullish sentiment as speculations rise for price increases.

Crypto derivatives trading is another factor affecting the exchange balance inflows and outflows. Investors could be selling their coin holdings to invest in BTC ETFs, increasing the liquidity inflow and creating a bearish movement while increasing the interest in Bitcoin.

How to Check Bitcoin Balance on Exchange?

Some crypto exchanges offer a Bitcoin balance chart in the standard or premium analysis toolkit. You can also find blockchain scanners that analyse the crypto balance on a given exchange or wallet address.

Additionally, you can add a third-party integration or a plugin to receive real-time Bitcoin exchange balance and make timely investing decisions.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Using market intelligence is crucial to watch large crypto holders, such as investment banks and wealthy crypto investors, who move millions of dollars worth of BTC and other virtual coins. Tracking the activity of these market players gives a crucial insight similar to the crypto liquidity balance.

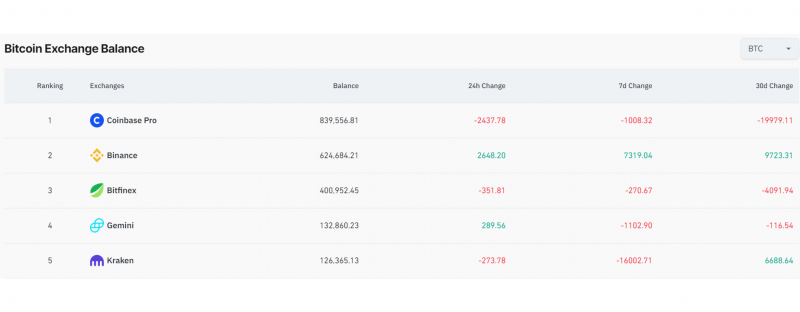

Coinbase is the largest Bitcoin exchange platform, with almost 840,000 BTC in its balance and over 200,000 Bitcoins ahead of Binance.

Whale Tracking: Why is it Important?

Whales are significant market players who hold the largest share. Their trading activities largely affect the market. Several scanners and whale trackers monitor the movement of wealthy crypto wallets and speculate on their buying and selling behaviour.

For example, if a crypto whale reduces its Bitcoin holdings, creating market liquidity inflows, it signals that the investor will make a large-volume trade, mostly selling off its coins. It is also important to track if other whales followed the same approach, which could trigger a rippling effect and initiate a new trend.

On the flip side, liquidity is leaving the market, and investors are holding on to their coins. This activity means they are unwilling to sell Bitcoin because the price is estimated to increase soon, triggering a bullish market run.

Conclusion

The Bitcoin exchange balance measures the BTC liquidity on a particular crypto platform or the overall market. It measures the crypto liquidity levels, contributing to coin prices and execution speed. Moreover, it affects market speculations, driving buying and selling pressure.

A high crypto exchange balance refers to high liquidity due to increasing selling activities, leading to bearish markets and vice versa. Understanding these forces is essential to make informed trading decisions.