MicroStrategy Bitcoin Strategy – What Drives This Aggressive BTC Purchase Campaign?

Despite the high volatility and risks associated with most cryptocurrencies, one organisation seems to benefit from investing heavily in Bitcoin and buying as many coins as possible.

MicroStrategy is beating the odds with its bold strategy, which has, so far, reflected positively on its balance sheet, share price and stock performance.

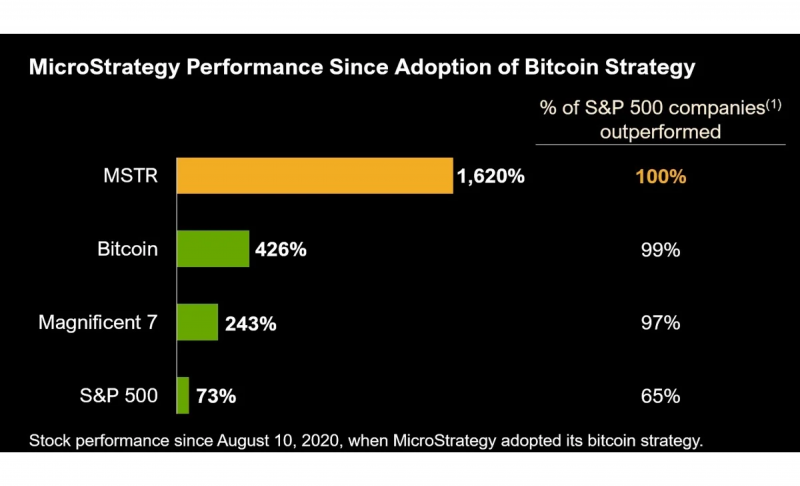

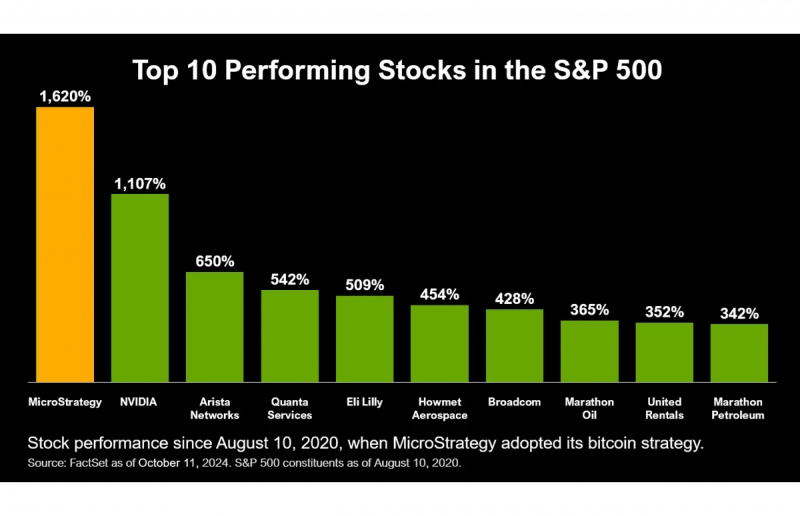

MSTR has grown over 1,000% since the start of this bullish campaign, and it has recently outperformed the big seven firms and the S&P 500, with gains outweighing those of Bitcoin. With billions worth of BTC, let’s explain the MicroStrategy Bitcoin strategy and where the company is headed.

MicroStrategy Bitcoin Strategy Explained

MicroStrategy is a business intelligence company that offers cloud computing and storage services, mobile app development, software development, market research and SaaS solutions. However, it has been facing fierce competition from Microsoft and Oracle, which caused its shares to stagnate.

In 2020, the company began a campaign to strengthen its stock price and boost its value. The strategy was to buy Bitcoin progressively as the coin’s price was growing, which would pull MSTR’s value higher.

Now, the company has around $17 billion worth of Bitcoin as of today’s prices. This strategy surged MSTR stock by 1,620% in four years.

Why is MicroStrategy Buying So Many Bitcoins?

This approach comes from the executive chairman, Michael Saylor’s Bitcoin prediction that the crypto will grow phenomenally in the future, and investing in BTC would be the right thing to do to boost the company’s stock value.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

The company aims to become the leading Bitcoin bank, offering lending and investing instruments based on the leading cryptocurrency. The results: outperforming the “Magnificent 7 Stocks”, S&P and Bitcoin itself.

MicroStrategy Bitcoin Purchases

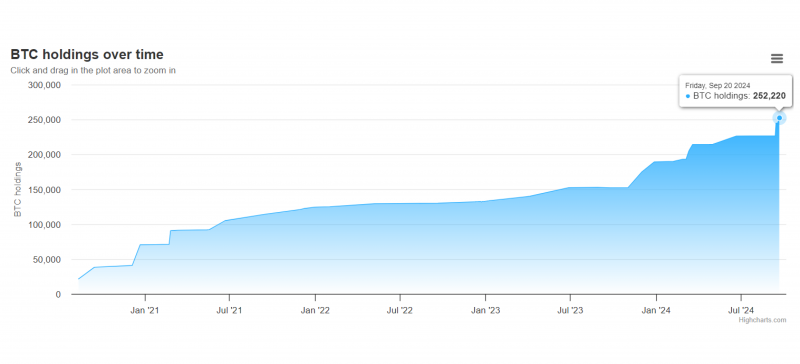

The company started its bullish movement on August 10, 2020, by purchasing 21,454 BTC at $250 million. Since then, the company has been buying Bitcoin in bulk almost every month, sometimes twice a month.

Its largest transaction was on December 21, 2020, when the company added 29,646 to its stash and reached over the 1 billion mark of Bitcoin value.

MicroStrategy’s total Bitcoin holdings have reached 252,220 after the last transaction on September 20, 2024, putting Michael Saylor among the top 5 individual BTC holders.

MicroStrategy Stock Performance vs S&P 500

In a recent interview with CNBC, Saylor reflected on the successful strategy, which placed MicroStrategy at the forefront of the S&P 500 index. He highlighted the massive value growth compared to Bitcoin and S&P’s yearly return and positive Q2 earnings report, where the company generated over $110 million in revenue.

MSTR stock price currently stands at $195, after a considerable jump from $160 at the beginning of October, marking a surge of 21% in two weeks and around 10% from the last week.

The company’s share price soared by 183% in YTD numbers and a whopping 478% in YTY figures. This phenomenal growth puts MicroStrategy as the best-performing stock in the S&P 500 index despite Nvidia’s recent massive valuation.

In comparison to the overall index performance, the S&P 500 grew by 33% from the last year, while Bitcoin grew by 122%, way below MSTR’s.

The company does so by using its cash reserves and convertible senior notes to raise funds and add more coins to MicroStrategy’s Bitcoin holdings. As the coin’s price and MSTR stock soar, the company can repay its debts and cover its operating expenses.

The company is also doing well in its business intel and software solutions, with huge speculations over the Q3 reports on October 30.

Will MicroStrategy Stop Buying BTC?

It is unclear whether the company intends to slow down on its approach. According to Michael Saylor’s Bitcoin vision, there is a huge chance that MSTR will become a trillion-dollar company if the crypto prices grow sufficiently in the coming years.

During its 4-year purchase history, MicroStrategy conducted only one sale transaction. In December 2022, the company sold 704 Bitcoin for tax reasons during its SEC filings. However, the CEO insisted it will not change its stance and will remain buyers.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Conclusion

MicroStrategy keeps on buying Bitcoin, a strategy that benefited its value largely and placed the company as a top performer in the stock market.

Currently, MSTR owns 252,220 BTC, causing its share price to surge to all-time highs at $212 before settling down to $195. With a soaring stock of 10% in the last week and over 20% in two weeks, MicroStrategy is probably heading to new levels.

MicroStrategy Bitcoin investment strategy seems to pay off, and as it continues buying Bitcoin, its market value will most likely continue climbing the charts.

Disclaimer: This article is for informational purposes only. It is not finance advice and should not be relied upon for investment decisions. Always do your own research and consult a financial advisor before investing.