MarksMan Rebrands as B2CONNECT and Extends Connectivity Options

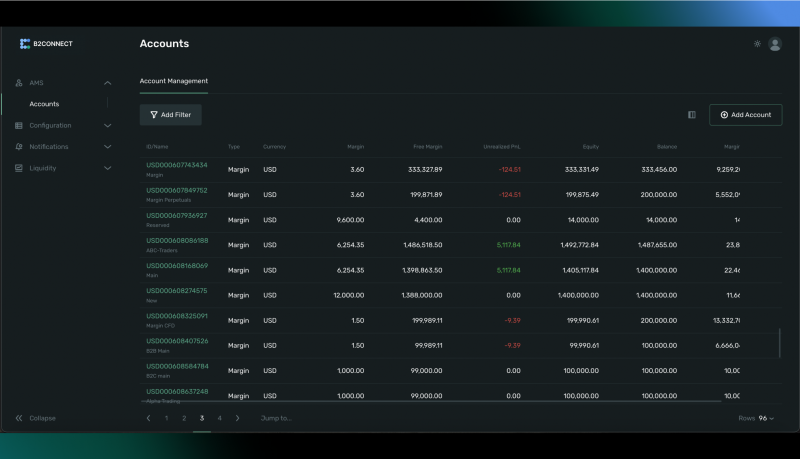

We are thrilled to announce a major rebranding and technology upgrade for our industry-leading crypto liquidity hub, formerly known as MarksMan LDE. The newly renamed B2CONNECT offers crypto brokers and exchanges seamless access to both spot and futures liquidity of digital assets and provides top-of-the-book and full market depth pricing, along with advanced price construction and risk hedging features.

Besides rebranding, key updates include the integrations of the B2TRADER Spot Broker, the new Binance Futures WebSocket API, and a fully featured adapter for Crypto.com. These additions enrich our existing capabilities, making B2CONNECT a powerful gateway to first-class digital asset liquidity pools.

The Rebrand: How MarksMan Became B2CONNECT

We have renamed our liquidity hub to B2CONNECT to better reflect its core value—connectivity. With this new identity, we aim to build strong, efficient connections between liquidity providers and trading venues.

As part of the rebrand, B2CONNECT will continue its evolution as the leading liquidity infrastructure, delivering on-demand access to deep liquidity, custom integration features, and innovative trading technology.

“We’re genuinely thrilled to bring this significant update to our clients. This release is an important step in B2CONNECT’s development into a standalone product that delivers leading connectivity solutions to Forex and crypto brokerages and exchanges. It also strengthens its role as a major liquidity infrastructure next to our Prime of Prime multi-asset liquidity offering.”

New Connectivity with the B2TRADER Brokerage Platform

Among the most exciting new developments for B2CONNECT is the addition of B2TRADER Spot Broker to the list of supported trading platforms.

Want to See It in Action?

Book a live walkthrough of the tools you're reading about — tailored to your business model.

B2TRADER’s integration introduces various unique features that streamline order execution and optimise user experiences. This includes a custom FIX API endpoint that facilitates the retrieval of market information and contract specifications.

These endpoints, in conjunction with a tailored order execution flow, form the backbone of a seamless connection between B2CONNECT and B2TRADER, allowing the two systems to work harmoniously.

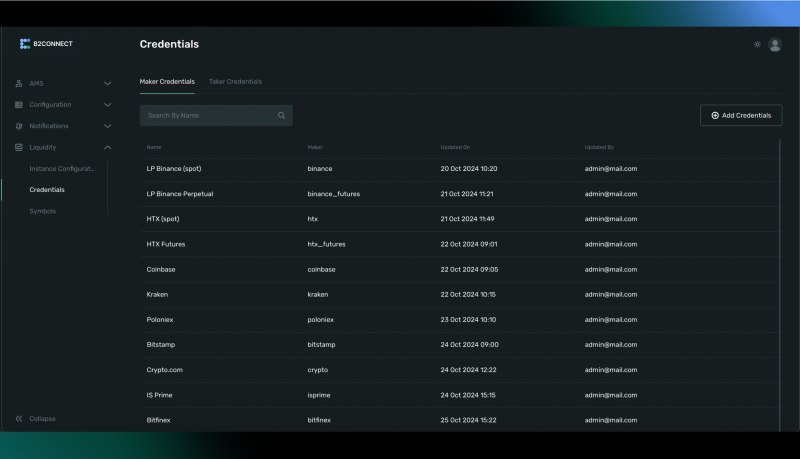

Fully-Featured Liquidity Adapter for Crypto.com

The liquidity acquisition adapter for Crypto.com is now fully available to all B2CONNECT Liquidity Hub clients via the FIX API. Crypto.com, a leading cryptocurrency exchange, has gained significant popularity among B2B clients seeking direct market access.

With this new integration, B2CONNECT clients can now expand their offerings with additional trading pairs, which increases their ability to diversify and manage risks such as counterparty and regulatory challenges.

The adapter provides access to price feeds (Level 2 quotes) and supports order placement, execution, and confirmation. Importantly, it enables these processes to occur in parallel, maximising throughput and minimising latency.

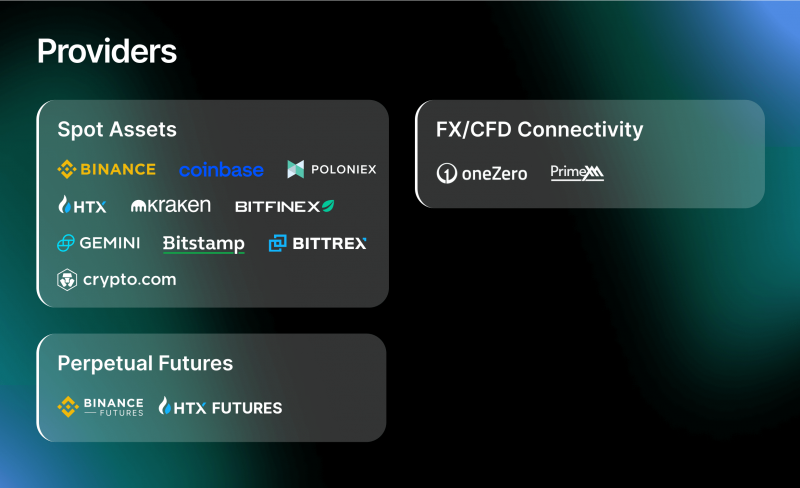

Besides the newly integrated Crypto.com adapter, B2CONNECT supports a robust and systematic flow from leading centralised crypto exchanges such as Binance, Coinbase, Kraken, HTX, Gemini, Bitstamp, BITFINEX, BITTREX, and Poloniex, which guarantees easy and reliable access to liquidity.

High-Speed Perpetual Futures Trading with Binance WebSocket API

Another key upgrade in this release is the integration of Binance Futures’ new WebSocket API with the B2CONNECT Liquidity Hub. Binance introduced this high-speed API earlier this year, and B2CONNECT’s adoption of this innovative technology is a major leap forward in order execution quality for perpetual futures.

The new WebSocket-based API allows for full-duplex, bidirectional communication, drastically improving trading efficiency.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

With this new connectivity, B2CONNECT has achieved a 4x improvement in average round-trip time for trades, meaning that orders are executed significantly faster, and the end users experience smoother, more reliable trading interactions.

Moving Forward with B2CONNECT

As we look to the future with B2CONNECT, our goal is to continuously expand our connectivity services while setting new industry standards. Already aggregating spot and futures liquidity from market-leading crypto exchanges such as Binance, Binance Futures, Coinbase, Kraken, Gemini, Bitstamp, HTX, and more, we plan to further broaden our network.

With new platforms like B2TRADER and Crypto.com and the implementation of cutting-edge technologies like Binance Futures’ WebSocket API, B2CONNECT will help you establish seamless connections with essential market players.Read more about the B2CONNECT updates here!