How Identifying a Liquidity Zone in Forex Can Elevate Your Profits

Identifying liquidity zones is one of the most dependable ways to get ahead of the competition, and this article will discuss the inner workings of this technique.

The forex market has evolved into a global playing field accommodating traders of all shapes and sizes. Before the digital disruption, an average forex trader had to be a battle-tested professional with many years of experience in financial markets. Today, almost any average person can enter the forex world through a digital trading account and start investing immediately.

Despite the lowered entry barriers and available educational resources, becoming a successful trader is more competitive than ever. So, before jumping straight into forex investment, developing a trading strategy and learning how to analyse market trends is prudent.

Key Takeaways

- Liquidity zones in forex are instances where there is a high demand to sell or purchase a specific currency pair.

- Identifying liquidity zones allows traders to get a sense of possible trends and price movements in the market.

- To identify liquidity zones, you must combine volume analysis with finding support and resistance levels.

- It is possible to make this process easier with automated analytics tools.

What is Smart Money in Trading?

The smart money concepts in trading have emerged with a simple realisation – most trading markets are heavily impacted by institutional players, also known as “smart money” organisations. These large entities include commercial banks, whale investors, hedge funds, investment banks, and other experienced trading players with massive investment capital.

Supply and Demand Dynamics

Smart money trading strategy requires a sound understanding of supply and demand dynamics, as the entire concept is built on the idea that big institutional players drive the market trends. So, according to SMC, it is vital to analyse the trading field in the context of large players making moves and driving price action.

By applying the SMC tactic, traders can get a more in-depth understanding of the trading market, being able to spot increased market activities and possible trends going forward.

Thanks to the SMC strategy, investors no longer have to trade in a vacuum. Instead, they can identify price gaps, discover liquidity zones and develop trading decisions with increased profitability and reduced risks of loss.

The forex trading strategies are no different in this case, as numerous large organisations are involved in this sector. While SMC is not a foolproof strategy, it has often showcased reliable results, especially after the invention of advanced analytics and monitoring tools.

What is a Liquidity Zone in Trading?

In general, liquidity refers to how easy it is to sell or purchase assets on the market, primarily due to the increased or decreased presence of market buyers and sellers. So, liquidity zones are areas on the specific price chart with elevated buying or selling activity from the market.

The liquidity zones are formed when most market participants develop the same approach toward a specific asset, deciding to sell or purchase it on a massive scale. As a result, liquidity zones often create support and resistance levels for tradable assets, signalling a probable price reversal shortly.

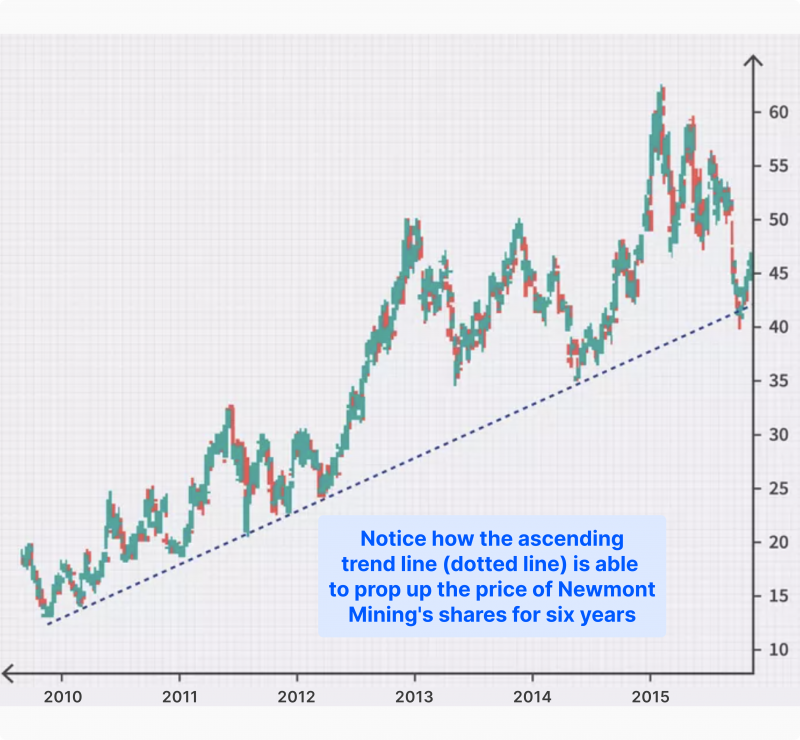

Liquidity zones vary dramatically in timeframes, from a couple of hours to consecutive days or weeks. The strength of a liquidity zone rises proportionally to an increased timeframe.

What Happens When Market Enters a Liquidity Zone?

As described above, liquidity zones indicate an increased interest in purchasing or selling currencies in the forex landscape. This concept reduces the unpredictability factor of forex, giving investors a measurable insight into what’s happening in the market and which currencies are in high demand or supply.

Once the liquidity zones are formed, it is much easier to develop successful trading strategies, as investors are aware of the current market demands and can formulate immediate price predictions.

Identifying the liquidity zones will swiftly eliminate any illiquid currencies in your potential strategies, letting you develop trading tactics with a higher chance of execution and profitability.

Naturally, identifying liquidity zones is just the beginning, and it doesn’t guarantee outright success, but liquidity zones are vital in making informed trading decisions.

How to Identify a Forex Liquidity Zone

The benefits of a high liquidity zone trading are apparent, allowing investors to be more informed, eliminate unprofitable strategies and understand the market trends in advance. However, identifying liquidity zones is a distinct skill that should be developed through experience and a keen understanding of the forex market.

Below, we present the blueprint for finding liquidity zones and different ways to simplify your analytical efforts in the initial stages of your trading journey.

Identify Support and Resistance Levels

On a technical level, identifying liquidity zones is relatively straightforward. As a rule of thumb, taking at least one day as a timeframe is always advisable. Otherwise, liquidity windows might be too short to impact the market substantially, and they could disappear before you execute any significant trades.

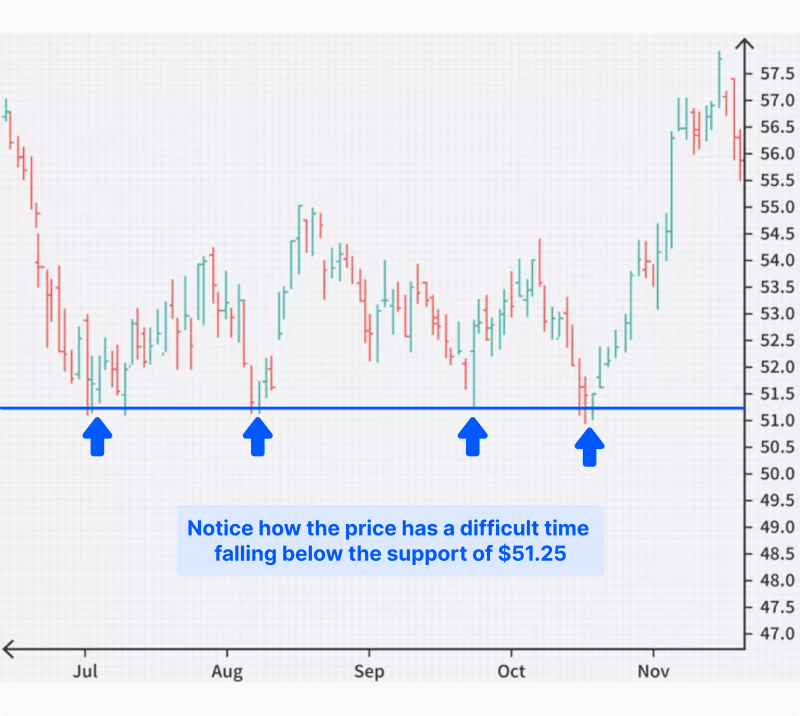

The first step in identifying liquidity zones is to analyse the candlestick price chart and look for support or resistance levels. Resistance levels are the peak prices reached by currency X in a specific period, whereas support levels are the lowest price quotes that can’t be exceeded due to market conditions. Both indicators show investors that the market won’t allow currency X to appreciate or devalue beyond specific points.

In most cases, support and resistance levels are formed naturally on the market, considering all relevant factors regarding the asset. The reasons behind support and resistance levels could be the general market demand, economic circumstances, supply levels and many other variables.

Using ratios like moving averages with support and resistance levels is highly recommended, as they could often fluctuate and create their own trends, dynamically changing the potential peaks and valleys for any currency.

Conduct Volume Analysis With Price Charts

Trading volume analysis is quite simple, as every major FX platform provides volume levels updated in real-time. Once the resistance and support levels are identified, it is crucial to combine the identified liquidity zones with a volume indicator.

This combination will help you understand if liquidity zones are substantial and if there is increased activity on the market, signalling the presence of many buyers or sellers.

In the case of resistance-level liquidity zones, traders should acquire short positions, as consistent resistance levels indicate that the asset is currently highly-priced and is most probably headed to a bear market.

Conversely, suppose we are dealing with support levels. In that case, traders will be motivated to use the liquidity zone to acquire long positions, as the asset will most likely enter a bullish market shortly.

However, traders must be careful with hasty conclusions, as not every liquidity zone is reliable, even with favourable volume indicators. Sometimes, the market can experience unusual activities that are not necessarily indicative of high liquidity. So, it is still essential to be aware of the general market developments and substantial news to avoid such scenarios.

Acquire a Liquidity Zone Indicator

Forex trading using volume price analysis and support or resistance levels can be tricky at first, as many intricacies are involved. Newcomer traders have an increased risk of making rookie mistakes in this process.

So, it is advisable to purchase a liquidity zone indicator software that automatically identifies such instances on the market, eliminating the chance of human error in your decisions.

It is still crucial to double-check the results of automated liquidity zone indicators, as the software could falsely identify high liquidity instances due to unusual market trends or other skewed variables.

However, most trading analysis bots are quite handy with major currency pairs. They could give you a much-needed jumpstart to formulate the best trading strategies early in your forex trading career.

Final Thoughts

Identifying a liquidity zone in forex is a great way to minimise market risks and increase the chances of profitability. This simple yet effective strategy will help you understand where the market is moving and how you can get the most out of the developing trends. However, properly analysing liquidity zones is more challenging than it appears at first glance, as many intricate details must be considered.

So, before putting your complete faith into liquidity zone trading, it is recommended that you acquire automated analysis software. This will help you get a head start in the competitive forex field and minimise the impact of inevitable newcomer mistakes.

FAQ

What is liquidity in forex?

Liquidity in forex refers to how easily a currency pair can be bought or sold without causing significant price changes. High liquidity means there is substantial trading activity with many buyers and sellers, ensuring smoother transactions and tighter spreads.

Why is liquidity important in forex trading?

Liquidity is crucial in forex as it impacts transaction speed, spreads, and price stability. High liquidity allows traders to execute trades quickly at desired prices, reducing slippage and making it easier to manage positions efficiently.

How do traders identify liquidity zones in forex?

Traders identify liquidity zones by analyzing price charts for support and resistance levels and combining this with volume analysis. These zones highlight areas where buying or selling activity is concentrated, helping traders predict potential price movements and develop effective strategies.

Recommended articles

By clicking “Subscribe”, you agree to the Privacy Policy. The information you provide will not be disclosed or shared with others.

Our team will present the solution, demonstrate demo-cases, and provide a commercial offer