What is Stablecoin?

Fourteen years have passed since the invention of crypto in 2009. In 2023, cryptocurrency is a well-established concept familiar to millions of people around the globe. As with any innovation, the field of cryptocurrency is rapidly expanding and evolving. Gone are the days of Bitcoin being the only viable offering in the crypto landscape. Numerous new developments, tweaks, and upgrades have deepened the foothold of this industry.

However, public opinion remains divided on accepting cryptocurrency as a mainstay in the currency market. Most users worldwide still need to be convinced that crypto can reliably replace traditional currency. This has led to the emergence of a new form of currency that attempts to combine the best of both worlds: stablecoin. Today, we will discuss its nature, significance to the currency market, and whether the stablecoin is here to stay for good.

Key takeaways:

- Stablecoin combines the security, decentralization, anonymity, and speed of cryptocurrency with the relative stability of traditional currencies. It achieves this either by tying itself to a fiat currency or by utilizing algorithmic regulation.

- Stablecoin was designed to win over the skeptical public that refuses to adopt crypto due to its volatility and unpredictability.

- Commodity-backed stablecoins fail to offer decentralization, one of the most significant advantages of the crypto world.

- Algorithmic stablecoin utilizes automatic price stabilization to achieve decentralization once again.

Stablecoin: The Definition and Mechanism

Before jumping into the intricacies and market implications of stablecoin, let us define the word first! Invented and deployed in 2014, a stablecoin is a type of cryptocurrency designed to maintain price stability. This is often achieved by tying it to a specific fiat currency, although other methods such as being backed by different assets or using algorithmic mechanisms are also used.

There are two principal types of stablecoin: currency-pegged and algorithmic. Both technologies are united with the same mission of solving the market volatility of the crypto landscape. After all, crypto’s unstable nature discourages user adoption worldwide. While there are other concerns from the side of potential adopters, the fluctuating and wildly unpredictable prices remain the biggest red flags of the industry.

Stablecoin aims to solve the volatility problem inherent in most cryptocurrencies by drawing from the stability that traditional currencies generally possess due to government backing and widespread use. Drawing parallels to the time when the USD was tied to gold for approximately a century to maintain stability, stablecoins were designed with a simple, yet effective, concept in mind. It should always equal a specific currency. No exceptions.

In many cases, that currency is USD, but new stablecoins are trying to expand the market horizons and introduce other fiat currencies as reliable backing solutions. However, to this date, USD remains the go-to option for stablecoin connection. Other than the flagship stablecoin discussed above, there are three variations on the stablecoin concept. Let us get you up to speed:

Three Other Types of Stablecoin

- Crypto-backed stablecoin – While this concept might seem redundant, crypto-backed stablecoins rely on the stability of other cryptocurrencies on the market. Despite their inherent volatility, industry-leading cryptocurrencies have maintained relatively more predictable and stable prices than the rest of the market.

- Commodity-backed stablecoin – If you are in the ranks of investors that trust certain commodities more than the fiat currency, this type of stablecoin will suit your needs perfectly. CB stablecoins tie themselves to various commodities like precious metals, properties, etc. Its biggest attraction is that investors can acquire various commodities without physically acquiring them.

- Algorithmic stablecoin – Imagine a cup of water that automatically regulates the water volume in the vessel. That is the exact purpose of the algorithmic stablecoins. They employ complex algorithms to automatically control crypto’s distribution and overall volume, stabilizing the price whenever it threatens to skew upward or downward.

The Role and Importance of Stablecoins

Now that we understand a relatively simple concept of stablecoins let’s discuss their crucial nature in the crypto market. In the fourteen years of the crypto world expanding and establishing itself as an essential player in the currency market, it has yet to get over the biggest roadblock: the volatility of prices. While the crypto field offers numerous advantages like speed, efficiency, low costs, and rock-solid security, this impressive package is still insufficient to overcome the fear of price variance.

Currency traders, investors, and the general public would love to enjoy the benefits of crypto, but not at the expense of losing substantial amounts of money. Even fourteen years later, this issue remains to be solved. That is why stablecoin matters in the crypto market, created to bridge the gap between the fiat and crypto worlds of the currency.

The Potential Impact of Stablecoin on the Forex Market

Aside from the obvious upside of price stability, a stablecoin can also be a glue for the two somewhat separated markets. There are no frequent overlaps between the two markets, and the massive adoption of stablecoin could bring the two fronts closer.

As the stablecoin becomes more popular, it will be simpler to trade between fiat and crypto due to increased liquidity in both markets. With this, traders will more actively conduct cross-market transactions and create a virtual bridge between fiat and crypto. As a result, the forex market could acquire a much-needed and completely organic jolt to the system that accelerates both markets. However, this equilibrium has not become a reality as stablecoin struggles to achieve its full potential.

How Do Algorithmic Stablecoins Differ from Other Stablecoins

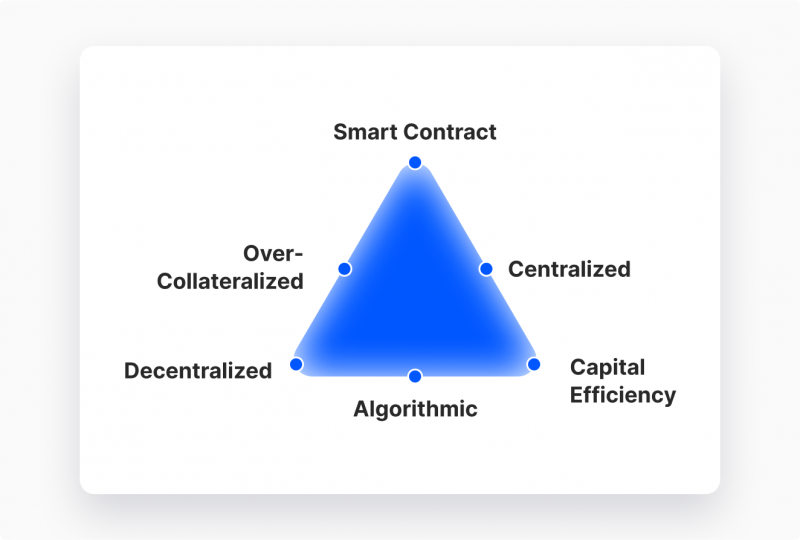

Now, reading through our guide to stablecoins, you might formulate one important question – If the commodity-backed stablecoin works perfectly, why is there a necessity for complex algorithms? The reason is simple. The former type of stablecoin does not share all the traits of a classic crypto currency. Crucially, fiat-backed stablecoins are inherently centralized, since they have tied themselves with centralized fiat currencies.

This significant sacrifice was made to stabilize the prices and make it possible to connect crypto with fiat, but a crucial aspect of crypto was lost in the process. Let us remember that crypto was created with the mission of being anonymous, secure, and free from intrusive third parties. This big promise is no longer present with commodity-backed stablecoins. While other benefits remain (speed, efficiency, low costs, and relative security), many users worldwide value their absolute privacy. For that reason, crypto developers came up with a fresh concept for stablecoin.

An algorithmic stablecoin uses automated algorithms to control the entire flow of crypto and ensure that the price does not skew dramatically in either direction.

Here’s an example of how algorithmic stablecoins control the price:

Let us take stablecoin A that uses algorithms to manage its price stability. Coin A costs exactly one dollar (A= $1). Now, imagine that coin A is sold massively and becomes more scarce on the market. Normally, this would cause the cryptocurrency to spike in price. But not this time. The automated algorithm steps in to distribute more coin A to the market and bridge the gap between supply and demand.

Conversely, if the demand falls for coin A, then the algorithm will get to burning the virtual currency supply. This goes on until coin A goes up to its inherent value of $1. It seems pretty reliable, right? Despite a brilliant design, algorithmic stablecoins have struggled to remain as predictable and reliable as fiat-backed stablecoins. While many state-of-the-art algorithms have been deployed to execute the protocols perfectly, algorithmic stablecoins still make mistakes and tend to be more volatile than commodity-backed cryptos.

So, we have a prevalent dilemma in the world of stablecoins – price stability against the benefit of decentralization.

How to Create Your Own Stablecoin

Now let us combine all our findings and answer the big question: what are the essential steps toward creating a stablecoin? Let’s discuss the step-by-step process:

Select your preferred stablecoin type

First, you must choose which stablecoin suits your needs and preferences related to your target audience. As mentioned, there are four types of stablecoin – fiat-backed, commodity-backed, crypto-backed, and algorithmic. Consider your options carefully and select the most realistic option here.

Ensure the stability of your coin

This step is heavily dependent on your previous selection. The above-mentioned types of stablecoin require different methods of stability. The first three types of stablecoin are all tied to a certain commodity. It is crucial to possess the required commodities outright or have an active credit line to acquire these assets in real-time. After all, these commodities are the prime reason your stablecoin will actually stay stable and satisfy the demands of the sellers and buyers in your niche.

When it comes to algorithmic stablecoin, you need sturdy development knowledge and experience. Stablecoin algorithms might be accessible conceptually, but they require colossal funds and brainpower to function smoothly. While algorithmic stablecoins do not require massive commodity backing, they still remain to be a hugely expensive endeavor. So, consider your options carefully!

Choose the best platform for your needs

While the Ethereum platform has dominated the stablecoin market, new options have emerged in recent years. Ethereum remains a solid option with its established reputation, but other platforms like Tron and EOS are challenging Ethereum’s dominance. There are numerous trade-offs to consider here.

Some platforms offer smooth scalability and speed, but could rack up significant transaction fees in the long run. Others offer relative stability but lack the desired speed. There are no objective answers here and most stablecoin creators choose to prioritize a specific set of benefits over others.

Deploy a smart contract for security

Smart contracts are essential aspects for any crypto currency. They ensure the security of transactions with their air-tight safety protocols. There are various ways to fortify your stablecoin with smart contract algorithms, which requires substantial software engineering skills. So, make sure to have a powerful team of developers on your side!

Various Methods to Purchase Stablecoins

While the creation of a stablecoin involves numerous complex steps, the process of purchasing it is significantly easier. As a trader or an investor, you will find no shortage of options when it comes to acquiring cold-hard stablecoin in your portfolio. There are many well-established crypto exchange platforms that offer fair terms on purchasing stablecoin.

The following are the five steps to acquiring your first stablecoin:

- Decide which coin works best for you – as a customer, it’s crucial to understand the distinct offerings in the stablecoin niche. Some offer increased stability, but fail to provide complete decentralization. Others give you complete anonymity, but pose risks to the stability of your investment.

- Select a reputable exchange platform – It is essential to seek out the most trusted and well-regarded exchange platform. There are several powerhouses in the industry like Binance, Coinbase, and Gemini. They offer their unique transactional terms and conditions. Pick out the best option for your distinct needs.

- Make your account – creating an account on any established crypto exchange platforms is fairly trivial. There are simple steps to follow, after which you will have the opportunity to conduct transactions on a given exchange platform.

- Make a deposit and purchase stablecoin – These steps are also simple to execute. All you need to do is deposit the desired amount of money in your crypto account and select the option to buy cryptos on your platform of choice. After that, you will have various options for purchasing different stablecoins, with respective transaction fees previewed on your dashboard. Select the coin of your choice, press buy, and you’re good to go!

As you can see, the process of purchasing stablecoin is far from being complicated. However, choosing the right stablecoin for your needs can be a tricky challenge for industry newcomers. Below, we present the most promising options in 2023.

Top 5 Stablecoins of 2023

1. Tether (USDT) – Tether is by far one of the most sought after stablecoins on the market. With its fixed relation to USD, Tether has remained stable and reliable in recent years.

2. Binance USD (BUSD) – Binance offers the most secure and transparent stablecoin offering as of 2023. Binance USD has active USD reserves to account for its volume at any given time, offering the highest level of security and dependability.

3. TrueUSD (TUSD) – Coming in as a close third, TrueUSD is a fully collateralized stablecoin. TrueUSD has a relatively safe track record and can reliably prove the sufficiency of USD reserves for its volume.

4. USD Coin (USDC) – We have reached the rising stars in the stablecoin industry. The USD coin has jumped up several levels in recent years due to its speed and security of transactions. With its increasing quality and competency, it would not be surprising if the USD coin cracks the top three on our list very swiftly.

5. DAI – Finally, we have DAI. This stablecoin is a go-to selection for those interested in algorithmic stablecoins. DAI has shown the most sturdiness and technological competency on the algorithmic niche of stablecoins.

In Summary

Stablecoins are an indispensable part of the crypto market. Their presence stabilizes the crypto market and creates additional value by connecting the two main types of currencies – crypto and fiat. Stablecoins have their risks and trade-offs to keep in mind. However, if you’re interested in entering the world of crypto and looking for a relatively safe option to do so, stablecoins can definitely be worth your while.

By clicking “Subscribe”, you agree to the Privacy Policy. The information you provide will not be disclosed or shared with others.

Our team will present the solution, demonstrate demo-cases, and provide a commercial offer