What is Short in Trading?

Articles

Trading is often both a complex and highly dynamic activity in the financial world. Participating in trading can yield enormous profits, but it’s essential to understand what you’re doing before taking part. One of the concepts that traders should become familiar with is “shorting,” which allows participants to speculate on potential downturns in asset prices. In this article, we will explain what is short in trading, why traders might want to use it as part of their investment strategy, and how understanding this concept is vital for experienced or novice investors interested in maximizing returns while diversifying their portfolios.

What is Short in Trading?

A short sale is a speculative investment or trading technique that anticipates a drop in the price of a stock or other asset. It is a complex approach that only experienced traders and investors should use. Shorting works by borrowing shares of a company or asset from a brokerage, then selling the borrowed stock immediately. The investor must then buy back the same amount of shares in the future at a lower price in order to turn a profit. When an investor short trades a security, the hope is that its price will decrease before the investor needs to buy it back again. If all goes according to plan, the difference between the two prices will be the trader’s profit.

Shorting is an essential tool for traders who wish to profit from stock market movements regardless of market direction. It can be a riskier strategy than investing in stocks, as it involves predicting the market’s direction. If an investor’s predictions are wrong, they may have to buy back their shares at a higher price and suffer losses.

Shorting is not for the faint of heart, as it involves taking on additional risks to potentially reap greater rewards. When taking a short position, market participants must recognize the high risk of this strategy and be familiar with any applicable regulations. To be successful, shorting needs expertise and stock market knowledge, therefore novices should seek professional assistance before trying this sort of investing. With caution and proper planning, shorting can provide lucrative opportunities for experienced traders who understand how to take advantage of stock price movements.

Key Takeaways

- Short selling is when an investor or a trader sells a financial asset they do not own in the hope of buying it back at a lower price. Short selling can involve a high degree of risk and is not suitable for all types of investors, so traders should take the time to educate themselves thoroughly before pursuing such a strategy.

- Various shorting strategies can be used to capitalize on stock market trends, such as short-term trend following, scalping, arbitrage, and momentum trading.

- Short selling may be used to hedge against losses in the event of a stock market slump and to speculate on anticipated asset price decreases.

Why do Traders Short?

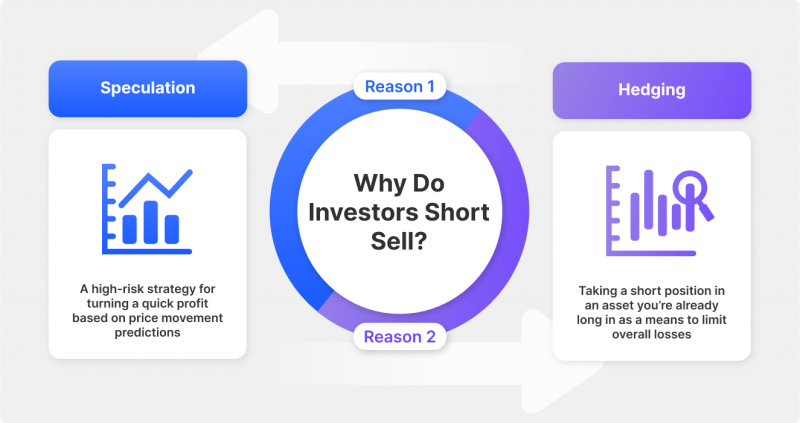

Traders sell short for a variety of reasons, the most frequent being to benefit from price falls in an asset, particularly in a bear market. Traders may profit if the market swings in the direction they predict by selling an asset early and then purchasing it back at a cheaper price later. This type of trading is especially popular among seasoned investors and experienced traders who are familiar with shorting strategies.

Another reason traders sell short is to protect their long positions. Hedging is holding an offsetting position to decrease risk and limit losses in the event of an unexpected occurrence or significant market movement. By doing so, traders can protect any profits they may have made from other trades while also limiting their downside exposure.

Finally, some traders use short selling as a way to speculate on the market. This involves taking a more aggressive stance in order to try and capitalize on large swings in price. While this type of trading does come with higher risk, it can also result in larger profits for those who can accurately predict market changes.

Benefits of Shorting

Short selling provides many benefits but carries additional risks compared to a traditional long position, so it’s essential to understand the nuances of this strategy before entering into any trades. Here, we will explore the benefits of shorting in more detail.

Profit During Bear Market

The first benefit of a short sale lies in its ability to generate profits during bear markets. Unlike long position traders who buy assets when prices are high and sell them when prices are low (in hopes of a profit), short sellers enter into a trade when the price of the stock, or any other financial instrument, is low, selling their assets at current market prices. As asset values fall, experienced investors seize the opportunity to repurchase these assets at a lesser cost and profit. This method allows traders to profit regardless of whether the market is heading up or down, making it an appealing alternative for traders who believe stock markets will continue to plummet.

Better Use of Capital

Another advantage of shorting is that it helps traders to make better use of their capital. Short sellers may initiate positions with less cash upfront and have an opportunity for bigger returns when the price decreases since they are not required to acquire assets at the present price. This also makes shorting a viable option for those wishing to limit their downside risks, as there is no need to buy a large number of assets to leverage a position.

Increased Leverage

Shorting a stock allows investors to take advantage of increasing leverage, which allows them to earn more money than they might with typical long holdings. Because of the higher leverage, traders may initiate bigger bets without investing as much funds up front. This also permits traders to take on more risks since the potential profits are higher than those of a standard long position.

Increased Liquidity

In certain markets, shorting may also increase liquidity. Investors may generate more market demand and supply by shorting a stock or another financial asset, enhancing overall liquidity. This is particularly useful in markets with little liquidity or depth. Short positions may assist lower spreads and boost liquidity by giving buyers and sellers additional alternatives in a particular market.

Improved Risk Management

Shorting can be used to help manage risk. As mentioned earlier, a short sale can be used to hedge existing long positions and limit losses in case of an unexpected event or large market movement. Using short sales as part of their strategy, traders can protect their profits as well as reduce risks. And by diversifying their investments across several trading assets, traders spread out the volatility of unstable markets. All this gives traders and investors added protection and allows them to maximize their profits.

Overall, short selling can be a powerful tool for traders looking to capitalize on bear markets or increase their leverage while limiting their downside exposure. Now, let’s explore how to open a short position.

Risks and Pitfalls of a Short Position

Short selling can be a powerful trading tool, but it does come with risks that traders should understand before entering into any short positions.

Huge Losses

Because of a stock’s unlimited development potential, short selling carries a high danger of incurring losses greater than the initial capital investment. As a result, if prices continue to rise and one fails to exit their trade quickly, they may sustain unimaginable losses.

Tax Implications

Another potential risk associated with short selling is the possibility of negative taxation. Depending on where you are trading and what asset is being traded, traders may need to be aware of additional taxes and charges when participating in certain kinds of short-selling strategies. Before making any trades, make sure you fully understand the ramifications!

Short Squeeze

Short sellers may be subject to a short squeeze. A short squeeze happens when a stock’s price begins to rise rapidly due to the large number of investors attempting to cover their positions at once. This can cause prices to spike dramatically, leading to potential losses for short traders who cannot cover in time.

Margin Calls and Forced Liquidation

Short sellers may also be subject to a margin call and forced liquidation of their positions. Margin calls occur when an investor’s account falls below a certain degree of leverage, which triggers the broker to demand additional funds or securities to maintain the position. Forced liquidations happen if the investor is unable to meet these demands, leading them to incur significant losses.

Regulatory Risks

Short selling can be subject to certain regulations depending on the jurisdiction. In certain cases, authorities, such as the Securities and Exchange Commission, may prohibit short sells in order to prevent panic and irrational selling. This may produce an immediate increase in the stock prices, resulting in massive losses for short sellers who must liquidate their positions fast.

It is crucial to note that short selling may not be suited for all types of investors because of its complexity and associated dangers. Before any trader adopts this strategy, they must educate themselves so that they can make an informed decision about whether or not the strategy fits their risk tolerance. The following section will go through several popular stock-shorting strategies.

How to Short in Trading?

Investors who want to make money by shorting stocks or other assets must first open a margin account since the investor must borrow the shares in order to sell them in the market. With this account, traders will have access to borrowed funds, which are required for initiating a short position and profiting if markets fall. After the margin account has been established and suitably funded, investors may begin looking for stocks or other assets that they anticipate will fall in value. Traders may place a short order with their broker after identifying a desired financial instrument.

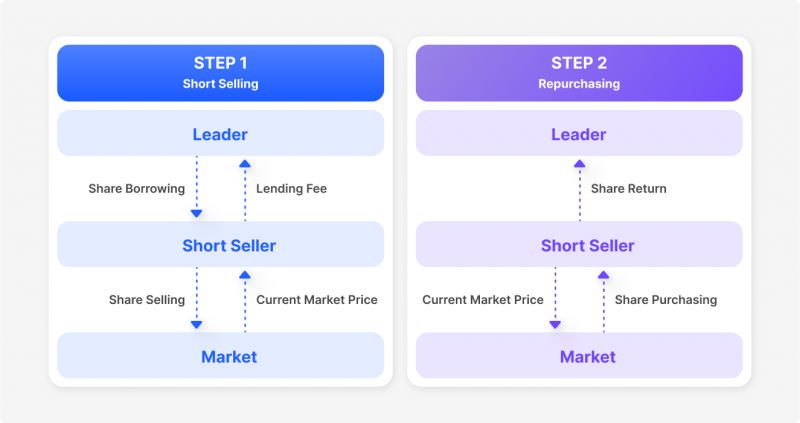

To execute a successful short sale, three critical steps must be completed: borrowing the security in question, selling it on the market, and purchasing it back at a lower price.

An investor must first borrow shares from their broker. The broker will then lend these stocks to the speculator so that they can sell them on the open market and use the proceeds to purchase any asset of their choice. When it comes time to liquidate their position, they must return the equal number of securities to the provider.

Next, the investor will place a “sell” order for their newly-borrowed securities at whatever current market rate is available. This transaction will leave the investor with cash proceeds. By selling these securities, the investor is betting that the price will fall soon so they can purchase them back at a lower cost and make a profit from the difference.

When it comes time to close out the position, the investor must now buy back the same amount of shares in order to return them to the lender. If everything went according to the plan, the trader can make a large amount with a successful short sale.

Short Selling Strategies

In addition to understanding the risks associated with short selling, traders should also familiarize themselves with different strategies that can be used in order to take advantage of markets.

- Short-Term Trend Following: Traders will look for momentum in a downward trend and enter into a short position when the market is breaking down below significant support levels. A stop loss should be set to protect against any sudden trend reversals.

- Scalping: This trading strategy involves taking advantage of minor price variations that occur in a matter of minutes or seconds. Traders must enter and exit positions quickly within a day to make money with minimal risk. By doing so, they can profit from minor price movements and make substantial profits while avoiding major losses.

- Arbitrage: Taking advantage of market disparities by buying cheap and selling high is a simple but very profitable approach. To do so, you must find two markets with identical assets but different prices. If done right, this can be a very profitable venture for any savvy investor!

- Momentum trading: Short-selling momentum traders look for a stock price that has already begun to decline in price and then take advantage of further drops in price by opening additional short positions. Traders should always set a stop-loss order when implementing a momentum trading strategy, as this will protect against any sudden reversals of the trend

- Covered Call: This approach entails purchasing a specified number of stocks and then selling call options against them in order to profit from the option premiums. Traders benefit from an increase in stock prices because they retain control over the underlying asset.

To prevent significant losses, protective measures such as stop loss orders and position sizing must be used regardless of approach. Furthermore, having a consistent trading strategy that you stick to is essential for remaining disciplined and making informed selections.

When Should Traders Short?

When deciding when to open a short position, traders should know market conditions that could lead to potential losses. Here are a few tell-tale signs that the market may be due for a correction.

Overvalued stocks in a bearish market

When the market is in a bearish phase, investors should look out for stocks that may be overvalued compared to the rest of the market. These stocks could face significant losses when the overall market corrects, and short selling them can effectively capitalize on their decline.

Negative news or scandals

When a corporation is embroiled in a controversy or announces negative news, the price of its shares may fall considerably. This creates an appealing opportunity for short sellers to profit by selling shares they do not own and hope to repurchase them at a cheaper cost, pocketing the difference as profit.

Companies with declining revenue or earnings

As a company’s profits or earnings begin to fall, its stock price may fall as well. Short selling offers a unique chance for those hoping to profit from the current crisis.

Industry or sector downturns

When an industry or sector is in decline, the stocks within that segment are likely to fall as well. Short selling these assets might be an effective approach to profit from the price drop.

Technical analysis signals indicating a potential downtrend

Technical analysis can be used to identify patterns and trends in the market. When a short-term bearish signal occurs, traders may open a short position, as this could indicate that the stock may experience significant losses.

Conclusion

Short sales in trading should be done with caution and can be a great way to make money if performed correctly. In order to get it right, it is important to research and understand the dynamics of the market before taking any risks like shorting. An experienced trader may know when the perfect time is to short sell; however, even those traders will recognize that it is an inherently risky strategy. Despite the potential rewards, there are many variables to consider, which can weigh heavy on retail investors if not considered carefully beforehand. Shorting should always be taken seriously and entered into with proper knowledge of the market and possible trade-offs. With the right approach and adequate preparation, though, short selling can be a great way to increase your profits while trading.

FAQ

What does short trade mean for a beginner investor?

A short trade definition involves selling an asset you don’t own in the hope of buying it back later at a lower price, aiming to profit from a decline in value.

How can I use the short trade definition to manage risk during market downturns?

By applying what does short trade mean in practice, you can offset potential losses on long positions, essentially hedging against falling prices and stabilizing your overall portfolio.

When is the best time to consider a short trade definition approach?

Traders often take a short position if market indicators suggest an asset is overpriced. Knowing what does short trade mean helps you identify when conditions favor selling high and then repurchasing at lower prices.