What Is B2TRADER Trading Platform, and How Does It Work?

Running a successful brokerage is about offering traders the trading software. Whether you're managing a Forex trading platform, a crypto exchange, or a multi-asset brokerage, your technology determines your success.

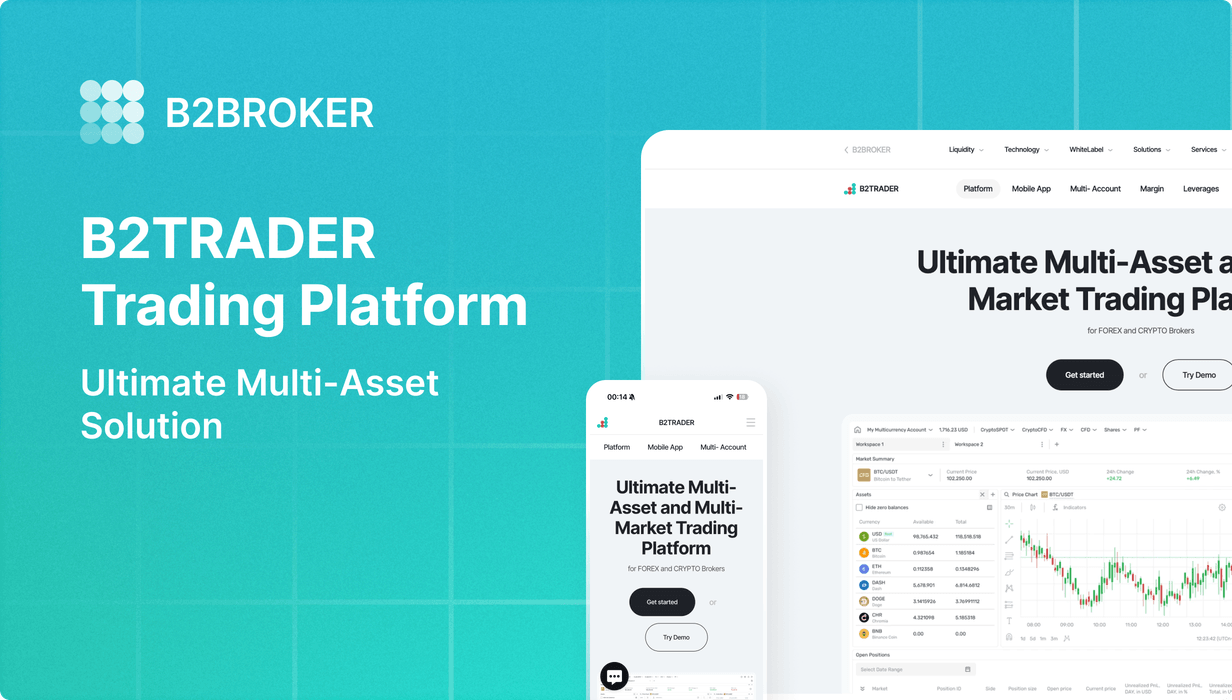

Designed for institutional and retail brokers, B2TRADER by B2BROKER is more than just another white-label trading platform. It seamlessly integrates crypto, Forex, and CFDs, offering ultra-fast execution, multi-market support, and full customisation without the usual tech headaches.

In this article, we’ll explore what the B2TRADER trading platform is, how it works, and why it stands out as a top solution for brokers and institutional clients alike.

Key Takeaways

B2TRADER is a multi-asset platform supporting Forex, Crypto, and more.

It processes up to 3,000 requests per second, ensuring ultra-fast execution.

B2TRADER integrates with top liquidity providers for optimal pricing and deep liquidity.

It offers a mobile-first experience, making it the best trading platform for modern traders.

What Is B2TRADER?

Developed by global technology provider B2BROKER, B2TRADER is the culmination of years of research, innovation, and multi-million dollar investments.

Initially focused on delivering a powerful crypto trading platform, B2TRADER rapidly evolved to include CFD and Forex trading platform functionalities under one seamless umbrella. This unique expansion was driven by the reality that modern brokers can no longer afford to limit themselves to a single market.

A Vision for Multi-Market and Multi-Asset Trading

Traditional white-label trading platform solutions often cater to narrow asset classes, focusing on either Forex or crypto, but rarely both in a genuinely robust manner. B2TRADER turned that concept on its head by integrating:

Crypto Spot Markets

Forex Markets

CFD Markets

This multi-asset trading approach meets the rising demand from a new generation of traders who want to shift effortlessly between spot crypto and margin-based products like CFDs—sometimes even from the same account.

How B2TRADER Works: Core Features and Functionalities

In this section, we’ll break down the core facets of B2TRADER, from its engine and liquidity integrations to advanced margin settings—and culminate with a deep dive into its robust mobile application.

High-Speed Order Processing

Trade execution speed sits at the core of any top trading platform. B2TRADER’s matching engine supports up to 3,000 requests per second, ensuring rapid confirmations and minimal slippage. Because financial markets can shift dramatically in microseconds, B2TRADER’s performance can be the difference between capturing a profitable move or missing it entirely.

True Multi-Asset Capabilities

B2TRADER allows you to introduce and manage an unlimited number of trading instruments, enabling you to offer:

- Forex

- Crypto Spot

- Crypto CFD

- Metals

- Indices

- Energy

- Commodities

- NDFs CFD

- Equities and ETFs as CFDs

- Cash Trading

These instruments can all operate from a single account or multiple dedicated accounts, depending on your brokerage model. It’s entirely customisable, allowing each broker to shape the platform to fit existing workflows, legal structures, and business objectives.

Cross-Margin Collateral Management

Cross margin collateral functionality is a powerful feature of B2TRADER, which allows for the distribution of available capital across different trading positions and asset classes.

Brokers can set specific collateral limits for currencies, whether fiat or crypto, promoting more flexibility in daily risk management. Traders, in turn, gain full control over how they allocate their assets to margin—choosing to concentrate on a single currency or diversify across multiple ones.

Enhanced Capital Efficiency: Traders can use various crypto assets or fiat currencies as collateral, effectively optimising margin usage.

- Dynamic Risk Management: The margin ratio can be adjusted on a per-asset basis, making it easier for brokers to incentivise certain currency pairs or manage volatility in real time.

Dynamic Leverage

Traders in search of the best trading platform look for dynamic leverage capabilities, as different assets and market conditions may call for different levels of margin. B2TRADER delivers exactly that. Admins can preset leverage ratios that can change in response to market volatility or broker-defined risk rules, ensuring a stable and controlled trading environment.

Liquidity-Agnostic Integration

Another area in which B2TRADER distinguishes itself is liquidity management. By integrating with OneZero, PrimeXM, and B2CONNECT, it connects brokers with:

Major Liquidity Providers: Gain access to deep Forex and CFD liquidity.

Leading Crypto Exchanges: Seamless integration with top-tier crypto exchanges via B2CONNECT.

This liquidity-agnostic design means B2TRADER can easily plug into different providers, ensuring robust spreads, minimal latency, and better fills. It eliminates one of the largest headaches in brokerage operations: stable and cost-effective liquidity.

Customisable Risk Models: A-Book, B-Book, and Now C-Book

B2BROKER has recently introduced C-Book routing to supplement existing A-Book and B-Book execution models. C-Book gives crypto and CFD brokers a new layer of flexibility:

Partial External Execution: Route a set percentage of order volumes to external providers (A-Book).

Partial Internal Execution: Retain the remaining percentage in-house (B-Book) for optimised profitability.

Brokers can intelligently manage exposure across multiple liquidity pools, mitigating operational risk and making better use of capital.

Benefits for Brokers: Why Choose B2TRADER

B2TRADER is designed to help brokers launch quickly, operate seamlessly, and expand effortlessly, whether you're running a startup or a large-scale brokerage.

Fast Deployment and Scalability

Setting up a new white label trading platform can be a lengthy, expensive process. However, B2TRADER offers a speedy setup—often just a matter of days—thanks to its pre-configured SaaS model. Once deployed, the platform’s elastic architecture effortlessly scales to thousands of users and can handle massive transaction volumes without a hitch.

Cost Predictability

Whereas many competitors charge based on traded volume, B2TRADER employs an accounts-based charging model. This gives brokers a clearer view of operational expenses, making it easier to forecast revenue and plan for growth.

Comprehensive White Label Experience

B2TRADER goes beyond mere back-end technology. As a white label trading platform, it allows brokers to establish a unique brand presence by customising the interface, adding corporate logos, and integrating local payment solutions.

Coupled with a dedicated mobile app (available for iOS, Android, and APK distribution), brokers can target user acquisition in creative ways without being bogged down by complicated technical constraints.

Customisation for Institutional Clients

B2TRADER offers advanced order-flow controls, sophisticated reporting systems, and near-limitless instrument creation for larger brokerages and institutional clients.

By blending multi-asset trading capabilities with advanced analytics and risk management, the platform caters to both novice and professional traders. Institutions can even set up prime brokerage services, providing liquidity streams to sub-brokers under a single administrative umbrella.

Whether you're an institutional broker or a startup, B2TRADER helps you grow smarter and faster.

Benefits for Traders: Faster, Smarter, More Efficient

A trading platform is only as strong as its user experience. B2TRADER goes all-in on providing traders with tools that enhance their performance and enjoyment.

Seamless User Flow with End-to-End Mobile Support

Today’s traders demand mobility. B2TRADER’s mobile app covers the entire trading journey, from registration and verification (KYC) to deposit, trading, and withdrawal. The app fully integrates all the features of the desktop version—like charting, order management, and analytics—into a user-friendly mobile interface.

Advanced Trading Tools: Stop Loss, Take Profit, Trailing Stops

B2TRADER’s robust order types, including Stop Loss, Take Profit, and the newly introduced Trailing Stops, help traders lock in profits and mitigate potential losses automatically. Even when users are away from their devices, these protective functionalities keep positions secure, which is paramount in highly volatile markets like crypto.

Comprehensive Analytics and Real-Time Reporting

Whether you trade Forex or crypto, timely data analysis is crucial. B2TRADER’s platform includes:

Real-Time Charts and Quotes: Quickly assess market direction.

Live Account Performance Metrics: Track gains, losses, and margin usage.

Detailed Transaction Histories: Ensure full traceability and compliance.

Everything loads quickly, thanks to the platform’s well-optimized data architecture.

The Technology Behind the Scenes

B2TRADER’s infrastructure is built to handle the heaviest trading loads without breaking stride. From real-time order matching to data integrity checks, every piece of the architecture aligns with one mission: to deliver seamless, ultra-fast, and reliable trading experiences.

Distributed Architecture for Reliability

B2TRADER employs a highly distributed structure that separates live trading components from historical data servers. This design ensures that if one element goes offline, essential trading functions remain unaffected, thereby protecting the integrity of order execution.

By consistently replicating data throughout the network, B2TRADER guarantees fault tolerance and safeguards every transaction in real-time. This layered strategy for resilience renders a single point of failure virtually impossible, ensuring that market access remains available even during extreme traffic surges or unforeseen events.

FIX and REST APIs

The platform supports industry-standard FIX and REST APIs, enabling brokers and institutional clients to connect external trading systems, risk engines, or analytics modules. This versatility encourages third-party developers to create specialised solutions tailored to individual brokerage needs, such as integrating advanced quantitative models or custom client dashboards.

Smart Cross-Rate Tree for Precision Pricing

Under the hood, B2TRADER leverages a sophisticated cross-rate tree that updates on the fly to provide consistent pricing across all pairs and instruments. When a currency or commodity price changes, the system recalculates the most efficient route for deriving that pair’s quote, automatically switching to backup paths if the primary feed encounters any issues.

Scalability to Match Any Growth Trajectory

Handling 100,000 accounts, each with multiple assets, and thousands of instruments is no small feat. B2TRADER is engineered to maintain performance even under extreme loads. As your user base grows, additional server capacity can be spun up swiftly, ensuring minimal downtime and consistent top-tier execution.

B2TRADER in Emerging Markets and Institutional Settings

Many emerging markets are underserved by mainstream financial technologies, often because they involve non-standard local currencies or exotic trading instruments. B2TRADER addresses this by allowing brokers to:

Launch new local markets using custom currency pairs or instruments.

Set local fiat currencies (or popular cryptocurrencies) as collateral for margin trading.

Establish multi-language and multi-currency front ends to address regional needs.

B2TRADER ensures consistent pricing and continuous operations, even if one liquidity source becomes unavailable.

Solution for Large Institutional Players and Emerging Brokers

High-volume brokerages, hedge funds, and prime brokers can leverage B2TRADER’s extensive liquidity management features—such as multi-provider connectivity, flexible routing rules, and advanced reporting—to optimise their trading ecosystems. Meanwhile, its intuitive interface and straightforward deployment make it just as attractive for retail-focused brokers aiming to scale.

Whether you need real-time risk monitoring across thousands of sub-accounts or require a sleek, user-friendly experience that appeals to everyday traders, B2TRADER excels at delivering both. With its robust matching engine, custom commission structures, and minimal latency, B2TRADER stands ready to meet the demands of large institutions and retail brokerages alike.

Final Remarks

Empower your brokerage with the best trading software designed to excel in ever-changing financial markets. From crypto trading platform capabilities to Forex and CFD integrations, B2TRADER is your all-in-one solution for success.

Start your journey now!

FAQ

- What types of markets can I offer with B2TRADER?

You can provide Crypto Spot, Forex, and CFD trading on a single account or across multiple accounts. B2TRADER supports major crypto exchanges, Forex liquidity providers, and top CFD instruments, making it a truly multi-asset trading platform.

- How long does it take to set up B2TRADER for my brokerage?

B2TRADER is a SaaS solution that can be configured within days. Its deployment process is streamlined to minimise technical complexities, allowing you to focus on your core business without extended downtime.

- Does B2TRADER handle mobile trading?

Absolutely. B2TRADER offers dedicated mobile apps for iOS and Android, featuring a seamless interface for registration, KYC, deposits, trading, and withdrawals. It’s a one-stop solution for traders who prefer to stay active on the go.

- Can B2TRADER help me attract institutional clients?

Yes. B2TRADER is designed to be flexible enough for both retail and institutional settings. With features like support for thousands of instruments, advanced order routing, and multiple liquidity connections, it’s an ideal choice for large brokerages and financial institutions.