5 सरल चरणों में क्रिप्टो एक्सचेंज प्लेटफ़ॉर्म कैसे खोलें

पंद्रह साल पहले, जब क्रिप्टोकरेंसी शुरू की गई थी, तो केवल कुछ लोगों ने ही इसके असाधारण भविष्य के विकास की भविष्यवाणी की थी, जिनमें संभवतः बिटकॉइन के संस्थापक और डेवलपर सातोशी नाकामोतो भी शामिल थे।

आज, विकेंद्रीकृत एसेट विभिन्न उद्योगों में एक प्रमुख भूमिका निभाते हैं, जो कई व्यवसायों के लिए उभरने और अधिकांश क्रिप्टो कॉइन्स और परियोजनाओं की वैश्विकता और विकास पर पूंजी लगाने का मार्ग प्रशस्त करते हैं। क्रिप्टो एक्सचेंज प्लेटफ़ॉर्म शुरू करना संपन्न विकेंद्रीकृत अर्थव्यवस्था से कमाई करने का एक मार्ग है।

हालाँकि, इस तरह के प्लेटफ़ॉर्म को विकसित करने और लॉन्च करने में कई चुनौतियाँ और विचारों को धयान में रखना होता हैं। आइए क्रिप्टो एक्सचेंज खोलने से पहले कुछ महत्वपूर्ण पहलुओं पर प्रकाश डालें और चर्चा करें कि पाँच चरणों में क्रिप्टो बिज़नेस को कैसे शुरू किया जा सकता है।

मुख्य बातें

- क्रिप्टो एक्सचेंज सॉफ़्टवेयर उपयोगकर्ताओं को वर्चुअल कॉइन्स, टोकन, स्टेबलकॉइन और अन्य डिजिटल एसेटों को खरीदने, बेचने और स्वैप करने की अनुमति देता है।

- क्रिप्टो एक्सचेंज चार प्रकार के होते हैं: केंद्रीकृत, विकेन्द्रीकृत, P2P और इंस्टेंट।

- आप इन-हाउस डेवलपर टीम का उपयोग करके या टर्नकी समाधान सॉफ़्टवेयर प्रदाता को काम पर रखकर अपना स्वयं का क्रिप्टो एक्सचेंज बिज़नेस खोल सकते हैं।

क्रिप्टो एक्सचेंज प्लेटफ़ॉर्म को समझना

क्रिप्टोकरंसी एक्सचेंज ऐसी वेबसाइट हैं जो उपयोगकर्ताओं को वर्चुअल कॉइन, टोकन, स्टेबलकॉइन और अन्य डिजिटल एसेटों को खरीदने, बेचने और स्वैप करने में सक्षम बनाती हैं। वे पारंपरिक विदेशी मुद्रा विनिमय किऑस्क की तरह ही काम करते हैं, लेकिन विकेंद्रीकृत कॉइन्स के लिए, फ़िएट-टू-क्रिप्टो कन्वर्शनकी पेशकश करने के इलावा।

जब 2010 और 2013 के बीच बिटकॉइन ने लोकप्रियता हासिल करना शुरू किया, तब केवल 50 के आसपास डिजिटल कॉइन्स थे। यह संख्या बहुत ज़्यादा बढ़ी, और आज, 10,000 क्रिप्टोकरेंसियाँ मौजूद हैं,, जो विवादास्पद रूप से 20,000 से भी ज़्यादा हो सकती हैं।

जब आप क्रिप्टो एक्सचेंज सॉफ़्टवेयर खोलते हैं, तो आपके पास प्रत्येक लेनदेन के प्रतिशत के रूप में कमीशन फीस के बदले में कई ब्लॉकचेन-आधारित करेंसियों को खरीदने, बेचने और परिवर्तित करने के विशाल अवसर होते हैं।

Binance, Coinbase, और Uniswap कुछ सबसे बड़े एक्सचेंज प्लेटफ़ॉर्म हैं, और वे दैनिक संचालन और लेनदेन में हज़ारों डिजिटल एसेटों और लाखों उपयोगकर्ताओं को शामिल करते हैं।

आपको एक क्रिप्टो एक्सचेंज खोलने की ज़रूरत क्यों है?

बिटकॉइन के साथ भुगतान करना कई कारणों से पारंपरिक बैंक ट्रांसफर की तुलना में ज़्यादा किफायती और ज़्यादा तेज़ है। विकेंद्रीकृत लेनदेन में कम बिचौलिए शामिल होते हैं और स्वचालित तंत्र का उपयोग करके सीधे संसाधित किए जाते हैं, जिससे वे तेज़ और ज़्यादा लागत प्रभावी हो जाते हैं।

इन कारकों ने अधिक उपयोगकर्ताओं को DeFi एसेटों और लेनदेन के डिजिटल साधनों पर स्विच करने के लिए प्रोत्साहित किया है, जिससे तेज़ी से भुगतान और व्यक्तिगत डेटा सुरक्षा में वृद्धि हुई है।

इसलिए, एक क्रिप्टो एक्सचेंज बनाने से आप इन बढ़ते रुझानों का लाभ उठा सकते हैं और ब्लॉकचेन संचालन की विशाल संख्या से लाभ कमा सकते हैं।

क्रिप्टोकरेंसी एक्सचेंज के प्रकार

आभासी मुद्राओं को बदलने का अवसर प्रदान करना एक सीधे-सादे बिज़नेस मॉडल जैसा लगता है। हालाँकि, हम नीचे कुछ प्रकार के एक्सचेंजों के बारे में बताएँगे।

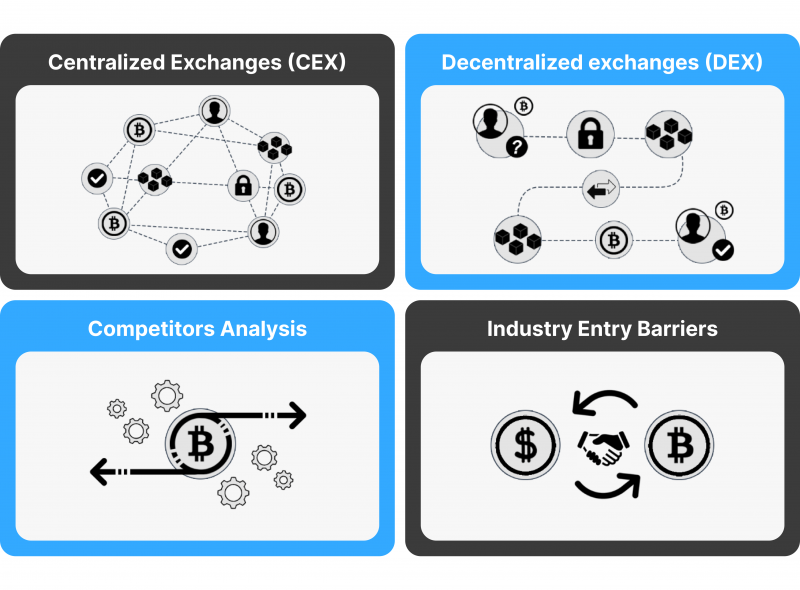

केंद्रीकृत एक्सचेंज

यह एक्सचेंज का सबसे आम प्रकार है, जहाँ सर्वर एक ऐसे मध्यस्थ की तरह काम करता है जो कॉइन्स बेचने वालों को खरीदारों से मिलाता है। ये कस्टोडियन प्लेटफ़ॉर्म उपयोगकर्ताओं के डिजिटल एसेटों को संग्रहीत करते हैं और उपयोगकर्ता के अकाउंट वॉलेट पर लेनदेन करते हैं।

केंद्रीकृत क्रिप्टो एक्सचेंज सॉफ़्टवेयर उपयोगकर्ताओं को फिएट करेंसी का उपयोग करके BTC खरीदने की अनुमति देते हैं और निवेशकों के लिए एक क्रिप्टो ट्रेडिंग प्लेटफ़ॉर्म प्रदान करते हैं।

उदाहरण: Binance और Kraken.

क्या आपको अपने ब्रोकरेज सेटअप से जुड़ा कोई सवाल है?

हमारी टीम आपकी मदद के लिए तैयार है — चाहे आप शुरुआत कर रहे हों या विस्तार।

विकेंद्रीकृत एक्सचेंज

ये दूसरे सबसे लोकप्रिय एक्सचेंज प्रकार हैं जहाँ लेनदेन को स्टोर करने और संचालन में कोई तृतीय-पक्ष संस्था शामिल नहीं होती है। इसके बजाय, उपयोगकर्ता प्लेटफ़ॉर्म पर अपने वेब 3.0 वॉलेट को कनेक्ट करके क्रिप्टोकरेंसी खरीदते और बेचते हैं।

इन्हें नॉन-कस्टोडियल प्लेटफ़ॉर्म भी कहा जाता है, ये उपयोगकर्ता के डिजिटल एसेटों को होल्ड करके नहीं रखते हैं और सीमित ट्रेडिंग और लिक्विडिटी विकल्प प्रदान करते हैं।

उदाहरण: Pancake Swap और Uniswap.

NXT एसेट एक्सचेंज कथित तौर पर पहला विकेन्द्रीकृत क्रिप्टो एक्सचेंज है, जिसकी स्थापना 2014 में BCNext नामक एक अज्ञात सॉफ़्टवेयर डेवलपर द्वारा की गई थी।

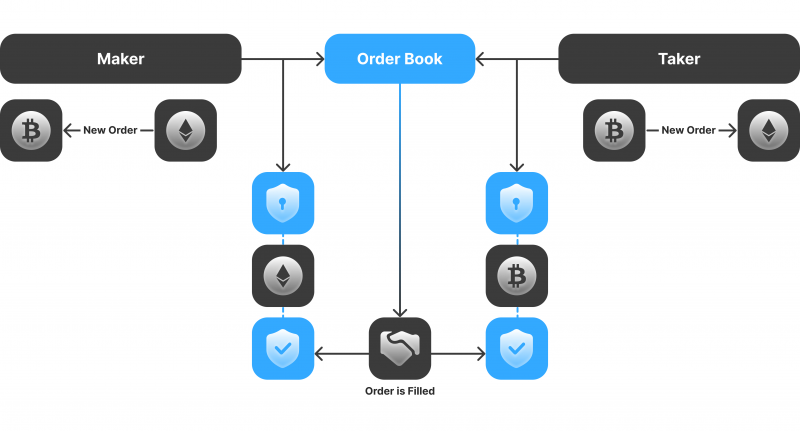

पीयर-टू-पीयर एक्सचेंज

P2P प्लेटफ़ॉर्म उपयोगकर्ताओं को विकेंद्रीकृत एक्सचेंजों के समान सीधे कनेक्ट करने और करेंसियों का आदान-प्रदान करने की अनुमति देता है। हालाँकि, मुख्य अंतर यह है कि संचालन एस्क्रो सेवाओं का उपयोग करके किया जाता है, यह सुनिश्चित करते हुए कि एक पक्ष का ऑर्डर दूसरे पक्ष द्वारा अपनी ऑफर देने के बाद पूरा हो।

दूसरे शब्दों में, वे दोनों पक्षों को सहमत की गई कीमत पर वह प्राप्त करने की गारंटी देते हैं जो वे चाहते हैं, जिससे निष्पक्षता और पारदर्शिता को बढ़ावा मिलता है।

उदाहरण: LocalBitcoins और Paxful.

इंस्टेंट एक्सचेंज

इंस्टेंट एक्सचेंज एक सरल कार्यक्षमता प्रदान करते हैं, कमीशन शुल्क के लिए एक क्रिप्टोकरेंसी को दूसरे के लिए स्वैप करते हैं। ये प्लेटफ़ॉर्म उपयोगकर्ताओं के एसेटों को स्टोर नहीं करते हैं और इनमें खाता स्थापित करने की ज़रूरत नहीं होती है।

इसके बजाय, उपयोगकर्ता अपने वॉलेट को कनेक्ट कर सकते हैं और प्लेटफ़ॉर्म द्वारा समर्थित अन्य एसेटों के लिए अपने स्वामित्व वाले आभासी कॉइन्स और टोकनों का आदान-प्रदान कर सकते हैं।

उदाहरण: Changelly और SwapZone.

5 चरणों में क्रिप्टो एक्सचेंज बनाएँ

यदि आप पहली बार क्रिप्टोकरेंसी एक्सचेंज बिज़नेस खोल रहे हैं, तो आपको उन भारी चरणों और कारकों से डर लग सकता है जिन पर आपको विचार करने की ज़रूरत होती है।

हालाँकि, इस तेज़ गति वाले उद्योग में, क्रिप्टो एक्सचेंज बिज़नेस को जल्दी से शुरू करना महत्वपूर्ण है ताकि क्रिप्टो बाज़ार प्रतिभागियों की काफी संख्या के साथ प्रतिस्पर्धी बन सकें। इसलिए, हम निम्नलिखित 5-चरणीय मार्गदर्शिका के साथ इस प्रक्रिया को सरल बनाते हैं।

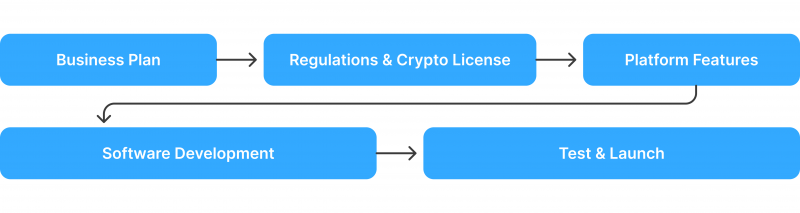

एक बिजनेस प्लान बनाएँ

सबसे पहला कदम एक बिज़नेस प्लान तैयार करना है, जिसमें आपके लक्षित बाज़ार की पहचान, एक्सचेंज प्लेटफ़ॉर्म का प्रकार, वे देश जिन्हें आप सेवा प्रदान करना चाहते हैं तथा आप अपने बिज़नेस का प्रचार कैसे करेंगे, शामिल हैं।

यह कदम आपके बिज़नेस में निवेश आकर्षित करने और पूंजी जुटाने के लिए महत्वपूर्ण है। इसके अलावा, कुछ अधिकार क्षेत्रों में बिज़नेस परमिट जारी करने से पहले बहु-वर्षीय बिज़नेस प्लान की ज़रूरत होती है।

आपके प्लान में आपका लाभप्रदता मॉडल, आप अपने ग्राहकों को कैसे सेवा देंगे, आप कौन सा सॉफ़्टवेयर उपयोग करना चाहते हैं, और आप लिक्विडिटी और तकनीकी समाधान कैसे प्राप्त करेंगे, ये शामिल होना ज़रूरी है।

स्थानीय विनियमों की समीक्षा करें और लाइसेंस प्राप्त करें

क्रिप्टो विनियम देशों के बीच व्यापक रूप से भिन्न होते हैं। इसलिए, क्रिप्टो एक्सचेंज बिज़नेस खोलने से पहले, विकेंद्रीकृत फाइनेंस और डिजिटल एसेटों के बारे में स्थानीय नियमों से खुद को परिचित करना महत्वपूर्ण है।

यह आपके लक्षित बाज़ार को निर्धारित करने में भी महत्वपूर्ण है। उदाहरण के लिए, दक्षिण अफ्रीका ने हाल ही में क्रिप्टो एक्सचेंज लाइसेंसजारी करना शुरू किया है, जबकि कतर और चीन में बिटकॉइन से लेनदेन करना प्रतिबंधित है।

आपको स्थानीय वित्तीय विनियामक के साथ पंजीकरण भी करना होगा और लागू होने वाले कानूनों का निरंतर पालन सुनिश्चित करने के लिए अनुपालन टीम को नियुक्त भी करना होगा। अपने प्लेटफ़ॉर्म में विश्वास बढ़ाने और अपनी सेवाओं का उपयोग करने के लिए ज़्यादा ग्राहकों को आकर्षित करने के लिए क्रिप्टो बिज़नेस लाइसेंस प्राप्त करना अत्यंत महत्वपूर्ण है।

अपनी क्रिप्टो एक्सचेंज के फ़ीचर्स निर्धारित करें

आप अपने ग्राहकों को कौन सी सेवाएँ और फ़ीचर्स प्रदान करना चाहते हैं, इस पर रणनीति बनाएँ। इसमें ग्राहकों को लुभाने और अपनी लीड रूपांतरण दर बढ़ाने के लिए साइनअप बोनस और प्रमोशन पैकेज शामिल हो सकते हैं।

इससे आपको यह समझने में मदद मिलती है कि क्रिप्टो एक्सचेंज प्लेटफ़ॉर्म बनाने के लिए आपको क्या चाहिए। सबसे ज़्यादा माँग वाली सेवाओं पर बाज़ार अनुसंधान करें, चाहे आप अपने ग्राहकों को क्रिप्टोकरेंसी और अन्य कस्टोडियल क्षमताओं और ग्राहक सहायता कार्यों के साथ खरीदने, बेचने, ट्रेड करने, स्वैप करने या निवेश करने की अनुमति देना चाहते हों।

अपनी क्रिप्टोकरेंसी एक्सचेंज बनाना शुरू करें

एक क्रिप्टो एक्सचेंज प्लेटफ़ॉर्म को बनाने के दो तरीके हैं। आप सिस्टम को शुरू से बना सकते हैं या प्री-बिल्ट सॉफ़्टवेयरसे लैस करने के लिए वाइट-लेबल समाधान प्रदाता को नियुक्त कर सकते हैं। आइए उनके बीच के अंतरों को समझाते हैं।

इन-हाउस डेवलपमेंट

एक्सचेंज प्लेटफ़ॉर्म डिज़ाइन करने के लिए आंतरिक संसाधनों पर निर्भर रहना निर्माण में लचीलापन प्रदान करता है। आप प्रक्रिया और उन फ़ीचर्स पर अधिकतम नियंत्रण का आनंद ले सकते हैं जिन्हें आप जोड़ना चाहते हैं।

जबकि, इन-हाउस क्रिप्टो एक्सचेंज डेवलपमेंट के लिए योग्य कर्मचारियों को खोजने, उन्हें नियुक्त करने और प्रशिक्षित करने के लिए बहुत ज़्यादा समय और फंड की ज़रूरत होती है। इसके अतिरिक्त, एक लंबा परीक्षण और गुणवत्ता नियंत्रण चरण आपके बिज़नेस को शुरू करने की अवधि की पूरी प्रक्रिया महीनों तक बढ़ा देगी।

500+ ब्रोकरेज को शक्ति देने वाले टूल्स की खोज करें

हमारे संपूर्ण इकोसिस्टम का अन्वेषण करें — लिक्विडिटी से लेकर CRM और ट्रेडिंग इंफ्रास्ट्रक्चर तक।

वाइट लेबल डेवलपमेंट

वाइट-लेबल कंपनियाँ वे डेवलपर हैं जो पहले से बनाए गए टेम्प्लेट प्रदान करती हैं, जिन्हें आपके व्यावसायिक उपयोग के लिए एकीकृत करने से पहले अनुकूलन और ब्रांडिंग की ज़रूरत होती है।

ये टर्नकी समाधान आपके बाज़ार में आने के समय को कम कर देते हैं, जिससे आप जल्दी से अपनी खुद की क्रिप्टो एक्सचेंज खोल सकते हैं और महीनों के विकास की तुलना में तेज़ी से पैसा कमाना शुरू कर सकते हैं।

WL प्रदाता तकनीकी सहायता, ऑनबोर्डिंग और सर्वर होस्टिंग प्रदान करते हैं, जिससे आप अपने मुख्य बिज़नेस के संचालन पर ध्यान केंद्रित कर सकते हैं। बदले में, वे क्रिप्टो एक्सचेंज शुरू करने के लिए अलग-अलग लागत लेते हैं, जो एकमुश्त भुगतान या आवर्ती वार्षिक फीस हो सकती है।

अपना एक्सचेंज प्लेटफ़ॉर्म टेस्ट करें और लॉन्च करें

अंतिम चरण आपके प्लेटफ़ॉर्म का परीक्षण करना है, यह सुनिश्चित करना कि फ़ीचर्स अपेक्षित रूप से काम कर रहे हैं और सर्वर बिना डाउनटाइम या क्रैश हुए सुचारू रूप से चल रहा है।

आप अपने क्रिप्टो बिज़नेस को अपने एक्सचेंज सॉफ़्टवेयर का पूरी तरह से परीक्षण करने और कई प्रारंभिक जाँचों के बाद ही लॉन्च कर सकते हैं। इसके साथ ही आपकी वेबसाइट के बारे में प्रचार करने और निवेशकों और क्रिप्टो समुदायों को आपके प्लेटफ़ॉर्म का उपयोग करने के लिए प्रोत्साहित करने के लिए एक मार्केटिंग अभियान भी होना चाहिए।

निष्कर्ष

क्रिप्टो एक्सचेंज प्लेटफ़ॉर्म बनाना बहुत ही मुश्किल और कठिन काम हो सकता है। आपको कानूनी, तकनीकी और व्यावसायिक दृष्टिकोण से कई चीज़ों पर विचार करना होगा। हालाँकि, अगर इसे सही तरीके से प्रबंधित किया जाए, तो यह बहुत ज़्यादा फायदेमंद हो सकता है।

हमरी पाँच-चरणीय मार्गदर्शिका का उपयोग करके, आप अपना क्रिप्टो एक्सचेंज प्लेटफ़ॉर्म खोल सकते हैं। आप अपने बिज़नेस प्लान बनाकर, कानूनी समीक्षा करके, सॉफ़्टवेयर के फ़ीचर्स का निर्धारण कर, डिज़ाइन विकसित करके और सफल परीक्षण के बहुत से राउंड चलाने के बाद अपने प्लेटफ़ॉर्म को लॉन्च करके शुरुआत कर सकते हैं।

संपर्क करें