Junk Bonds: What Are They & Are They Worth Buying?

There are thousands of assets that you can find in the financial markets, with many more that you might not have heard of. Junk bonds are some of these assets that provide high yields at high risk, but you can rarely find them compared to common stocks, bonds, and Forex currencies.

They provide seasonal gains to some investors, which are only recommended to professional traders and financial institutions. Let’s dive deeper into the junk bonds definition and whether you should invest in them.

Key Takeaways

- Junk bonds are low-grade debt instruments that offer high-risk, high-reward investment opportunities.

- Companies facing bankruptcy or financial challenges issue these securities to receive funds and improve their status.

- High-yield bonds are rated BB or less by leading benchmarks, such as S&P and Moody’s.

What Are Junk Bonds?

They are financial instruments with a higher risk factor than conventional bonds and have a low rating by standard benchmarks due to their default exposure.

Classically, bonds are issued by companies and governments with coupon rates and face value. They are used to attract investors, who buy these certificates and earn an interest payment before the bond expires, and they get back their initial investment.

Junk bonds are low-rated instruments issued by businesses facing financial hardship or at risk of bankruptcy. Companies offer speculative notes to lure traders and receive funding to overcome their financial challenges.

Issuing companies implement a relatively high interest rate of around 6%-10%, while investment-grade debt notes offer 2%-5%. The yield can be even higher in CCC-rated or less, reaching up to 12%.

In 2008, ICE BofA, a bond ETF combining multiple low-rated corporate notes, reached 23% during the financial crisis.

Understanding Junk Bonds Rating

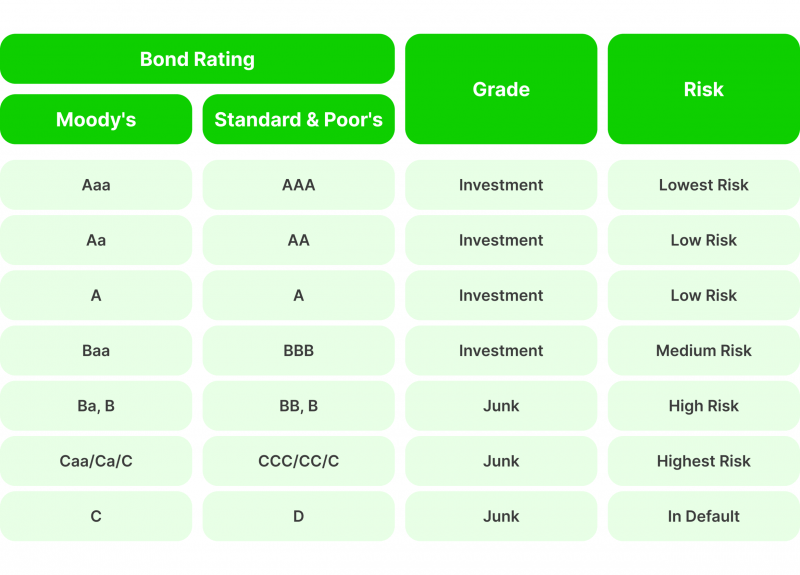

Fitch Ratings, Moody’s, and Standard & Poor’s (S&P) are popular rating agencies that determine the bond’s investment worthiness. They classify securities based on the issuer’s financial status, credit ratings, debt structure, market factors, and macroeconomic conditions.

They use ratings starting from AAA for investment-class instruments, down to BB for less quality ratings, and D at the bottom. They classify the risk as lowest – low – medium – high – highest – in default.

Accordingly, junk bonds are any debt instrument that receives a BB rating or less, which does not qualify them to be “investments” due to their higher risk of default.

Junk Bonds Example

Assume a company, ABC, is facing bankruptcy risk due to poor financial planning. They issue speculative bonds of 10% to receive financing and improve their situation. These securities hold a face value of $1,000 and mature in five years.

However, these instruments receive a CC junk bonds rating due to the company’s status and risk factors. Investors can buy these certificates and earn $100 annually, which is higher than other bonds but riskier.

So, why would one buy a high-risk investment?

There are various motives for buying high-yield instruments, such as high-interest payments and future bond improvement.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

Low-Rated Bonds Utility

It is generally accepted that junk bonds are risky, and your investment can be worthless at any point. However, wealthy investors seek these debt instruments for multiple reasons besides income-generating.

Long-term Improvement

High-yield junk bonds are not necessarily the results of companies on the verge of collapse and looking to clutch at straws. Many small businesses and startups with promising futures issue these securities.

Due to the lack of credit rating or debt record, they can get low ratings. However, some have lucrative potential, and investors seek these growing bonds to earn high returns and secure some long-term income generation.

Nevertheless, investing in financially challenged company bonds can be meaningful if more investors pool in and the business improves its situation. This leads to junk bond improvement, rating upgrades, and the attraction of more investors.

Market Sentiment Indicator

Risky investment is an indicator of the overall economy. When the market is growing, traders are more likely to seek risky assets due to rising optimism and the abundance of money from well-performing investments.

On the other hand, during market recessions, traders tend to avoid unnecessary expenditure and find the lowest risk possible. As a result, you can use the willingness to invest in junk bonds as a sign of market health and investors’ sentiment.

Earning High Yields

The obvious utility of low-rated securities is receiving high returns, which come with interest rates that almost double those of investment-class certificates and assets.

Therefore, only wealthy investors and institutions buy these securities because if the issuer defaults, the company will not be able to pay the coupon rate or the maturity value.

However, adding speculative debt instruments to your investments is an excellent portfolio diversification tactic. You can combine various bonds and certificates to hedge against unpredictable market movements or increase your income streams.

Who Buys Junk Bonds?

High-yield corporate certificates are not popular among retail traders or traders who want to make money on the side. They usually attract organisations with higher risk tolerance, such as hedge funds, mutual funds, and private equity firms.

These financial institutions add non-investment-grade notes to their accounts and offer their customers portfolio diversification through high-interest coupons that pay much higher than common government certificates.

Moreover, wealthy investors seek junk bond fund investments with high returns, especially if they mature in less than two years, providing significant interest payments in a short period of time to avoid the risk of default.

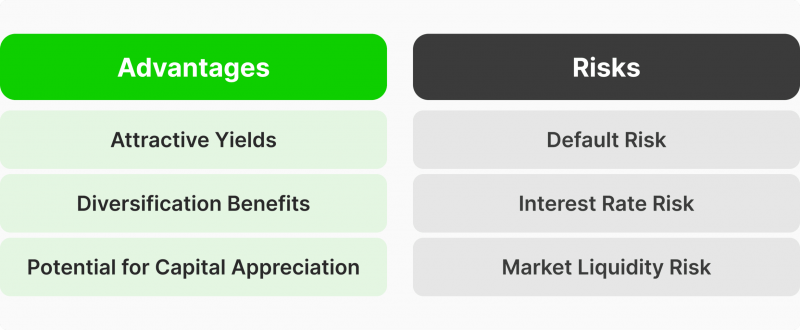

Junk Bonds Advantages and Disadvantages

Despite the challenges and risks associated with these securities, they offer generous returns. However, you might weigh out the benefits and drawbacks.

Pros

- High returns: Junk notes offer a higher yield than treasury bonds, ranging from 6% to 12%, instead of up to 5%.

- Stable income streams: Bonds are less volatile, including low-rated ones, which offer consistent lucrative payments.

- Portfolio diversification: sub-investment assets to your portfolio offer balance value when hedged or combined with low-risk assets.

- Possible capital gains: if the issuer’s financial health is improved, the bond’s rating and value will grow accordingly.

Cons

- High default risk: Companies offering CC-rated certificates usually face bankruptcy and can default at any time.

- Liquidity issues: High-yield notes are less available in the market, making them harder to sell or trade.

- Low recovery rate: If the issuing company applies for bankruptcy, you will receive a fraction of the face value due to its low-priority recovery scheme.

How to Invest in The Junk Bond Market?

If you decide to delve into the risky world of speculative-grade securities, you need to consider the challenges and benefits, the issuer’s payability and the business’s long-term plans. Here’s how you can start.

Calculate Your Risks

Low-class instruments are often issued by startups and companies facing financial difficulties. Therefore, by investing in junk notes, there is a big chance that the bond issuer will default, and you will not receive the promised coupon payment and face value.

Minimise these instances by finding a short-term maturity date and medium interest-bearing bonds, as high rates usually come with exacerbated default risks.

Additionally, ensure you have a diverse portfolio that does not highly rely on these fixed-income securities.

Find a Brokerage Platform

You can find various debt notes through online brokerage platforms like Charles Schwab and TD Ameritrade. These providers offer a wide range of high and low-risk options, with solid consultancy and guidance.

Opening an account is a straightforward process that will take a few minutes before you can deposit your money and start trading.

Choose The Right Investment

You can either invest in individual junk bonds or ETFs. These exchange-traded funds combine a collection of diverse-risk securities, including government notes and investment-grade bonds.

However, you must carefully analyse the junk bonds list and rating. BB-rated ones have a high-risk factor but are better established than CCC, CC, C or D.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Also, check the company’s long-term financial planning, sales projections, and earnings. Use these reports to predict if the business has a growth potential and if the investment is worth it.

Execute Your Order

Process your order and set your stop-loss limits. Placing and updating these limits is vital to ensure you sell your position before the company defaults.

However, if you directly purchase a high-interest company bond and it gets too risky to keep holding it, place it on secondary markets to sell it at a higher or lower price.

Overview Macroeconomic Changes

With these types of assets, you must keep your eyes on the overall market changes and conditions. Small businesses and companies facing economic challenges would benefit significantly if the lending interest rate drops or the government issues tax changes and subsidiaries.

Other industry-specific policies or competition changes can also affect the issuer, making the investment more or less risky.

Conclusion

Junk bonds are investment certificates that carry high risk and offer high returns. They provide higher coupon rates (6%-12%) than high-class corporate or government bonds (2%-5%), making them highly appealing to risk-taking investors.

Newly established companies and businesses with economic problems issue these bonds to receive funds. However, rating agencies classify them as low-grade due to their risk factors and financial characteristics.

However, they offer a good portfolio diversification value and provide high-income streams if the issuer improves financially over the years.