Risk Parity Strategy – An Investor’s Safe Choice

Articles

The portfolio management process is a hot topic for research in the financial investment industry. Many methods and approaches exist to optimise portfolios to deliver high returns with minimum risks. One such approach is the risk parity strategy. In this article, we will discuss what risk parity portfolio optimisation is, how to build a risk parity portfolio, and what are the benefits and limitations of the strategy.

Key Takeaways

- A risk parity strategy is a strategy that aims at an even distribution of risks in a portfolio.

- The expected return of the optimal risk parity portfolio is typically lower than the required return of the investor.

- There are two main approaches to building a risk parity investment portfolio — a permanent and all-weather portfolio.

- The risk parity portfolio can be built with leveraged ETFs.

What Is Risk Parity?

Risk parity is a method of investing that aims to evenly distribute the amount of risk in a portfolio between all the different types of assets. The aim is to make sure that no single asset is very risky and could cause the overall value of the portfolio to decrease. If properly monitored, this strategy can make consistent profits.

A risk parity portfolio can contain different types of assets, like stocks and equities, raw materials (commodities), bonds or other assets with uncorrelated returns. The important thing is to gather assets that act differently in the same situation, with some going up in value and others going down.

Risk parity is a progressive portfolio technique often used by hedge funds.

Using risk parity strategies, portfolio managers can determine the exact proportions of capital contributions of asset classes in a portfolio to achieve optimal diversification according to the investor’s objectives and preferences.

There are two essential elements needed for risk parity to give better returns for a specific level of risk:

- The return of the low-risk asset (bonds) should be adjusted according to the level of risk involved and should exceed the return of the high-risk asset (stocks) adjusted according to the risk involved. In this case, the diversified portfolio of low-risk assets can earn a higher return than the direct investment in a high-risk asset with the same level of risk.

- The leverage cost (the amount of money borrowed) should be low so that the expected profit from the leveraged allocation is more than the profit from the regular allocation.

The risk parity strategy aims to allocate the same risk to different asset classes. This resulted in bonds getting the largest allocation since they exhibit less volatility and better risk-adjusted returns than stocks for decades.

Risk parity resembles Modern Portfolio Theory (MPT) or mean-variance optimisation. MPT seeks the optimum asset class mix based on returns and risks, whereas risk parity distributes assets to equalise risk without concentrating on returns.

Building A Risk Parity Portfolio

The risk parity strategy is based on the negative correlation between the prices of different asset types. When one goes down, the other must go up to compensate for it. When this does not happen, the strategy is ineffective.

In a risk parity portfolio, an investor examines how risky each asset is and creates a portfolio that evens out the risks of the assets without considering how much money they could make. The expected return of the optimal portfolio is typically lower than investors’ required return.

To build a risk parity portfolio, managers usually use a mix of assets since the strategy allows for leverage, alternative diversification, and short selling in portfolios and funds.

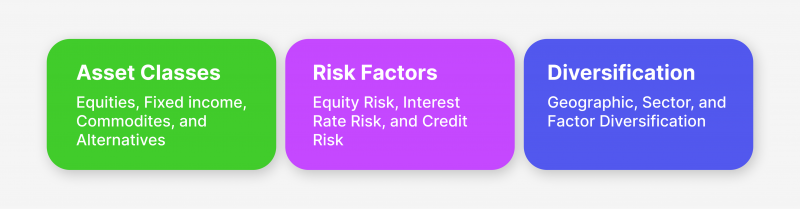

Components Of The Risk Parity

Risk parity portfolios are built based on three key factors:

- Asset Classes – A risk parity portfolio’s principal assets are commodities, stocks, bonds, and other options such as real estate or hedge funds. Each type of asset has its degree of risk and possible return. When all these investments are combined, they define the total risk of the assets under management. The selection of each type of asset is determined by how much it adds to the portfolio’s overall risk, not by its market value.

- Risk Factors – Risk factors refer to the elements that contribute to the level of risk within a portfolio. In a risk parity portfolio, the primary sources of risk include potential losses from stock investments, fluctuations in interest rates, inflationary pressures, and the possibility of a borrower defaulting or experiencing a credit downgrade.

- Diversification – Risk parity portfolios try to reduce the impact of regional economic shocks by investing in different geographic areas. This way, they spread out the risk and make it less likely that the economic shock in a particular country will significantly impact the portfolio. Spreading the investments across different industries can also reduce risk and improve the variety of assets in the portfolio.

Examples Of The Risk Parity Portfolios

Since each investor has their idea of acceptable risk and return, there is no one-size-fits-all solution. Therefore, the first thing to start with is determining your risk profile. The portfolio should be diversified not only by asset classes but also by geography.

Previously, the popular investing strategy 60/40 was widely used. In general, 60/40 is an investment strategy that implies the inclusion of profitable and protective assets in the portfolio in the specified ratio: 60% of assets that provide the main profitability with increased risks (these include stocks, commodity market assets, currencies, options and futures), and 40% of the protective part of assets that reduce volatility, overall risk and portfolio drawdown in case of crisis (these include bonds, bank deposits, some precious metals, etc.).

However, the 2008 crisis showed the instability of this strategy since the correlation between stocks and their volatility increased drastically, with stocks accounting for about 90% of all risk in institutional investors’ portfolios. That is where the risk parity strategy can be helpful.

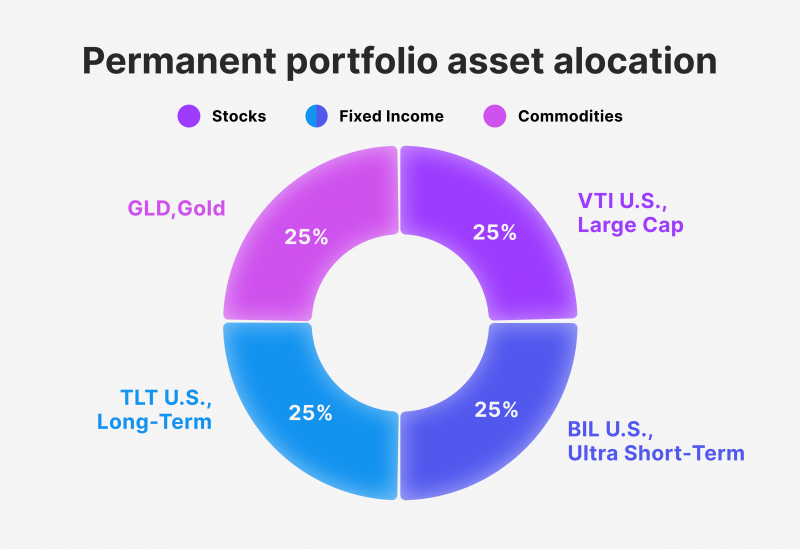

An American financial advisor, Harry Browne, suggested the idea of the risk parity strategy. He invented the concept of a permanent portfolio.

The core idea behind the portfolio is that the assets in it, on the one hand, have a long-term upward trend; on the other hand, they almost always move in opposite directions. This holds back the return on the part that is rising but also prevents losses on the part that is moving down.

The permanent portfolio asset allocation structure is as follows:

- 25% U.S. stocks – Stocks are meant to supply a solid return during times of prosperity. For this part of the portfolio, Browne suggests S&P 500 index funds, for example, the Vanguard 500 Index Fund Admiral Shares.

- 25% long-term U.S. Treasury bonds – The bonds are supposed to bring profit during times of prosperity and in case the prices are lower, but they will do poorly during other economic cycles.

- 25% short-term U.S. Treasury bonds – This portion of the portfolio aims to hedge against periods of tight money market and recession.

- 25% gold – Precious metals are supposed to protect the funds during periods of inflation.

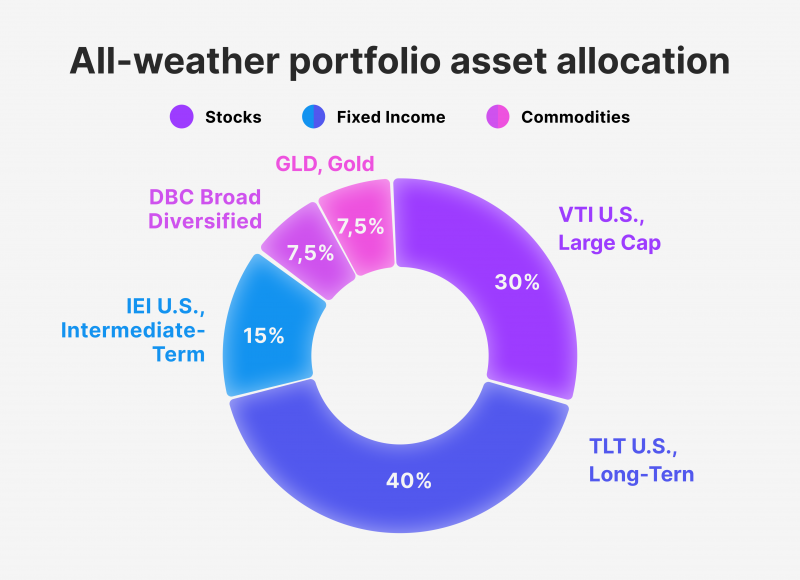

Another example of the risk parity portfolio is the so-called all-weather portfolio, suggested by Ray Dalio, the founder of Bridgewater.

Dalio identified four main factors that can influence the value of assets, that is, four macroeconomic “seasons”:

- Inflation.

- Deflation.

- Economic growth.

- Economic decline.

Dalio then selected asset classes that performed well in each of these periods, resulting in a resilient portfolio in which the total value of assets remains unchanged during any economic changes.

The asset allocation in the all-weather portfolio is as follows:

- 30% U.S. Stocks – This is the most profitable part of the portfolio, especially in a strong economy. At the same time, however, stocks are the most volatile assets.

- 40% Long-Term Treasury Bonds – These are bonds from both developed and emerging markets. The former are risk-free assets but can give zero or even negative returns during deflation. The latter can deliver higher returns but can lose value during a recession. Treasury bonds, however, can protect the portfolio against inflation.

- 15% Intermediate-Term Treasury Bonds – These bonds can provide an increased income level, especially during periods of economic prosperity, but during a crisis, they may become a risky asset.

- 7.5% Commodities – This asset class becomes highly in demand during economic prosperity. Their quotes grow along with inflation, so commodities allow you to protect capital from depreciation.

- 7.5% Gold – This is a classic defensive tool that should be included in any diversified portfolio. As a rule, gold price rises during a crisis, as well as with rising inflation.

The stock part of the portfolio ought to bring profit in bull markets when stock costs are rising. Equities and bonds are usually not prone to inflation so they can do well during falling prices.

The all-weather portfolio can be built using leveraged ETFs to enhance the returns of the all-weather strategy.

Leveraged ETFs are essentially the same funds as regular ETFs, but they use double or triple leverage and open short positions to seek returns that are double or triple the index they track. However, this approach is very risky since you need to take into account that if the underlying index loses 1% during a trading session, the risk parity ETF with double leverage will show a loss of about 2%.

In a growing economy, both permanent and all-weather portfolios will grow with stocks and commodities, while in periods of financial or economic turmoil, Gold and bond prices will rise. You can calculate your portfolio’s risks and potential returns using a portfolio and investment analytics platform.

Benefits and Limitations

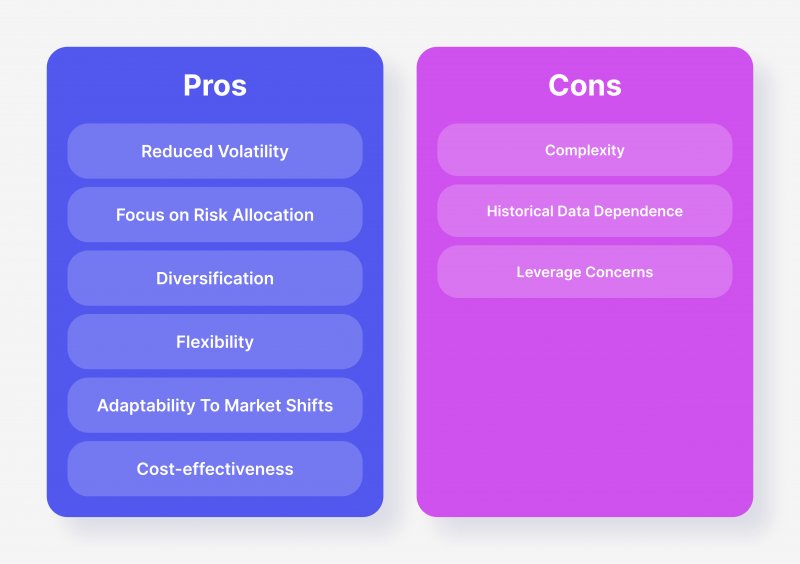

The risk parity approach might seem a perfect strategy for any investor. However, as with any other investment strategy or method, the risk parity approach has benefits and drawbacks. Let’s look at some of them closer.

Benefits

- Reduced volatility – The risk parity approach attempts to decrease portfolio volatility. This is achieved by balancing risk exposures across various asset classes.

- Focus on risk allocations – By focusing on risk allocation rather than funds allocation, the strategy lowers the dependence on a single asset class, which results in a more balanced and robust portfolio.

- Diversification – Risk parity portfolios consist of assets of different types, which increases the chances of a good return even when the stock market performance is low. Also, such portfolios have lower chances of losing value during an economic recession since the diversified pool cushions the return.

- Flexibility – Risk parity strategies make it easier for investors to change their asset distribution and adjust their portfolios according to market movements.

- Adaptability to the market shifts – Risk parity portfolios can be adapted to different market situations and economic cycles, which can help investors effectively manoeuvre in different financial environments.

- Cost-effectiveness – Risk parity portfolios require less management than other types of portfolios, and therefore, they can earn a passive return. Moreover, the fee structure of such portfolios is low, which makes them a safe choice for those who cannot afford heavy investment management fees.

Limitations

- Complexity – Implementing risk parity strategies requires a profound knowledge of advanced analytical tools and complex optimisation algorithms, which can be difficult, especially if you are a beginner investor.

- Historical data dependence – The strategy greatly relies on historical data in the risk exposure assessment, which can prevent precise and accurate prediction of future risks and market behaviour.

- Leverage – You may need a more considerable leverage amount to generate a significant return. Using leverage can increase risk exposure and lead to substantial losses during market downturns.

Conclusion

Risk parity strategy is a complex approach that can help you build a resilient portfolio that can survive almost any economic turmoil and deliver a good and steady return. However, this strategy has drawbacks and requires a lot of experience and knowledge in investment and financial awareness. Using this approach correctly and wisely can bring you a significant profit and deliver a passive income, while ignorance in the aspects of risk parity can lead to substantial losses.

FAQ

What is hierarchical risk parity?

This method uses a hierarchical approach to the asset allocation process in a portfolio. Hierarchical risk parity implies dividing the portfolio into different levels or tiers based on different classes of assets or portfolio risk factors.

How Do Leveraged ETFs work?

Leveraged ETFs are securities traded on the stock exchange that allow you to replicate the intra-trading movement of another security by 2 or 3 times, thereby magnifying both potential losses and profits.

What are the differences Between Browne's and Dalio's portfolios?

The Permanent Portfolio divides assets equally among stocks, bonds, gold, and cash, aiming for simplicity and balance across various economic conditions. In contrast, the All-Weather Portfolio uses a more complex, risk-parity optimised asset allocation that includes stocks, various types of bonds, and sometimes commodities, aiming to perform well in all economic “seasons.”