DEX vs CEX Crypto Exchanges: What’s The Difference?

Articles

With the advent of cryptocurrency technology in our lives, there are many tools and solutions for working with them. One such tool is a cryptocurrency exchange, which today are represented in two groups: decentralized exchanges and centralized exchanges.

This article will help shed light on what decentralized and centralized exchanges are. You will also learn the difference between them, and from this you will be able to understand which crypto platform for trading crypto assets is right for you.

What is DEX?

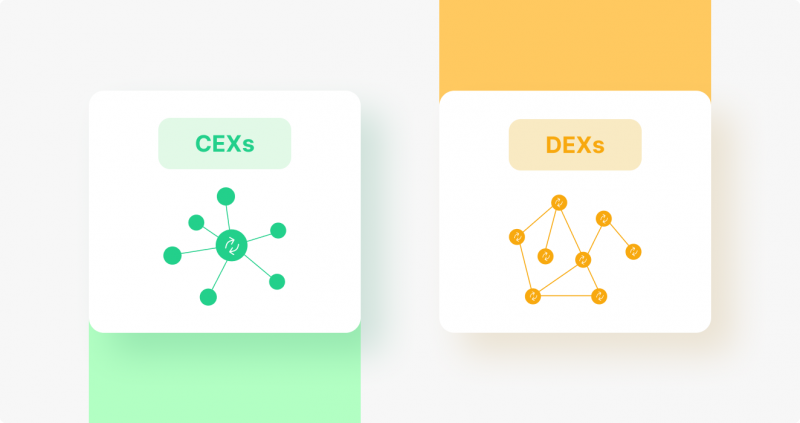

Decentralized exchanges (DEX) are exchanges whose main difference and advantage is that their operation is based on a distributed registry. Such companies are a platform for users to find new orders to sell or buy a cryptocurrency asset. Such exchanges do not store user funds, do not collect personal data about them, and do not have servers – all work between the participants is done directly through peer-to-peer data exchange. DEXs aim to complete transactions more quickly and cheaply than their centralized counterparts.

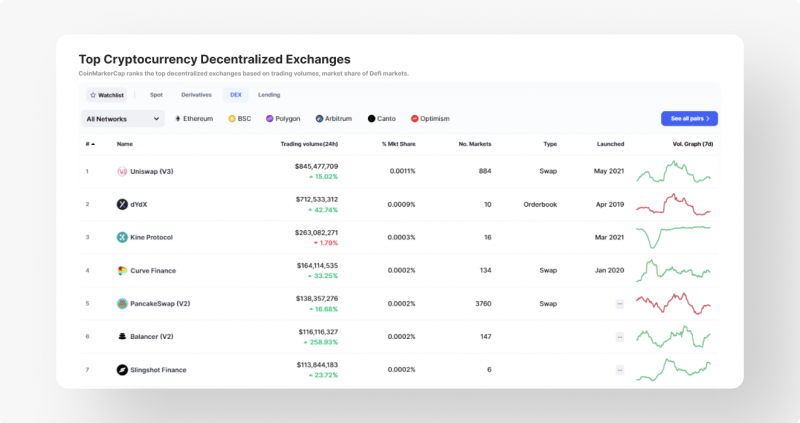

A decentralized crypto exchange is a single-ranked trading floor where transactions are executed directly between crypto traders without a central authority. DEXs implement one of the main features of cryptocurrencies: they facilitate financial transactions without banks, brokers, payment processors, or any other intermediaries. According to the CoinMarketCap website, the most popular DEXs, such as Uniswap and Sushiswap, use the Ethereum blockchain and are part of a growing set of decentralized finance (DeFi) tools that make a huge range of financial services available directly from a compatible crypto wallet.

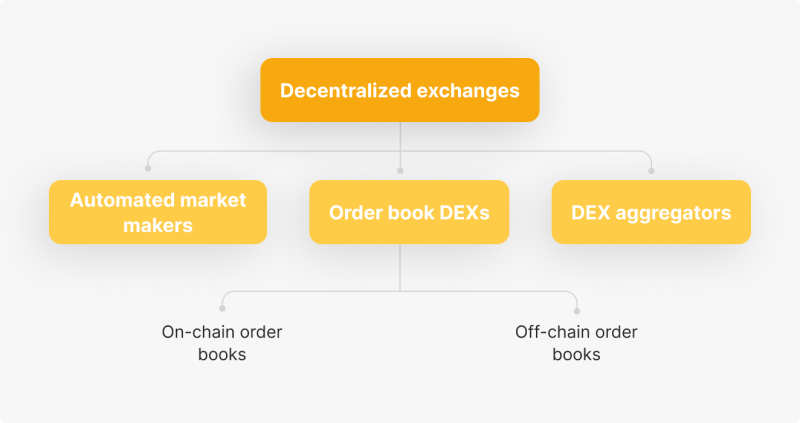

There are different types of decentralized exchanges. Here are the main ones:

DEX Aggregators

Combine different exchanges into one trading platform. Here, users can view information on the tokens of interest and choose the most profitable commission from a single interface. Aggregators do not need to serve pools of traders’ liquidity, as in the AMM model. This category includes 1Inch and 0x. To enable low-cost trading with a large number of trade pairs, a decentralized server network is deployed.

Automated Market Maker (AMM)

This method involves abandoning the order book and providing automatic trading according to a certain algorithm. That way, users don’t need another trader on the other side to make a trade. Consequently, they interact with smart contracts. This trading principle involving the use of smart contracts is one of the most popular today, gradually replacing other methods.

Network Order Books

This system stores all transactions, purchase requests, changes, or cancellations on the blockchain. This approach provides transparency because everything happens without third-party involvement. But all processes are slow and often more expensive due to additional fees.

Offline Order Books

All transactions take place offline; only the transaction itself takes place on the blockchain. This is a faster and cheaper method of exchange. Its disadvantage is a security vulnerability.

What is CEX?

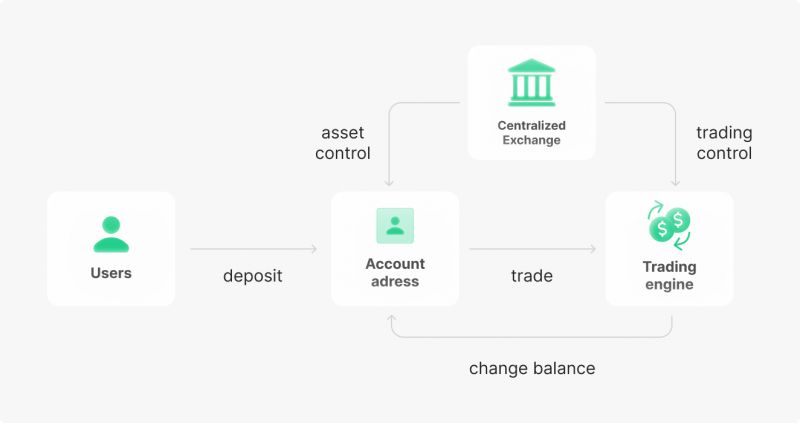

Centralized Exchanges or centralized trading platforms (CEX) are specialized platforms for buying, selling, and exchanging digital instruments. All this happens within the service itself. The most important feature of a centralized exchange is the way it functions. Centralized exchanges are created and controlled by a certain group of people. This is how many exchanges work, even outside the cryptocurrency market. A large team or organization is fully responsible for the operation of such exchanges. This is the origin of the name of such exchanges – centralized, which means that the management core of the exchange is a single center that manages absolutely everything.

Centralized crypto exchange work very simply. Crypto investors register on their website and pass through the verification procedure (read more about KYC and AML verification procedures here). Then, the user’s cryptocurrency or fiat currency is deposited into the exchanger’s cryptocurrency wallet with the help of an exchange service from the fiat currency on their bank card to any cryptocurrency directly on the exchange’s website. It’s also possible to choose to buy cryptocurrency through P2P crypto trading. Furthermore, if users already have cryptocurrency somewhere, they can simply transfer it to their exchange account quickly and safely. After all these manipulations, crypto users can search for the trading pairs they want (for example, Bitcoin to Stablecoin USDT) and buy Bitcoin or any other cryptocurrency with their U.S. dollars. The most important thing is that the trading pairs of interests exist on that exchange.

The main feature of centralized exchanges is that all users’ money is stored on the exchange itself. From this follows the obvious pros and cons of this type of exchange for trading the crypto assets. Roughly speaking, the pros are as follows: reliability, transaction speed, site guarantees, and tech support. The main disadvantages are that the users’ money is essentially in someone else’s pocket, there is complete transparency of transactions for the state and fiscal authorities when the authorities need the users’ personal data, and there are international sanctions on geographical grounds, etc.

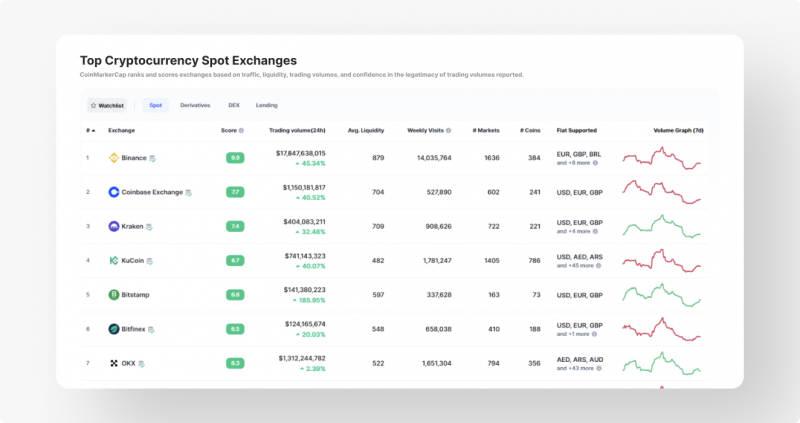

The largest and most trustworthy CEXs include: Coinbase, Kraken, Bybit, KuCoin, Poloniex, Binance, Bitfinex, Gemini, Bittrex, CEX.IO and others. A full, daily updated rating of CEX exchanges can be found on CoinMarketCap and Coingecko portals.

Key Takeaways

- A centralized exchange is an exchange with centralized structure and centralized authority that uses a third party to facilitate transactions between buyers and sellers, while a decentralized exchange is an alternative that has no intermediaries, crypto assets are never held by the service, and transactions are based solely on smart contracts and atomic swaps.

- Most decentralized exchanges and use the AMM order execution system, which allows you to use smart contracts to confirm trades.

- Centralized exchanges allow you to exchange fiat money for digital assets, while decentralized exchanges allow you to exchange one digital asset for another digital asset.

DEX vs. CEX Crypto Exchanges: What is the Difference?

Both centralized and decentralized exchanges, as the central link in the crypto markets where crypto trading takes place, are designed to provide the ability to easily, quickly, and safely trade and exchange different digital coins and fiat currencies with each other, while complying with all the necessary legal regulations and requirements established in the country where the exchange, regardless of the type and size, carries out its activities.

At the same time, each of these types of trading venues has its own advantages, disadvantages, characteristics and differences, which to varying degrees determine the principle of each particular exchange. Let us consider in detail the difference between both centralized and decentralized exchanges.

Liquidity

As a rule, centralized exchanges, unlike decentralized platforms, have higher liquidity, trading volume and order execution speed. Moreover, in most cases they have multiple liquidity providers and higher trading volume, and can fill and close open orders almost instantly. It follows that these characteristics help to prevent liquidity problems, slippage fees, slow filling and high spreads that are typical for decentralized exchanges. In addition, this high liquidity and volume also translates to lower volatility and less room for manipulation.

Verification

This advantage goes to decentralized exchanges because the compulsory passage of identity verification is an integral part of registration on a centralized exchange (cex). For some users, undergoing the KYC procedure is an additional guarantee of safety of their account and funds, but for many, mandatory verification on the exchange is deanonymization. Since one of the key advantages of cryptocurrency is anonymity, many traders do not want to reveal their identity so that someone could trace the flow of their funds or use confidential data against them. There is also a risk of users’ personal data being “leaked” from a centralized exchange, especially those as private keys.

Management and Administration

As mentioned above, a decentralized exchange (dex), unlike a centralized one, does not have a governing body, which is engaged in the full management of the platform. This means that users need not fear for the safety of their data and money, because there is no person who has access to it. Full transparency and security of trading are the distinctive features of decentralized exchanges, which also offer full control over the crypto wallet and other key elements of the platform interface. This feature is primarily appreciated by crypto-enthusiasts who want a higher level of security in trading, knowing that their funds belong only to them.

Security

Security is always an issue when it comes to managing crypto assets. Unlike centralized platforms, decentralized exchanges offer a higher level of security because they do not have a central wallet where user funds are stored, including private keys and other personal information. At the same time, history knows many cases of hacking of hot wallets of crypto exchanges and crypto exchange platforms themselves, when traders and investors lost millions of dollars with no way to get their funds back.

Naturally, hackers can hack your wallet and steal your funds even when using decentralized exchanges. Still, if, in that case, the security of your wallet depends solely on your actions, where in the case of CEX, nothing depends on you at all. If an exchange gets hacked, you can lose your investment. For example, not so long ago one of the largest crypto exchanges in the world, FTX, was hacked after the collapse, and over $400 million was stolen from it.

Against this background, the head of the largest cryptocurrency exchange Binance also spoke on Twitter about the need to adhere to certain requirements to maintain the trust of users.

In light of what happened last week, I felt compelled to define the six most important requirements that #Binance and every other centralized exchange should adopt in order to ensure trust with our users.https://t.co/BmZsNraNs5

— CZ :large_orange_diamond: Binance (@cz_binance) November 15, 2022

Anonymity

This advantage of decentralized exchanges stems from the point about governance. Since decentralized exchanges completely lack the bodies to control its processes, any personal data including private keys, interface settings, wallet addresses for transactions, etc. are completely under the control of users and have a high level of anonymity. This aspect helps to prevent fraudulent actions and in general any kind of crime related to the theft of money and digital assets, because in this case it is much easier for fraudsters to get access to data.

Despite all the advantages and disadvantages that both centralized and decentralized exchanges have, it is the latter that may get more development in the future in the form of the absence of a regulatory body.

What Type of Exchange Should I Choose to Trade Cryptocurrencies?

To choose the type of exchange for trading crypto assets, first of all, you need to consider the above factors, which directly affect the choice and determine the terms of the trade itself. In addition, it is necessary to conduct a thorough analysis and consider the following points, which will also help to make a choice in favor of one or another type of exchange.

Available Assets

Find out on the exchange website whether it provides the opportunity to trade the coins (coins, cryptocurrencies) you are interested in. The first, primary, and most expensive cryptocurrency today is Bitcoin. The other coins are called altcoins. In second place after Bitcoin in terms of liquidity is Ethereum. Stablecoins are cryptocurrencies whose value is pegged to some fiat currency (i.e., the regular currency – the dollar or euro) and to other crypto assets. And also to commodities traded on exchanges, such as precious metals and gas: one such stablecoin is Tiberius, supported by prices of seven precious metals.

Commissions

Different platforms have different levels of commissions that are taken for the purchase and sale of assets. Depending on how much and how often you trade, the amount of commissions will also vary. If you have a large amount of money to trade frequently, it is in your best interest to pay lower commissions per trade. For the most part, commissions on decentralized exchanges are much lower than on centralized exchanges because in the former case, the commissions are set by the blockchain network and sometimes cannot be changed, whereas on any centralized exchange, the commissions are set by the exchange itself and can often change depending on the decisions of the management of the exchange.

Conclusion

Centralized exchanges are a great tool for capital appreciation, offering a wide range of digital instruments for trading in crypto markets. They are characterized by high liquidity and the presence of a governing body. On the other hand, decentralized platforms offer more anonymity, enabling transactions through smart contracts and liquidity pools, which in turn expand the scope of trading any digital coin or token. Regardless of which choice you make, a crypto exchange is an important linking element of crypto trading, without which a crypto system cannot exist.