MT5 vs cTrader: Which Platform Fits Your Business’s Target Market?

When building a brokerage infrastructure, you need to connect with a trading platform. You are most likely to choose between the top software providers, such as MetaTrader and cTrader. But which one is better?

This strategic decision directly impacts how you acquire and retain traders, comply with regulatory frameworks, and manage your costs. MT5 and cTrader are top trading platform choices, with differences in programming languages, platform ecosystems, and built-in indicators.

In this comparison, we will highlight the features and benefits of each software, performance metrics, platform scalability, target-market fit, integration requirements, and how they affect your business potential.

Key Takeaways

- MetaTrader 5 and cTrader are renowned trading platforms that most retail traders and institutional investors are familiar with.

- MT5 is popular for its long-rooted history, making it suitable for brokers targeting large-scale operations and user bases.

- cTrader is better positioned for specialized use cases, with flexible integration and customization capabilities.

- Multi-asset brokerage platforms can offer both MT5 and cTrader to broaden their offerings and segregate client categories.

Key Distinctions Between MT5 and cTrader

MT5 and cTrader reflect two different platform philosophies rather than incremental variations of the same concept. Understanding these foundations helps you avoid any mismatch between software setup and business objectives.

MT5 builds on MetaQuotes’ long-standing dominance in retail trading infrastructure, being one of the first providers of Forex trading. MT5 shines in broad broker adoption, multi-asset support, and operability. Over time, these qualities contributed to a massive algorithmic ecosystem and strong familiarity with MetaTrader among trading environments.

cTrader is developed by Spotware with a different set of priorities. It emphasizes transparent Electronic Communication Network (ECN) models, accurate execution practices, and professional technical tools. Moreover, cTrader relies on strong native functionality and clear API architecture, without depending on third-party marketplaces, boosting execution quality, platform stability, and accurate pricing.

Deciding which platform architecture to adopt influences your positioning, future partnership opportunities, and onboarding flow. As such, MT5 lowers barriers through familiarity and ecosystem depth, while cTrader delivers execution-centric design and user experience.

Build a cTrader Trading Platform

Explore how our white-label cTrader solutions enable you to launch faster & scale more efficiently

1. Comparing Performance and Scalability

The first focus is performance, a business metric that directly affects execution quality, client satisfaction, and infrastructure efficiency. You need a platform that supports growth and scales as you expand your user base and product offerings, without impacting margins or operational stability.

Execution Speed Under Load

Execution speed refers to the platform’s consistency when processing orders, especially during periods of high activity and market volatility. Your platform must ensure stable performance for high-volume traders, scalpers, and algorithmic trading strategies.

MT5’s multi-threaded architecture allows it to distribute workload across multiple CPU cores, making it well-suited for environments with large numbers of concurrent users, multiple open positions, and automated strategies. This design supports stable execution during peak sessions and helps brokers manage loads predictably as volume increases.

On the other hand, cTrader’s model emphasizes precision and transparency, performing strongly in execution-sensitive environments, particularly for ECN trading. Its strengths lie in market depth and order-handling quality, rather than raw throughput. These characteristics suit professional traders but may require tighter tuning for retail-focused platforms.

Resource Requirements and VPS Optimization

Virtual Private Server (VPS) settings and infrastructure resources are also determined by the platform of choice.

MT5 is generally more resource-intensive at scale, allowing brokers to support large client bases and numerous automated trading strategies with optimized server utilization.

cTrader, on the other hand, offers advanced graphical interfaces and accurate real-time data presentation, which increases bandwidth requirements and resource consumption. While this enhances the trading experience for large-scale trading activities, it can raise the average cost per client, making this infrastructure more suitable for premium segments.

2. Comparing Algorithmic and Charting Tools

Chart types, technical analytics, and automation capabilities dictate the trader segments you attract. These tools determine the trader’s experience, long-term activity, and churn rate.

Indicators and Timeframes

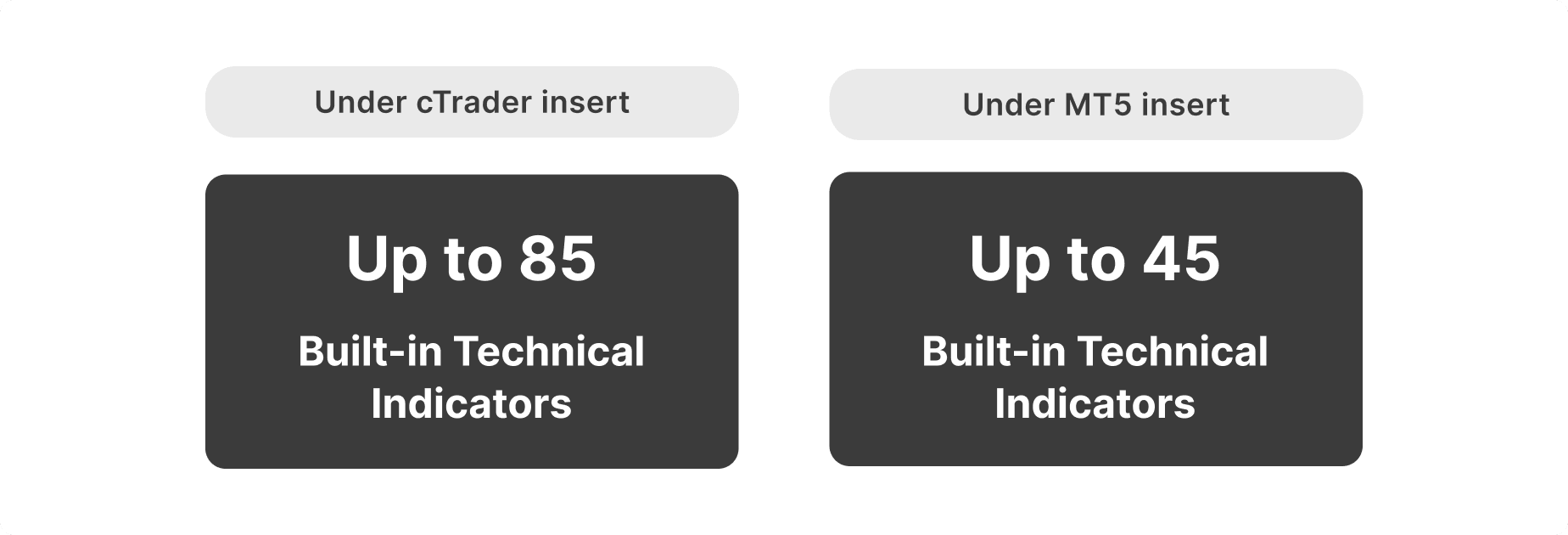

Timeframe granularity and indicator availability impact how traders analyze markets and execute orders, dictating how loyal they stay to your platform.

MT5 benefits from an extensive third-party indicator marketplace built over many years, offering a massive collection of standard and custom technical tools. While its native charting is functional, the volume of community-developed technical indicators and timeframes is a powerful advantage.

cTrader emphasizes native visual clarity and flexibility, with an advanced charting environment that is designed for discretionary traders who prefer clean layouts, intuitive drawing tools, and quick timeframe toggles. The platform provides a built-in technical analysis environment without relying on external add-ons, aligning well with professional and beginner trading styles.

EA vs cBot Ecosystems

Automation has become a key retention driver that contributes to higher trading volume and client lifetime value—rather than a technical feature. The maturity and accessibility of a platform’s automation ecosystem directly affect how easily algorithmic traders can onboard and scale.

MetaTrader’s MQL5 ecosystem significantly lowers the barrier for algo-traders, offering thousands of pre-built expert advisors, scripts, and trading signals that can be deployed quickly and without extensive development. This makes it much easier for brokers to accelerate client onboarding, ensure higher automation adoption, and reduce the need for technical support.

Similarly, cTrader’s cBot framework is built on C#, offering cleaner architecture and deeper bot trading customizations for professional developers and tech-savvy traders. However, they come with limited pre-integrated solutions, requiring brokers to engage in longer development cycles and a greater reliance on in-house or external development support.

Community Support and Plugins

The community is part of the trader’s experience, which directly impacts the broker’s operation. The scale of your traders’ community determines the support burden, issue resolution, platform visits, and available tools.

MT5’s global user base generates extensive documentation, forums, and third-party plugins. This results in common issues resolved faster, reducing pressure on proprietary support teams. This ecosystem supports operational efficiency, especially when managing high-volume traders.

cTrader has a relatively smaller community, offering few plugins but often with higher code quality and maintainability. The trade-off here is cleaner integrations, but slower problem resolution through communities due to lower participation, leading to higher pressure on technical support teams and direct vendor involvement.

3. Liquidity Access and Order Management

Liquidity connections and order flow are central to execution quality and client experience. Whether you are targeting institutional or high-volume traders, how your platform processes liquidity and orders can become a primary differentiating factor.

Level II Market Depth

Level II market data provides better visibility into available liquidity beyond merely showing the best bid and ask rates. It offers insight into market structure and execution conditions, playing a significant role in perceived transparency.

MT5 supports market depth functionality but treats it as a supplementary feature rather than a focal point. While it supports executing a wide range of trading strategies, MetaTrader places less emphasis on visual liquidity presentation and analysis.

cTrader, on the other hand, places market depth at the core of its trading experience. Its native user interface is highly visual and interactive, focusing on ECN models and appealing to those tracking liquidity movements and distribution. This model suits brokers competing on execution quality and price discovery.

Advanced Order Types

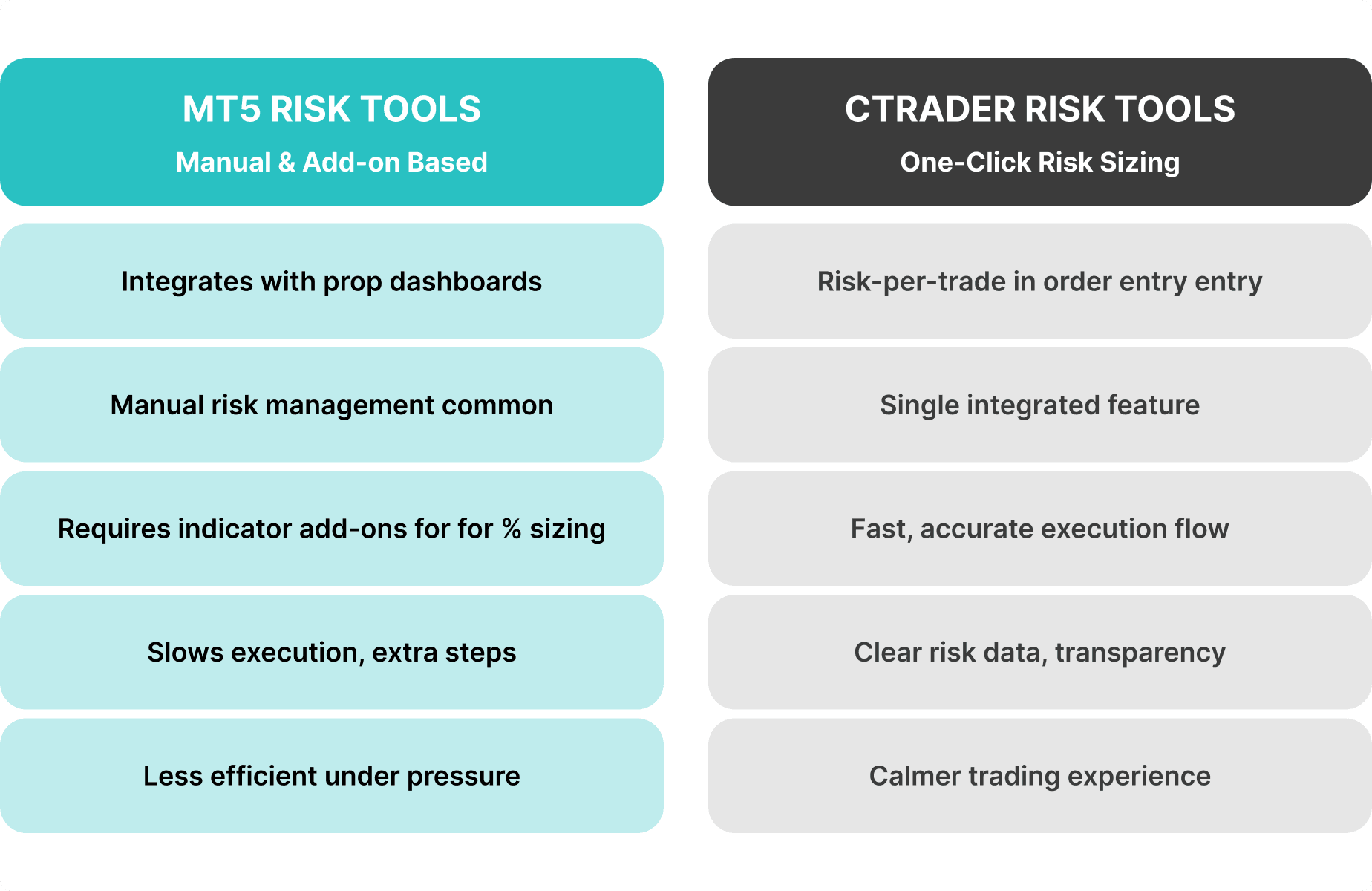

Advanced order types enable complex trade management and risk control, especially for professional and institutional clients. Ensuring these capabilities are built in reduces execution friction and reliance on external tools.

MT5 supports sufficient customization and broker-side extensions that offer flexible order placement. This functionality can be implemented with external providers rather than embedded in the software, leading to potential deployment delays or operational overheads.

cTrader offers built-in advanced order routing logic, allowing traders to execute sophisticated strategies and risk-aware positions without additional customization. This immediacy benefits brokers serving execution-sensitive clients, such as institutions that expect timely implementation.

Deep, Reliable Liquidity Across 10 Major Asset Classes

FX, Crypto, Commodities, Indices & More from One Single Margin Account

Tight Spreads and Ultra-Low Latency Execution

Seamless API Integration with Your Trading Platform

4. Broker Integration and Regulatory Support

Integration is not a technical checkbox—it is a cost, speed, and scalability factor. Platform compatibility with CRM, compliance, and reporting systems determines how quickly brokers can launch and how efficiently they can scale.

CRM and Back Office Connectivity

Back-office and Customer Relationship Management (CRM) systems help organize client data, reporting, risk controls, and daily operations. Integration with these tools and ensuring smooth interoperability directly affects time-to-market and ongoing maintenance costs.

MT5 benefits from broad third-party CRM and back-office support, with many pre-integrated solutions that allow brokers to deploy faster with predictable costs. This ecosystem maturity enables rapid scaling and minimizes the need for custom development.

On the other hand, cTrader offers clean, well-documented APIs that enable robust custom integrations with CRM providers. While this provides architectural flexibility, it often requires additional development time and budget. Therefore, brokers with strong technical resources can leverage this feature, while smaller firms may face longer deployment cycles.

All-In-One CRM & Back Office for Brokers and Exchanges

Fully Customisable Trader’s Room with Modular Features

Built-In IB Module, KYC, Payment Integrations, and Reporting Tools

Intuitive Interface that Boosts Client Engagement

KYC and AML Requirements

Know-Your-Customer (KYC) and Anti-Money Laundering (AML) processes are mandatory operational layers rather than luxury features. Both MT5 and cTrader support compliance through integrations and automation frameworks.

MT5’s advantage lies in its existing compliance tooling ecosystem, where brokers can integrate established KYC and AML providers with minimal friction. This supports faster rollout and standardized workflows, especially when serving larger client bases across different jurisdictions.

cTrader allows for more customized compliance architectures through its API-first approach. This flexibility benefits brokers operating across complex regulatory environments, but it may require greater upfront planning and technical execution.

5. White Labeling, Time to Market, and Commercial Flexibility

Platform access models determine how quickly you can build a fully functional trading environment, which influences launch speed, capital allocation, and platform ownership.

White labeling is not just a technical shortcut. It is a commercial decision that affects upfront costs, operational control, and long-term scalability. As such, the sooner you can enter the market, the faster you can capture ongoing opportunities.

White Label Availability and Entry Barriers

Historically, MT5 white labels offered a fast entry point for brokers to operate under the renowned MetaTrader environment. However, tightened MetaQuotes policies now require most brokers to work through licensed providers, increasing costs, reliance on intermediaries, and entry barriers, particularly for early-stage firms.

Thus, cTrader’s white-label model remains more accessible, offering lower upfront commitment and fewer structural constraints. This enables faster market entry and supports capital-efficient growth, especially for brokers testing new business models or expanding into new markets.

Time to Market and Operational Control

Deployment timelines directly impact revenue realization and strategic flexibility. Delays in platform onboarding, resulting from development cycles and technical hiccups, can stall launches and inflate costs.

MT5 deployments often involve longer timelines due to licensing coordination, infrastructure setup, and third-party dependencies. This approach can slow time-to-market, despite offering stable operations once configured.

cTrader typically enables faster deployment and greater operational control through its easy-to-integrate solutions. This way, brokers can launch faster, iterate more frequently, and scale smoothly, offering key advantages in competitive or rapidly evolving markets.

Which White-Label Solution Suits You?

Check out our breakdown of the best white-label trading platforms you need

MT5 vs cTrader: Which Platform Fits Your Target Market?

Selecting a trading platform ultimately determines your execution strategy, marketing approach, backend integrations, and competitive edge. Both MT5 and cTrader overlap in core functionality, but their adoption purposes can vary widely.

MetaTrader 5 dominates retail-heavy regions, where trader familiarity, multi-asset access, and automation adoption drive volume and user experience. cTrader, meanwhile, has gained traction in execution-focused markets, where transparency, pricing integrity, and ECN models are core.

Therefore, when operating internationally, you must consider these differences to ensure the platform aligns with your business objectives.

MT5

MetaTrader 5 is best suited for brokers targeting broad retail and multi-asset markets at scale. Its global adoption and long-term presence are the reasons many retail traders prefer its interface, trading logic, and automation workflows. This advantage reduces onboarding friction and accelerates client account activation.

Therefore, from a business perspective, MT5 supports high client volumes, with a connected ecosystem that covers Forex, cryptocurrencies, equities, indices, and derivatives under a unified platform.

Brokers can boost this breadth with powerful integrations, existing plugins, and automation tools, offering the flexibility to diversify product offerings without infrastructure fragmentation.

cTrader

cTrader is optimized for ECN/STP brokerage models, targeting professional, high-volume, and volatile trading activities. Its architecture and user experience are built around transparency, precision, and market structure visibility rather than mass familiarity.

For brokers focusing on execution quality, cTrader offers a better edge. Its native depth-of-market tools, refined order handling, and clean interface reinforce credibility with traders who value liquidity and pricing discovery.

These qualities make cTrader more effective for brokers serving proprietary firms, professional traders, and seasoned retail investors. The trade-off with this positioning is that brokers must support technically advanced users, maintain execution integrity, and invest in infrastructure that aligns with the platform’s expectations, favoring specialization over broad-market coverage.

Offering Both MT5 and cTrader

Multi-asset brokerages serving multiple client segments or operating across regions benefit more from a dual-platform strategy. By offering both MT5 and cTrader, brokers can clearly separate retail and professional audiences while maximizing overall market reach.

This approach reduces dependency on a single ecosystem and allows firms to adapt as client behavior evolves. For example, retail traders can be onboarded through MT5’s familiar environment, while execution-focused clients are directed toward cTrader’s transparent, deep liquidity and trading models.

However, success depends on building the right platform infrastructure. Liquidity aggregation, risk management, CRM, and reporting must operate seamlessly across platforms, and without this coordination, complexity can erode efficiency.

Where Does MT4 Fit in a Platform Strategy?

Despite being legacy technology, MetaTrader 4 remains relevant in many brokerage platforms. Its continued use is driven less by innovation and more by entrenched client behavior, as many communities and traders still find it easy to use and simpler to navigate.

Certain trader segments remain resistant to platform migration, particularly those running long-established strategies or automation built specifically for MT4. Therefore, platforms are more likely to use MT4 as a retention and acquisition tool rather than a growth platform.

Brokers maintain MT4 to preserve existing revenue streams and reduce client churn, which may result from software changes.

Launch Your Trading Platform Infrastructure with B2BROKER

Platform selection is a key component of a successful brokerage operation. It includes execution quality, liquidity access, compliance, payments, and client management — all of which influence long-term performance.

B2BROKER supports both MT5 and cTrader within a unified, turnkey ecosystem. Access liquidity aggregation, CRM, payment solutions, and risk management tools that operate seamlessly across platforms.

This flexibility allows firms to launch with a single platform, support multiple markets and assets, or evolve their technology stack as business needs change, without rebuilding core infrastructure.

Integrate & Customize Your Trading Platform

Build a powerful infrastructure fully integrated with trading platforms, payment systems, institutional liquidity, and a back-office CRM.

Frequently Asked Questions about MT5 vs cTrader

- Can brokers offer both MT5 and cTrader to clients simultaneously?

Yes. Offering both platforms is common, especially to segment retail and professional clients. However, it requires additional operational planning, parallel infrastructure, separate integrations, and expanded support and dealing resources.

- Which platform works better for cryptocurrency-focused brokerages?

MT5 generally better suits crypto-focused brokerages due to its broader support for crypto spot, futures, and multi-asset models. cTrader is typically limited to crypto CFDs, so the choice depends on product scope rather than platform quality.

- What hidden costs should brokers consider when choosing between platforms?

Hidden costs may include infrastructure scaling, integration and custom development, support staffing, and differing client acquisition models. MT5 tends to benefit brokers pursuing mass activity and large scales, while cTrader aligns more with specialized, narrower offerings.