How Can Hedge Funds Benefit From Prime Broker Services

Hedge funds are not going away, even if they have been around for a while. They look to a variety of sources, including prime broker services, to increase their capital. These services, which are mostly offered by financial institutions, are created to meet the needs of hedge funds.

Prime brokers (PBs) can be important in the routine of hedge funds since they offer services that make their daily operations easier. As a result, prime brokerage services are in more demand due to the growth of the hedge fund sector.

A prime broker is the head broker for a hedge fund, supervising the majority of the fund’s transactions and frequently serving as the custodian of assets.

In this article, we will discuss the relationship between hedge funds and prime brokers and highlight the services and common benefits they share.

Key Takeaways

- Hedge funds rely on prime brokers since they provide crucial services like money management, securities lending, and market-leading investment strategies.

- Selecting the appropriate PB is essential for hedge funds. Concerns regarding credit risk and operational efficiency affect how successfully businesses use their assets, obtain various financial tools, and draw in investors.

- The mutual dependence of PBs and hedge funds impacts the financial sector. The challenge is the possibility of losing access to assets in the event of a prime broker’s failure and the need to maintain positive relationships.

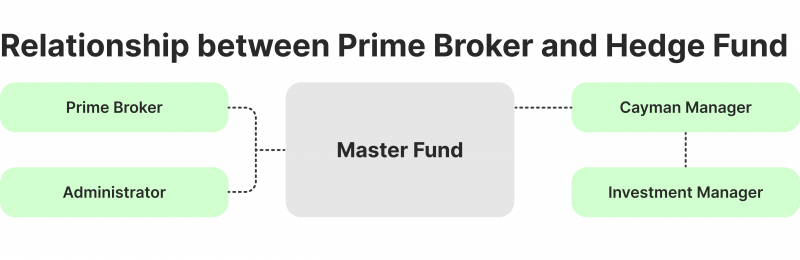

Partnership Between Hedge Funds and Prime Brokers

Hedge funds rely on the services provided by prime brokers to improve their operational and investing strategies. These banks, including Morgan Stanley, mediate between the market and hedge funds.

PBs offer intermediate services between institutional investors and commercial banks, which provide loans to hedge funds for margin financing. Thanks to this relationship, hedge funds now find it simpler to acquire capital and securities.

When a hedge fund manager selects a prime broker, it is an essential decision since it influences the fund’s ability to secure funding, the level of deal execution, and its involvement in the market. The services provided by prime brokerage firms should meet the requirements of hedge funds, even those with smaller assets under management. This highlights the importance of choosing a PB who shares the fund’s philosophy and size.

Multi-prime brokerage arrangements have been more popular recently, particularly among more considerable hedge funds that want to diversify their counterparty risk.

By using this method, hedge funds can maximise their operations and investing strategies by taking advantage of the benefits offered by different PBs.

The history of hedge funds began with just one hedge fund manager in 1949 and has since grown to include 9,370 managers and more than 29,000 firms worldwide.

Prime Brokerage Services for Hedge Fund Management

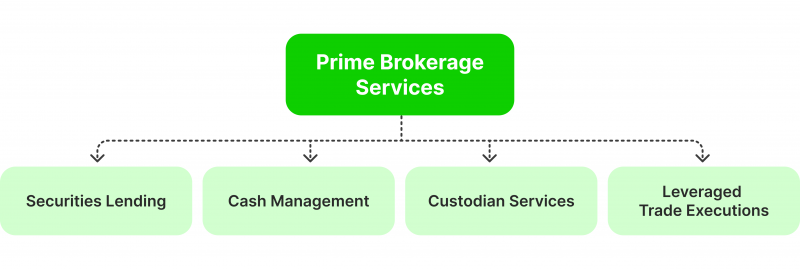

If a hedge fund decides to partner up with a prime broker, it might get multiple assistance with investment plans and operations. We will break down some of them:

Custodial Services

Hedge fund assets are protected by PBs, which also allow the efficient transfer of funds following trades. They provide thorough custodial services to protect the operational integrity of funds.

Clearing and Settlement

They ensure quick settlement by streamlining transaction processes, controlling the flow of cash and securities, and effectively resolving trade inconsistencies.

Margin Financing

By providing customised margin loans, PBs enable hedge funds to increase the amount of money they can invest and earn.

Securities Lending

They give funds access to a large inventory of securities, facilitating the borrowing and short-selling of securities.

Research Access

Prime brokers provide hedge funds with access to a wealth of information spanning a wide range of markets and financial instruments, which helps them make sound choices.

Capital Introduction

By putting hedge funds in touch with possible investors and assisting with marketing initiatives, they contribute to capital raising.

Regulatory Advice and Reporting

PBs provide complete reporting tools for risk management and performance analysis while guiding hedge funds through intricate rules.

Technology and Execution Services

They offer cutting-edge trading technology for efficient strategy execution, such as DMA and unique algorithms.

Additional Services

PBs provide additional credit lines, subleasing of office space, and administrative support to meet the unique requirements of developing hedge funds.

Why Do Hedge Funds Need Prime Brokers?

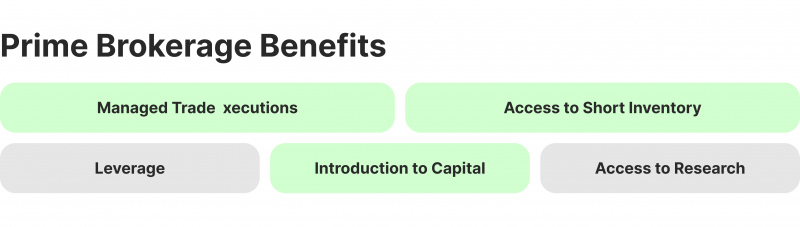

PBs are necessary for hedge funds to succeed both operationally and generate large profits from their investments. As middlemen, prime brokers let hedge funds borrow the money and securities they need to conduct trading.

A hedge fund’s capacity to raise capital may be impacted by the PB selection, which in turn may affect the fund’s attractiveness to possible investors.

For hedge funds, PBs serve as a focal point, combining asset servicing and closing. The investment process is made simpler by this centralisation, which improves the efficiency of hedge funds’ portfolio management.

In order to reduce risk and diversify their offerings, hedge funds may allocate their assets among several prime brokers. Hedge funds are able to take advantage of a greater range of services and reduce their reliance on a single service provider thanks to this approach, even though it may increase operational complexity.

Prime brokers give hedge funds the necessary services to help them function in the market more successfully. Hedge funds are a great source of income for prime brokers. So, as they say, it’s a win-win situation.

Some Challenges in the Hedge Fund and Prime Broker Connection

There are various obstacles to the relationship between PBs and hedge funds. In order to maintain their relationship with prime brokers, hedge funds frequently accept offered rates in the absence of procedures for confirming the best or lowest cost.

The significance of this connection occasionally overshadows concerns regarding the credit standing or operational controls of the prime broker.

Hedge funds that move assets to other banks run a big risk to prime brokers since they can ruin their reputation. One significant event during the 2008 financial crisis was the failure of Bear Stearns, a well-known international investment firm with its headquarters in New York City.

The primary cause of the bank’s collapse was its extensive exposure to mortgage-backed securities, which were sold to JPMorgan Chase for a significant discount after they became toxic as the underlying loans stopped making payments.

This incident was a turning point that foreshadowed the wider collapse of the sector of investment banks and revealed significant weaknesses in the financial system.

Hedge fund managers are now required to check their PBs’ reliability to minimise the possibility of having their assets frozen in the case of a broker default.

The industry’s need for stronger operational and legal protections in the connection between prime brokers and hedge funds has shifted.

Final Thoughts

Financing securities, managing capital, and advising on potential investments are all provided by prime brokerage businesses. Through this relationship, hedge funds can increase the size of their assets, get access to a variety of financial instruments, and optimise their operations.

Choosing the correct PB is crucial because of issues like credit risk and operational controls. The alliance between prime brokers and hedge funds is essential because it shows a mutual reliance that improves the dynamics of the financial industry.

FAQ

Do hedge funds work with several prime brokers?

Indeed, the practice of hedge funds working with a single prime broker has changed over time. Hedge funds are increasingly opting to work with many primary brokers.

How do hedge funds acquire their capital?

Hedge funds receive capital from different sources, including pension funds, endowments, corporations, charities, and rich individuals.

What is the relationship between hedge funds and prime brokers?

Prime brokers provide hedge funds with essential services like custodial support, securities lending, margin financing, and trade execution. This partnership streamlines hedge fund operations and enhances their ability to raise capital and access financial tools.

Why are prime brokers important for hedge funds?

Prime brokers enable hedge funds to execute trading strategies, secure capital, and access securities for borrowing or short selling. Their services are vital for maximising returns and managing operations efficiently.

Can hedge funds work with multiple prime brokers?

Yes, many hedge funds use multiple prime brokers to diversify risk and access a broader range of services. This approach reduces reliance on a single provider but can increase operational complexity.

Recommended articles

By clicking “Subscribe”, you agree to the Privacy Policy. The information you provide will not be disclosed or shared with others.

Recent news

Our team will present the solution, demonstrate demo-cases, and provide a commercial offer