What Does Slippage Stand For in Crypto?

Articles

Are you a crypto trader or investor looking to maximize your returns? Then you’ve likely already heard of the term “slippage.” But what exactly does it mean? In simplest terms, slippage describes the difference between the expected price of an asset and its actual execution price. Though small differences in pricing can frequently occur while investing in cryptocurrencies, they can also have significant impacts if not appropriately monitored. This blog post will discuss why slippage happens and how traders should approach these discrepancies when dealing with crypto assets.

What is slippage?

Slippage is a crypto trading term that describes the difference between what was expected and what actually occurred. Slippage is the amount of money lost or gained as a result of market fluctuations while executing an order. It happens when an order is filled at an unexpected price, which usually results in a negative outcome for the trader. Traders should take slippage into account when placing orders, and it is critical to understand the potential risks associated with slippage before engaging in any trade.

Key Takeaways

- Slippage is the gap between what you expect to pay for a trade and its actual cost. It can significantly lower your returns if not managed properly, so it’s important to be aware of it when planning trades.

- Automated trading systems, limit orders, and deep liquidity levels can be effective tools in minimizing slippage.

- Different exchanges have different levels of slippage for given cryptocurrencies due to order book depth and trading activity.

Causes of Slippage

When the market experiences sudden volatility, or when liquidity is low, slippage can occur. As prices fluctuate rapidly in a volatile climate, it becomes increasingly difficult to execute orders at the desired pace. Similarly, during periods of reduced liquidity there may not be enough buyers or sellers available which will result in orders being filled with an alternate price point than expected.

Slippage can be caused by a multitude of factors including technical malfunctions, the size of your order and even human error. If you are suffering from an unreliable internet connection or place an order that is too large for current market conditions then expect slippage to occur as this will likely result in orders not being executed at desired rate. Lastly, if any mistakes are made when submitting orders or monitoring markets -inadvertently- it could lead to further issues with slippage also arising.

Types of slippage

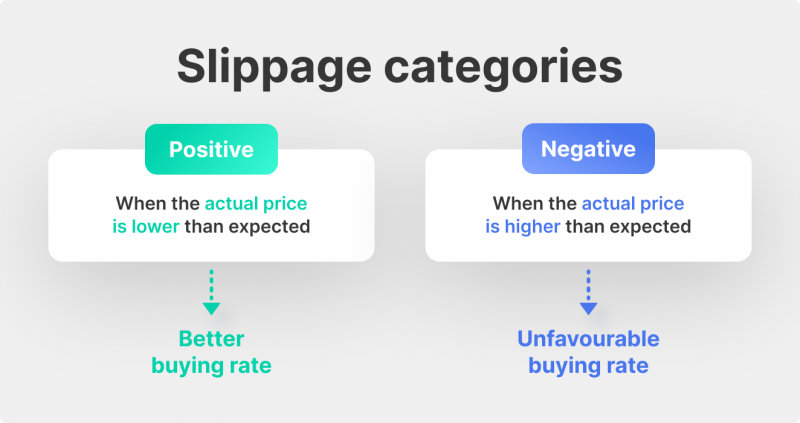

The most desirable type of slippage is positive slippage, which occurs when an order is filled at a lower-than-expected price. This can occur when high demand drives up prices, causing orders to be filled faster than expected. Positive slippage can benefit traders by increasing the potential profits on a position.

Negative slippage is the opposite of positive slippage and occurs when an order is filled at a worse price than expected. Negative slippage can lead to significant losses, which should be considered before entering any positions. This could occur due to fast-moving markets or low liquidity, causing orders to be executed at unexpected rates.

Why Slippage Matters?

Slippage is an important concept to grasp because it may make or break your success. Assume a trader placed a huge market order for a particular coin. In that instance, the cryptocurrency’s price may begin to move against the trader before the trade is completed. As a result, the trader may receive a lesser price than anticipated, resulting in large losses.

Slippage can also have an impact on trading costs, as more slippage means more expenses. More crucially, order execution delays caused by slippage might cause a trader to miss out on potential possibilities.

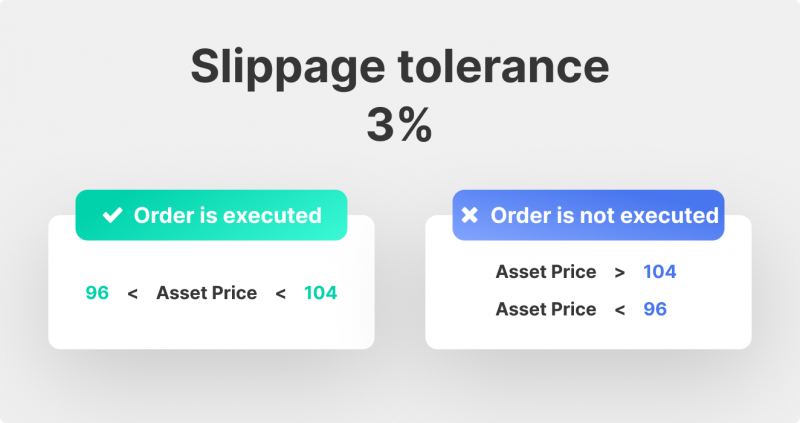

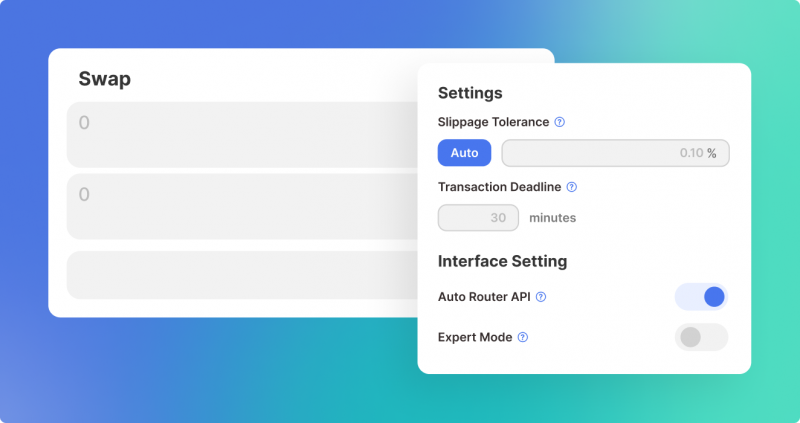

It’s also important to consider your slippage tolerance when trading in cryptocurrency. Slippage tolerance is the maximum price difference a trader is willing to accept in order to execute their trade. This tolerance should be considered when trading so that traders can accurately weigh their rewards and risks. Generally, the higher the slippage tolerance, the greater the risk of losses due to slippage.

Choosing an appropriate level of slippage tolerance requires careful consideration. The optimal choice depends on factors such as market conditions and trading strategies. When markets are volatile, trades may require a higher degree of slippage tolerance to be executed quickly and efficiently.

Alternatively, during less volatile times, it may be possible to set lower levels of slippage tolerance which could result in more favorable executions. Therefore, adjusting slippage tolerance levels according to the current market conditions is essential. Understanding and managing slippage tolerance can help traders make informed decisions when entering or exiting trades, improving trading performance.

Calculating slippage can be tricky, but it is essential to understand to maximize profits and minimize losses. Let’s look at how to calculate slippage when trading in the cryptocurrency market.

Slippage is unavoidable in any market, including stocks, forex, and crypto. However, slippage can be particularly concerning in crypto due to its extraordinary volatility.

How to Calculate Slippage

Slippage can be calculated by taking the difference between the current market price and the executed trade price. The calculation is simple: Slippage = Current Market Price – Executed Trade Price.

For example, if you placed a buy order for 1 Bitcoin at $10,000 and it was filled at $9,800, then your slippage would be $200 (10,000-9,800). In this case, you received a lower price than expected due to slippage.

Slippage percentage can also be calculated by dividing the current market price and the executed trade price by dividing it by the current market price. The calculation is Slippage Percentage = (Current Market Price – Executed Trade Price) / Current Market Price.

For example, if you placed a buy order for 1 Bitcoin at $10,000 and it was filled at $9,800, then your slippage would be $200 (10,000-9,800). The slippage percentage, in this case, would be 2% (200/10,000). This means that you received a lower price than expected due to slippage amounting to 2%.

It is important to note that slippage can have a positive or negative effect on traders, as we previously discussed. In the example above, the trader received a lower price and thus incurred losses due to slippage. However, if the market had moved in the trader’s favor before their trade was executed, they would have benefited from slippage as they would have received a better price than anticipated.

Fortunately, several tools and resources are available to help traders calculate slippage. Many cryptocurrency trading platforms provide slippage calculators that allow users to input their trade parameters and estimate the expected slippage.

Additionally, online slippage calculators can be used for free by anyone who wishes to check their potential order execution costs. These online calculators use live market data to calculate the estimated slippage on trades, allowing traders to gain insight into the potential risks associated with their trades before they are executed.

Overall, slippage can majorly impact traders’ profits and losses. Fortunately, there are strategies that traders can use to reduce the impacts of slippage. Let’s take a look at some of these strategies.

Strategies for reducing slippage

By understanding the impact of slippage and taking steps to minimize its effects, traders can improve their trading performance. Here are some strategies that can help traders reduce slippage impacts when trading in the cryptocurrency market.

Limit Orders

Using limit orders is one of the most effective ways to reduce slippage. By placing a limit order, traders can specify a certain price at which they are willing to buy or sell, and the order will only be executed once this price is reached. This ensures you get what you expect and helps avoid unwanted slippage.

Slop Losses

Setting a tight stop loss also helps to minimize potential slippage by limiting how much the price can move before an order is executed. This allows traders to take control of their trading and reduces the risk of major losses due to slippage.

Monitor Market Conditions

Monitoring market conditions can also help traders limit their losses due to slippage. By watching news and events that could affect the market, traders can adjust their orders accordingly to avoid sudden price changes and minimize potential losses.

Automated Systems

Automated trading systems are another great way to reduce slippage, as they execute trades based on predetermined parameters with minimal lag time. These systems use sophisticated algorithms to monitor the markets and execute trades when favorable conditions allow traders to minimize losses due to slippage.

Trusted Exchange

Finally, using a trusted and reliable exchange can help traders reduce their losses due to slippage. Trusted exchanges offer high liquidity, low fees, and fast order execution times, all of which contribute to reducing the impact of slippage on trades.

Liquidity

In addition to the strategies outlined above, another essential factor in reducing slippage is liquidity. Liquidity refers to how easily a trade can be executed without significantly affecting the asset’s price. Higher levels of liquidity often result in lower slippage as trades are more likely to be executed quickly and at a fair price. As such, traders should ensure they use an exchange that offers good liquidity to reduce their exposure to slippage.

Now that we have discussed some strategies for minimizing slippage let’s take a look at how slippage affects different cryptocurrencies.

Slippage in Different Cryptocurrencies

The amount of slippage traders can expect when trading different cryptocurrencies varies significantly. This is due to the different levels of liquidity and volatility in each cryptocurrency. For example, Bitcoin tends to have higher liquidity levels and lower volatility than other cryptocurrencies, resulting in less slippage on trades. On the other hand, smaller altcoins often have much lower liquidity and higher volatility, leading to more slippage.

Before trading, traders must research an exchange to determine the amount of slippage they can expect when trading a specific cryptocurrency. Traders should also be aware that different exchanges may have varying degrees of slippage for a particular cryptocurrency. This is due to the depth of each exchange’s order book and trading activity.

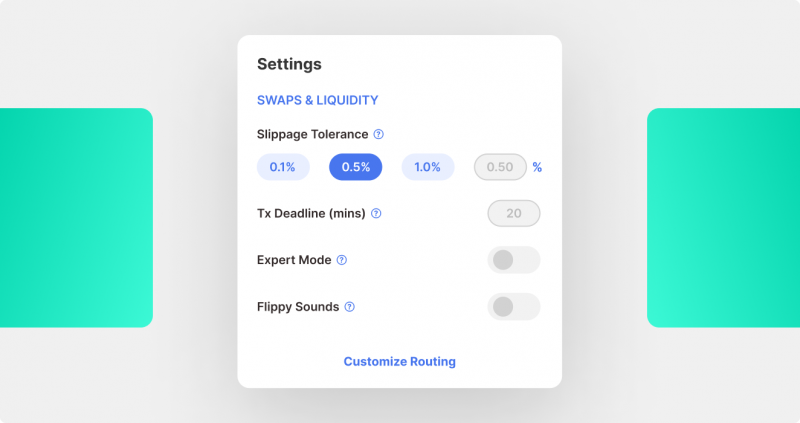

Additionally, decentralized exchanges such as Uniswap and PancakeSwap can also have significant slippage due to the nature of their order book. These exchanges are open 24/7 and have no central authority controlling trading activity. As a result, traders need to be aware that liquidity on these platforms can vary significantly from day to day, resulting in greater potential for slippage when trading certain cryptocurrencies.

Furthermore, since exchanges like Uniswap and PancakeSwap do not provide access to limit orders, they are more prone to slippage than centralized exchanges, which offer both limit and market orders.

Typically, the default slippage rate on decentralized platforms ranges from 0.5% up to 1%. Each trader’s strategy will determine the best appropriate slippage tolerance for them since there isn’t a generalized one-size-fits-all answer. However, you are able to adjust your slippage on platforms like PancakeSwap and UniSwap to your desired levels.

Conclusion

Trading cryptocurrencies is not without risks, and slippage can be a major factor in determining an investor’s success. But by understanding how it works, you can reduce the potential damage that slippage could bring upon your returns – allowing you to maximize profits with successful trades while safeguarding against losses associated with this potentially damaging phenomenon.

To ensure a successful trade and limit the potential for slippage, cryptocurrency traders must understand strategies such as deploying automated trading systems, using limit orders, and increasing liquidity levels. Investors can confidently navigate volatile markets and maximize their profits by wisely executing these techniques on trusted exchanges.

FAQ

What is crypto slippage, and why does it matter?

Crypto slippage refers to the difference between the expected price of a cryptocurrency trade and the actual price at which the trade is executed. It matters because high slippage can significantly impact trading profits, particularly in volatile markets or low-liquidity conditions. Managing max slippage effectively is essential for minimizing losses.

How can I reduce slippage in crypto trading?

To reduce slippage in crypto trading, you can use limit orders to specify the exact price at which a trade should be executed. Additionally, choosing exchanges with high liquidity and deploying automated trading systems can help mitigate the effects of crypto slippage.

What is max slippage, and how should I set it?

Max slippage is the highest price difference a trader is willing to accept for a trade to be executed. It can be set based on the trader’s risk tolerance and market conditions. Lower max slippage is ideal in stable markets, while higher settings might be necessary in volatile markets to ensure trades go through.