Liquidity as a Service in The Crypto Industry

Articles

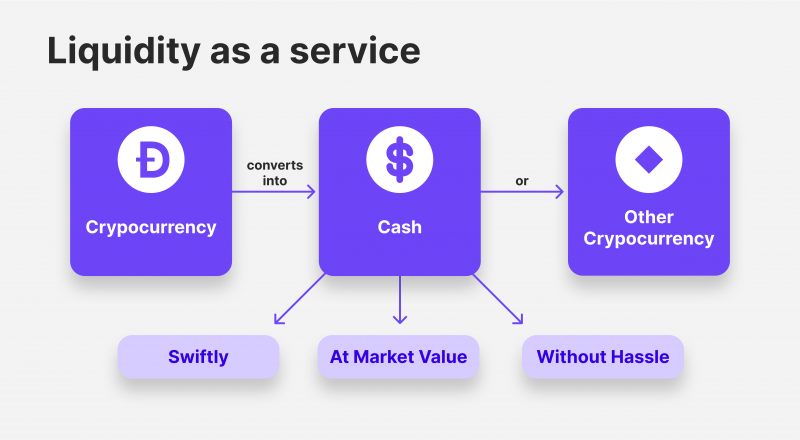

Liquidity is a core pillar of building properly functioning money markets around the globe. Liquidity showcases how swiftly you can convert one currency into another and how active the market is with overall money flow. In simple terms, liquidity measures how easy it is to exchange cryptocurrencies without delays, excessive trading fees, and inability to find buyers and sellers on the market.

Therefore, liquidity services are crucial in any crypto market across the globe. These services are offered mainly by liquidity providers who supply liquidity pools to the market and fill the demand gaps as they emerge on the crypto trading landscape. These entities ensure that their respective forex markets have enough liquidity. High liquidity equals a healthy trading environment. But why is that, exactly? Let us discuss further.

Key Takeaways

- Liquidity in crypto markets facilitates smooth trading by enabling swift currency conversions without significant delays or costs.

- Liquidity Providers (LPs) enhance market liquidity by creating liquidity pools, boosting daily trading volumes, and stabilising price fluctuations.

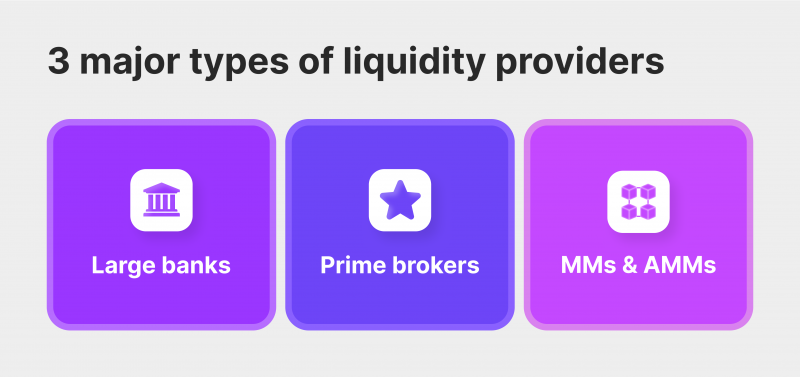

- Various types of LPs, including Large Banks, Prime Brokers, and Market Makers, contribute uniquely to providing liquidity and attracting more traders to the crypto landscape.

- Excessive liquidity provision can lead to rising trading costs and monopolistic control by LPs, underscoring the need for a balanced approach to maintain a competitive market environment.

Liquidity – A Practical Example

To better visualise the concept of liquidity, let us imagine a scenario where seller A wants to sell crypto X. If buyer A trades in the market with high liquidity, they will convert crypto X into their favourable currency almost instantaneously and without dropping the price.

With low liquidity, seller A will have to either wait or consider selling at lower prices than expected since the market is quite dry and devoid of active buyers. While seller A will probably find a good deal eventually, the crypto exchange market is very time-sensitive, and seller A will likely miss their window of profit opportunities.

Some crypto exchange markets are naturally highly liquid, but that is not the case in many sectors. So, how does a low-liquidity market reverse its fortune and become sufficiently liquid? That is where liquidity providers come in to raise the overall liquidity pool by purchasing and selling high volumes of specific cryptocurrencies.

As a result, the entire crypto niche will have more favourable quotes on selling and buying crypto assets, attracting new traders to its offerings and raising trading activity across the board.

Why Liquidity Service Is Essential For Crypto Markets

As discussed above, the concept of liquidity makes everything flow around the crypto exchanges worldwide. However, high liquidity is only sometimes achieved naturally in the crypto landscape. Due to high volatility and significant risks tied to trading in the crypto industry, liquidity tends to be considerably lower compared to fiat currencies and their respective exchange markets.

That is why LPs and their services are practically indispensable in the crypto sector. Without their efforts to inject liquidity into crypto markets, we would have a very slow-moving crypto environment, with buyers and sellers rarely finding mutually beneficial deals.

Thus, a crypto liquidity provider can uplift the daily trading volume significantly. They also stabilise the market since more liquidity means less price fluctuation and reduced risks of the crypto downturn.

For their invaluable efforts, liquidity providers receive a commission in the form of a spread, which is the difference between selling and buying amounts of a given cryptocurrency. With this methodology, LPs are able to make consistent profits and have a strong incentive to supply markets with liquidity.

So, with LPs taking the initiative to supply cash to a given market, we have a Pareto improvement. From increased stability and trading volume to an accelerated execution of exchange deals, LPs increase the quality and scope of a given exchange market.

Types of Liquidity Providers in Crypto

LPs come in many shapes and sizes, offering different varieties of liquidity provisions and additional services that assist crypto traders. While liquidity provision is their many responsibilities, LPs have many complementary services, helping companies and individuals make sense of the robust crypto market and its challenges. Below, we present the three principal types of LPs and their unique value propositions.

Large Banks

Large banking institutions are considered market leaders in the LP segment. Large banks possess massive capital and extensive international networks, letting them purchase and sell colossal cryptocurrency volumes and almost single-handedly uplift liquidity in some cases.

While large banks mostly accommodate entire markets and serve as the general liquidity providers, you can still benefit from their services directly. Large banks provide ample opportunities for aspiring crypto traders with initial capital to acquire the essential liquidity for growth.

However, the requirements are strict here, and your business must be eligible with its scope and profitability to use these liquidity services. After all, large financial institutions have high operational costs due to their sheer size and complexity. So, partnering with smaller clients is often not profitable for their purposes. However, certain large banks have dedicated small to mid-sized liquidity services.

Prime Brokers

While prime brokers offer similar liquidity services as large banks, their proposition goes far beyond this offering. Prime brokers have a general mission to assist traders in growing their crypto portfolios through diligent trading and winning investment strategies. Therefore, their liquidity provision is often accompanied by research, consultation, and even portfolio management.

Prime brokers also introduce crypto traders to advanced financial instruments like options contracts, margin trading, and other concepts. They ease the transition from simple exchange trading to a complex crypto landscape that requires extensive financial experience.

So, if you aim to acquire liquidity for your crypto exchange business but also need some complementary services to accelerate your growth, prime brokers are the way to go. However, these services are fairly expensive, and it is wise to consider other options if your business scope is not quite eligible.

Market Makers (MMs) & Automated Market Makers (AMMs)

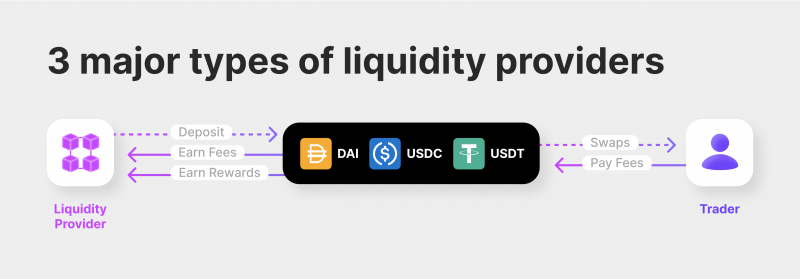

Finally, we have the market makers. These entities have wildly varying scopes. There are massive and relatively smaller market makers, each accommodating their respective liquidity scopes. However, all MMs have the same purpose – purchasing and selling a particular cryptocurrency at favourable prices.

Unlike large banks and prime brokers, market makers exclusively focus on providing ample liquidity. In most cases, MMs attract various investors to accumulate large liquidity pools and then fill the liquidity gaps in the market. Their main source of income is the spread – the difference between bid and ask prices.

Despite their simple operating concept, MMs face numerous challenges in the crypto market. With such a volatile and unpredictable industry, MMs need extensive market research skills, in-depth analysis, and expertise to avoid bad liquidity investments.

The crypto landscape is still relatively young, and there are only a handful of currencies that manage to keep stability. Therefore, MMs must stay vigilant and support cryptocurrencies with strong inherent value and a bright future.

Conversely, we have automated market makers, which serve the same purpose as MMs but act strictly according to the predetermined algorithm. Much like traditional market makers, AMMs must identify the correct liquidity gaps to keep prices stable and prevent a given crypto market from superficial disruptions.

With advanced algorithms, AMMs monitor the market prices of cryptocurrencies and automatically dispense or burn cryptocurrencies that have skewed beyond their market values. AMMs provide liquidity with predictable patterns, which is great for the participating traders in the given market.

While this method is less prone to human error and opportunistic behaviour, there is still a chance of human manipulation of the algorithm. So, AMMs offer several improvements over standard MMs but also bring considerable risks to the table.

The Pros And Cons Of Providing Liquidity Pools

Now that we have a firm grasp on the types of LPs in the crypto market, let us delve into the general values that unite them all. LPs often serve as a stabilising agent in the broad crypto exchange market. Their presence and active involvement go beyond a simple increase in liquidity.

Pros

High trading volumes – When a given LP steps in to supply ample liquidity, a given crypto segment will attract more traders. This inflow of market participants increases the price competition and distribution of assets. As a result, no single trader or entity will possess enough funds to impact the exchange market adversely.

Market stability – LPs also have an inherent interest in keeping prices stable. Therefore, they often counter any sudden price shifts, supplying the liquidity to stabilise any sudden price deviations.

Accelerated market growth – The inflow of new traders also facilitates high trading activities and volumes, letting the crypto markets grow exponentially faster. Higher trading volumes lead to increased competition and a demand for larger liquidity pools, and the cycle goes on. Although this growth is slightly superficial and powered by an LP, it positively impacts the general crypto economy with almost no downsides.

Positive signal to aspiring traders – Additionally, LPs send good signals for aspiring traders to enter the crypto landscape. It’s important to remember the public conception that cryptocurrencies include inherent volatility and cyber threats. The presence of LPs softens this sceptical outlook, sending signals to potential crypto traders that the market is relatively safe and most likely won’t experience huge fluctuations in the near future. Therefore, the mere involvement of LPs leads to an opportunity for growth.

Cons

Increased transaction costs – When liquidity reaches a certain level and volume, the given crypto market might experience rising transactional costs, wider spreads, and higher fees for utilising liquidity pools. This happens due to the increased power of LPs in a particular segment, allowing them to dominate the market and set their preferred terms without fearing adverse consequences.

Risks of monopolisation and liquidity crisis – As with all other financial industries, giving LPs overwhelming leverage to dictate terms is undesirable, leaving the market with limited options. In that case, LPs can increase their charges exponentially, potentially leading to a market downturn. High dependence on liquidity provision could also cause a liquidity crisis, leading to a potential collapse of a given crypto market. As a general economic rule, it is best to keep the free market free and avoid the monopolisation of power from any single institution or party.

Summary

Liquidity is the prime concept in the crypto trading market worldwide. It is a pillar of stability, activity, high trading volumes, and growth. With LPs, crypto exchange platforms and entire markets can facilitate continuous trading and keep the participants happy. After all, the crypto market is all about trading swiftly and capitalising on new opportunities without delay.

FAQ

What is liquidity used for in Crypto?

Liquidity in crypto facilitates easier buying and selling of assets without causing significant price changes, ensuring smooth trading and stable prices in the market.

What is liquidity as a service in DeFi?

Liquidity as a Service (LaaS) in DeFi refers to platforms or services providing liquidity to decentralised exchanges or protocols facilitated by liquidity providers pooling their assets to reduce price slippage and improve trading efficiency.

Which crypto has the most liquidity?

As of 2023, Bitcoin (BTC) and Ethereum (ETH) are typically the most liquid cryptocurrencies due to their high market capitalisation and substantial trading volumes across various exchanges.

How is liquidity in crypto calculated?

Cryptocurrency liquidity is calculated using metrics like trading volume, order book depth, bid-ask spread, and slippage, which help determine the ease of executing trades without significant price impact.