Crypto Regulation Developments — What‘s Next for the Industry?

The rapid expansion of the cryptocurrency sector is forcing regulators worldwide to step up their game, with groundbreaking changes shaping the future of digital finance.

One of the latest major milestones is the European Union’s Markets in Crypto-Assets (MiCA) regulation, slated for full implementation by December 30, 2024. It aims to standardise crypto rules across member states, setting a global precedent.

Meanwhile, more and more governments across the globe are focusing on establishing frameworks to govern digital assets, aiming to balance innovation with investor protection and market integrity.

Here’s a look at the latest crypto regulation news shaping the industry.

United States: SEC Leadership Transition

Gary Gensler, Chair of the US Securities and Exchange Commission (SEC), announced his resignation effective January 20, 2025. Gensler described his tenure as “an honour of a lifetime,” emphasising that the SEC had met its mission and enforced the law “without fear or favour.”

His leadership was marked by criticism of the cryptocurrency industry and aggressive enforcement actions, including lawsuits against major cryptocurrency entities such as Binance and Coinbase.

Industry experts have weighed in on this development. Cory Klippsten, CEO of Swan Bitcoin, remarked, “Gensler is criticised by many, but to be fair, the history of the crypto industry is indeed littered with scams and illegal securities.”

At the same time, Eleanor Terret, a journalist at Fox Business, noted that eighteen US states have filed a lawsuit against the SEC and its Chair, claiming “gross government overreach” into the emerging cryptocurrency sector.

The focus now shifts to President-elect Donald Trump, who is expected to nominate a successor. Industry speculation points to figures like Paul Atkins and Brian Brooks, both of whom have previously advocated for a more lenient regulatory approach toward digital assets.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

This leadership change could influence the SEC’s stance on cryptocurrencies and regulatory policies in the coming years, bringing more US crypto regulation news to the public.

United Kingdom: Comprehensive Crypto Regulations by 2026

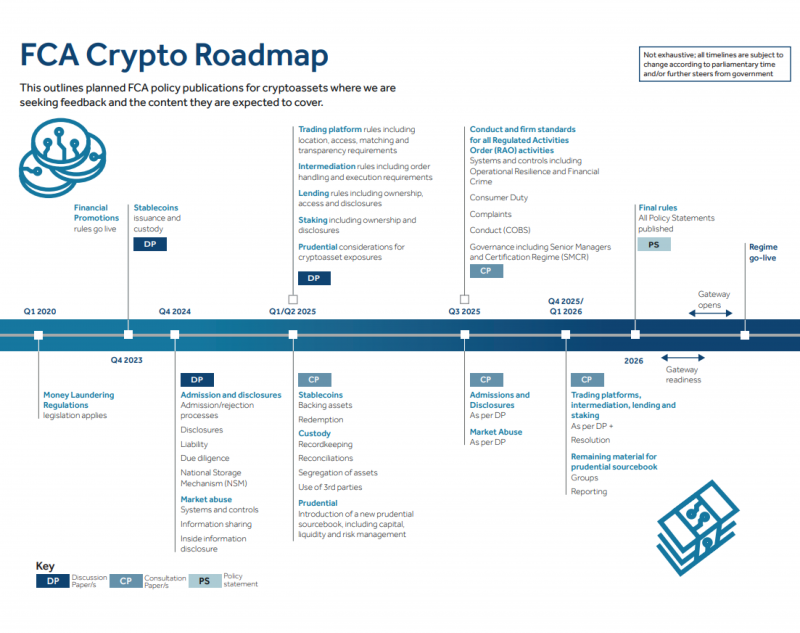

On November 26, the UK’s Financial Conduct Authority (FCA) revealed plans to implement comprehensive cryptocurrency regulations by 2026. These include measures to combat market abuse, establish capital requirements, and prevent insider trading in the crypto sector.

This announcement has been a key focus in recent UK crypto regulation news, highlighting the country’s proactive stance on overseeing the digital asset market.

“We’re committed to working closely with the Government, international partners, industry, and consumers to help us get the future rules right,” Matthew Long, Director of Payments and Digital Assets at the FCA, said. At present, “there are no protections” for UK crypto investors, Long warned in an interview with Bloomberg. “Be prepared to lose all your money”.

The UK will be the first European country to regulate the cryptocurrency market officially. Even though the industry faces criticism from authorities, about seven million people in the UK own some type of digital asset. Once these rules are in place, other European countries might follow the UK’s lead in supervising the industry.

Japan: Introducing a New Crypto Brokerage Category

In Japan, a November 21 report from Nikkei revealed that the Financial Services Agency (FSA) is considering removing restrictions for businesses dealing with stablecoins and cryptocurrencies.

In order to achieve this, FSA proposed the creation of a new business category termed “cryptocurrency and electronic payment means brokerage business.”

This initiative aims to provide a lighter regulatory framework for intermediaries dealing with stablecoins and virtual assets, distinguishing them from traditional crypto exchanges.

According to meeting materials from a recent FSA discussion, “When game companies, telecommunications companies, or other businesses with a wide customer base act as intermediaries for transactions of crypto assets—between crypto asset exchanges and users in the game apps or unhosted wallets they provide—depending on the nature of the transaction, this may constitute ‘intermediation’ under the Payment Services Act.”

The new “lighter regulations” will hinge on shifting the burden of anti-money laundering (AML) and counter-financing of terrorism (CFT) compliance to registered exchanges. This approach would streamline the responsibilities of intermediaries but still keep the overall ecosystem firmly under the control of the Japanese state, many experts say.

Beyond G7: Morocco Is Reversing the Crypto Ban

In North Africa, Morocco is set to legalise cryptocurrencies, reversing its 2017 ban. The nation’s central bank, Bank Al-Maghrib, is drafting a law to regulate crypto assets, according to Reuters. Governor Abdellatif Jouhari highlighted that the law aims to balance innovation with citizen protection.

Jouhari also revealed that Morocco is exploring the launch of a central bank digital currency (CBDC). “Regarding central bank digital currencies, and like many countries around the world, we are exploring to what extent this new form of currency could contribute to achieving certain public policy objectives,” he stated in a recent interview.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Morocco’s decision to legalise cryptocurrencies after a prolonged ban signifies a significant policy shift, acknowledging the inevitability of digital finance’s growth.

Final Remarks

The global trend towards establishing comprehensive crypto regulations reflects a recognition of the sector’s growing significance. Industry leaders advocate for clear and consistent regulatory frameworks to ensure safer and more stable crypto markets.

They argue that such regulations are essential for restoring credibility and investor trust, especially in the aftermath of high-profile scandals like the collapse of the FTX exchange in 2022.

These regulatory developments have elicited varied responses from industry stakeholders. Proponents argue that clear regulations will foster innovation, attract institutional investment, and enhance consumer protection. Critics, however, caution that overly stringent rules may stifle growth and limit the transformative potential of blockchain technology.

Disclaimer: This article is for informational purposes only. It is not finance advice and should not be relied upon for investment decisions. Always do your own research and consult a financial advisor before investing.