Cryptocurrency Exchange Matching Engine

Articles

If you’ve heard the term, but are still not exactly sure about what a matching engine is or the technology behind them, this article seeks to provide a basic understanding on how they work.

What is a Matching Engine?

A matching engine is essentially the core mechanic of a digital exchange which matches up bids and offers to execute trades. They work by using one or more algorithms which keep a record of all open orders in a market and generating new trades if the two orders can be fulfilled by each other. A matching engine is able to support different order types, such as a limit order or market order and may have unique APIs as well as offering a wide range of other features.

These days, trading is almost entirely facilitated by electronic trading matching engines. The software supporting it is the most crucial part of any exchange as this is what enables users to trade with each other. Leading cryptocurrency exchange, B2BX.

B2TRADER Matching Engine

B2BROKER launched the first version of its matching engine in 2018 after an in-depth development and integration phase which incorporated ground-breaking technology. The first version of B2TRADER was launched with over 70 instruments and is today used by many of the world’s best-known exchanges. B2TRADER handles the job of matching an incoming market order of the user with the existing limit order of another user in the DOM, executing the trade on the order book and publishing the result. B2Broker’s solution provides ideal performance and functionality, ensuring that all market participants are given the best execution.

Components of the Platform

B2TRADER comprises of the following components:

- Load balancer

- Frontend server

- User-account database

- Matching engine

- Message queue for order execution

- Multiple services

- Front office

- Back-office

- Market data office and API WS

- Time scale database

Key features include:

- 21 trading pairs and deep institutional liquidity

- Tight spreads with average BTC/USD spread is as low as $2 USD or less

- Institutional grade volumes

- Various payment systems/SWIFT & SEPA bank transfers/Faster payments

- Crypto withdrawals with high-limit withdrawal conditions

- Featured in the Top 50 exchanges in terms of liquidity on coinmarketcap.com

- User-friendly KYC procedures

- REST, WebSocket API

- Exceptional trading UI with multiple user-friendly features

- Market depth of volumes on all pairs viewable via trading UI

- User access security with 2FA verification,Google Authenticator and SMS

- Withdrawal address whitelist function for specifying chosen wallets

- Integrated with B2BINPAY for industry-leading payment processing

- Helpdesk with FAQ and support section including live chat

- iOS mobile app for trading, analyzing charts, etc on the go

- 24/7 multi-lingual support and live chat

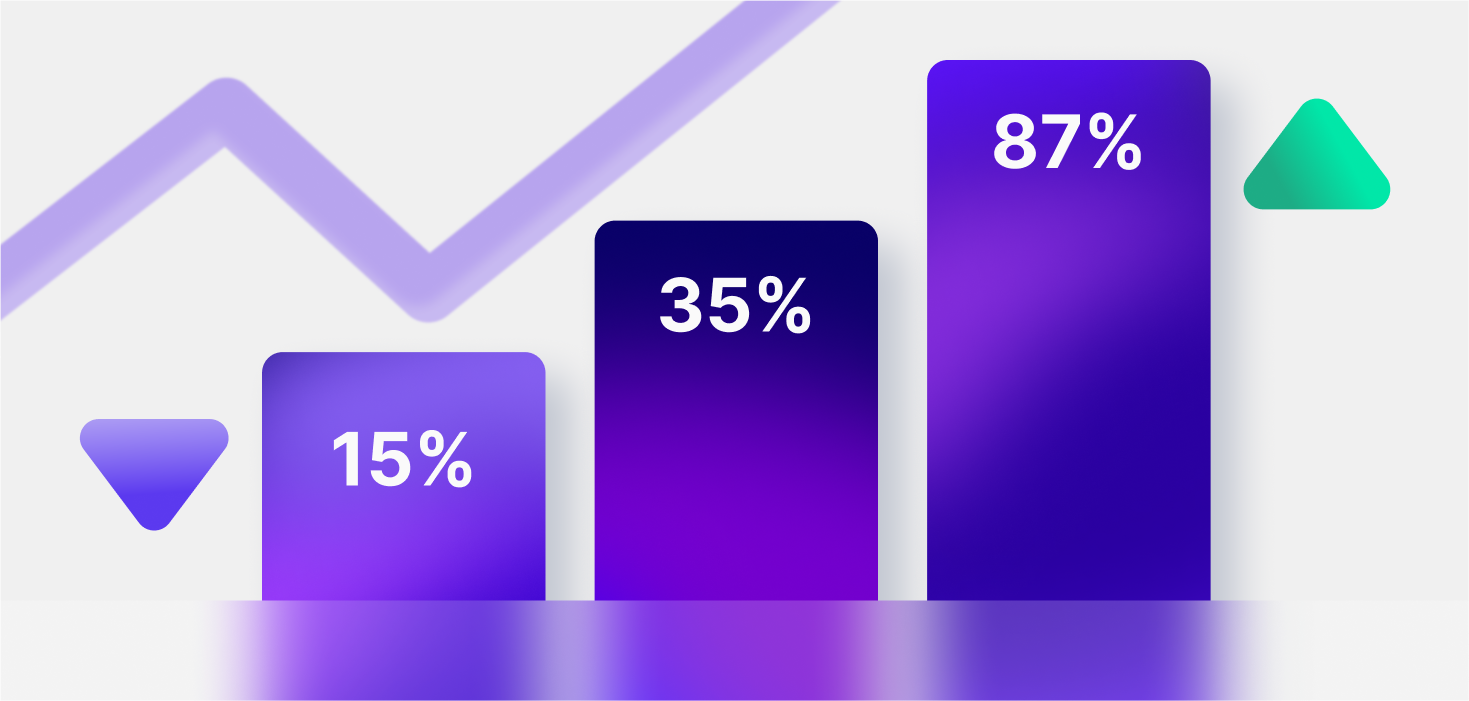

Above all, B2TRADER has a high capability matching engine that offers a robust and stable service to traders and is capable of processing 30,000 requests per second, with an average execution time of less than 10 ms.

If you’d like to find out more about B2TRADER or are looking to start your own cryptocurrency exchange, please contact [email protected]