Long-term Bitcoin hodlers are allegedly to reach new highs

Industry News

According to Glassnode analysts, Bitcoin holders have reduced their spending since October, and the chart displays they are more likely to open new positions than quit the market. Bitcoin spent volumes varied from 2.5% to 12% within the last 15 months; meanwhile, in October the spending volume has fallen below 2.5%.

As for multi-year indexes of short-term holders, the volumes are moving towards the lowest indicators. Glassnode states that 3 million Bitcoins are kept by short-term holders. Such a case is rather unique for the market. The analysts point out that the market cannot be understood as ‘overly saturated with take-profit moods.’

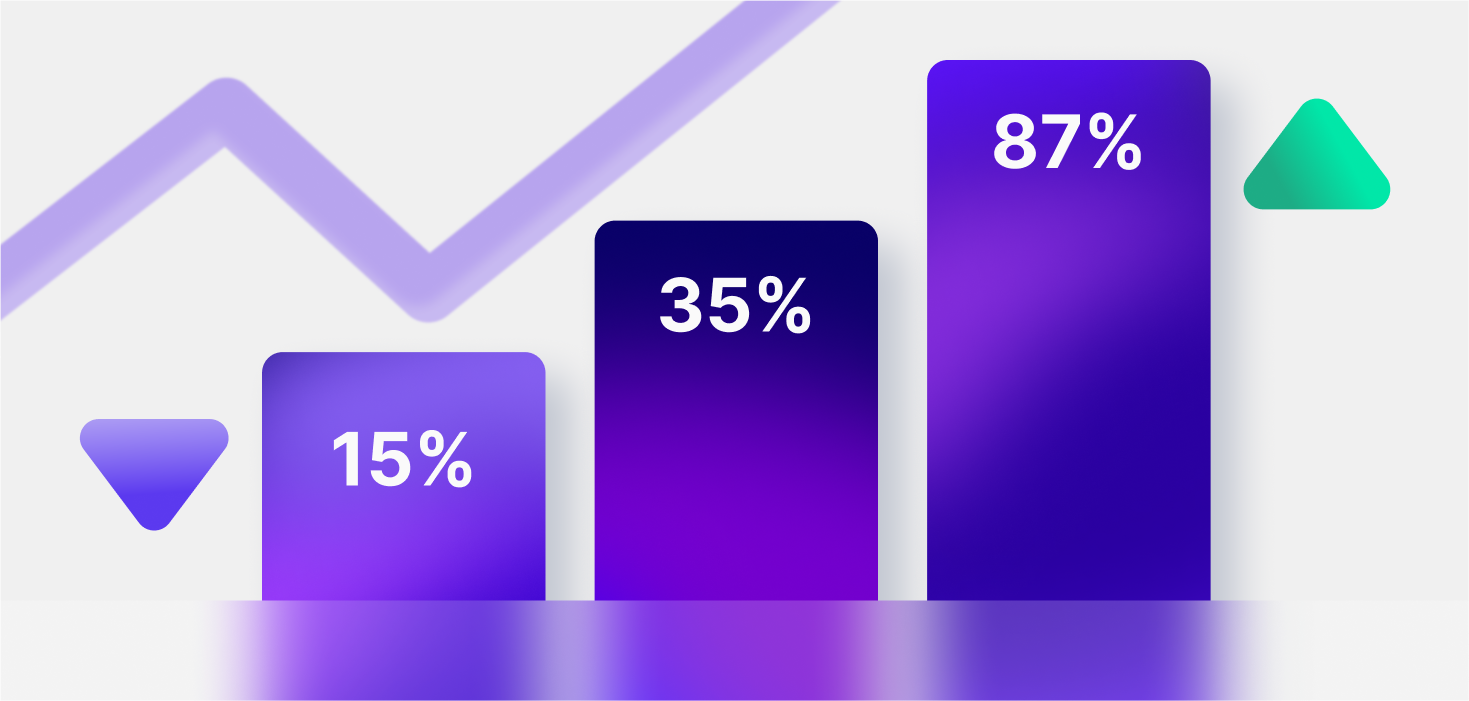

As for the long-term holders, the Cointelegraph report disclosed that 13.3 million Bitcoins are stored by financial buyers who prefer to wait for more highs. The total supply of Bitcoin is 18.88 million coins available for investors. This means long-term investors hold 70.7% of the overall supply.

The October-November period turns out exceptionally bullish for the first digital currency, as the Bitcoin price has reached its new all-time high mark at $68 789 per coin. Since November 11, Bitcoin has been driven by bearish moods, as its price has dropped to $56 532 within a week.