Why Does Forex Liquidity Matter, and How Do You Measure it?

Articles

Understanding these factors is crucial to improving your experience and skills, enabling you to trade more professionally using concepts like Forex liquidity, market volume, order flow and more. We’ve created this detailed guide to take you through everything about liquidity and Forex.

For new entrants, trading in financial markets may seem as simple as buying and selling as prices change, especially with the digitalisation of platforms, where everything is made simpler and easier.

However, behind closed doors, there is a robust system of dependencies and connections that dynamically move and impact each other. These elements include, but are not limited to, central banks, financial institutions, liquidity providers, local regulators, and the list goes on.

Key Takeaways

- Liquidity refers to the ease with which products can be bought and sold in the market and at close prices to the real market value.

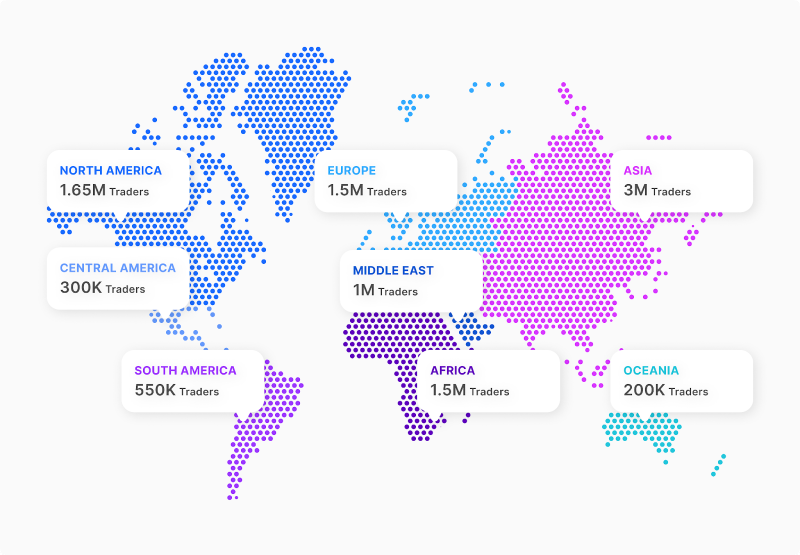

- Forex is the most liquid market in the world, with trillions of dollars traded daily and a massive number of traders and participants.

- The Forex market participants include large financial corporations, central and commercial banks and wealthy investors who trade multiple currencies, resulting in high market liquidity.

- Forex liquidity is affected by various factors, such as market size, global news, trading hours, and central banks’ monetary policies.

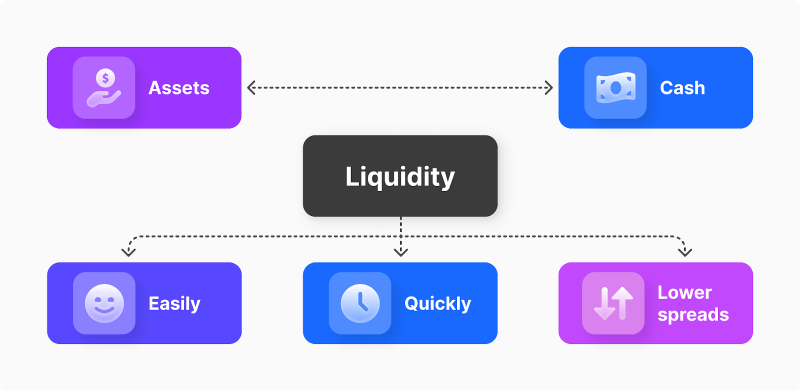

Introducing Liquidity

Liquidity can be understood similarly to availability. In other words, liquidity means the ease with which someone can buy and/or sell a product in the market.

This definition entails that assets are sufficiently available and there are enough traders in the market willing to trade with you, taking the counterpart side of the exchange.

Markets with increased liquidity are more efficient, where orders are executed seamlessly, with a low spread range and minimum slippage. Highly liquid assets can be easily traded without long waiting times and at a close price to the market value.

On the other hand, markets with less liquidity experience a shortage in asset supply and fewer buyers, where orders are pending for long times and are executed at slightly different rates due to delays.

What is Liquidity in Forex?

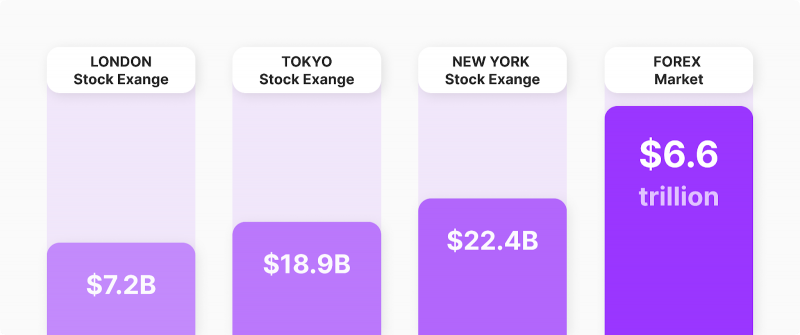

The foreign exchange, or the currency market, is the largest and busiest financial market in the world, where trillions of dollars are exchanged, and hundreds of currencies are traded in pairs.

Liquidity plays a key role in Forex, considering the huge number of participants and providers that operate, requiring transactions to be settled quickly and as close as possible to real market value.

The Forex market plays a vital role in world trade, where the USD dominates the world economy, and the slightest price action in Forex can heavily affect trade agreements and investments around the world.

Given the huge number and importance of FX market participants, it is considered the most liquid financial market where currencies are highly available, and orders are usually matched instantly.

Trading Volume

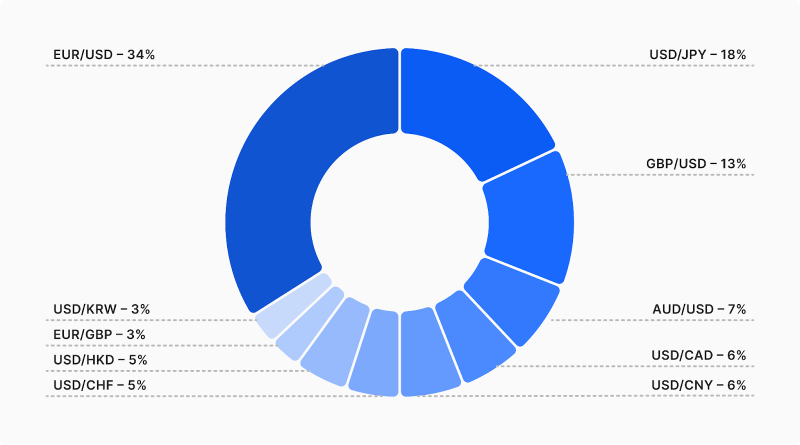

One of the main determinants of the Forex market liquidity is the trading volume, referring to the amount of currencies being traded. For example, EUR/USD is the most traded currency pair in the market, followed by USD/JPY, GBP/USD and USD/CHF, which shape the most important economies in the world.

The foreign exchange market is characterised by having the highest trading volume, which retail Forex traders and large financial corporations contribute. Key players in this market include central banks, large commercial banks, financial and investment firms and hedge funds.

These participants aid the market liquidity through their constant order executions and transactions in the market, trading for themselves to grow their wealth and as intermediaries for independent investors.

Currencies Liquidity Levels

There are more than 180 currencies. However, not all of them enjoy similar traits, such as volume and liquidity. Currencies of leading economies trade the best, including the US dollar, Great Britain pounds, euros, Japanese yen, and Swiss francs.

Other economies also enjoy high liquidity, such as the Australian dollar, New Zealand dollar, Mexican peso and Canadian dollar.

Currency pairs are usually classified as high-liquidity and low-liquidity pairs.

High Liquidity Pairs

- GBP/USD

- USD/JPY

- EUR/GBP

- AUD/USD

- USD/CAD

- USD/CHF

Low Liquidity Pairs

- NZD/USD

- USD/ZAR

- EUR/TRY

- PLN/JPY

Some of these currencies are called exotics because they have high volatility due to less demand than major currencies. Risk-taking investors may consider exotic currency pairs as their volatility can bring higher returns in a shorter time, while major currencies are less volatile and require more time and larger capital to strike a noticeable profit.

The first Forex market was established in 1624 in Amsterdam, where currencies were exchanged between the Netherlands and Italy.

The Role of Liquidity in the Forex Market Stability

Liquidity is one of the most important factors in the Forex market’s stability and low volatility. Prices of different currencies vary due to many factors, such as political events, global news, financial announcements of large companies, international trade and geo-political relations.

The late introduction of cryptocurrencies added other factors, where the developments and crypto prices can also affect the demand for major currencies.

These factors make the market highly speculative. However, the significant liquidity in Forex offsets this volatility, making the market relatively stable. On average, major currency pairs like EUR/USD fluctuate around 1% daily.

How to Measure Forex Liquidity

The involvement of large financial organisations, like multinational organisations, hedge funds and central and investment banks, makes this market highly liquid.

However, global events and announcements can majorly shift the market dynamics and make it difficult to predict. During these events, traders can measure liquidity and stability using these tools.

Spread

In every market, products are traded at different buying and selling prices, which also differ between liquidity providers and traders. Market makers buy assets at a low price and sell them at higher prices.

Therefore, brokers offer assets with different buy and sell rates. For the trader, the buying price is usually higher than the selling price. This gap between the asking and bidding price is called spread.

Brokers realise the spread amount as a payment in exchange for their service. The spread range varies between markets, products, liquidity providers, etc.

The Forex market is relatively liquid, and the supply levels for major currencies are high, which makes the spread range low in most cases, resulting in lower fee payments by the trader.

Volume

Trading volume in Forex is skyrocketing, and in April 2023, the daily OTC transactions were valued at $918.4 billion on average. This significantly high activity results in high market liquidity, whereas low trading activity and volume are associated with a lack of liquidity and inefficiency.

Traders can analyse the liquidity levels of a given currency pair by tracking its trading patterns and comparing current and historical FX volumes. If the current trading volume is higher than in previous periods, it indicates that liquidity is improving and the market is becoming more efficient.

Price Action

Analysing the price activity and historical market movements helps understand the liquidity level and its change patterns. Liquid markets tend to experience smoother price changes due to various factors and events.

On the other hand, an illiquid market is more prone to sudden price surges and declines as a response to market changes. This difference in price activity results from the different supply levels of the subject products.

For example, when a tradable security is not sufficiently available, its price is more likely to jump suddenly than highly liquid products.

Market Depth

The market depth refers to the pending buy and sell orders from other market participants. The number of placed orders is an excellent indicator of the liquidity of the Forex market.

Traders can analyse the order book and measure its depth to understand liquidity changes and patterns in the market. When many placed orders are waiting to find the right match, it means enough traders are willing to exchange with you and have relatively high liquidity.

Liquidity Ratios

One of the best ways to measure liquidity is using ratios, looking at figures and numbers that carry out various meanings indicating liquidity, profitability and more. Turnover ratios, such as current, quick, and cash ratios, are commonly used to measure market liquidity.

Factors That Affect Forex Liquidity

The currency market is affected by multiple factors, making it quite a complex system with various dependencies. Since currencies are part of world trade, local and international economies and national politics, it is crucial to analyse these factors and their impacts on the Forex market.

Market Size

In general, the market size defines a given market’s liquidity and activity level. Thus, when an exchange includes many traders and assets, it is more liquid.

Moreover, major currencies have greater demand and activity within the Forex market, with a deep order book and extremely high trading volume, making them highly liquid than less common currency pairs or exotics.

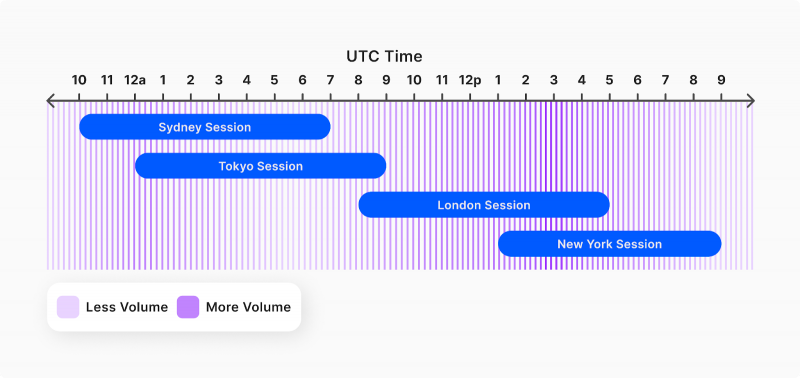

Trading Session Hours

Timing is essential in the Forex market because of its global reach. Some major currency exchange locations include the US and the UK. Thus, when the market reaches its closing hours in the US, the UK markets start opening, marking the peak time for Forex exchange.

These peak hours, caused by different timezones, mark the times with the highest liquidity and trading volume. Therefore, it is vital to analyse the global market’s time and decide the entry point accordingly.

News Announcements

Global events and news like trade agreements, central bank decisions, geopolitical events, black swan events, and conflicts can vastly change the demand pattern on currencies, especially the US dollar, as the world’s leading currency.

For example, in times of war, the United Nations and other countries may initiate humanitarian aid and support packages, which increases the demand for the USD needed to purchase and transport different goods and eventually increases the USD value against other currencies.

Another example is when the European Central Bank increases the money supply in circulation to control interest rates, the supply of the EUR increases, and its value decreases against other currencies.

Top Forex Liquidity Providers

Forex brokers offer traders and investors multiple major, minor, and exotic currency pairs. These intermediates provide access to the market and rely on liquidity providers to make securities available for trading.

Liquidity providers are large financial firms that trade actively in the market to keep it up and running, and they come in different forms.

Banks

Central and commercial banks are key players in providing liquidity, as they are the primary providers of liquid assets “money”. Banks issue loans, offer savings accounts, and change the interest rate, which are mechanics used to control the money supply.

Central banks like the Federal Reserve, European Central Bank, and the Bank of London announce and change several policies about interest rates, which directly affect supply and demand factors.

When the interest rates are lower, individuals and companies tend to take more affordable loans, increasing the demand for money and the value of the associated currency.

Financial Institutions

Investment firms and hedge funds are key industrial players who actively trade for themselves and their clients in the Forex market. They provide various trading opportunities and employ market experts to lead multi-million dollar accounts to increase their wealth, which increases the trading volume and liquidity in the market.

Large Investors

Wealthy investors and crypto whales play a significant role in providing liquidity in the market. They place large trading orders capitalising on global events and news to grow their wealth.

Their activity increases market liquidity, especially if they include the exchange of multiple currency units. Moreover, large investors taking higher risks are involved in exotic currencies like the Turkish Lira, South African Rand and Polish Zloty, aiding liquidity in those less-traded currencies.

Retail Traders

Retail and average traders participating in the market to grow their accounts play a vital role. Despite their lower capital compared to corporations, many more individuals are trading in the market than organisations.

The Ups and Downs of Forex Liquidity

In a nutshell, high liquidity is good and low liquidity is bad. However, after going through the details of the market dynamics, let’s compare both sides of the coin regarding liquidity in Forex.

Advantages of High Liquidity

- Faster order execution: higher liquidity means more pending orders and traders, which makes the execution process quicker and easier.

- Low spread: higher supply decreases the gap between the bidding and asking prices, resulting in lower spread ranges.

- Controlled volatility: increased liquidity makes price change smoother and avoids sharp price drops or surges.

Disadvantages of Low Liquidity

- Price instability: Low liquidity risk makes prices prone to market events and more sensitive to global events that cause sudden price changes and insatiable movements.

- Higher costs: Lower supply levels increase prices and the difference between the buy and sell prices, which makes the spread greater and transaction costs higher.

- Market inefficiencies: The lack of assets and traders in the market results in delayed execution and increased costs. Overall, the market becomes inefficient and less appealing to traders.

Conclusion

Forex is larger than other financial markets, where trillions of dollars are traded daily, and a vast number of traders and market participants exchange various currencies. These facts make the FX market very liquid, where currency pairs are exchanged and orders are executed quickly and efficiently.

Liquidity in FX can be measured using different criteria, such as trading volume, spread levels, market depth and historical price action, which dictate the patterns in liquidity. Traders can also analyse various financial ratios to track liquidity and market efficiency changes.

This colossal market involves many providers and participants contributing to its liquidity and efficiency, leading to massive demand for various currencies in response to global news and events to grow a trader’s wealth.

FAQ

Which Forex has the most liquidity?

The US dollar is the world’s leading currency and the most liquid when paired with another leading currency like the Euros. EUR/USD is the most used and liquid currency pair.

What times are Forex liquidity?

Forex peak hours are when the UK and US markets overlap. The NYSE and LSE working hours coincide between 13:00 and 16:00 UTC, marking the time of the highest trading volume and liquidity.

Why is Forex so liquid?

The FX market consists of several currencies, such as USD, EUR and GBP, the leading currencies for global trade and economies. These are traded and controlled by significant market players like financial corporations, central and commercial banks and governments who trade trillions of dollars daily.

What do liquidity providers do in Forex?

LPs, such as large financial firms and banks, participate in trading financial markets to serve their users and grow their wealth, supplying the market with liquidity and making assets more available. They also make currency pairs more accessible for FX brokers to engage in trading activities on behalf of their traders.