What is Market Making and How Does It Work?

Articles

With the high volume of trading and the continuously changing price of exchange-traded assets, the stability of market trading, which is achieved by creating an equilibrium balance between the power of buyers and sellers, is especially important. In cases when the demand is higher than the supply, destabilization of quotations appears, and the asset price undergoes great changes. To prevent such situations, there is a particular class of market participants — market makers, who support the prices of financial assets through their activities.

This article will tell you what market making is and its features. In addition, you will learn about the importance of this process and how it affects the financial market. Ultimately, we will discuss the primary market maker types and their distinctive characteristics and examine several conditions necessary for market making.

Key Takeaways

- The main types of market makers in the market include institutional market makers, brokers, dealing desks, investment funds and high net worth private investors.

- Market makers are directly involved in the market making process by providing the liquidity necessary for conducting purchase and sale transactions.

- The primary task of market makers is to balance the power of buyers and sellers, thereby reducing the likelihood of large price fluctuations.

What is the Market Making Process and What are its Features?

In general terms, market making is the process of maintaining the liquidity of a trading instrument by creating and placing simultaneously various orders to buy and sell in order to maintain the necessary trading turnover and thereby stabilize quotations. This process is caused by the fact that for the possibility of buying or selling a financial asset, the second side of the transaction should always be available. When counter bids are not enough, and thus there is not enough liquidity to support the asset’s price, market makers use free cash to balance supply and demand, which helps avoid sharp price changes and, consequently, high volatility.

From the perspective of the average trader, the amount of liquidity is often expressed through changes in volatility. Changes in quotations on the illiquid market occur at a chaotic pace and are sometimes quite significant. An excellent example is the crypto market, a relatively new market that is less liquid than Forex or stock markets. Due to market makers having large amounts of money, they can regulate the level of supply and demand, avoiding sudden price leaps, which frequently lead to impressive profits and significant losses when trading with high-risk instruments like derivatives.

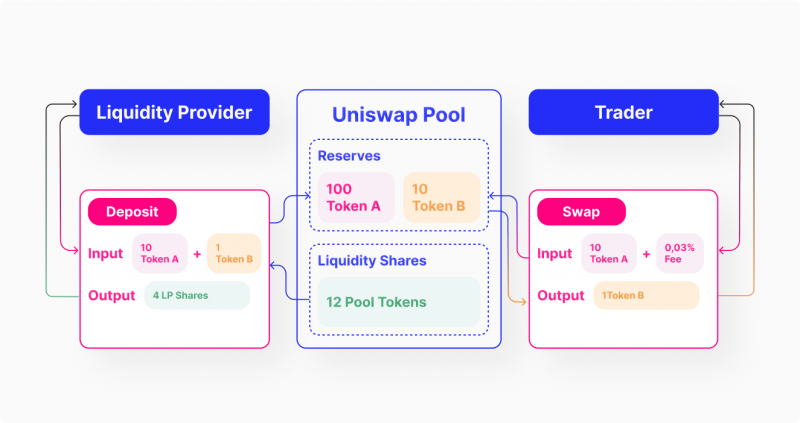

On the other hand, the market may have a shortage of market maker players, which directly affects the liquidity needed to maintain the stability of asset prices. In the crypto market, particularly on decentralized exchanges, the so-called automated market makers (AMMs) — protocols that use automatic algorithms to manage liquidity on the platform – come into play.

Automated market makers work with the help of smart contracts, which allows exchanges to automate and increase the speed and efficiency of matching orders.

The Importance of Market Making: What Impact Does It Have on the Financial Market?

The importance of market makers cannot be overestimated, because they are an integral part of any financial markets where electronic trading in financial instruments takes place. By providing liquidity, market makers play the role of a foundation on which the market is based and on which its stability depends. Market makers’ activity has a direct and quite essential influence on the market itself and on other market participants. Here are a few of the effects that appear when market makers operate.

Maintaining Supply and Demand (Liquidity)

Thanks to the presence of market makers, any participant has the opportunity to buy or sell any financial asset in the right volume at market prices. There are cases when the sentiment of buyers or sellers is either not defined or defined almost unambiguously. In the first case, supply and demand will be poorly defined — the number of bids to buy or sell will be small and the spread between the best prices can be drastically high. In the second case, when the market sentiment is unambiguous, it could be that there are no buyers or sellers in the market at all. The presence of the market maker helps to maintain liquidity, which allows any participant of the trades to always find a buyer or seller.

Maintaining Price Stability

The presence of market makers allows you to maintain the relative stability of financial assets and prevent jump changes in their value. As we said before, there are times when the sentiment of buyers or sellers is either undecided or almost unambiguous. In the first case, most buyers will seek to put lower prices, and sellers — to place bids much higher than the last transaction. In the second case, there may be no bids to buy or to sell on the market at all. The presence of a market maker allows any participant at any time to find a buyer or a seller, and, with the price, always close to the previous deal. In this way, market makers maintain price stability.

Maintaining Trading Volume

Market makers provide liquidity and price stability. Consequently, it is less likely that transactions in the market will stop due to the inability to buy or sell a financial instrument. Due to this, trade turnover (or volume) is also supported. High trading volume allows market participants to buy or sell large blocks of assets, whether common stocks, crypto, or Forex currencies, at market price. This, in turn, makes an exchange or broker attractive to traders and investors, who are usually guided by the trading volume before deciding whether to invest.

The exchange or broker may grant market makers special powers to maintain the trading volume. So, for example, except for the last deals and “stack” of limited orders — the list of price general market orders of all traders — the market maker can see the pending orders, take profit and stop losses.

For example, the New York Stock Exchange (NYSE) allocates a category of participants on the stock market — specialists. The specialist becomes the second party to every transaction with a certain security. As a result, it may have the following additional functions:

Mediation between Buyers and Sellers

This function of the market maker implies the process of making all deals at the exchange only with the participation of specialists, who determine the appropriateness of their performance and determine other parameters of the deal. Such a function can be useful in cases where it is necessary to ensure that the deal will be concluded strictly at the set market price and will be executed in full.

Information Provision to Trading Participants

This function of the market maker represents the process in which specialists undertake to record all open and completed trades in the specialist’s book and provide bidders with all necessary and related information.

Recognition of Quotations

In this case, specialists play the role of information supply. For various market participants, such as investment funds and commercial banks, it is important to have official recognition of certain prices — closing, opening, buy and sell prices, etc. The obligation to determine such prices for individual instruments is imposed by the exchange on the specialist.

Types of Market Makers and Their Distinguishing Characteristics

Today, trading in different assets has moved to a new level and has become faster, more convenient and functional. Due to these and other advantages, every day more and more traders and investors begin to explore the basis of trading, whether it is the cryptocurrency market or Forex. In order to provide a constant flow of liquidity to a particular market, there is a whole list of different types of market makers supporting their stability.

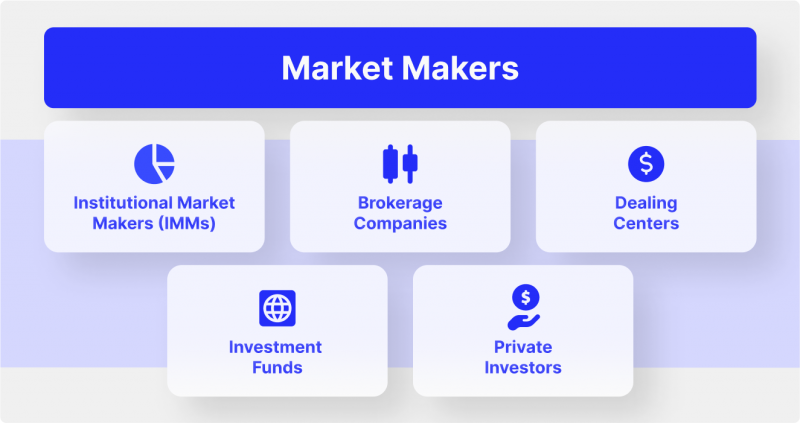

Institutional Market Makers (IMMs)

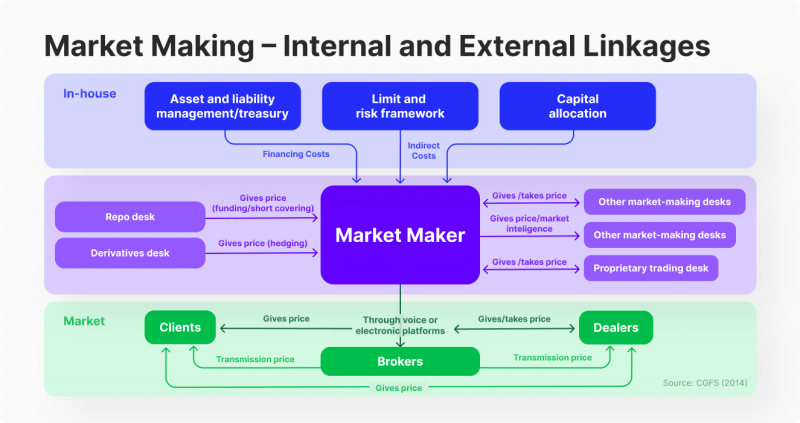

Institutional money market makers are predominantly commercial banks of various sizes that work together to provide liquidity to financial institutions, among which special attention should be paid to the field of electronic trading, where Forex brokers, crypto exchanges and other services act as consumers of liquidity offering access to capital markets. Institutional market makers play a primary role in maintaining liquidity in the markets due to the enormous amount of funds they have at their disposal. Their participation makes it possible to stabilize any market and prevent price collapse.

Brokerage Companies

Brokerage companies are intermediaries between the financial markets and traders who, by registering on the platform, enter into an agreement that gives them access to trading financial instruments. Brokers are regulated and licensed by financial authorities like the Financial Industry Regulatory Authority (FINRA). In all their variety, brokerage companies also provide liquidity to financial markets or other financial institutions, thus maintaining a balance between supply and demand for a particular currency pair or any other trading instrument. It is worth noting that brokerage companies can offer institutional liquidity in cooperation with larger banks, despite a more modest volume of available funds compared to institutional market makers.

Dealing Centers

A dealing company, or a center, is an intermediary company operating in the Forex market. This organization facilitates access to the foreign exchange market for traders who do not have enough assets to trade independently. Dealing centers may not put clients’ orders on the market but cancel them between themselves if one client wants to sell and another wants to buy. This situation is called internal clearing; essentially, it is that the buyer and the seller exchange the difference in the buy-sell price. The more clients there are, the more transactions overlap each other. Dealing centers form a directed position out of the surplus and bring it to the real forex market, thus securing themselves against unfavorable price changes, reducing costs, and increasing profits.

Investment Funds

An investment fund is an organization (state, municipal or private, commercial) that manages the money of investors or depositors. The investment fund’s main task is to combine investors’ money into a “common pot” and dispose of customer funds so that the return on investment in the fund exceeds the rate of inflation or the potential return on the deposit. Investors’ assets are managed either by the fund managers or by third-party specialists — employees of management companies.

Investment funds, as a rule, have considerable capital, allowing them to participate in financial markets and contribute to the stability of the markets by providing the necessary volume of liquidity.

Private Investors

Many private investors have a solid amount of cash that helps them trade freely in many financial instruments and extract bellwether percentages of profit. Due to this, such investors often act as market makers, providing their capital as a kind of collateral for the possibility of providing liquidity of certain trading instruments. Private investors acting as market makers make profit from the difference between the buying and selling price, which sometimes amounts to a considerable sum.

It is worth noting that big private investors in trading are called whales, because they are able to directly influence the behavior of asset prices in the process of buying or selling large volumes, which typically causes serious volatility.

Prerequisites for the Market Making Process

The work of market makers is not just important — it has much more meaning than simply providing liquidity to the market. Nevertheless, in order to carry out the process of market making, these participants must comply with several indispensable conditions which are presented below.

Maintaining Stable Spread

The market maker must keep a stable difference between the buy and sell price — the price quotation spread (bid-ask spread). This difference can be stable either in percentage or absolute value — in monetary units (as a rule, in their fractions), for the stock market or the Forex market, or in percentage points for the bond market. Thus, a market maker working with the ruble-dollar pair can quote EUR 1.0850/1.1900, EUR 1.0975/1.1025, or EUR 1.1050/1.1100 for $1, thus maintaining the spread ₽0.005. Adhering to the spread maintains price stability for the financial instrument, preventing sharp fluctuations and price gaps.

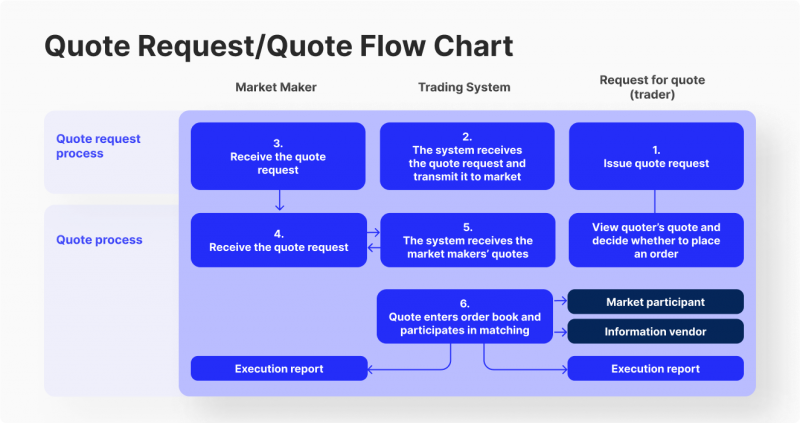

Maintaining Two-way Quotes

A market maker carries out the price of a financial instrument, foreign currency, and/or goods by submitting and simultaneously maintaining orders to buy and sell (bilateral quotes) about the relevant financial instrument, foreign currency, and/or goods during the trading session. In case the trading participant assumes the obligation to the trade organizer to maintain the price of a financial instrument, foreign currency, and/or commodity, the trade organizer sets mandatory requirements for the spread of a bilateral quotation on the orders submitted by the market maker, the minimum volume of orders submitted by the market maker, the time period during which the market maker must submit the relevant orders.

Conclusion

It is impossible to imagine the financial market without the process of market making, which provides the stability of the entire financial market as a whole, allowing you to avoid unpleasant situations resulting in significant losses as a result of high price fluctuations. A market maker’s work also helps maintain the desired level of liquidity to reduce the risk of wide spreads and slippage in trading.