MicroStrategy Joins NASDAQ-100 with a Soaring Stock Price

Amidst the crypto market hype and the soaring coin prices, one company emerged as the propellant and leverager of these trends. MicroStrategy has been bullish on cryptocurrencies, buying and storing as many Bitcoin as possible to secure and boost future value.

This approach raised MicroStrategy’s valuation, placing it at the top of the market with a historical entry into the NASDAQ-100 index. This announcement witnessed another surge in the company’s capitalisation.

Let’s track the phenomenal growth of MicroStrategy and how it doubled its worth.

MSTR NASDAQ-100 Entry

On 11 December, Nasdaq Inc. announced its yearly NASDAQ-100 reconstitution, which saw MicroStrategy entering the index for the first time since its establishment in 1989.

The NASDAQ-100 index combines the largest non-financial companies listed on the Nasdaq stock exchange by market capitalisation.

The announcement included adding three companies, Palantir Technologies, Axon Enterprise, and MicroStrategy, to replace Moderna, Illumina, and Super Micro Computer.

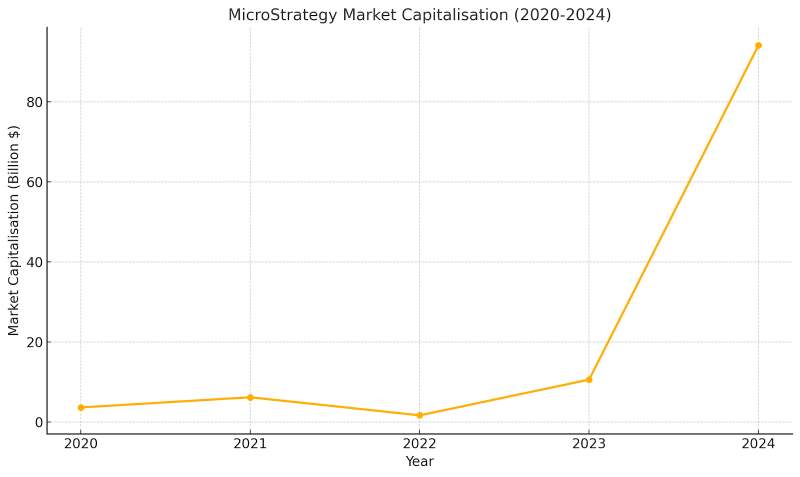

This inclusion was motivated by the staggering company value, which jumped from $10 billion to over $90 billion in 2024 alone, marking a 790% growth.

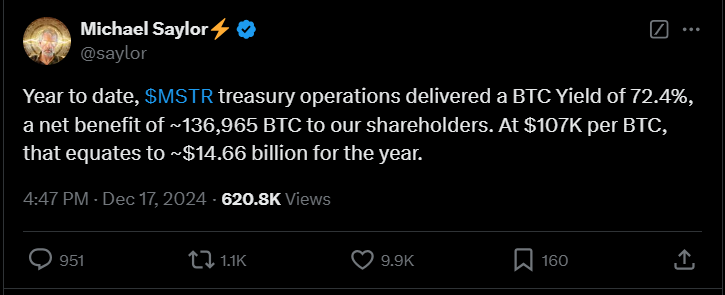

MicroStrategy’s Bitcoin holdings contributed massively to this valuation. The CEO, Michael Saylor, prides himself on being pro-Bitcoin and aims to buy as many BTC as possible to back the company’s reserve.

Industrial Impact

MicroStrategy’s Bitcoin approach affects the enterprise and the entire market, driving more interest in buying the crypto or owning MSTR shares as a BTC-based stock.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

The inclusion of the NASDAQ-100 will attract more investors who will explore more digital-based securities, diversify their portfolios, and capitalise on the surging coin prices.

Moreover, ETFs that track the performance of tech companies will now include MSTR stocks, giving shareholders more exposure to the crypto market.

On Crypto Prices

Since the MSTR NASDAQ inclusion was announced, Bitcoin price has soared massively, reaching the $100,000 mark for the first time ever and trading in the $105,000 region as a historical valuation.

Ethereum also experienced a similar surge, growing from $3,630 to $3,835 (+5%) on the 11th, which continued to scrape the surface of the $4,000 threshold for the second time this year after the March bull run.

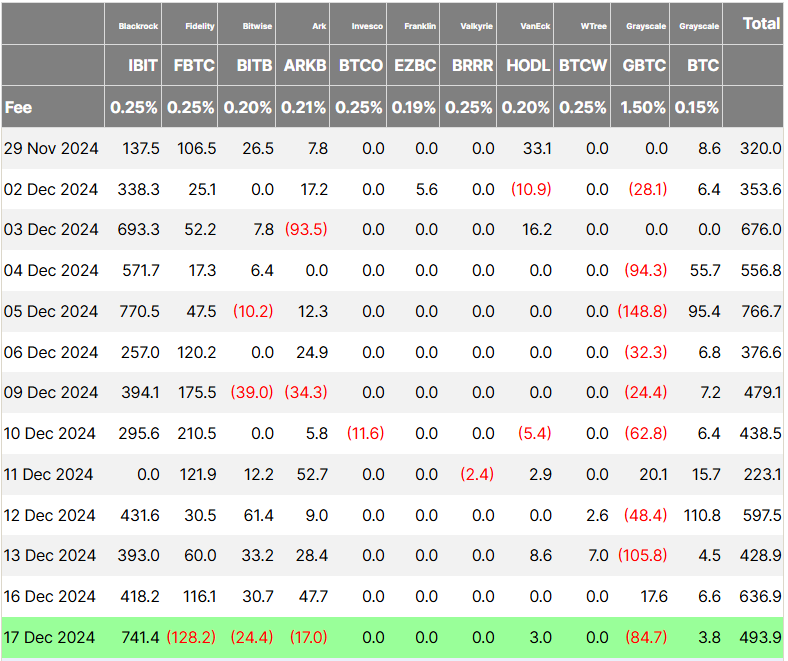

The BTC ETF inflow also increased significantly across all issuers, rising from $223 million to $597 million one day after the announcement.

On MSTR Stock Price

Retail investors showed an increasing interest in buying MSTR stocks, with an unprecedented inflow since the inclusion decision.

Non-institutional investors poured a whopping $11 million into the company shares, tripling the average daily inflow for MicroStrategy.

MSTR surged by 9%, from $385 to $411 on the 11th, after a massive increase in the after-hours session on the 10th.

Stocks continued to climb, peaking on 16th at $436. However, a market correction happened, and MSTR dropped back to the $385-$395 region.

MicroStrategy Bullish Bitcoin Approach

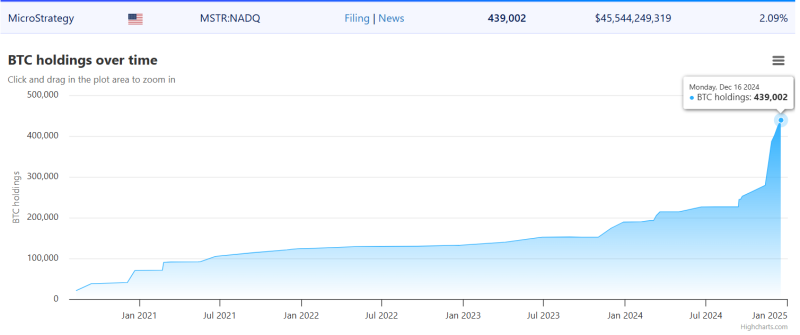

This extraordinary growth is justified by the bullish Bitcoin approach that started in August 2020, when the company purchased the first batch of 21,454 BTC for around $250 million.

In December, the company fueled the crypto market surge with two major purchases, becoming the holder of 2% of the overall BTC supply.

Between 2-8 December, the company acquired 21,550 BTC for approximately $2.1 billion. Then, during the week ending 15 December, the company purchased an additional 15,350 BTC for about $1.5 billion.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Today, the company owns 439,002 Bitcoins, valued at around $46.7 billion as of 18 December.

MicroStrategy primarily uses its Bitcoin holdings as a treasury reserve asset. The company views digital currency as a superior store of value to cash and aims to hedge against inflation, currency devaluation, and economic uncertainties.

Final Remarks

MicroStrategy’s Bitcoin approach is paying off. The company has received massive attention from retail and institutional investors, and its stock price has risen from under $50 in the last three years to $400 by December 2024.

The company was named to the renewed NASDAQ-100 in the annual restructuring, effective 23 December 2024, which increased retail investments to over $11 million.

This strategy stems from the CEO’s belief in Bitcoin and its future value, coinciding with the BTC price surge over the $100,000 limit.