Role and Principles of Liquidity Distribution in Forex

Liquidity distribution is paramount for the effective operation of finance markets. It permits people to engage in commerce without creating substantial fluctuations in the value of currency.

Liquidity significantly influences various elements of FX trading, such as the disparity in buying and selling rates and the speed of trade completion. Brokerage professionals must have access to liquidity to fulfil their clients’ needs.

As technology advances, the digital finance industry evolves, creating opportunities for innovative liquidity providers. As traders invest in various markets, reliable liquidity services with adequate risk management are essential for success. With numerous options, including trading venues and payment services, it’s essential to choose an experienced partner.

In this article, we will discuss how FX liquidity works and liquidity distribution in FX, as well as find out how to choose a reliable supplier of liquidity.

Key Takeaways

- Trading in the FX market heavily hinges on liquidity.

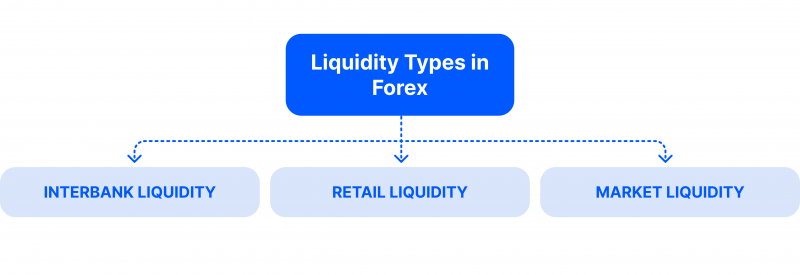

- There are various types of liquidity: for example, market or intrabank liquidity.

- To pick a dependable provider, pay attention to pricing, reputation, and trading instruments offering.

- A liquidity zone is a price range with a high active and pending order density, influencing price direction.

Explaining Liquidity Distribution

Forex trading relies heavily on liquidity, which applies to the easiness with which a currency can be bought or sold without notable price movements.

Liquidity in the FX market is crucial for retaining price steadiness, efficient execution, and risk management. High liquidity allows for gradual and predictable price movements, while low liquidity can lead to sharp swings. High liquidity also allows traders to enter quickly and exit positions at desired prices, reducing slippage risk. Additionally, it provides for the effective use of stop-loss orders in volatile markets, minimising potential losses.

High liquidity refers to buying and selling currencies with no significant impact on the currency pair’s value in foreign exchange trading. It involves easy trading activity and a broad liquidity pool.

Market liquidity affects bid-ask spread, transaction execution speed, and position opening and closing speed.

The liquidity distribution of a currency pair in Forex refers to its ability to purchase and sell without affecting its exchange rate. It allows for easy transactions and substantial trading volumes. This distribution determines the success of trade and prompt fulfilment of open positions. A liquidity pair is considered liquid if it can be rapidly purchased or sold and has high trading activity.

Brokers must access the largest liquidity pool to meet customer needs and offer liquidity to multiple tokens on a single platform. This multi-asset liquidity allows investors to optimise earnings by utilising market changes and abundant trading views.

Maintaining liquidity is crucial for smooth trade, as it affects bid-offer spreads and individual trades. Brokerage companies acquire their liquidity from various sources.

The FX market is the world’s largest and most liquid market, with a daily trading volume of over $7.5 trillion. It is primarily dominated by the U.S. dollar.

How to Find Liquidity in Forex

To determine FX liquidity, brokers use various indicators and techniques like trading volume, bid/ask spreads, market depth, and the number of participants in the market. Thus, higher transacting volume and narrower spreads indicate greater liquidity, market depth indicates the quantity of buy/sell orders at different price levels, and more active participants indicate increased liquidity.

Traders must have a good knowledge of the various channels through which foreign exchange funds can move in the market. This can make it easier or harder for them to buy and sell currencies at the right times. Here are the most common types of liquidity in the Forex market.

- Interbank liquidity is the highest level of forex market liquidity, provided by large finance institutions to other institutions through direct or electronic communication networks, characterised by deep order books and narrow bid-ask spreads.

- Retail liquidity refers to the one offered by retail brokers, acting as intermediaries between traders and the interbank market, offering varying levels of liquidity to cater to different traders’ needs.

- Market liquidity is determined by trade volume, with higher values indicating more elevated liquidity. Traders should be aware of market liquidity conditions to avoid wider spreads and slippage.

Brokers come across such elements as bid-and-ask spread and slippage in the FX market — the key components affecting its liquidity.

The bid-ask spread in Forex is the dissimilarity between the highest price a customer is willing to buy and the lowest price a seller is willing to sell. It represents the cost of trading and is a key component of liquidity. Tight spreads indicate high liquidity, while wider spreads suggest its lower level. Major currency pairs like EUR/USD and USD/JPY have tighter spreads due to their high liquidity.

Slippage in Forex occurs when a trade’s execution occurs at a different price than expected and can be positive or negative. High liquidity reduces the chances of slippage.

Where Does Liquidity Come From?

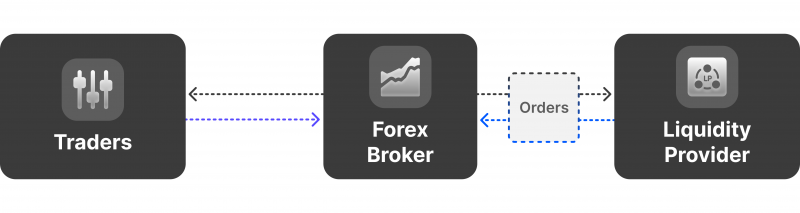

Brokers must have the broadest available liquidity pool to meet client expectations and satisfy their clients’ expectations. The question remains about how the brokers gain liquidity.

FX broker liquidity providers (LPs), including market brokers and professional market makers, contribute to the FX market’s liquidity. They aggregate rates from major banks and hedge funds, displaying them in a broker’s order book, ensuring a smooth trading experience.

FX liquidity distributors act as counterparties in global transactions, matching customers with buyers or assets. They facilitate transactions, acting as market makers and influencing market volatility. FX LPs are financial institutions that own or have access to a large pool of currencies and lend them to smaller firms for trade execution.

LPs in the forex market are essential for efficient currency exchanges. There are various types of LPs in the market:

- Banks – They amass large amounts of assets to offer competitive pricing to their clients.

- Electronic communication networks (ECNs) – They match algorithmic buy and sell orders from traders, banks, and hedge funds.

- Market makers – They buy and sell assets from their inventories to supply liquidity in global markets, even in volatile situations.

- Hedge funds – They buy up large quantities of financial assets to boost their liquidity and offer competitive pricing to market participants.

- Retail brokers – They provide liquidity primarily to retail traders, serving as intermediaries between financial institutions and retail traders to maximise liquidity pools and reduce slippage.

LPs can be categorised into Tier-1 and Tier-2 suppliers, which act as Market Makers, offering liquidity to clients, setting prices and commissions, and being counterparties of trades.

Tier-1

Tier 1 LPs, such as large banks and financial entities (Deutsche Bank and Barclays Capital, for example), accept large-volume orders that smaller brokers cannot obtain.

Tier-2

Tier-2 suppliers, also known as Prime of Prime (PoP) or liquidity aggregators, act as a bridge between smaller market participants and Tier-1 liquidity providers.

PoP firms are non-bank liquidity providers that aggregate numerous small-volume orders from small forex brokers to send big-volume orders to Tier 1 providers. Tier 2 LPs, such as B2PRIME, FXCM and Swissquote, are large, well-known, and reliable forex brokers that can aggregate orders from smaller brokers.

Identifying Forex Liquidity Zones

A liquidity zone in FX trading is a high-volume price range with a high concentration of active and pending buy and sell orders. These zones can influence price direction, with previous lows and highs typically located in these zones.

Liquidity zones can be identified in trading levels where previous support can transform into resistance and vice versa.

These zones are crucial for institutional traders to execute large orders without significantly affecting market prices. These zones are price magnets, as they represent intense buy or sell interest areas. They can also act as dynamic support (zones with buy orders) and resistance (zones with sell orders) areas.

The 30-day high and low prices are pivotal levels in trading. They represent recent valuation extremes and create psychological benchmarks for traders and investors.

Liquidity zone trading is a trading strategy that focuses on areas with high liquidity or large volumes of orders being executed. These zones are areas with elevated trading volumes and volatility, providing traders with a better understanding of market sentiment and enabling more informed decisions.

Traders can identify liquidity zones using technical indicators like moving averages, Bollinger Bands, psychological levels, volume indicators, historical price data, and price action analysis for consolidation or breakouts. However, liquidity zone trading is not foolproof, and traders should use proper risk-addressing techniques such as stop-loss orders and position management.

For instance, historical price data can help identify areas where price has reacted strongly in the past, such as when the price has reversed or consolidated, while volume profiles can show the amount of trading activity at various price levels, with high-volume nodes often representing liquidity zones.

Support and resistance levels can also act as liquidity zones, as traders remember these levels and make buying decisions based on them.

How to Find A Reliable Liquidity Supplier?

LPs are crucial in trading, especially for beginner brokers, as they expand the order book, execute traders’ orders instantly, and provide beneficial conditions. Insufficient liquidity can lead to heavy losses, so liquidity partners help traders apply diverse strategies and achieve profits.

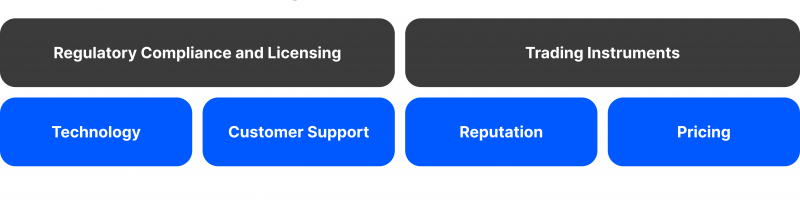

LPs play a crucial role in trading by providing traders with access to capital markets and assets. Key factors to consider when selecting a liquidity partner include the following.

Technology

Trustworthy LPs offer top-notch technology and infrastructure, such as robust trading platforms, fast execution times, and reliable connectivity. Choose a provider that can handle high volumes of trades without experiencing downtime or technical issues.

Regulatory Compliance and Licensing

Ensure an LP’s regulatory compliance and licensing, as different jurisdictions may have different rules. Check if the provider is licensed, complies with applicable regulations for your region and meets additional requirements like MiFID II or EMIR. This ensures the safety and security of their services for users.

Trading Instruments

Choosing a liquidity supplier involves considering their span of trading instruments and asset classes, such as FX Spot, crypto assets, and specific markets or asset classes like equities or commodities. Identifying these options ensures traders and businesses have access to all necessary products.

Reputation

Reputation is essential when choosing an LP, as it indicates their ability to deliver on promises and provide excellent service. Look for providers with a solid reputation in the industry and a proven track record of delivering excellent service.

Pricing

Pricing and fees are another critical factor, with some providers charging fixed fees per trade or a percentage of the trade value. When choosing an LP, consider pricing and fees, comparing them between providers to get the best deal.

Different providers may have different fee structures, including flat fees or commissions, and may offer competitive spreads. Consider discounts for frequent traders or volume-based rates for long-term savings. Read the fine print to avoid hidden costs.

Customer Support

Customer support is another critical factor, with providers offering 24/7 support and multiple channels of communication. Popular options for LPs include banks, market makers, and ECNs. Banks offer access to finance markets and competitive pricing, while market makers buy and sell assets themselves, providing faster execution times and tighter spreads but potentially having a conflict of interest.

ECNs connect buyers and sellers directly, offering fast execution times and competitive pricing but limited asset coverage.

Final Thoughts

The trade sector offers various liquidity solutions and technology suppliers, allowing investors and brokers to access trading instruments through user-friendly interfaces. LPs are essential in the FX realm, providing good prices, quick trades, and value-added services, adding steadiness to the market, and helping traders succeed.

Liquidity zones provide traders with insight into price interest areas in the FX market, allowing them to anticipate conceivable evolution in the prices and refine their strategies. However, comprehending the context and combining multiple forms of analysis is crucial for consistent success.

FAQ

What are FX LPs?

Forex liquidity providers act as counterparties in global transactions, matching customers with buyers or assets, encouraging transactions and extremely influencing market volatility.

How do you spot liquidity zones?

Traders can identify liquidity zones by analysing price charts and observing concentrations of buy/sell orders, often corresponding to support or resistance levels, using technical analysis tools.

Who are Tier 1 LPs?

Tier 1 LPs primarily accept large-volume orders, making them unsuitable for smaller brokers. The examples are Deutsche Bank, UBS, and Barclays Capital.

How do LPs make money?

LPs profit from transaction fees induced by users who exchange tokens in the market created by the pools with multiple token types.

By clicking “Subscribe”, you agree to the Privacy Policy. The information you provide will not be disclosed or shared with others.

Our team will present the solution, demonstrate demo-cases, and provide a commercial offer