XRP ETF Gains Momentum as the SEC Acknowledges New Crypto Fund Filings

Crypto investors have something new to cheer about—XRP ETFs are making headlines. The U.S. Securities and Exchange Commission (SEC) is now reviewing multiple XRP ETF applications.

With the latest XRP ETF news sparking discussions across the industry, investors are eagerly watching for regulatory decisions that could open new doors for mainstream crypto adoption.

What Happened?

On February 6, 2025, the SEC took its first steps toward approving a broader array of crypto-based exchange-traded funds (ETFs). In a series of closely watched filings, the Cboe BZX Exchange submitted four separate 19b-4 documents on behalf of leading asset managers:

- Bitwise

- 21Shares

- Canary Capital

- WisdomTree

Many believe the change in stance is due to the SEC’s new acting chair, Mark Uyeda, who appears to be more crypto-friendly than his predecessor, Gary Gensler.

While the SEC’s acknowledgement of these filings does not equate to approval, it does mark a significant departure from previous reticence. This suggests that regulators are now more willing to explore the potential of crypto ETFs beyond Bitcoin and Ether.

The SEC’s Crypto-Friendly Pivot

For years, the SEC has maintained a cautious stance on digital asset investment products, particularly those linked to cryptocurrencies that regulatory authorities once deemed securities. However, recent filings signal that the landscape may be shifting, with XRP ETF proposals now emerging as a key area of focus.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

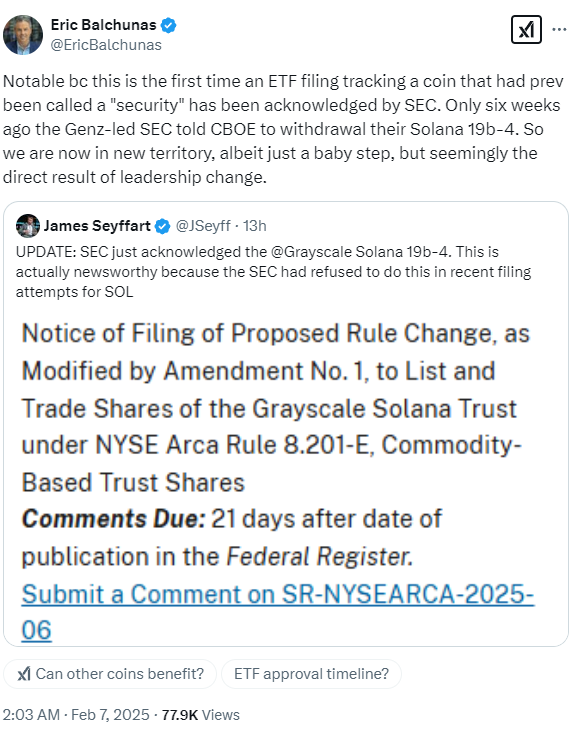

Eric Balchunas, a senior ETF analyst at Bloomberg Intelligence, described the SEC’s recent actions as a “baby step” into uncharted territory. According to Balchunas, the acknowledgement of these filings is particularly significant given the historical hesitancy around crypto products, especially those involving assets like XRP that have faced heightened regulatory scrutiny in the past.

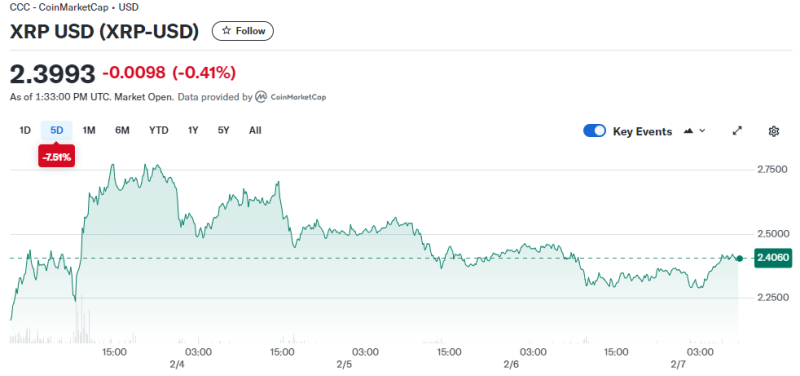

This sentiment has fueled discussions about the XRP ETF approval potential, with market participants closely watching for any signs that the SEC might favour a favourable ruling.

What’s at Stake?

If approved, XRP ETFs could open the floodgates for institutional money to flow into XRP. Analysts at JPMorgan predict that spot XRP ETFs could attract between $4 billion and $8 billion in net new assets within their first year. That kind of investment could significantly impact the price of XRP.

Moreover, the new wave of ETF filings extends beyond XRP. Earlier filings for crypto ETFs tracking assets such as Litecoin and Solana and innovative redemption structures for Bitcoin and Ether have underscored a broader trend: the institutionalisation of cryptocurrency investments.

XRP ETF Timeline Predictions

Despite the excitement, investors should temper their enthusiasm with a healthy dose of caution. The process for ETF approval is complex and time-sensitive, with regulatory bodies operating under strict deadlines.

For instance, the SEC’s acknowledgement of Grayscale’s filing for a Solana ETF comes with a deadline in October for a decision. Analysts advise patience, noting that evolving legal interpretations and market conditions could still influence the SEC’s decision-making process.

The historical context of these filings adds complexity. Previous ETF proposals for crypto assets often encountered significant regulatory pushback, particularly when the asset in question was under heightened scrutiny. XRP, to be exact, has long been the subject of regulatory debate with the SEC, with questions about its status as a security lingering in the background.

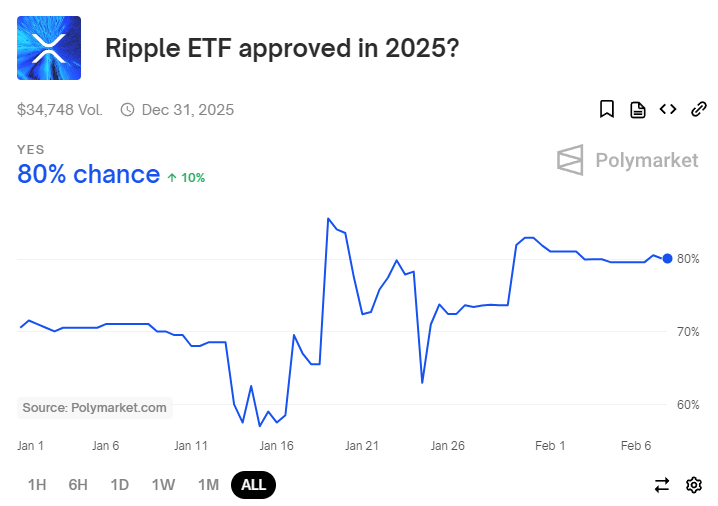

At the same time, data from prediction markets like Polymarket indicate an 80% probability of XRP ETF approval within 2025, reflecting the market’s confidence in the evolving regulatory landscape.

Final Thoughts: What This Means for Crypto Investors

The SEC’s recent actions indicate that crypto ETFs are no longer a club for Bitcoin and Ethereum only. The push for XRP ETFs, alongside similar efforts for Solana and Litecoin, signals a shift in regulators’ views of the digital asset space.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

If XRP ETFs get approved, they could mark the next major step in crypto’s integration into traditional finance. That would mean more institutional adoption, increased liquidity, and a stronger bridge between the crypto and traditional financial markets.

For now, all eyes are on the SEC. Will they embrace this new wave of XRP ETFs, or will regulatory roadblocks delay their debut? One thing’s for sure—2025 is shaping up to be a pivotal year for crypto investment.

Disclaimer: This article is for informational purposes only. It is not finance advice and should not be relied upon for investment decisions. Always do your own research and consult a financial advisor before investing.