Central Bank Institutions And The Forex Market: Functions, Influence, and Strategies

According to the International Monetary Fund, global inflation is projected to edge closer to pre-pandemic levels by 2025. The driving force behind this shift isn’t mere luck—it’s the carefully orchestrated actions of central banks.

By managing interest rates and controlling the flow of money, these powerful institutions shape everything from national currency strength to the cost of everyday essentials.

In this article, we’ll pull back the curtain on how major central banks operate, revealing the far-reaching impact of their decisions on economies around the globe and the Forex market in particular.

Key Takeaways

- Central banks sometimes enter the market directly, purchasing or selling currency to manage exchange rates and maintain economic stability.

- When interest rates climb, they often entice international investors seeking higher returns, boosting demand for the currency and pushing its value upward.

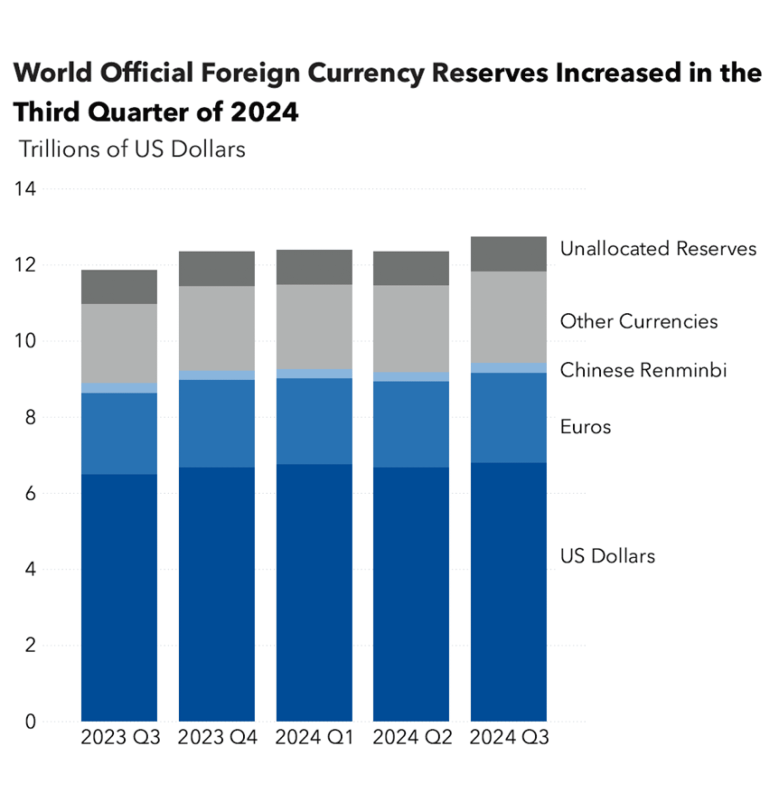

- Due to the U.S. dollar’s role as the leading reserve currency, policy decisions by the Federal Reserve ripple across the globe.

- Economies in emerging markets are particularly sensitive to monetary shifts in wealthier nations.

What is a Central Bank?

A central bank is a government-backed financial institution overseeing a country’s currency, regulating its money supply, and guiding interest rate policies. Its main mission is to keep prices stable, ensuring that inflation stays low and predictable.

Unlike commercial banks, which serve individual customers and businesses, central banks operate at a national or regional level to oversee the broader financial system.

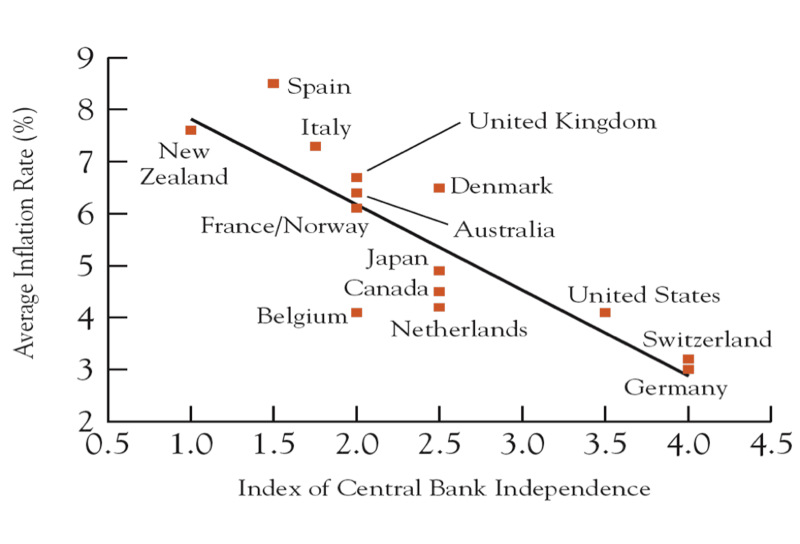

Central banks usually operate independently from direct government control to shield monetary policy decisions from political pressures. This structure allows them to make impartial decisions aimed at long-term financial stability, yet they are still accountable to both the public and the government through regular reports and transparency measures.

Key Central Banks

Several major authorities stand out for their global impact:

- Federal Reserve (Fed)—United States: Oversees the U.S. dollar, widely viewed as the world’s primary reserve currency. Fed policies thus ripple across international markets.

- European Central Bank (ECB)—Eurozone: Regulates monetary policy for nations using the euro, influencing its value throughout member countries.

- Bank of England (BoE)—United Kingdom: Governs the British pound, directly shaping the UK economy and beyond.

- People’s Bank of China (PBOC)—China: Holds growing importance due to China’s expanding economic influence. Notably, the PBOC has been criticised for its lack of transparency compared to other central banks.

- Bank of Japan (BoJ)—Japan: Crucial for managing the yen, particularly given Japan’s role in international trade.

The idea of a central bank acting as a “lender of last resort” took root after the 1907 financial panic in the United States. This idea ultimately inspired the foundation of the Federal Reserve System in 1913.

Functions of Central Bank

Here are some key functions that central banks fulfil in the economy:

Controlling the Money Supply & Inflation

Central banks influence economic activity by controlling interest rates.

- If the economy is slowing, the central bank can lower interest rates to make borrowing cheaper. This will encourage businesses to invest and people to spend more money.

- If inflation (prices of goods and services rising) gets too high, the central bank can raise interest rates to slow down spending and borrowing.

Issuing Money and Controlling Its Supply

Central banks have the exclusive authority to issue banknotes and coins, ensuring the public’s confidence in the nation’s currency. They regulate the amount of money in circulation to prevent issues like inflation (too much money chasing too few goods) or deflation (too little money causing reduced spending).

Managing Foreign Currencies and Trade

Central banks also manage a country’s foreign exchange reserves, which means they control the amount of other countries’ currencies (such as U.S. dollars, euros, or gold) they hold.

- If the value of their own currency changes too much, it can affect businesses and international trade.

- The central bank can buy or sell foreign money to stabilise the value of its currency and help maintain a balance between exports and imports.

This function helps a country stay competitive in global trade and ensures the national currency remains strong.

Keeping Banks and the Financial System Stable

Central banks oversee the banking system to ensure its stability and soundness. In times of financial distress, they can act as a lender of last resort, providing emergency funding to banks facing short-term liquidity issues.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

This function helps prevent bank runs and maintains public confidence in the financial system.

Regulating Commercial Banks

Central banks establish regulations and guidelines that retail banks and financial firms must follow. These regulations cover capital requirements, lending practices, and risk management.

Enforcing these rules, central banks aim to promote a safe and competitive banking system, protect consumers, and prevent financial crises.

Central Bank Influence on Currency Values

Central banks are pivotal in shaping foreign exchange markets through various mechanisms. Let’s explore how they influence currency values, making the complex world of currencies more approachable.

Interest Rate Adjustments

Interest rates are a key instrument central banks use to steer economic conditions. Raising interest rates attracts foreign investors seeking better returns, raising currency demand and enhancing its value. Conversely, cutting interest rates can reduce investor interest, leading to currency depreciation.

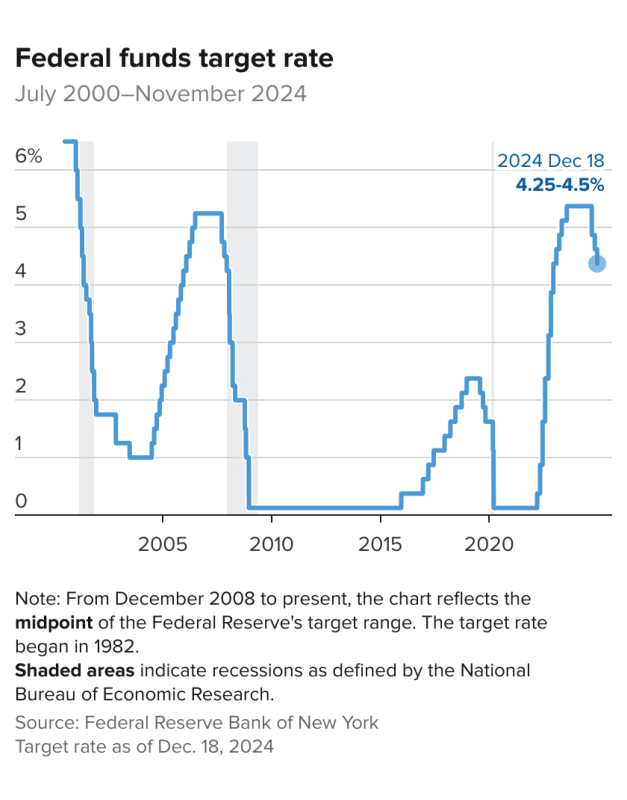

For example, in 2022, the Federal Reserve increased interest rates to combat rising inflation. This move strengthened the U.S. dollar (USD) as investors sought the higher yields offered by USD-denominated assets.

Even a hint from a central bank about future interest rate changes can cause immediate reactions in forex as traders anticipate and adjust to the expected moves.

Open Market Operations (OMO)

OMO involves central banks buying or selling government securities in the open market. Purchasing securities injects money into the economy, potentially lowering interest rates and affecting currency value. Selling securities can have the opposite effect, reducing the money supply and possibly strengthening the currency.

The European Central Bank has sometimes engaged in bond-buying programs to increase liquidity in the Eurozone, influencing the euro’s value in the markets.

Currency Intervention

Sometimes, central banks intervene directly in the forex market to stabilise or influence their currency’s value. This intervention can involve buying or selling their own currency against others to prevent excessive volatility or achieve economic objectives.

The Reserve Bank of India (RBI), for instance, recently sold U.S. dollars to support the Indian rupee, aiming to prevent it from reaching new lows and to maintain economic stability.

Forward Guidance

Forward guidance refers to the communication by central banks about their future monetary policy intentions. By providing insights into their plans, central banks can influence market expectations and behaviours, which in turn affect currency values.

The euro may depreciate when the ECB signals potential interest rate cuts in upcoming meetings as traders anticipate a more accommodative monetary policy.

Central Bank Forex Interventions

Central banks use different ways to influence currency values in the market:

- Direct Intervention: The central bank buys or sells its own currency to change its value.

- Indirect Intervention: Instead of directly buying or selling currency, central banks change economic policies, like adjusting interest rates.

- Verbal Intervention (Jawboning): Central banks sometimes influence the market by talking. They signal possible future actions or express concerns about currency values, impacting how traders and investors react.

A well-known case of central bank intervention is the Swiss National Bank and the EUR/CHF peg (2011-2015).

In 2011, the SNB pegged the Swiss franc to the euro at 1.20 to prevent excessive appreciation, which was hurting Swiss exports. To maintain this rate, it bought large amounts of foreign currency. However, in 2015, the SNB abruptly removed the peg, triggering extreme volatility and causing the franc to surge.

The Bank of Japan has historically intervened to weaken the yen to support Japan’s export-driven economy. In the early 2000s, it conducted large-scale currency sales to maintain yen competitiveness. More recently, the BoJ’s ultra-loose monetary policies, including negative interest rates, have kept the yen weak, ensuring favourable trade conditions.

The People’s Bank of China actively manages the yuan’s value through a controlled float system. It sets a daily reference rate and allows the yuan to trade within a fixed range, intervening when necessary to prevent excessive fluctuations. Additionally, China imposes capital controls to curb speculative currency trading and maintain stability in its financial markets.

Interest Rates: A Driving Force for Currency

Central banks use interest rates to guide economic growth and keep inflation in check. Shifts in these rates can instantly make a currency more or less desirable to global investors, shaping its overall strength in international markets.

Interest rate increases:

- Attracting Foreign Capital: Higher returns on savings and investments invite an influx of funds from abroad.

- Boosting Currency Value: Increased demand typically pushes the currency’s price higher.

- Taming Inflation: Costlier borrowing slows down spending, helping maintain stable prices.

Interest rate decreases:

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

- Lowering Investment Appeal: Reduced returns prompt investors to look elsewhere for better gains.

- Weakening the Exchange Rate: With less demand, the currency often drifts downward.

- Potential Inflationary Pressures: Cheaper borrowing can spur more spending, possibly pushing prices up.

For example, in January 2025, the Canadian dollar weakened against the U.S. dollar as investors anticipated a potential interest rate cut by the Bank of Canada, widening the interest rate gap between Canada and the U.S.

Sweden’s Riksbank, established in 1668, is the world’s oldest central bank. It began as a private bank and evolved over centuries into the central banking institution it is today.

The Role of the U.S. Federal Reserve

As the issuer of the world’s primary reserve currency, the U.S. dollar, the Federal Reserve’s monetary policies have far-reaching effects:

- Interest Rate Adjustments: When the Fed increases interest rates, USD-denominated assets become more attractive to investors seeking higher returns. This heightened demand strengthens the USD. Conversely, lowering interest rates can lead to a weaker USD as investors seek better yields elsewhere.

- Quantitative Easing (QE): QE involves the Fed purchasing large quantities of financial assets to inject liquidity into the economy. While this stimulates economic activity, it also increases the сurrency circulation, potentially leading to a depreciation of the USD. A weaker dollar can make U.S. exports more competitive internationally.

The U.S. dollar’s status as the world’s reserve currency means that changes in its value can influence global commodity prices, as many are priced in USD.

The policies of major central banks, particularly the Fed, significantly impact emerging market economies.

Higher interest rates in developed countries can attract capital away from emerging markets, leading to currency depreciation and financial instability in those regions.

Emerging economies with high external debt or reliance on external investment are especially vulnerable. Countries like Turkey and Argentina have faced currency crises exacerbated by central bank policies and external economic pressures.

Final Remarks

Central banks don’t just oversee the flow of money; they actively shape economic landscapes through currency interventions, interest rate decisions, and forward-looking policy clues. Their moves can swiftly change market conditions, affecting businesses and investment portfolios worldwide.

Recent events highlight their influence. The Bank of Japan has kept the yen weak through low interest rates, while the U.S. Federal Reserve raised rates sharply in 2022-2023, strengthening the dollar and putting pressure on emerging markets. Meanwhile, China’s central bank carefully controls the yuan to support its economy and maintain stability.

For anyone participating in global markets—whether trading, investing, or managing a business—grasping how these institutions function and anticipating their actions can provide a clear edge.

FAQ

What does a central bank do?

A central bank shapes a nation’s monetary policy, keeps inflation in check, sets interest rates, and oversees the banking sector. It also acts as a last-resort lender in financial emergencies.

What happens when the central bank buys the currency of the other nation?

By purchasing foreign currency, the central bank boosts demand for that currency and may weaken its own. This move can foster exports but might also increase the local money supply, which can raise inflation risks.

Why do central banks raise or lower interest rates?

They raise rates to cool an overheating economy and curb inflation, and they lower rates to spur investment and consumer spending when growth slows down.

Is trading forex a good idea?

Opportunities exist, but they also involve significant risks due to unpredictable price swings. A solid grasp of economic indicators, central bank strategies, and sensible risk management is vital for success.