Who Are High Net Worth Individuals (HNWIs), And How Do They Influence Market Liquidity?

Wealth is not about numbers — it goes beyond that. It is also about power, strategy, and impact. High-net-worth individuals (HNWIs) have a lot of financial power. They drive global investment trends, set market liquidity, and influence the economy.

Their financial decisions carry substantial weight, often establishing patterns across industries through strategic allocations to hedge funds, luxury assets, and other investment vehicles. However, what makes one an HNWI, and how do they generate and keep riches?

This article aims to clarify the definition of HNWIs, explore the classifications within this group, and analyse their considerable impact on market liquidity.

Key Takeaways

HNWIs are essential in driving the financial markets. They invest their money in various outlets. These outlets include stocks, real estate

The paragraph portrays UHNWIs as a group of people who have a wealth of over $30 million and shape the economic policies and

High net worth individual wealth management includes estate planning and tax structuring as well as international diversification.

What Do High-Net-Worth Individuals Stand For?

Fundamentally, a HWI definition is an individual recognised by the substantial volume of their financial assets, which must surpass a minimum threshold set by the financial entities they interact with.

These individuals generally require access to specialised financial services, encompassing sophisticated wealth management, tailored investment advisory, and strategic tax planning.

HNWI status is generally determined by financial institutions, private banks and investment firms on the basis of their investable assets, which do not include such illiquid assets as primary residences, collectibles, or personal property.

While the precise definition of HNWI status can vary across different financial institutions and geographical regions, the most commonly accepted benchmark is possessing at least US$1 million in liquid assets.

Ultra-high net worth individuals (UHNWIs) are a subset of HNWIs, and these individuals typically possess a net worth exceeding $30 million. These classifications assist banks, asset managers, and financial advisors in catering their services toward the distinct needs of wealthy individuals.

Over 60% of UHNWIs use family offices to manage wealth, ensuring lasting financial security and legacy planning.

The Influence of HNWIs on Market Liquidity

HNWIs are largely caught in market liquidity due to the vast amount of capital they can deploy across all asset classes, such as equities, fixed-income instruments, real estate, private equity, and other alternative investments.

Investment behaviours and financial strategies of these market participants are the basic foundations for the formation of market dynamics. These foundations directly influence the level of price stability, trading volumes and capitalisation of market participants.

Direct Impact of HNWIs on Market Liquidity

HNWIs have a direct impact on market liquidity as follows:

High-Value Transactions and Trading Volumes

HNWIs typically partake in big transactions alone, through family offices, hedge funds, or private investment firms. This contributes to the escalated trading volumes, thanks to the inflow and outflow of significant capital. This is particularly the case with high-value asset classes like equities, real estate, and alternative investments.

Active participation of high-net-worth individuals in the markets plays a role in liquidity provision. This happens when they are able to ensure that there are buyers and sellers for every trade, to reduce bid-ask spreads, and to make it easier for other investors to enter and exit positions.

Participation in Private Ventures and Venture Capital

HNWIs often invest in private equity and venture capital by funding early-stage and high-growth companies. Providing capital to businesses that may not have access to traditional financing allows for liquidity within the private investment ecosystem.

Furthermore, secondary liquidity opportunities are created when startups and innovative sectors that the firm invests in undergo initial public offerings (IPOs) or acquisitions.

Demand for Alternative Assets and Luxury Markets

Outside of typical stock and bond investments, high net worth individuals usually add a substantial amount of their wealth to other alternative assets, for example, fine art, rare collectibles, cryptocurrencies, and luxury real estate.

Using the CME Group as an example, the demand for this type of product can help provide liquidity in markets that are illiquid due to the high-value nature of the underlying assets and the limited number of potential buyers.

Hedge Fund and Institutional Investments

A lot of HNWIs invest their wealth using hedge funds and asset management firms. Those firms, in their turn, allocate funds into global financial markets. As a result, more liquidity appears in asset markets, especially in speculative and high-yield sectors.

HNWIs themselves are often crucial capital providers for hedge funds, backing strategies like arbitrage, market-making, and short-selling. Such activities play a vital role not only in providing necessary market liquidity but also in facilitating efficient price discovery.

Indirect Impact of HNWIs on Market Liquidity

At the same time, HNWIs have indirect effects on the liquidity of market assets, which are due to the following provisions:

Influence on Market Sentiment and Volatility

What HNWIs do with their money gets noticed. As trendsetters, their decisions can visibly shift the overall mood of the market. For example, when well-known investors make public calls, such actions can easily trigger wider buying or selling, feeding liquidity when optimism reigns or draining it when caution takes over.

Impact on Financial Organisations and Banking Liquidity

Private banks thrive on relationships with HNWIs, whose substantial deposits become the bedrock of the bank's lending capacity. This pool of capital enables banks to extend credit to companies and individuals, thereby facilitating the operation of the broader economy.

Separately, the appetite among the wealthy for complex financial products pushes banks and financial engineers to innovate, which can eventually broaden the range of tradable assets and deepen market liquidity over the long run.

Role in Economic Stimulus and Capital Flow

Wealthy individuals often direct significant funds beyond listed stocks and bonds. Their investments in businesses, sizable contributions to philanthropy, or funding for infrastructure projects all inject fresh capital into the economy.

This spending stimulates activity, supports job growth, and keeps money flowing through both mature and developing markets, ultimately contributing to greater overall liquidity.

Influence on Monetary Policy and Interest Rates

Central banks and policymakers are interested in the behaviour of HNWIs as their investment choices and trends can provide them with relevant information regarding economic conditions.

When a high-income person moves a large chunk of their capital to another country or a secure investment, domestic liquidity is decreased, which can lead to an adjustment in the policies of the central bank.

Classification of High-Net-Worth-Individuals

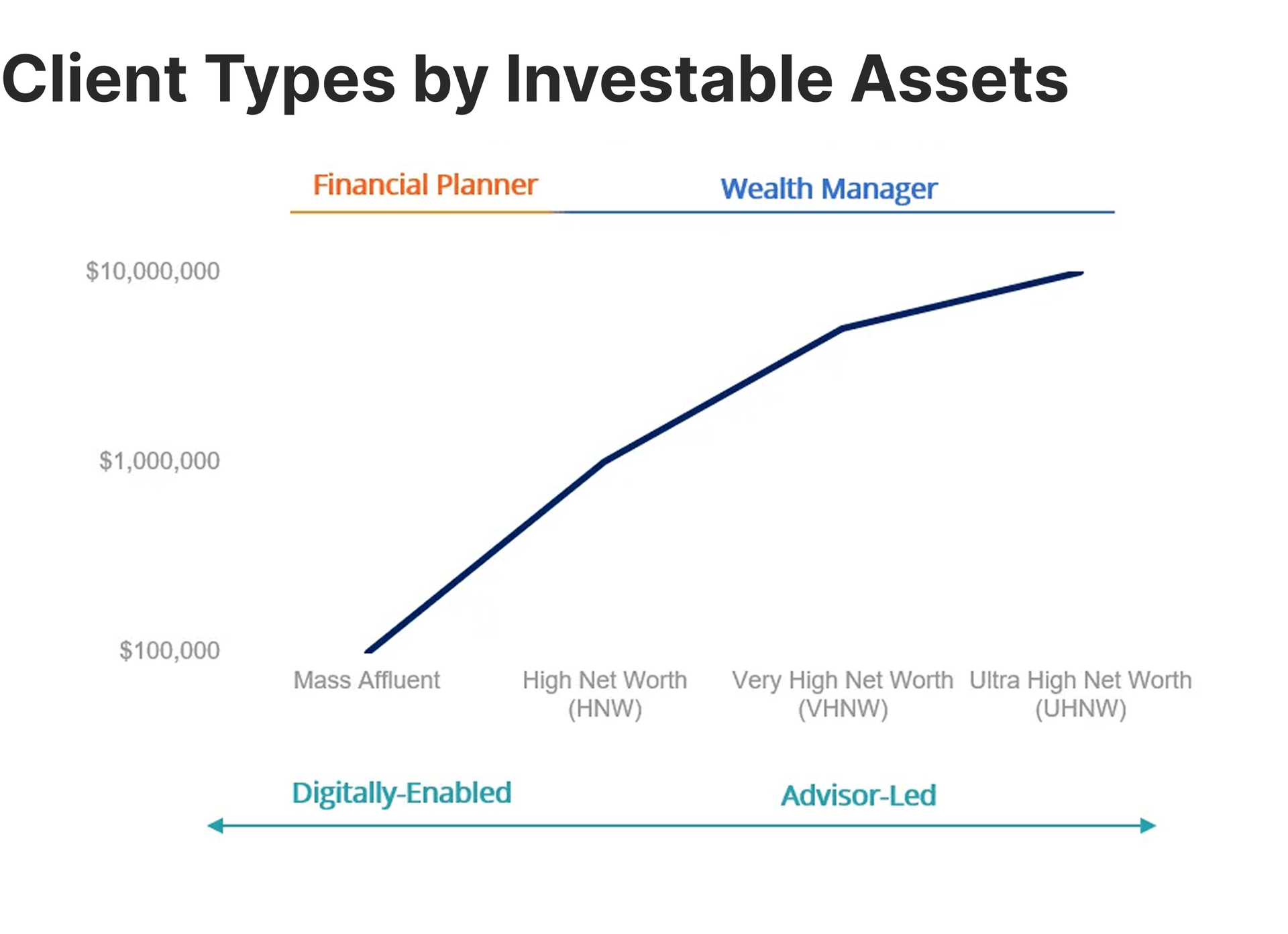

HNWIs are classified primarily by the amount of investable assets they control, which excludes primary residences and other illiquid assets. Wealth management companies and financial institutions categorise them into various levels of wealth by net worth.

Standard Classification of HNWIs

The standard classification generally accepted in the financial and investment world contains the following groups of high-income earners:

High Net Worth Individuals

HNWIs have investable assets of $1 million to $5 million. They are typically professionals, accomplished entrepreneurs, and business owners. They have built wealth through their careers, investments, and business ownership. The financial services that they frequently require are investment management, retirement planning, and tax optimisation.

HNWIs tend to invest in traditional asset classes, such as stocks, bonds, mutual funds, real estate, and private businesses. Although they may not directly impact market trends, they collectively influence the market liquidity and the capital markets during periods of economic change.

Very High Net Worth Individuals (VHNWIs)

High-net-worth individuals with a net worth of $5 million to $30 million have more financial flexibility and access to much more complex investment opportunities. They generally have diversified international investment portfolios that might include alternative investments, such as hedge funds, venture capital, and luxury real estate.

Ultra-High Net Worth Individuals (UHNWIs)

Ultra high net worth individuals with more than $30 million in investable assets form the wealthiest class of individuals, which includes billionaires, business magnates, and influential investors.

Their portfolios cover global stock markets, private equity, commodities and frontier technology ventures. Their investments are often structured through family offices and private wealth management firms.

A lot of UHNWIs are involved in philanthropy, endowing large-scale funds, and the realisation of global projects. They can allocate/withdraw enormous capital, which makes them the main actors in the financial markets.

Alternative Classifications of HNWIs

The traditional system of ranking the wealthy is represented by the income class distributed according to a certain price indicator. However, besides this, there is an alternative system of ranking that characterises the rich by the size of their financial resources.

Emerging HNWIs ("Millionaires Next Door")

With assets of between $500,000 and $1 million, the emerging high-net-worth individuals typically are entrepreneurs, self-made professionals, or high-income career starters who are in the early stage of wealth accumulation.

They invest in long-term growth through real estate, diversified stock portfolios, and retirement planning. While they may not need fully comprehensive private banking services yet, many are interested in scaling up their wealth through financial advice.

Deca-Millionaires

Deca-millionaires, with net worths between $10m and $100m, make up an elite subset of ultra-high-net worth individuals. A significant portion of this group owns multiple businesses, sophisticated investment portfolios, and/or luxury assets. Their financial strategies often focus on tax efficiency, estate planning, and international diversification.

The common investment vehicles are private equity, hedge funds, and more sophisticated financial products, which require high wealth management skills. A significant number of them are also active philanthropists, setting up charitable foundations or trusts.

Centi-Millionaires

Centi-millionaires are wealthy with between $100 million and $999 million in assets. They operate major enterprises, investment companies, and estates around the world. They use private banking, offshore accounts, and high-impact investments to grow their wealth.

In the worlds of hedge funds, political donations, and economic regulation, their reach is long, typically significant characters, at least within a company and financial decision-making.

Billionaires (Exclusive UHNWIs)

These billionaires who have a wealth of at least $1 billion are the most exclusive group of UHNWIs. They consist of business tycoons, technology innovators, and heirs to vast fortunes. They are so powerful that their investment is not only for the financial markets but also for shaping government policies and affecting global trade and economic trends.

Billionaires are involved in major investment projects such as emerging sectors (AI and biotechnology), space programs and large-scale philanthropy. The movement of their capital can cause significant fluctuations in the stock market, interest rates and economic stability.

Sources of Wealth for HNWIs

High net worth individuals generally build a fortune through a variety of ways, the most common being entrepreneurship and investments. However, some inherit their wealth while others own alternative assets that appreciate over time.

Entrepreneurship and Business Ownership

Entrepreneurship is the most common path to wealth accumulation among HNWIs. Many grew their fortunes by founding and scaling successful businesses in high-growth industries such as technology, finance, healthcare, manufacturing, and consumer goods.

Aside from startups, a substantial number of HNWIs amass wealth from conventional business ownership in real estate, retail, logistics, and construction sectors. Some receive family businesses, which are often family heirlooms.

Consequently, some inherit businesses and continue the trend to pass them on to the next generation. Others buy franchises in high-demand markets, such as the food service or hospitality industry.

Aside from that, private equity investments and business acquisitions present another means of wealth creation as HNWIs purchase and restructure underperforming firms for profits. Leveraged buyouts (LBOs), where debt finances acquisitions, are common methods for maximising returns for rich individuals.

Investments in Financial Markets

Putting capital to work in the financial markets is nearly always in the playbook for growing wealth. Trading stocks – buying directly or using funds like ETFs – is common for both growth and dividend income. Bonds offer another layer, alongside more complex instruments for managing risk.

Getting in early with promising new companies is another angle. Angel investors and venture capital funds provide the cash startups need to get going, taking a piece of the company in return. The ultimate prize is finding that rare 'unicorn' startup (valued over $1 billion) before it takes off – high risk, but potentially massive rewards.

Real Estate Investments

Property remains a cornerstone for many wealthy individuals. It's tangible, can generate rental income, and often appreciates in value. You'll find HNWIs investing in luxury residential properties – apartments, villas, estates – in major global hubs like New York, London, or Dubai. Owning multiple properties for rental income or eventual resale is common.

Commercial and industrial properties are just as important: office buildings, shopping malls, hotels, the warehouses powering online retail. These typically provide steady cash flow from leases. For those wanting exposure without the hassle of direct ownership, Real Estate Investment Trusts (REITs) offer a diversified option. And with the digital boom, industrial properties like logistics hubs and data centers have become particularly attractive. Some even play the long game with 'land banking' – buying undeveloped land hoping its value will rise – or by financing large-scale development projects that shape urban landscapes.

Inheritance and Family Wealth

A lot of wealth isn't earned from zero; it's inherited. These individuals receive hefty packages – trusts, company shares, real estate, investment accounts – passed down the line.

Protecting that inherited wealth takes careful planning for the future. Families often set up trusts and use legal strategies to handle taxes smoothly and keep family harmony when assets change hands. Giving back through charitable foundations also frequently becomes part of how a family defines its legacy.

Alternative Investments and Non-Traditional Wealth Sources

To diversify their profile and hedge against market risks, many HNWIs allocate capital to alternative assets. Cryptocurrencies and digital assets, including Bitcoin and Ethereum, have become increasingly popular among wealthy investors looking for high-risk, high-reward opportunities.

Many HNWIs invest in fine art, rare collectables, luxury watches, and classic cars. These tangible assets serve as inflation hedges and storehouses of value. High-profile art auctions at Sotheby's and Christie's attract wealthy collectors who influence asset valuations in this niche market.

Intellectual property and royalties represent another source of wealth. Some HNWIs generate income through patents, trademarks, book rights, music royalties, and licensing agreements. This category includes authors, musicians, entertainment professionals, and tech innovators who monetise intellectual properties over time.

Where Are Most of the High-Net-Worth Individuals?

HNWIs are concentrated in financial and economic power centres worldwide, primarily in countries with strong economies, business-friendly policies, and stable financial markets.

The largest populations of HNWIs are found in North America, Europe, and Asia-Pacific, with emerging wealth hubs growing in the Middle East and Latin America. These regions attract wealthy individuals due to favourable investment environments, advanced banking systems, and opportunities for business expansion.

North America

The United States has the broadest number of HNWIs globally, driven by its dominant financial markets, thriving technology sector, and deep-rooted entrepreneurial culture.

Cities like New York, Los Angeles, San Francisco, and Miami are major wealth hubs, attracting investors, tech entrepreneurs, and corporate executives. The U.S. is home to Silicon Valley, which has produced some of the world's wealthiest individuals, including tech billionaires.

Canada also has a significant HNWI population, particularly in Toronto and Vancouver, where the real estate and financial services industries contribute to wealth creation.

Europe

Europe remains a key region for HNWIs, with major wealth centres in London, Paris, Zurich, and Frankfurt. The financial services industry, luxury markets, and real estate investments make these cities attractive to the wealthy.

The United Kingdom, despite Brexit, continues to be a top destination for HNWIs, especially London, which serves as a global financial hub. Switzerland, known for its private banking industry and tax-friendly policies, attracts wealthy individuals seeking asset protection.

Countries like Germany and France also have strong business environments that foster wealth accumulation, particularly in industries like manufacturing, luxury goods, and finance.

Asia-Pacific

Asia-Pacific has seen a rapid rise in HNWIs, with China, Japan, India, and Singapore emerging as major wealth centres. China, particularly in cities like Shanghai, Beijing, and Shenzhen, has produced a major pool of HNWIs through its booming technology and manufacturing sectors.

The rise of billionaires in China has been fuelled by e-commerce giants like Alibaba and Tencent. With its strong economy and advanced financial markets, Japan remains home to an abundance of wealthy individuals, particularly in Tokyo.

India is another major player, with Mumbai and Delhi leading the way in wealth creation, thanks to a growing number of tech entrepreneurs, industrialists, and investors.

Meanwhile, Singapore has established itself as a premier financial hub, attracting HNWIs due to its business-friendly policies, low taxes, and high-quality lifestyle.

Middle East and Emerging Markets

The Middle East is home to many HNWIs, particularly in Dubai, Abu Dhabi, Riyadh, and Doha. The region's wealth is largely driven by oil and gas, but there has been significant diversification into finance, tourism, and real estate. Dubai, in particular, has become a hotspot for international investors and expatriate millionaires due to its tax-free environment and luxury lifestyle.

In Latin America, countries like Brazil, Mexico, and Chile have growing HNWI populations driven by commodities, banking, and real estate industries.

Wealth is concentrated in cities like São Paulo, Mexico City, and Santiago, where business-friendly reforms and economic growth have encouraged investment. However, political and economic instability in some parts of the region can challenge wealth preservation.

Conclusion

HNWIs are more than just wealthy individuals — they are powerful economic players whose investment decisions shape industries, drive market liquidity, and influence global financial policies.

As the financial landscape matures, HNWIs will remain at the forefront, leveraging wealth management strategies to preserve and expand their fortunes.

FAQ

- What is considered high net worth?

An individual with $1 million or more in liquid assets qualifies as an HNWI, excluding primary residences and personal assets.

- How do high net worth individuals invest?

HNWIs diversify their portfolios across stocks, private equity, real estate, hedge funds, and alternative assets like art and cryptocurrency.

- What is the UHNW meaning?

Ultra-high net worth individuals have at least $30 million in investable assets.

- Why is HNWI wealth management different?

HNWIs require specialised financial services, including tax efficiency, estate planning, and access to exclusive investment opportunities.