BlackRock IBIT Sees Record-High Bitcoin ETF Inflow – is it FOMO?

The Bitcoin ETF frenzy is taking its toll, with the massive number of inflowing traders and crypto holders trying to catch on to the growing coin price.

With an increase in open interest and BTC assets, financial institutions and ETF issuers are having the time of their lives.

BlackRock IBIT – Bitcoin Trust ETF – is breaking new records with the daily trading volumes and capital inflow scraping new surfaces. Let’s discuss the latest crypto ETF updates and what does the market say.

Bitcoin ETF Overview

After the massive valuation and BTC price record in March 2024, the coin is heading towards an unreached high in Q4, possibly beyond the $73,750 threshold it set earlier this year.

Much of this growth stems from the significant inflow of crypto-based exchange-traded funds. Traders and investors are allocating massive funds to BTC ETFs, as issuers are experiencing an all-time high traffic.

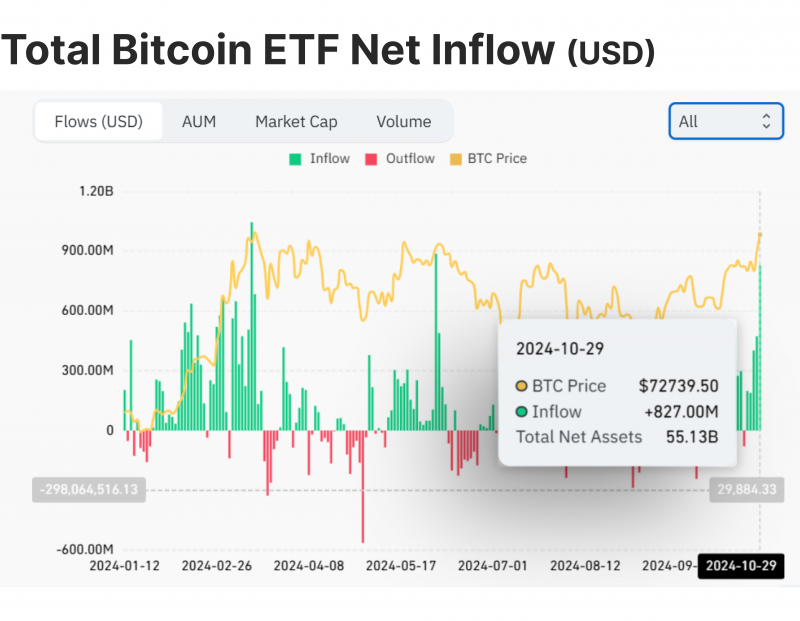

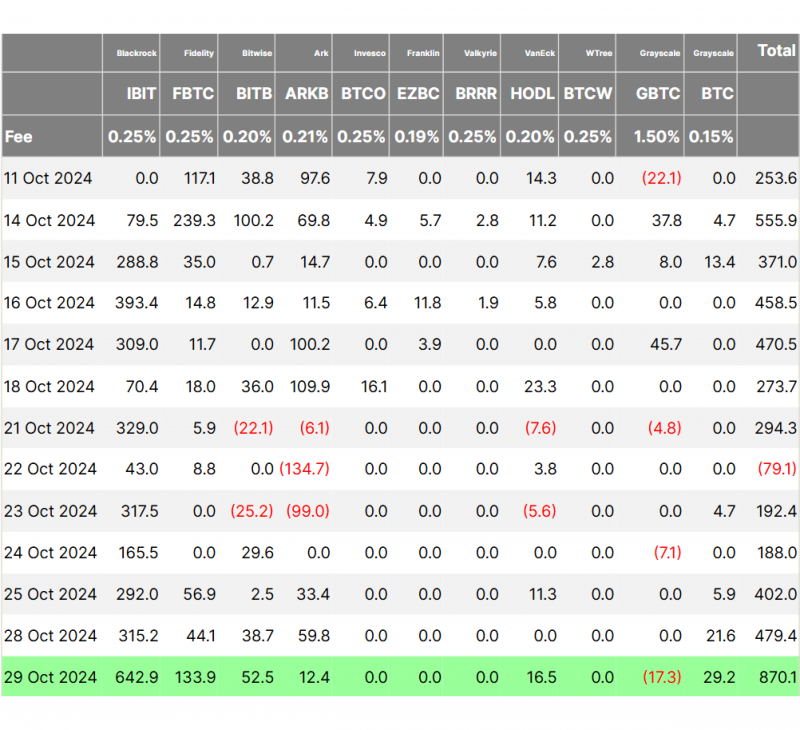

On 29 October, the capital inflow into BTC ETFs exceeded $827 million across all US trading venues, a massive number that was last reached in June this year.

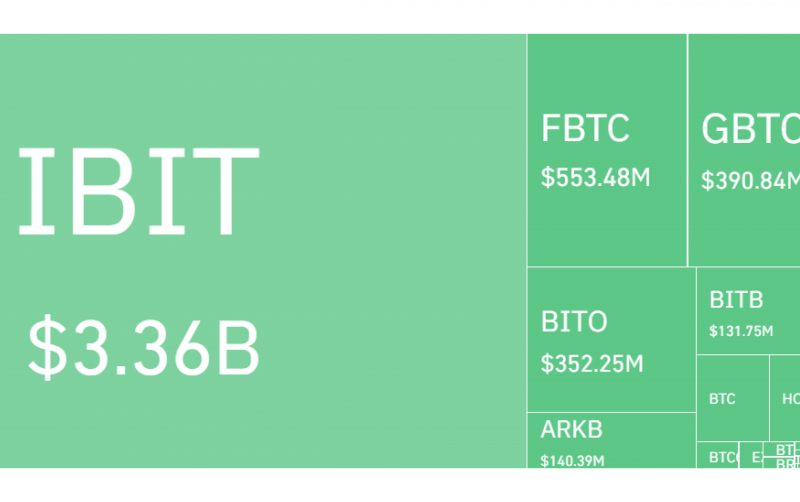

On the same day, the spot BTC ETF trading volume reached a whopping $4.7 billion one day, equalling the performance of three trading days of the previous week. BlackRock Bitcoin spot assets alone grabbed $3.36 billion from the entire trading activity.

A senior financial analyst at Bloomberg, Eric Balchunas, attributed this rush to the fear of missing out (FOMO), as market speculators promise an unprecedented Bitcoin price before the end of this year.

However, multiple factors might have played a role in this rising trend. The geopolitical instability in the Middle East and Europe motivates investors to keep their funds in crypto assets as Forex pairs become unpredictable.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

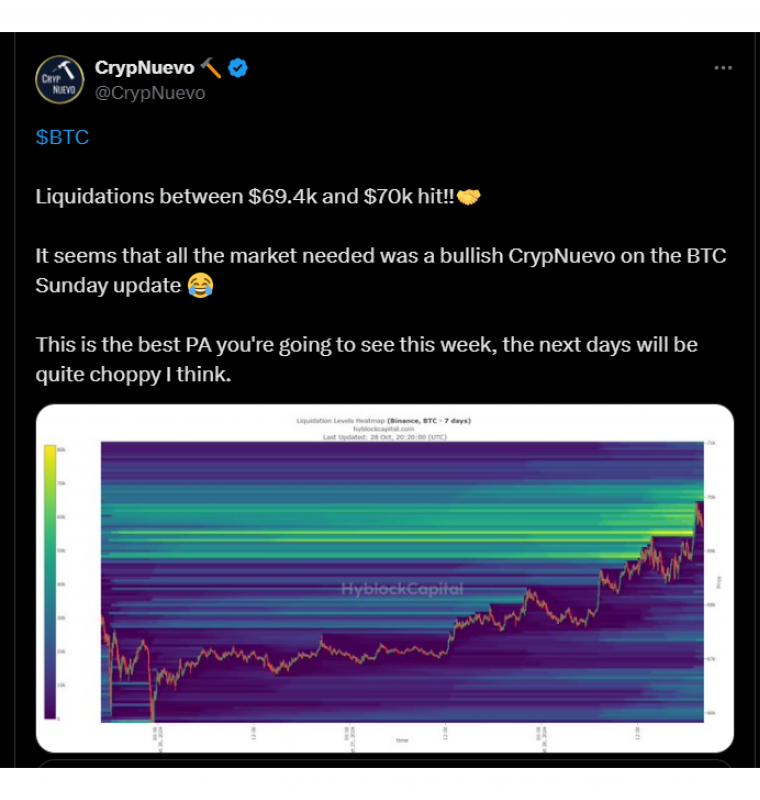

Another source cited the liquidation of short positions, causing liquidity grabs, to add to the buying pressures and surge the coin’s price.

BlackRock Bitcoin ETF Inflow

BlackRock has experienced the highest inflow of ETF investors. The company’s trading volume outperformed that of its competitors, with a massive $3.36 billion, way above Fidelity’s $553 million trading value.

The company outperformed itself after achieving record numbers in spot Bitcoin ETFs in one day earlier this month. BlackRock had a positive flow this month, recording $393 million on the 16th and $329 on the 21st.

However, according to Farside’s reports, IBIT ETF inflow reached $642 million on the 29th, almost doubling its previous record and outpacing other issues altogether.

As the coin’s price keeps growing, there is no reason for BlackRock Bitcoin ETF numbers to slow down, especially if the coin reaches a new record price, which is not far reached at the moment.

How Much Bitcoin Does BlackRock Own?

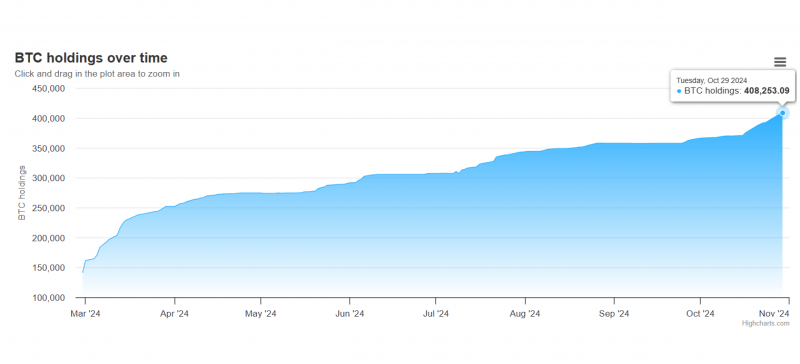

As capital inflow and interest increases, BlackRock BTC holdings increase steadily. The company currently owns over 400,000 Bitcoins, followed by Grayscale and Fidelity, holding 220,000 and 178,000, respectively.

In October alone, the company increased its holdings by 11% from 366,448 to 408,253 BTC across 12 purchases. The last one was conducted on 29 October, involving an additional 4,528 coins.

BlackRock vs MicroStrategy Bitcoin Holdings

MicroStrategy and BlackRock are the largest institutional Bitcoin holders. MSTR has 252,220 BTCs to its name, valued at around $16 billion after the last purchase on 20 September. BlackRock, however, holds over 408,000 coins, estimated at $27 billion.

Both companies have different approaches to their investments. MicroStrategy’s CEO aims to buy and store as many coins as possible as a corporate treasury asset for long-term goals. The company plans to become the largest holder and offer high-end investment instruments.

On the other hand, BlackRock offers crypto investment opportunities at lower price requirements. The company’s iShares Bitcoin Trust ETF trades at around $41, facilitating the way for more investors to trade BTC without owning the cryptocurrency or paying the surging coin price.

Impact on The Crypto Market

Despite the great valuation of Bitcoin’s price and the usual impact on the overall market, other coins failed to simulate a similar surge. Ethereum grew by 3% over October without a massive diversion from the average monthly price. Other altcoins also did not cast any significant rise.

However, as more individual and institutional investors open up to the relatively new crypto investments, you can expect more market stability.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Today, there are 11 Bitcoin ETF contracts offered by renowned financial firms. This connects traders with reliable and reputable institutions, boosting confidence and increasing liquidity, leading to controlled volatility levels.

Conclusion

BlackRock IBIT ETFs experience an unprecedented capital inflow, marked by the increasing number of traders and all-time high demand. The company outperformed the entire market, posting over $3.3 billion in trading volume, with Fidelity trailing behind with $500 million.

These activities occur as the Bitcoin price nears its all-time high, with speculations hinting at a new peak before the year ends. Will a new BTC record price be the market’s Christmas gift?

Disclaimer: This article is for informational purposes only. It is not finance advice and should not be relied upon for investment decisions. Always do your own research and consult a financial advisor before investing.