What is a Trading Session: Selecting The Best Time for Trading

The expansion of global markets has made it possible for individuals to trade stocks and other assets from other nations. FX trading is open around the clock, but assets should be traded at specific times due to different trading sessions. Understanding the main ideas behind these sessions is crucial for determining the best times and the best assets to trade.

In this article, we will answer the question: What is a trading session? Moreover, we will discuss the main types of sessions.

Key Takeaways

- A trading session is when stock exchanges are open for trading various securities.

- There are several types of trading sessions, including after-hours and pre-hours.

- Four major time periods for trading are named after the most significant financial cities — New York, Tokyo, Sidney, and London.

What is a Trading Session?

A trading session refers to the active trading hours during which a stock exchange is open, allowing traders to buy or sell securities such as stocks, bonds, and commodities.

Market characteristics for stocks, futures, bonds, and foreign exchange define their sessions, which differ from place to place. The timing and type of trading period are crucial for investment decisions, strategies, and market performance.

A standard stock exchange session consists of three phases: pre-opening, continuous, and closing, with the pre-opening phase allowing order entry and amendment, the continuous phase involving most trading, and the closing phase processing final orders. So, how long is a trading session? The answer is one business day in a local financial market, from opening to closing bells.

Asset classes have varying trading hours worldwide, and traders should know these schedules to plan their trading hours.

Most market hours worldwide are open Monday to Friday and closed on weekends. So, how many trading days are there in a year? The exact number varies across markets and countries. There are 252 trading days in the U.S., but the country has a stable advantage due to holidays falling on the same day of the week, except for major holidays like Christmas.

Other countries don’t have this advantage, so the number of trading days should be calculated separately for each country.

Prices of assets and securities fluctuate as the market opens or closes, as business news or announcements frame traders’ trading strategies.

For instance, an FX market is highly changeable, aiding in trading currency pairs during the time frame when two or more sessions overlap.

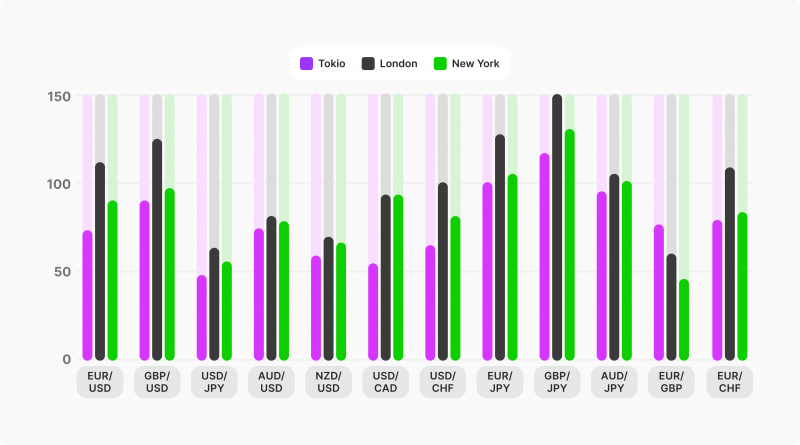

Traders can adopt support, resistance, or breakout strategies to benefit from the currency exchange during overlapping sessions. Different trading sessions exhibit varying levels of volatility, which can affect various characteristics of a session, such as, for example, average pip movement per trading session.

What Impacts the Market Session

FX sessions can be impacted by many factors, among which the most noticeable are the following:

Economic & Political Events

Economic data, including employment figures, GDP, and central bank decisions, can significantly influence market dynamics. Investors should know financial news and wait for anticipated releases to avoid volatility.

Political events and policy changes can also increase trading volatility, requiring traders to monitor these events to predict potential market movements closely.

Market Overlaps

Market overlaps occur when two major markets are open simultaneously, increasing trading activity, liquidity, and volatility. The sentiment of one market can affect another. Waiting for market sentiment to settle before entering a position can save money.

Social Media

The internet has significantly influenced investment and news consumption, making it crucial for investors to monitor major news portals for market-moving stories. However, they should avoid sites offering stock recommendations based on personal stocks, as they can impact a company’s stock.

Friday Trading

Many retail and institutional traders liquidate their equities on Friday afternoons to avoid holding positions and risk through the weekend. This means stocks can often be sold off during the last few hours of trading if traders don’t want to have any positions on their books. This is a significant factor to consider when entering or exiting a stock position on Fridays.

Types of Trading Sessions

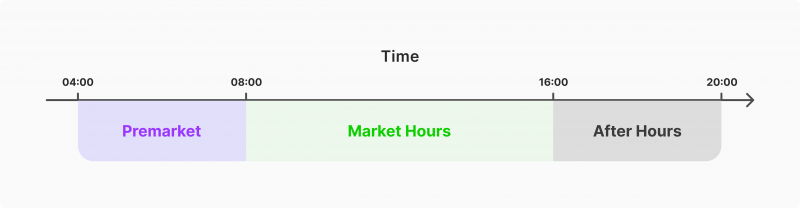

Market hours come in different types: regular, after-market, off-trading, and pre-market. Let’s have a closer look at each type.

Regular

The regular session, also known as the “core trading session”, is the primary trading period recognised by major exchanges worldwide, such as the NYSE and NASDAQ, which lasts from 9:30 a.m. to 4:00 p.m. EST.

After-Hours

An after-hours trading session (also known as an extended trading session) occurs after the trading day for a stock exchange, allowing the buying or selling of stocks outside regular trading hours. This method allows investors to react to news events beyond normal trading hours, similar to the volatile pre-market period. Prices can swing significantly on earnings releases or news, so placing an order for after-hours trading is necessary to buy or sell stocks quickly.

In the U.S., typical after-hours trading is between 4 p.m. and 8 p.m. Eastern Time.

Pre-Market

The pre-open session is a daily market opening procedure for securities to minimise volatility and determine opening prices. During the pre-market session, which typically occurs between 8 a.m. and 9:30 a.m. EST, orders are collected, modified, or cancelled, and clients can place limit or market orders. The order collection window can close between 9:07 a.m. and 9:08 a.m., and orders are matched and confirmed after the window closes.

Off-Trading

Off-trading session meaning implies an extended trading period after the regular session ends, allowing investors, mainly institutional and foreign investors, to adjust their positions and cover transactions executed during the common session. It begins at random closing times and ends at 17:00 hours, with only specified trade report transactions recorded.

Major Sessions

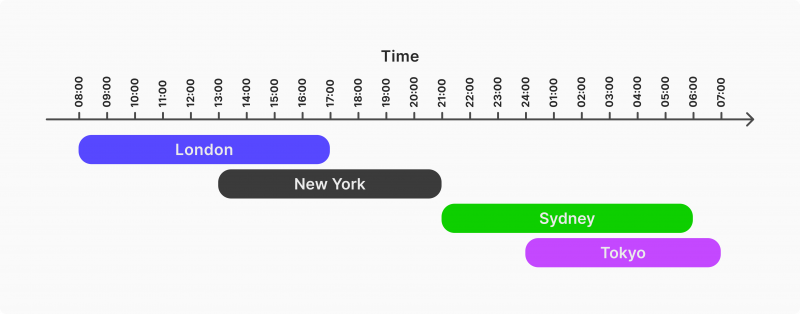

The trading hours are based on the time zones of important financial cities: London, New York, Sydney, and Tokyo. These 4 session times encounter the highest levels of market activity due to the significant trading engagement from major banks and companies in these cities.

American Trading Session (New York)

The American Session, also known as the New York Session, is a significant part of the world’s FX market, accounting for 16% of the world’s FX volume. It begins after the Asian Session is closed and midway through the European Session’s trading hours, from 8:00 a.m. to 5:00 p.m. EST. The NY session is the last to open and often experiences high trading volume and volatility, particularly during opening and closing hours.

European Trading Session (London)

London is a major metropolis recognised for its prominent position in the financial and banking sector, housing some of the largest banks worldwide. With 34% of the daily transaction volume in FX, the London session is regarded as the most significant and most extensive trading session globally.

The official trading hours are from 7:30 a.m. to 3:30 p.m. GMT, with the period expanded by the presence of other capital markets like Germany and France. The London session co-occurs with those in Asia and North America and is notorious for significant price fluctuations.

Asia Trading Session (Tokyo)

The Asian Session, also known as the Tokyo Session, marks the beginning of the market’s trading hours. Market participants utilise it to devise their strategies. It starts at 11:00 p.m. The beginning of the Asian trading session marks the start of market activity and can be affected by economic releases from New Zealand or Australia.

Australia Trading Session (Sydney)

The Australian session occurs Monday to Friday, starts at 3 p.m. EST, and closes at noon. It has thin liquidity but widespread currency pair trading. The maximum exchange occurs during the early phase. Traders can use strategies like position trading, swing trading, scalping, and day trading.

Futures Trading Sessions

It offers numerous advantages over other asset types, including trading around the clock outside traditional market hours. Futures markets operate nearly 24 hours a day, six days a week, from 6:00 p.m. EST on Sunday to 5:00 p.m. EST on Friday. This provides traders with more trading flexibility and the freedom to manipulate positions at any time of day.

Futures trading requires traders to identify opportunistic session times and areas to trade and avoid certain times. Finding the best time to trade futures can be challenging due to the scale of futures markets, with optimal times during periods of higher liquidity and price volatility.

U.S. futures offer 24-hour trading access, attracting international traders from various sectors like agriculture, crude oil, energy, equity index, interest rates, metals, real estate, and weather. The market is transparent and regulated, with abundant trading opportunities in various categories.

Final Takeaways

The significance of trading sessions cannot be overestimated in the realm of business and finance since they influence stock liquidity and pricing around the globe. It’s essential to understand how various markets work and have the answer to the question “What is a trading session?” since it can enable traders to make wiser decisions and comprehend how different sessions can be helpful in terms of successful trading.

FAQ

What are trading sessions, and why are they important?

Trading sessions refer to specific periods when stock exchanges are open for trading various securities. Understanding trading sessions is essential as they influence market liquidity, price volatility, and the best times to trade for optimal results.

What are futures trading sessions, and how do they work?

Futures trading sessions allow nearly 24-hour trading access, operating six days a week from Sunday at 6:00 p.m. EST to Friday at 5:00 p.m. EST. These sessions provide traders with flexibility and opportunities to manage positions across various markets, including agriculture, energy, and equity indices.

Which trading sessions overlap, and why is this important?

The overlap of trading sessions, such as the London and New York sessions, often results in increased liquidity and volatility. These overlapping periods create opportunities for traders to benefit from higher trading activity, especially in futures trading sessions and the FX market.

Recommended articles

By clicking “Subscribe”, you agree to the Privacy Policy. The information you provide will not be disclosed or shared with others.

Our team will present the solution, demonstrate demo-cases, and provide a commercial offer