How to Sell Shares of a Private Company

Stock trading is one of the oldest forms of financial trading in business, where traders can buy and sell shares of company stocks. However, private companies’ shares are treated differently than publicly listed ones. Private companies’ shares are not found in famous stock exchanges like NYSE or LSE and are less common than public share trading. Selling private company shares is somehow complicated and involves several considerations.

The good news is that you can sell private shares, but it takes a different route, which we will explain in the following.

Key Takeaways

- Private shares are not traded in public secondary markets like public companies. Instead, they are sold privately to investors.

- Private companies may issue and sell shares to raise funds through angel investors, venture capitalists, accelerator programs and other fundraising methods to increase operating cash flow.

- Employees holding private company shares can sell their shares back to the company or externally to investors and institutions.

- Private companies do not need to comply with the SEC’s requirements and are not required to disclose their reports like public companies.

Saudi Aramco (Petroleum company) holds the record for the largest IPO of all time, with $25.5 billion raised from going public in 2019.

What Are Private Shares?

Shares are parts of a company’s overall value and equity, and their price performance reflects the company’s activity. Companies start as private entities with privately held shares before announcing them to the public and trade stocks in secondary markets and exchanges.

However, unlike publicly traded companies, private shares are not traded in secondary markets, and retail traders cannot buy private shares. Companies may issue privately held shares to raise funds, attract investors, or as a part of an internal shareholders program.

Additionally, since private shares are not publicly traded, they do not need to comply with the Securities and Exchange Commission. Therefore, only institutional investors and firms can trade private stocks.

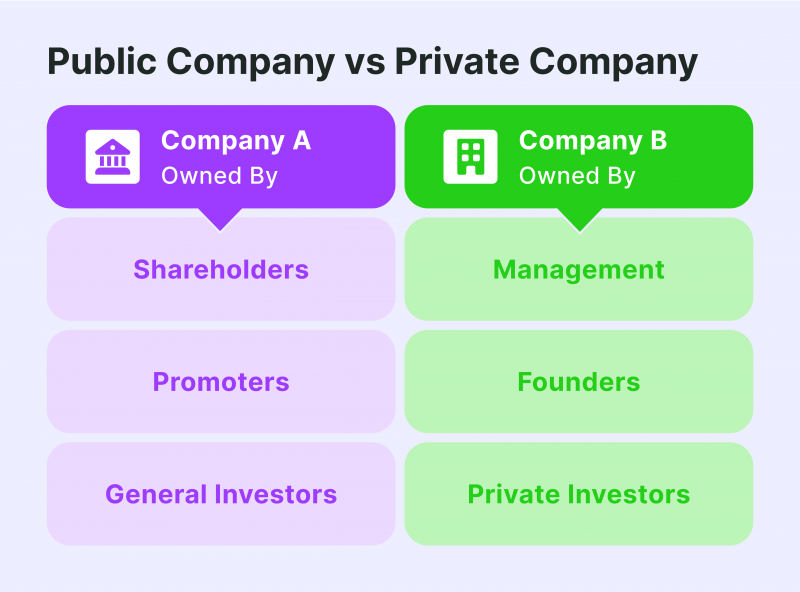

Private Shares vs. Public Shares

Private companies issue a small number of shares compared to publicly listed companies. Therefore, their stock price does not fluctuate so much, and it would only change based on the company’s performance and overturn.

However, public corporations issue a large amount of shares that numerous individuals and institutions hold. Therefore, their stock price changes according to supply and demand factors, besides corporate valuation and reports.

Additionally, trades can find public shares on secondary markets and exchanges, while private shares are privately traded.

In order to buy a private company’s shares, a trader or a company must be accredited by the SEC and meet certain requirements involving net worth and source of income. These conditions may include having a $200,000 net worth of working in the finance industry.

Why Sell a Private Company Shares?

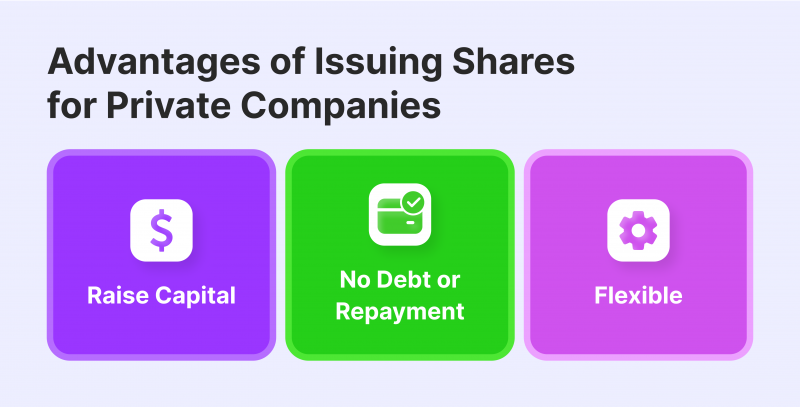

There are several reasons a private company would offer their shares for sale. Startups and newly emerging companies tend to offer their shares to investors, institutions, and financial firms as part of their fundraising efforts.

Small companies usually have limited resources and rely on fundraising campaigns to generate liquidity and proceed with business operations pay salaries, and work software.

Additionally, private companies may offer their shares to partners as collateral, attracting a strategic partnership that boosts their performance and returns in exchange for private company shares.

Private company shares can also be used in employment loyalty or equity share programs, retaining employees and motivating them by offering a piece of the company’s equity.

Can a Private Company Sell Shares To The Public?

Private companies cannot sell their shares to secondary markets and exchanges like public companies. You are unlikely to find any private company’s shares on the stock exchange.

Private corporations do not need to meet the requirements of the SEC. Therefore, they are not listed on stock exchanges and are not required to disclose their reports and financial statements to the public, unlike public companies that must publish their reports regularly.

How To Sell Stocks Of a Private Company

Private stocks can be bought and sold, but not as easily as public shares. However, if a company decides to go public and sell their shares in secondary markets, or an employee wishes to sell their equity, there are few ways to do so.

Public Sale

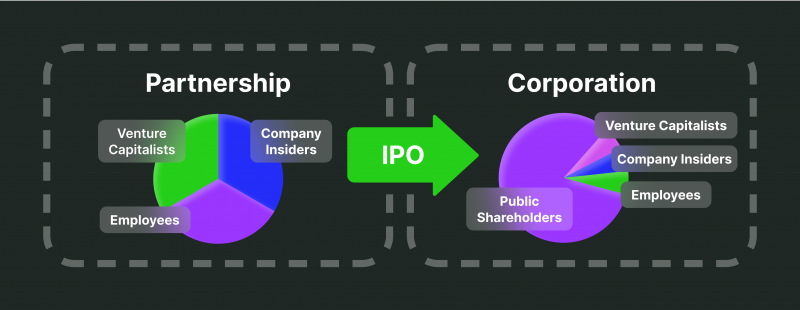

A company may wish to go public and comply with the US Securities and Exchange Commission, conduct an IPO process, and list its shares for the general public. Selling shares on the stock exchange benefits companies to raise more funds and awareness about their business, especially if they succeed as a private entity and wish to expand their recognition and focus on the long term.

Companies also go public to raise more funds from a larger pool of investors and traders in different stock exchanges and marketplaces. However, this step requires comprehensive regulatory compliance, including periodic reports of their performance and finances.

Private Investors

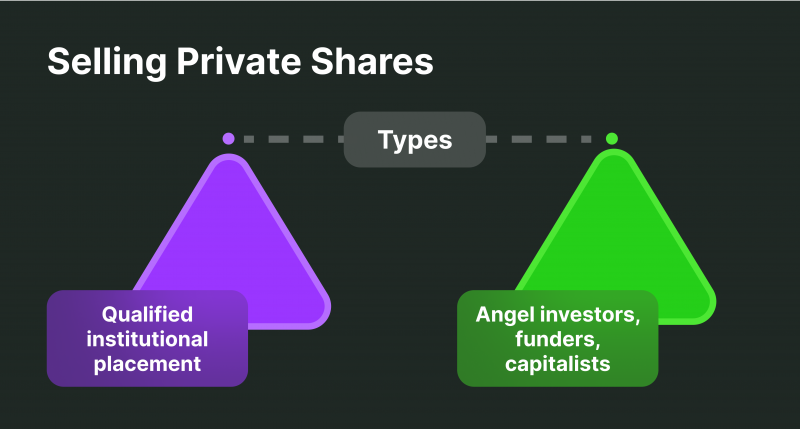

Private companies may sell their shares to individual or institutional traders. Selling to private investors can be advantageous since SEC compliance is not required, and private corporations can engage with angel investors, funds, accelerators, and more ways to raise funds.

Independent investors and entrepreneurs may also be interested in buying a private corporation’s shares, and they can be a valuable source of funds for private entities.

Employees

Sharing a company’s equity among employees is becoming an increasingly used method by companies to attract and retain employees. Since small companies and startups are limited on funds, they use this approach as compensation for their employees.

Stocks can also be offered to employees as a part of the bonus system to ensure the employees stay at the company, hoping the company will grow and the stock price will increase.

Buy-Back Programs

Companies that offer equity shares to their employees may offer a buy-back system, where the company purchases the shares from employees.

Employees may use this opportunity for monetary compensation. However, this approach is quite rare because companies are basically offering these shares because they are short on money.

Special Considerations For Selling Private Stocks

Private shares are treated differently than public shares as they are not as common as public ones, where anyone can buy any stock in secondary markets. Therefore, there are some factors that you need to consider.

Pre-IPO Shares

Private companies and startups may consider going public and filing for an Initial Public Offering (IPO), where the shares become publicly traded on secondary markets and stock exchanges.

When the company announces its intention to do so, it raises funds in pre-IPO markets, raising capital from venture capitalists and institutional investors who are interested in that company’s shares.

Institutional and individual investors may buy pre-IPO shares, hoping the price will rise once their stocks are publicly traded, where they can resell in secondary markets for a higher price and make some gains.

Therefore, the company’s shareholders, like employees, can seize this opportunity and sell their shares and holdings in several pre-IPO private shares markets, where prices are higher than non-pre-IPO stocks.

Non-Pre-IPO Shares

Institutional investors and ventures find it challenging to get around non-pre-IPO stocks, where private companies do not intend to go public. Therefore, the interest in these companies is driven either by their successful business model or by the investor’s speculation about the company’s future.

There is no market to buy and sell no-pre-IPO companies’s shares, and investors looking to buy those may contact the issuing firms about the availability of shares or if they repurchased shares from existing shareholders.

Entrepreneurs and investors who want to buy these stocks may also benefit from employees’ knowledge of the current shareholders and try to purchase shares from them or directly from the private company.

Organisational Restrictions

Unlike public shares, private shares have few restrictions regarding ownership and transfer of ownership. Therefore, if you hold shares in your private company, you must ask permission from your company first before offering your shares to an investor or an outsider buyer.

The company has the right to refuse your offer to sell externally and may offer you buy-back programs, where they purchase the stock back from you according to their policies and valuation.

Alternatively, if the company agrees that you sell your shares externally through tenders or in other ways, you can go ahead and find investors to buy your shares. However, ensure that you meet any conditions the company may set, like holding the shares for specific periods before selling them or the number of shares you are allowed to sell.

Spread

The spread is the difference between the selling (asking) and the buying (bidding) price, which is something you need to consider when selling your private shares in secondary markets or to investors.

For example, if a stock is worth $150 and the highest bid you receive is $140, the spread is $10. This might seem a tiny difference, but the number will accumulate if you have multiple shares, and you may realise considerable losses.

On the one hand, looking for a higher and best bid in the market is better. On the other hand, investors are not always willing to match your expectations because of the risky nature of private shares, and you may miss your opportunity to sell with a loss by not selling at all.

Steps To Sell Private Company Shares

If you have found the opportunity and were approved to sell your privately held shares in secondary markets or to external investors, it is time to determine the value of your shares and where you can sell them.

Stock Price Valuation

Since private shares are not listed in public markets, it is challenging to determine their value in the absence of supply and demand and market dynamics.

The issuing firm may set a stock value, and you may use this valuation when selling private shares. However, there are other ways to determine the value of your shares.

1. Internal Rate of Return (IRR)

IRR analysis is a complex financial tool that measures the profitability of an investment, which is one way to evaluate the stock value. The higher the IRR, the better the investment is in that share, which gives you a direction of where you should be going with pricing your stock.

The calculations are more complicated because they include debts, business performance, economic status, and the company’s market share.

2. Discounted Cash Flow Analysis

The discounted cash flow analysis is a standard financial model that measures the company’s ability to generate cash in the future.

The concept determines if investing in that company is beneficial or not based on its potential to generate cash flow in the future. If the analysis is positive and a company has an excellent cash flow generation potential, it is a positive signal that a stock should be more valued.

3. Comparable Public-Shares Value

Finding a publicly traded company of a similar business is one of the easiest and most common ways to estimate the value of a private company’s stock price.

This way, a shareholder gets a realistic view of the stock price and how much an employee would ask to sell their shares in the market or to an investor.

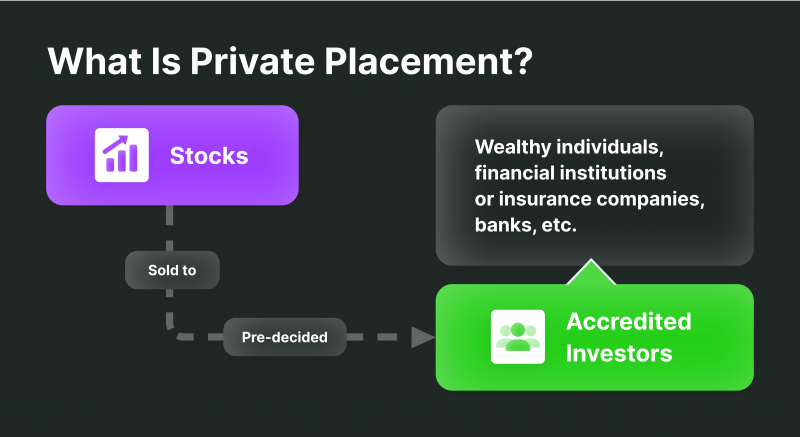

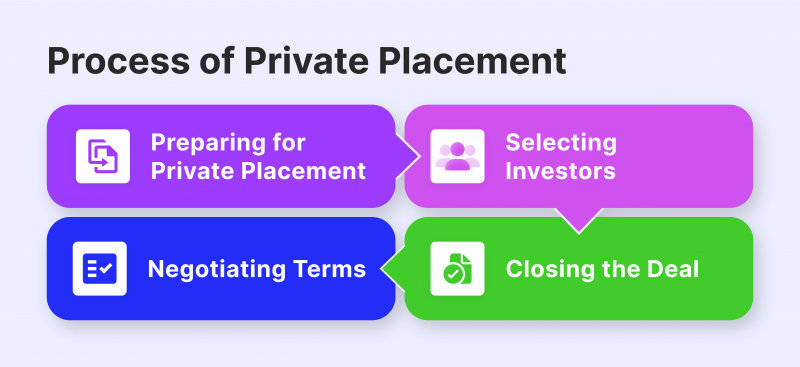

Stock Placement

Private stocks are not placed in public stock exchanges and secondary markets. However, there are private placements where private companies can sell their shares to qualified investors and entrepreneurs.

This way, private entities can raise funds and sell their shares without going public, which involves complying with the SEC and reporting financial statements to the public.

Therefore, private companies find private placements valuable to sell their shares, especially if their business has excellent potential and attracts venture capitalists and institutional investors.

However, private markets are not liquid, and it may not be easy to sell the shares because only a limited number of investors, financial firms, and high-net-worth individuals make it to the private placement market.

In this case, a company may need to settle with the best bidder price when selling a stock, even if that results in a considerable spread or loss if they want to increase liquidity.

Conclusion

Selling private company shares is challenging and less flexible than publicly traded companies. Public shares are listed in secondary markets, where many traders and individuals can buy and sell shares, and the stock price fluctuates based on market conditions and business activity.

However, private shares are sold in private placement markets to a selected list of investors, venture capitalists and wealthy individuals who may be interested in the company’s business model or profitability.

FAQ

Can a private limited company sell its shares?

Yes. However, private shares are not sold in secondary markets and stock exchanges like publicly traded companies. Private shares are sold to institutional investors and venture capitalists privately or through private placement markets to a selected group of qualified investors.

How do I value the shares that I own in a private company?

There are several ways to evaluate a private stock price. Comparable public companies are one of these ways, by comparing the private company to a publicly traded company and comparing the prices. Other ways include IRR analysis and discounted cash flow financial analysis.

How do shares work with a private company?

Private companies may issue shares for stakeholders, including current investors and employees. Also, private companies may sell their shares in private placements and markets to raise capital to run their business or offer their stocks to angel investors, venture capitalists, accelerators and other financing ways that keep their business running.

How do I sell shares in a privately owned company?

Employees can sell their shares in a private company, but they need approval from their company first (the issuing firm). The issuing company may buy back the shares or allow an employee to sell their shares to external investors and financial institutions.

How to sell shares of your company as an employee?

To sell shares of your company, first obtain approval from your employer. You can then choose to sell your private stocks back to the company or to external investors. Ensure you understand the company’s buy-back policies and find qualified buyers to facilitate selling privately held stock.

What are the best methods to sell private company shares?

The best ways to sell private company shares include private placements to institutional investors, using private stock marketplaces, or through company buy-back programs. Each method requires understanding the value of your stock in a private company and complying with any organizational restrictions on selling privately held stock.

By clicking “Subscribe”, you agree to the Privacy Policy. The information you provide will not be disclosed or shared with others.

Recent news

Our team will present the solution, demonstrate demo-cases, and provide a commercial offer