What is Crypto Arbitrage?

As the trading landscape thrives and various online solutions make it easier for aspiring traders to enter different markets without barriers, a particular practice has become increasingly popular. While arbitrage in trading has been a mainstay for centuries (Tracing back to the 18th century), this methodology is more accessible and easy to execute than ever before.

With the introduction of Cryptocurrencies, the crypto arbitrage specialty has entered the market and introduced a new way to generate profits. Crypto arbitrage has become one of the most popular means to benefit from the surging crypto industry. Today, we will discuss the process of crypto arbitrage and how you can benefit from it.

Key Takeaways

- Crypto arbitrage is acquiring Crypto on one market and selling on the other to utilize the price variance and generate profit.

- Traditional arbitrage in trading has been almost eliminated by various safeguards, digital software, and other prevention tools to stabilize prices. Crypto Arbitrage, on the other hand, remains profitable as of 2023.

Trading Arbitrage, explained

Let us start with the basics – What exactly is arbitrage in the trading context? This market-dependent practice is almost as old as currency trading itself. As the international currency exchange became a prevalent part of the global economy, specific traders realized that the same assets (money, stocks, etc.) had marginally varying prices across international markets.

With this revelation, traders would purchase a given asset at a low price and then immediately sell it on a different market at higher prices. While the profits from a single arbitrage transaction were mostly minuscule, this process was virtually risk-free and instantly beneficial to the traders. With enough volume, arbitrage specialists generated colossal profits in months.

How is crypto arbitrage possible?

Crypto arbitrage is the latest version of this practice and it is executed in the same fashion as traditional arbitrage. Although, unlike the latter, Crypto arbitrage is still viable due to market differences. Due to the centralized nature of fiat currency exchange institutions, the old-fashioned fiat arbitrage has become nearly impossible to benefit from.

Most financial institutions closely monitor price discrepancies and employ various restrictions to ensure that currency values across the globe are standardized. This in turn has left arbitrage traders with empty pockets, but the emergence of crypto has shifted the status quo once more. Unlike the banks and other large financial institutions dealing in fiat, Crypto exchanges are decentralized and control the balance of assets separately.

The Windows of Opportunity

Most crypto exchange platforms employ an automated matching system that eliminates third parties from the occasion. Due to this fact, a given crypto exchange market needs to control the balance of assets automatically. If a given crypto becomes scarce in the mentioned exchange market, its price might rise significantly compared to similar platforms. While everything eventually evens out and various crypto exchange platforms try to maintain similar prices with the industry leaders, there are ample opportunities to benefit from this window. That is where crypto arbitrage comes into play.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

How You Can Arbitrage Crypto Today

As discussed above, crypto arbitrage is a straightforward concept – you must thoroughly research the crypto market and identify the same assets with different prices. With over 600 active crypto exchanges, price variations are relatively common and sometimes material. Crypto arbitrage specialists closely monitor dozens, or even hundreds of these platforms, seeking out opportunities to buy low and sell high. However, this is the simplest example of arbitrage, and there are various types to consider. Let us jump right into it.

Different Types of Arbitrage

- Simple arbitrage – this classic method of arbitrage is the most trivial to execute. As discussed above, simple arbitrage enables traders to benefit from immediate price changes on different trading platforms. However, the crypto world is employing numerous safeguards and methodologies to minimise this practice, making it less profitable every year.

- strong>Spatial Arbitrage – While this practice is virtually identical to simple arbitrage, it offers a different approach to seeking out potential gaps in same-asset prices. Instead of concentrating on the digital landscape of crypto trading, spatial arbitrage is all about weeding out variations between countries and sovereign entities.

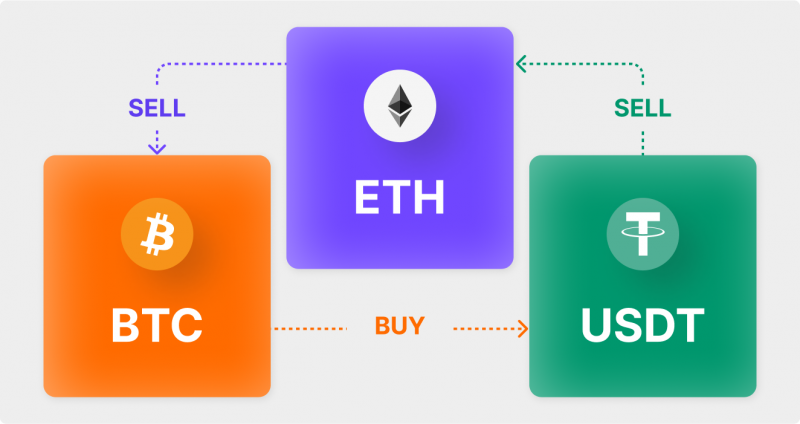

It is no secret that numerous government bodies have become interested in the crypto world and have employed different policies in their respective markets. This creates ample arbitrage opportunities. However, this method is admittedly more complex and time-consuming than searching for arbitrage options online. - Triangular arbitrage – Since various crypto currencies have different price relationships with each other, another type of arbitrage becomes possible and, potentially, more lucrative than the simple method. The process here is to seek out exchange rate variations between three different cryptos and execute a three-way trade.

For example, if currency A has a different exchange rate from currency B and C, all you have to do is convert A into B, Convert B into C and then circle your way back to C/A exchange. With this slightly more complex transaction, you have a chance to increase currency A without any risks. Naturally, the transaction needs to go through almost instantly.

There are more specialised and complex ways to conduct arbitrage (convergence and cash-and-carry methods), but the above mentioned three practices are the best options for newcomers to the arbitrage field. While our described arbitrage practices are simple in concept, they often prove exceedingly challenging due to the sheer number of variables to consider. So, let’s discuss the ways you can assist your arbitrage efforts.

Key Takeaways

- You can simplify Crypto arbitrage by employing automated arbitrage bots and similar applications. With their assistance, you will swiftly identify price gaps on the market.

- Crypto arbitrage bots are not without risks. Faulty algorithms, ever present market volatility and shifting transaction fees are the main culprits of potential losses for your arbitrage transactions.

How You Can Simplify Crypto Arbitrage

As discussed above, Crypto arbitrage is about finding the market’s price gaps. Naturally, the process of searching is the biggest challenge, demanding colossal amounts of time and energy from you. Conducting this research can be exceedingly difficult and often fruitless without any automated help. That is where the arbitrage bots and other handy apps come in and minimize your time searching for price variations.

These nifty digital tools scan the colossal crypto exchange market automatically and keep you in the loop whenever an arbitrage opportunity arises. The best tools in this niche offer instant response times, letting you capitalize on presented opportunities without any delay. Arbitrage bots can also give you a much-desired advantage to execute transactions swiftly and follow the best arbitrage algorithms.

Crypto Arbitrage Apps: Things to Consider

As with everything else on the broad currency market, crypto arbitrage tools have certain risks tied to them. First, choosing the right arbitrage bot is easier said than done. While there are prominent leaders in the market, even the best solutions have their shortcomings. However, the most crucial challenge here is to select reputable and trusted arbitrage software with a clean track record. After all, this digital tool will control your crypto funds, and there is no room for potential risks of fraud or digital theft.

But, even with the most well-established arbitrage software powering your efforts, the risks are still considerable. Since the crypto market moves fast and is highly volatile in some cases, the built-in arbitrage algorithms can lead your portfolio to sizeable losses. The arbitrage bots are also very complex, so you need acquire a solid understanding of how they function. Negligence here could lead to significant money loss scenarios.

Lastly, staying aware of the changing transaction fees would be the best action. If a particular crypto’s transaction fees increase, this could completely negate the potential profits per transaction. Moreover, increased transaction fees could lead to a negative transaction balance, costing your arbitrage efforts.

Is Crypto Arbitrage Worth it in 2023?

Despite some material changes on the side of crypto exchange platforms, Crypto arbitrage remains a lucrative business in the current landscape. The Crypto market is still fairly new and far from being standardized across international markets and different sovereign entities. The industry has also remained volatile and susceptible to dramatic price changes, which creates significant profit opportunities to those interested in arbitrage.

Thus, Crypto arbitrage is undoubtedly profitable and worthwhile to jump into. But as with every other business tied to currency dealings, the material risks can deter many traders. The market’s overall volatility could turn your arbitrage operation into sunk costs on several occasions, so it is crucial to understand the risks and conduct operations diligently.

Here’s an overview of significant crypto arbitrage risks

- The volatility that cuts both ways – frequent price changes on the crypto market might seem promising for arbitrage purposes. However, certain arbitrage transactions might lead to a loss due to an opposing shift in the price. Arbitrage windows can close in hours or even minutes, leading you to a substantial loss in such cases.

- Transaction fees – many newcomers to arbitrage have made the mistake of not accounting for transaction fees and jumping on the opportunity to reap profits. You must always remember that arbitrage spread is not just a difference between the prices, and always consider the transactional fees in your profit calculations.

- False information – even with the state-of-the-art crypto arbitrage bots and software simplifying the research process, you are only partially safe from acting based on inaccurate data. The Crypto market is gigantic and consists of numerous information streams that could malfunction in some instances. So, if you discover an arbitrage opportunity that looks too good to be true, you might be right on certain occasions.

What About the Legal Side of Crypto Arbitrage?

The legality of forex arbitrage, in general, is a complex topic with no apparent answers. On paper, crypto arbitrage is entirely legal and does not violate any explicit laws and regulations. Moreover, many experts believe that arbitrage practices can help the markets eliminate spontaneous price discrepancies and signal any gaps the forex platforms should fill.

However, many market makers and financial institutions put in substantial effort to eliminate arbitrage possibilities worldwide. There are two main reasons for this opposition – institutional losses and the belief that arbitrage is exploitative. Naturally, when the crypto arbitrage operation is successful, the respective exchange markets stand to lose their potential income.

The wealth acquired by the arbitrage specialist is deducted from the possible liquidity pool of the exchange platforms. As for the negative impact on the market, many experts believe this practice harms the overall industry. If a significant price discrepancy occurs in the market, many traders and investors will pay opportunity costs due to the arbitrage intervention.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Due to these reasons, some market makers actively employ different practices to discourage arbitrage. However, arbitrage methodology remains perfectly legal and does not oppose the free market philosophy. So, if you’re interested in starting crypto arbitrage, laws and regulations will not pose a significant problem in most cases.

In summary

Arbitrage is one of the oldest and simplest ways to reap benefits from the diverse selection of money markets. It has been around since the 18th century and has managed to live on thanks to the emergence of Crypto. In today’s landscape, Arbitrage is a conceptually sound idea that promises immediate, risk-free profits. However, as we have discussed above, this topic is not as trivial as expected.

Numerous risks, like volatility, unpredictability and technological errors keep arbitrage from being a completely safe investment of your funds. However, with enough research, diligent choice of assisting software and disciplined way of conducting transactions, arbitrage can prove to be a lucrative business to get into.

Keep in mind that crypto arbitrage is not best-suited for industry newcomers. Like other industries, the Crypto field is ripe with numerous details and factors to consider. There are many intricate details and aspects to Crypto arbitrage that could be impossible to notice as a beginner in this industry. So, we implore you to conduct due diligence before entering this niche of the Crypto universe.