Introduction to Oil Trading — What Are Oil Futures And How to Trade?

Engaging in futures settlements has long been a preferred investment method for numerous capital market enthusiasts, letting them experiment with various trading strategies while facing lower risks than those associated with cryptocurrencies or binary options.

Among the many assets used as a basis for futures trading, one of the market’s most popular options is oil, one of the key and valuable minerals used in countless fields and applications. But what are oil futures commitments, and how do we trade them?

Let’s explain oil futures, contract types, and the reasons why you should invest in them. You will also learn the steps to follow when investing in these assets.

Key Takeaways

- Oil futures trading calls for a special balance of patience and courage — qualities that do not often coexist — combined with a healthy cash flow.

- Although there are hundreds of factors that determine the ultimate cost of oil, our minds immediately focus on those most obvious factors, including its current market price.

- WTI, Brent Crude, and Dubai/Oman Crude are the most widely used benchmarks of oil futures.

Understanding Oil Futures

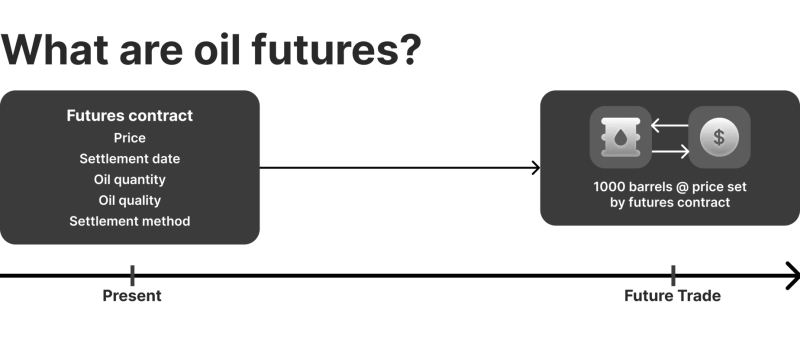

Oil futures are formal contracts that are exchanged on oil markets that allow market participants to purchase or sell a measurable quantity of oil at a fixed price and at a fixed future time. Because they offer some protection against price volatility and market swings, these transactions are essential in the oil trading environment. These are founded on expert analysis, advanced risk hedging techniques, and speculation.

Oil futures contracts include grade specifications (WTI or Brent), contract amount (1,000 barrels), delivery point, and expiration month, and are traded on the secondary markets of the NYMEX and the Intercontinental Exchange.

Hedgers and speculators are the main buyers of oil futures contracts.

- Hedgers are oil producers, refineries, and airlines, who use futures to hedge against adverse price changes.

- Shareholders and investors looking to profit from a shift in prices by purchasing and selling contracts without owning them are speculators.

The largest single-day oil price drop occurred on April 20, 2020, when WTI crude futures fell below zero to—$37.63 per barrel. This reflects an unprecedented oversupply and lack of storage during the COVID-19 pandemic.

Main Types of Oil Future Contracts

Oil futures contracts are executed on supervised market platforms and are fundamental for traders, investors, and entrepreneurs involved in energy production or consumption. Thus, understanding their types is integral to navigating the oil market efficiently.

Below is a detailed breakdown of the main types of oil futures.

West Texas Intermediate (WTI) Crude Oil Futures

WTI is the standard U.S. benchmark crude oil and is listed on the New York Mercantile Exchange under the CME Group. It is a light, sweet oil with low sulphur content and a high API gravity and is ideal to refine into gasoline and diesel. Most of the WTI oil is extracted in the U.S., the majority of which comes from Texas, Oklahoma, and surrounding areas.

Every WTI futures contract is equal to 1,000 barrels of crude oil, quoted in U.S. dollars per barrel. Settlement is by physical delivery at Cushing, Oklahoma, a central hub of storage and transport. Refiners, producers, merchants, and speculators make broad use of WTI to represent U.S. energy market conditions. Domestic demand, supply, and inventories affect prices.

Brent Crude Oil Futures

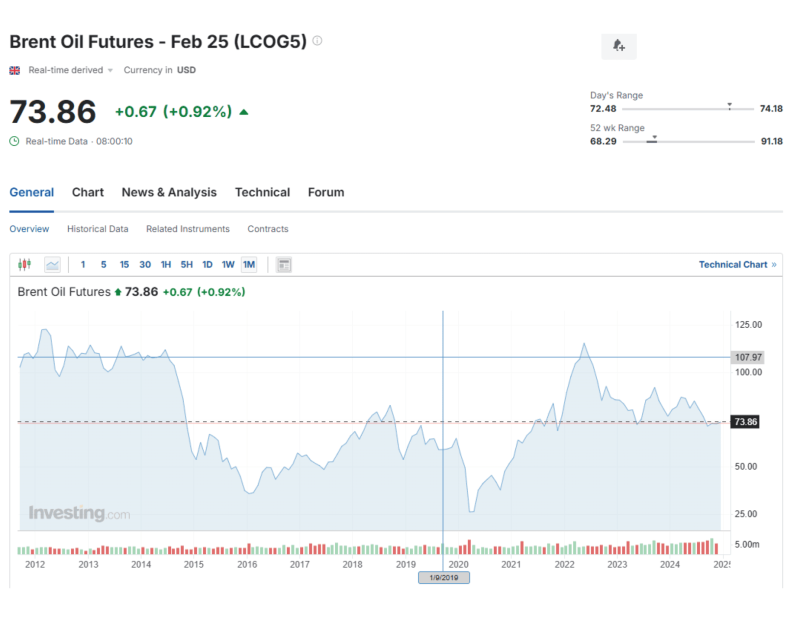

Brent is the standard oil price used worldwide. It is produced from the North Sea oil fields and, similar to the WTI, light in gravity and sweet but with a bit of extra sulphur. Brent Crude is used worldwide because it represents oil prices in Europe, Africa, and the Middle East, where a majority of the world’s oil is sold.

One standard Brent futures contract is equivalent to 1,000 barrels of oil and is quoted in U.S. dollars per barrel. It is cash-settled, meaning that no actual delivery of oil occurs. Brent futures are used by trading, refiners, and international firms to hedge against world prices. As Brent represents around two-thirds of the world’s crude oil transactions, Brent’s prices directly influence the international markets.

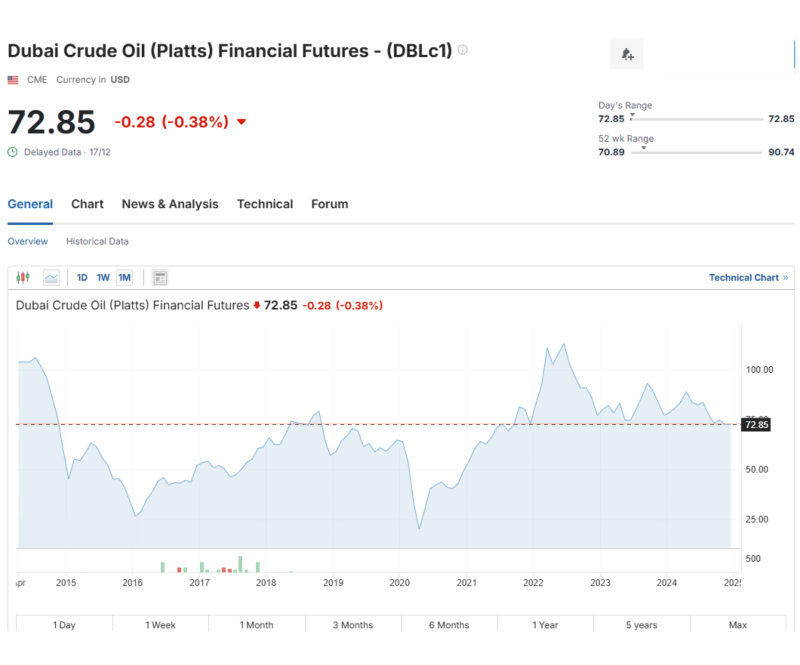

Dubai/Oman Crude Oil Futures

Dubai/Oman refers to the benchmark of Middle Eastern oil produced and sold mainly in the Asian markets. It is sour crude oil with greater sulphur content and a greater demand to refine compared to WTI and Brent. The benchmark captures market conditions of crude oil supplied to Asia by large producers like Saudi Arabia, the UAE, and Oman.

Dubai/Oman futures contracts typically equal 1,000 barrels, although exchange-specific contract quantities could vary. The quotes are in dollars per barrel, and settlement is based on physical delivery through ports in the Middle East.

These contracts are largely employed by Asian refiners and traders to protect against regional price downturns. Dubai/Oman crude serves as a stable pricing marker to Asian buyers of oil imported from the producers of the Gulf.

Urals Crude Oil Futures

Urals crude serves as the benchmark for Russian oil exports. Heavier and more sulphur-rich than Brent, it trades at a discount due to its lower quality. Comprised of a mix of Russian heavy crudes, Urals has higher sulphur content and is primarily delivered to Europe via pipelines and seaports, making it a key grade for European refiners.

A standard Urals futures contract covers 1,000 barrels and is priced in U.S. dollars per barrel, with physical or cash settlement depending on the exchange.

These contracts are mainly utilised by European refiners, traders, and investors focused on Eastern Europe. Urals pricing reflects not only global oil demand but also Russia’s economic and geopolitical landscape.

Regional Crude Oil Futures

There are other crude oil sources that are traded as derivatives, which are used to hedge against market risks and achieve proper portfolio diversification. Some of these examples include:

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

- Asia-Pacific oil futures: Originated from oil production in Singapore and Malaysia.

- Canadian Heavy Crude: Produced in Canada and used for oil refineries in the US Midwest.

- West African Crude contracts: Based on production from Nigeria and Angola.

Heating Oil and Gasoline Futures

Heating oil and refined derivatives of gasoline are not crude oil futures, though the two are related as they are refined oil products. Heating oil futures are an index of the prices of refined fuel employed for heating applications and for the manufacturing of diesel. The derivatives are listed on the NYMEX and act as a hedging mechanism against downstream products made from the crude oil.

NYMEX also deals in gasoline futures, which are essentially reflective of the wholesale prices of unleaded gasoline. Refiners and fuel distributors utilise them as a means for hedging against the fluctuations of the prices of gasoline. Futures in both heating oil and gasoline are simple mechanisms for managing the risks of prices across the entire energy market.

Main Reasons to Trade Oil Futures

Since oil is one of the most valuable minerals and an important asset among other financial products, trading in futures contracts for diverse types of ‘black gold’ has become a popular investment.

Here are the main reasons why it is worth investing in these futures.

Benefitting from Price Deviations

Oil markets are volatile, and prices move widely, offering earning opportunities through different instruments, including futures contracts. Many factors affect these movements, including production shifts, global demand status, and geopolitical stability.

Speculation Opportunities

Oil price fluctuations are lucrative to investors and traders. Because oil futures are very liquid and often have wide price fluctuations, speculators are able to capitalise on short-run and long-run patterns of price. Oil futures are therefore appealing to traders who are seeking to take advantage of market volatility.

Portfolio Diversification

Oil futures are a great method through which to diversify a portfolio. Because energy commodities tend to act in unique ways relative to other securities like stocks and bonds, trading crude oil can diversify overall portfolio risk and increase returns in times of economic volatility.

High Liquidity

The oil futures are one of the stock market’s most reliably traded contracts, thanks to global demand. Easy entry and closing out of positions are facilitated by large crude oil liquidity, with narrow spreads and low price slippage, which are vital to effective trading.

Leverage

Most brokers offer leverage trading with oil futures derivatives, enabling investors to place orders with high volumes and limited funds while being financed by the broker. This tactic offers greater exposure to market dynamics, offering amplified gains and losses, requiring careful deployment and solid strategies.

Global Value

Oil occupies a foundational role in underpinning global economic activity, rendering it an asset of pronounced strategic interest among traders.

The pricing dynamics of oil futures are acutely sensitive to a variety of international developments, ranging from supply chain disruptions and OPEC’s production mandates to macroeconomic growth trajectories—each offering traders numerous entry points for forecasting market changes.

Transparency and Standardisation

Oil futures orders are exchanged on market-regulated exchanges, such as NYMEX and ICE, ensuring price transparency, fair trading conditions, and standard contract terms.

Inflation Hedge

Commodity like oil tends to behave favorably in times of inflation. As the price of goods increases, the price of oil also rises, making oil futures a sound hedge against inflation and a form of value storage under uncertain economic times.

Access to Global Energy Markets

Oil futures give access to global energy markets and major benchmarks such as West Texas Intermediate, Brent Crude, and Dubai/Oman Crude. Investors can access regional and global markets based on their trading method and risk profile.

Price Discovery

Oil futures play a crucial role in the process of price discovery within global crude oil markets. Futures prices are used by traders to gauge supply, demand, and the overall market attitude, making futures trading a vital part of the global energy market.

How to Trade Oil Futures? — Essential Steps to Take

By and large, trading oil futures contracts does not differ from trading other financial tools or futures on them, but some nuances require some steps to be taken into account. Among them:

Understand Contracts Nature

A fundamental grasp of the mechanics behind oil futures and the variables that influence their pricing is essential. These financial instruments represent agreements to purchase or offload a specified quantity of crude oil at an agreed-upon price, set for delivery on a future date.

Such contracts are typically anchored to key global benchmarks like West Texas Intermediate (WTI), Brent Crude, and Dubai/Oman Crude, which serve as pricing references across different markets.

Most contracts are quoted per 1,000 barrels of crude oil in USD per barrel. Some contracts require the delivery of actual oil, such as WTI, while Brent contracts are settled in cash.

Choose a Reputable Futures Broker

The Internet is crowded with a plethora of brokerage platforms and operators offering various oil trading assets. However, you must look for a reputable one that is trusted by institutional investors and many clients.

Also, look for the broker’s license, and ensure they comply with global standards or acquire renowned certifications from the CFTC in the US, for example.

Then, check their financial instruments, and ensure they have oil futures contracts and multiple derivatives that align with your needs. Look out for trading features, such as chart options, analysis tools, and fees.

After choosing a platform, open a futures trading account, complete the KYC verification process, and deposit initial funds to begin crude oil trading.

Conduct Market Analysis

Analyse the market to detect possible price movements before placing an order. This involves fundamental and technical analyses. Fundamental focuses on factors that impact oil supply and demand, while technical refers to reading charts and drawing actionable conclusions.

For instance, global supply depends on OPEC production levels, U.S. shale output, and production from other oil-rich regions. Demand is influenced by industrial activity, transportation trends, and global economic growth.

Geopolitical disputes, such as wars or sanctions, can disrupt supply. Reports such as EIA and API inventory data, GDP figures, and inflation rates provide insights into the market.

Technical analysis, on the other hand, studies price charts and patterns. You can use moving averages, Bollinger Bands, RSI, and MACD to identify signals for entering or exiting trades.

Track and analyse support and resistance levels to predict potential trajectories. Ideally, you would combine both approaches to provide a well-rounded perspective on market direction.

Develop a Trading Strategy

Create a sound trading strategy. There are traders who concentrate on trend following, looking at large-scale price trends and trading in the same direction.

Others employ range trading, selling and buying within levels of support and resistance when the market trends laterally. Breakout trading is another system where one enters into a position once the market breaks through a key level with a lot of momentum.

Day traders and scalp players seek to make a profit from small, temporary variations in price. A sound strategy has well-established entry, exit, and risk allocation rules, including profit targets and stop-loss levels.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Manage Risk

Risk monitoring is extremely important when trading oil futures since exposure will create rewards as well as losses. Employ stop-loss orders to automatically close out trades once the market moves against you past a set limit. Good position sizing is also vital. Keep the amount of capital risked per transaction restricted, typically to no greater than 1-2% of trading balance.

Keep a check on margin requirements so that you have sufficient funds in your account and are not subject to margin calls, in which case your broker could liquidate your positions if your account does not have the required margin. Diversify the trades instead of risking all capital in a single contract or direction.

Execute Your Trade

Once you’re ready to trade, choose a futures order based on the oil benchmark (e.g., WTI or Brent), the contract month, and the size. Then, decide on the type of order you want to place.

A market order will execute immediately at the current price, while a limit order allows you to specify the price you want to buy or sell at. After placing the order, monitor the platform to confirm that the trade has been filled.

Monitor Your Positions

After you enter a trade, it’s important to actively monitor it and respond to market changes. Monitor live oil prices and any market news that could impact your position.

Adjust stop-loss or take-profit points to protect gains or limit likely losses as the market fluctuates. Monitor the major factors such as inventory reports, geopolitical events, and technical signals to determine whether to hold or close the position.

Close Your Position

Closing your trade is just as important as opening it. If the price reaches your profit target, close the position to secure your gains. If the market moves against you, your stop-loss order will automatically close the trade to minimise losses.

You can also manually close a position if market conditions suddenly change. For contracts that settle through physical fulfilment, make sure to close the position before the expiration date unless you intend to take delivery of the oil.

Review and Learn

Once the trade is closed, take time to review its performance. Analyse what went right or wrong and compare the actual market outcome to your initial analysis.

Use this feedback to refine your strategy as well as your decision-making in future trades. Maintaining a trading journal is a sound principle since it enables you to monitor performance, recognise strengths, as well as correct weaknesses over a period.

Final Takeaways

Oil futures trading is a dynamic channel for hedging against price fluctuations, speculating against market direction, and portfolio diversification. Rooted in oil benchmarks like WTI, Brent, and Dubai/Oman, the contracts are a way of gaining access to regional and global oil markets.

Yet effective trading requires a sound knowledge of the contract specifications, the dynamics of the market, and the principles of risk management. With a disciplined approach and careful monitoring of positions, traders are in a much better position to cope with the complexity of the oil market.

FAQ

What are oil futures?

Oil futures are agreements that entail buying or selling a given quantity of crude oil at an agreed-upon price and future date. This instrument provides a hedge against market risks and offers a more flexible tool for earning returns in financial markets.

What are the main benchmarks for oil futures?

WTI (West Texas Intermediate), Brent Crude, and Dubai/Oman Crude are the most widely used benchmarks for oil futures, known for their global importance and reliable production levels.

Who uses oil futures agreements?

Hedgers and speculators are the main holders and traders of oil futures, benefitting from their volatility and exposure to maximise their gains and hedge against market risks.

What are the risks of trading oil derivatives?

Oil futures trading comes with risks such as high price fluctuations, losses from leverage, and margin calls.