Coinbase Derivatives Set to Launch Solana Futures: A Market’s Defining Moment for Altcoins?

Coinbase Derivatives, a subsidiary of the well-known crypto exchange, plans to introduce Solana futures on February 18th. The new investment vehicles could be pivotal for Coinbase and the broader industry, especially as enthusiasm for Solana gains momentum.

This development arrives amidst a quickly shifting regulatory environment in the United States, spurred by the return of President Donald Trump, widely touted as America’s first pro-crypto leader.

Regulatory Winds Favouring Crypto Innovation

Since January, the Trump Administration has wasted little time reconfiguring the nation’s cryptocurrency policies, resulting in what many call a “land of opportunity” for new crypto products. Numerous crypto-based financial products have received renewed attention and increased clarity from regulators.

This environment has allowed Coinbase Derivatives to file for and potentially launch Solana (SOL) futures contracts without facing the same regulatory hurdles once prevalent in past years.

Such moves reflect a broader industry trend: more established platforms are eager to expand their crypto services for alternative digital assets. CME Group reportedly explores new instruments for more tokens, while firms like VanEck and ProShares submit new applications for spot crypto ETFs.

These could signal a new era in which major financial institutions are more willing to embrace cryptocurrencies beyond just BTC and ETH.

Coinbase’s Position in the Market

Coinbase Derivatives was first launched in 2021 and is regulated by the Commodity Futures Trading Commission (CFTC) as a designated contract market, which grants it the authority to list crypto derivatives, including futures contracts.

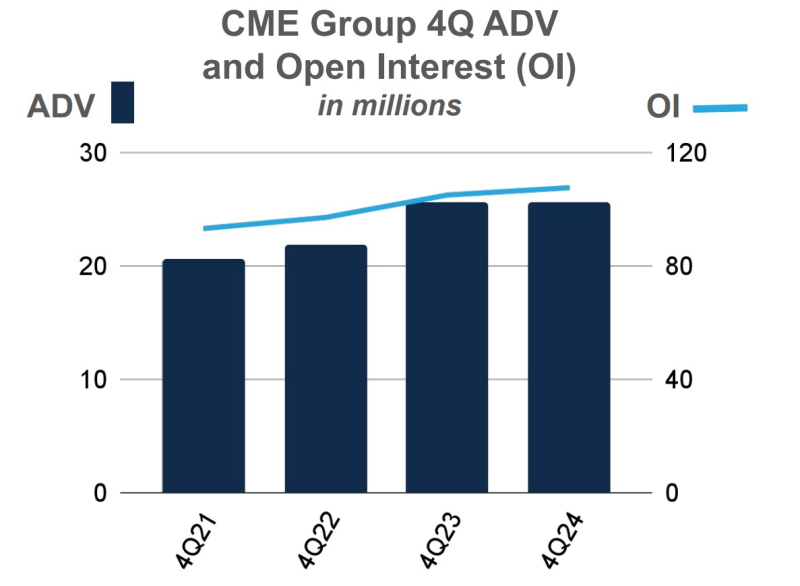

While Coinbase has traditionally focused on spot trading, introducing Solana futures indicates an intention to broaden its product line. The company’s leadership appears motivated by the success of competitor offerings, such as CME Group’s record performance in crypto futures contracts trading last year.

In an increasingly competitive environment, Coinbase’s derivatives exchange aims to capture a share of the demand for altcoin products. Adding SOL and HBAR futures could help diversify trading options and, crucially, differentiate Coinbase from other major players.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

For an exchange that reported a drop in transaction revenue last year, expanding into derivatives products for emerging digital assets is a strategic effort to sustain and grow its revenue streams.

Why Solana Futures?

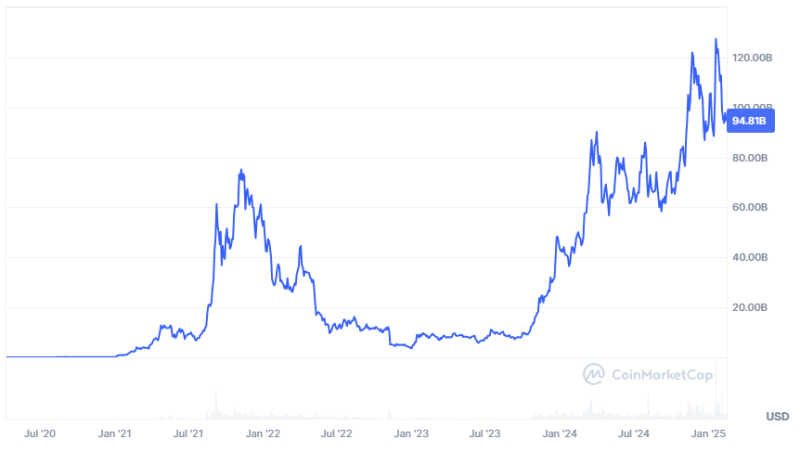

Many investors have been interested in Solana due to its high transaction speeds, low fees, and expanding ecosystem of decentralised applications. Despite experiencing challenges in 2022 and 2023, Solana has rebounded and now boasts significant developer activity.

Today, Solana’s market capitalisation exceeds $95 billion, making it the 6th biggest cryptocurrency. The project is attracting the attention of institutional players, and some are speculating about altcoin ETF approvals in the near future.

Another reason for this heightened interest is Solana’s high volatility: its 30-day volatility rate is 3.9%, compared to Bitcoin’s 2.3% and Ethereum’s 3.1%. This attracts traders looking for larger price swings, although it also carries increased risk.

Key Mechanics and Risk Management

According to filings, new Solana futures contracts will be settled in cash monthly, with trades terminating at 4:00 PM London time on the final Friday of each contract period.

The listing will feature contracts of 100 SOL tokens each, potentially worth around $25,000 at current prices. Plans are also underway for a “nano” version of these futures, with each contract representing only five SOLs. This would likely appeal to a broader range of traders interested in smaller positions.

Coinbase has stated that a sophisticated settlement mechanism will be used to prevent market manipulation. The mechanism draws price data from multiple exchanges and employs 20 three-minute intervals over a one-hour window. Risk management features include a 10% hourly price fluctuation limit and kill switches to halt trading under certain extreme conditions.

Coinbase will set position limits at 3,500 contracts in aggregate. This approach reflects lessons learned from volatility spikes in the crypto market over the past few years.

Furthermore, Coinbase is working closely with Nodal Clear, LLC, a derivatives clearing organisation registered with the CFTC, to handle all clearing services.

Meanwhile, the exchange has partnered with Frankfurt-based MarketVector Indexes GmbH to supply benchmark rates for settlement prices. This way, Coinbase attempts to provide transparent and fair pricing, which is especially important in a rapidly changing crypto industry.

Institutional Interest and Future Prospects

Market sentiment appears favourable for the launch of SOL futures, with positive indications from asset management firms and other market participants.

As more professional investors enter the crypto space, the need for diversified trading instruments grows. Products like Solana futures contracts can serve both speculative and hedging purposes, offering a potential tool for portfolio risk management.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

For competing exchanges, the success of Coinbase Derivatives could serve as both an inspiration and a challenge. Platforms that have so far limited their crypto derivatives offerings to Bitcoin and Ethereum may accelerate plans to list additional altcoin futures.

At the same time, they will be watching closely to see how Coinbase manages liquidity, volatility, and regulatory scrutiny—a combination of factors that can make or break a new derivatives product.

Final Thoughts

Coinbase Derivatives’ plan to introduce Solana futures reflects the platform’s effort to stand out in a shifting regulatory landscape. The pro-crypto signals from the Trump administration and growing institutional appetite for cryptocurrencies have laid the groundwork for such products to thrive.

While risks remain—changing policies and possible market fluctuations—the introduction of new crypto-based futures contracts is a notable step toward a more diverse and sophisticated digital asset market.

Disclaimer: This article is for informational purposes only. It is not finance advice and should not be relied upon for investment decisions. Always do your own research and consult a financial advisor before investing.

Recommended articles

Recent news